Conditional High Yield Savings Account

Conditional High Yield Savings Account

|

|

Mar 20 2019, 12:37 PM Mar 20 2019, 12:37 PM

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

|

|

|

Mar 20 2019, 12:56 PM Mar 20 2019, 12:56 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(xcxa23 @ Mar 20 2019, 12:37 PM) Is this account the best? Put aside paying transfer and etc. Just deposit correct? I can only my fulfill the deposit part. So, if hit 2.75. will stagnant for 2.75 if we continue to deposit 500 monthly correct? Will be got beyond 2.75? And if miss will drop to 2.65 only rite? |

|

|

Mar 20 2019, 01:09 PM Mar 20 2019, 01:09 PM

|

Senior Member

2,649 posts Joined: Nov 2010 |

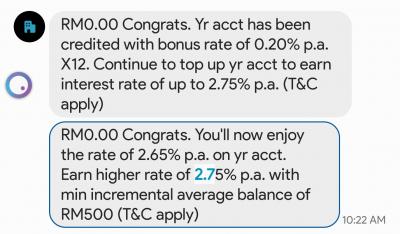

QUOTE(Ancient-XinG- @ Mar 20 2019, 12:56 PM) Is this account the best? Put aside paying transfer and etc. Imo easiest wit no min required $$ after fulfilling requirements and min requirements to fulfill.Just deposit correct? I can only my fulfill the deposit part. So, if hit 2.75. will stagnant for 2.75 if we continue to deposit 500 monthly correct? Will be got beyond 2.75? And if miss will drop to 2.65 only rite? 1. Yes. Deposit min rm500 monthly by 3rd of the month and jZ to be safe don't touch the money. (You ND to have increment of rm500 of the month according to 25th of last month, not sure if it's 25th) 2. Yes, confirmed last year with their staff 3. It won't go beyond 2.75% confirmed last year with their staff 4. Yes. This post has been edited by xcxa23: Mar 20 2019, 01:10 PM |

|

|

Mar 20 2019, 01:16 PM Mar 20 2019, 01:16 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(xcxa23 @ Mar 20 2019, 01:09 PM) Imo easiest wit no min required $$ after fulfilling requirements and min requirements to fulfill. I found that 2.75 is quite a lot for an account that not require few type of transections per month as seen in ocbc 360. 1. Yes. Deposit min rm500 monthly by 3rd of the month and jZ to be safe don't touch the money. (You ND to have increment of rm500 of the month according to 25th of last month, not sure if it's 25th) 2. Yes, confirmed last year with their staff 3. It won't go beyond 2.75% confirmed last year with their staff 4. Yes. No other strings attached correct besides 500 deposit monthly rite? Any other account that provides more than 2.75 besides the bonus savers? With the same conditions? Currently find an account that is available for withdraw even on Sat and sun with atm card.... |

|

|

Mar 20 2019, 01:55 PM Mar 20 2019, 01:55 PM

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Ancient-XinG- @ Mar 20 2019, 01:16 PM) I found that 2.75 is quite a lot for an account that not require few type of transections per month as seen in ocbc 360. Afaik, nope.. previously only ambank, which offer 2.9/2.8 but after a year discontinued, slashed to 1.80.. No other strings attached correct besides 500 deposit monthly rite? Any other account that provides more than 2.75 besides the bonus savers? With the same conditions? Currently find an account that is available for withdraw even on Sat and sun with atm card.... Since rhb jz min rm500 per month, so I jz scheduled transfer. The staff did said few times it's better >rm500 and better don't touch the money for a year to safeguard 2.65% cos the t&c about min increment of rm500 per month is kinda confusing so I did rm800 per month and din touch the money for a year jz to be safe and yes it's proven successful.. lol As far as I remember, nope. Jz min rm500 by 3rd of the month and with min increment rm500 of the month. This rhb got provide ATM card.. but since your planning to use the money, I suggest you go to rhb ask in depth. |

|

|

Mar 20 2019, 07:39 PM Mar 20 2019, 07:39 PM

Show posts by this member only | IPv6 | Post

#86

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(David83 @ Mar 20 2019, 12:34 PM) Thanks. The effective rate is 3.5%pa For those who has interest on Stash Account, you can apply/open online at UOB PIBIt's about the same as UOB e-Account. I think no point to go for it. URL: https://www1.uob.com.my/stash/index.html |

|

|

|

|

|

Mar 20 2019, 08:17 PM Mar 20 2019, 08:17 PM

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(Ancient-XinG- @ Mar 20 2019, 01:16 PM) I found that 2.75 is quite a lot for an account that not require few type of transections per month as seen in ocbc 360. throw 30k to 50k and enjoy 3.25% (basic) or 4.45% (for 12 months promotion) without doing anything else.No other strings attached correct besides 500 deposit monthly rite? Any other account that provides more than 2.75 besides the bonus savers? With the same conditions? Currently find an account that is available for withdraw even on Sat and sun with atm card.... https://www.ocbc.com.my/personal-banking/Ac...ster/index.html |

|

|

Mar 20 2019, 08:23 PM Mar 20 2019, 08:23 PM

Show posts by this member only | IPv6 | Post

#88

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(skty @ Mar 20 2019, 08:17 PM) throw 30k to 50k and enjoy 3.25% (basic) or 4.45% (for 12 months promotion) without doing anything else. With 50k to 60k, just dump to UOB e-Account or Stash, can earn 3.5% pa. https://www.ocbc.com.my/personal-banking/Ac...ster/index.html |

|

|

Mar 20 2019, 08:50 PM Mar 20 2019, 08:50 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(skty @ Mar 20 2019, 08:17 PM) throw 30k to 50k and enjoy 3.25% (basic) or 4.45% (for 12 months promotion) without doing anything else. Thanks for the suggestion. https://www.ocbc.com.my/personal-banking/Ac...ster/index.html I only intend to put around 10k in an account that is fluid. And allow me to withdraw any time. Already have emergency fund in fd. And I wish to be fully invested. |

|

|

Mar 20 2019, 08:53 PM Mar 20 2019, 08:53 PM

Show posts by this member only | IPv6 | Post

#90

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(Ancient-XinG- @ Mar 20 2019, 08:50 PM) Thanks for the suggestion. RM 10k won't able to play any game in conditional high yield saving acccount.I only intend to put around 10k in an account that is fluid. And allow me to withdraw any time. Already have emergency fund in fd. And I wish to be fully invested. For RM 10k, better put into 1-month FD. |

|

|

Mar 20 2019, 09:30 PM Mar 20 2019, 09:30 PM

|

Junior Member

233 posts Joined: Mar 2007 |

QUOTE(David83 @ Mar 20 2019, 07:39 PM) For those who has interest on Stash Account, you can apply/open online at UOB PIB If i read correctly, you must maintained the same balance or more than previous month balance to qualify for the interest, else u get... nothing?URL: https://www1.uob.com.my/stash/index.html "*Maximum Effective Interest Rate on the Stash Account is 3.5% p.a. at RM100,000 deposit, provided customer's Monthly Average Balance (MAB) for the current month is equal to or more than previous month’s Monthly Average Balance." |

|

|

Mar 20 2019, 09:34 PM Mar 20 2019, 09:34 PM

Show posts by this member only | IPv6 | Post

#92

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(shuin1986 @ Mar 20 2019, 09:30 PM) If i read correctly, you must maintained the same balance or more than previous month balance to qualify for the interest, else u get... nothing? You still get your base interest of 1% for min placement of RM 5k."*Maximum Effective Interest Rate on the Stash Account is 3.5% p.a. at RM100,000 deposit, provided customer's Monthly Average Balance (MAB) for the current month is equal to or more than previous month’s Monthly Average Balance." This post has been edited by David83: Mar 20 2019, 09:35 PM |

|

|

Mar 20 2019, 09:39 PM Mar 20 2019, 09:39 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(xcxa23 @ Mar 20 2019, 01:55 PM) Afaik, nope.. previously only ambank, which offer 2.9/2.8 but after a year discontinued, slashed to 1.80.. thanks for the info. Currently with M2U savers. But the minimum requirement of 2k really let down. and 2% vs 2.75% is a lot in the long run. Since rhb jz min rm500 per month, so I jz scheduled transfer. The staff did said few times it's better >rm500 and better don't touch the money for a year to safeguard 2.65% cos the t&c about min increment of rm500 per month is kinda confusing so I did rm800 per month and din touch the money for a year jz to be safe and yes it's proven successful.. lol As far as I remember, nope. Jz min rm500 by 3rd of the month and with min increment rm500 of the month. This rhb got provide ATM card.. but since your planning to use the money, I suggest you go to rhb ask in depth. QUOTE(David83 @ Mar 20 2019, 08:53 PM) RM 10k won't able to play any game in conditional high yield saving acccount. Just that need an account that parking for all the bills monthly before due date. For RM 10k, better put into 1-month FD. This post has been edited by [Ancient]-XinG-: Mar 20 2019, 09:39 PM |

|

|

|

|

|

Mar 20 2019, 09:41 PM Mar 20 2019, 09:41 PM

Show posts by this member only | IPv6 | Post

#94

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(Ancient-XinG- @ Mar 20 2019, 09:39 PM) thanks for the info. Currently with M2U savers. But the minimum requirement of 2k really let down. and 2% vs 2.75% is a lot in the long run. M2U savers will be good for very low entry. Just that need an account that parking for all the bills monthly before due date. Just RM 2k as you pointed out there. |

|

|

Mar 21 2019, 12:43 AM Mar 21 2019, 12:43 AM

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(David83 @ Mar 20 2019, 08:23 PM) I am actually studying about Stash.QUOTE(David83 @ Mar 20 2019, 08:53 PM) RM 10k won't able to play any game in conditional high yield saving acccount. 10k can play OCBC 360 if you can meet the criteria.For RM 10k, better put into 1-month FD. actually the criteria damn easy to achieve. |

|

|

Mar 21 2019, 12:50 AM Mar 21 2019, 12:50 AM

|

All Stars

24,360 posts Joined: Feb 2011 |

|

|

|

Mar 21 2019, 01:26 AM Mar 21 2019, 01:26 AM

|

Senior Member

2,932 posts Joined: Sep 2007 |

QUOTE(Ancient-XinG- @ Mar 20 2019, 12:56 PM) So, if hit 2.75. will stagnant for 2.75 if we continue to deposit 500 monthly correct? Will be got beyond 2.75? Yes.And if miss will drop to 2.65 only rite? The 2.75% is a marketing gimmick. If you have on-going additional 500, put it into FD with at least around 3% rather than the 2.75%. |

|

|

Mar 21 2019, 05:59 AM Mar 21 2019, 05:59 AM

Show posts by this member only | IPv6 | Post

#98

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(skty @ Mar 21 2019, 12:43 AM) I am actually studying about Stash. I prefer simple direct product. 10k can play OCBC 360 if you can meet the criteria. actually the criteria damn easy to achieve. I don't really like those that requires applying additional credit card or buying additional wealth management products. EIA is 3.5% pa which is about the same as UOB e-Account. So I'll pass. QUOTE(Ramjade @ Mar 21 2019, 12:50 AM) OCBC is out of my reach because availability of branch in Penang island. |

|

|

Mar 21 2019, 07:17 AM Mar 21 2019, 07:17 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

skty

Item 50 for EIR calculation for Stash account at below link: https://www1.uob.com.my/web-resources/perso...asa-tnc-eng.pdf |

|

|

Mar 21 2019, 07:43 AM Mar 21 2019, 07:43 AM

Show posts by this member only | IPv6 | Post

#100

|

All Stars

24,360 posts Joined: Feb 2011 |

QUOTE(David83 @ Mar 21 2019, 05:59 AM) I prefer simple direct product. The criteria very easy to meet. I don't really like those that requires applying additional credit card or buying additional wealth management products. EIA is 3.5% pa which is about the same as UOB e-Account. So I'll pass. OCBC is out of my reach because availability of branch in Penang island. 1/ Transfer in min RM50 1 via IBFT from other bank 2/ Transfer out RM1 via IBFT to 3 different bank account 3/ Use their card to pay RM500 (can be used on ewallwts) Radar. Instant free 4.1% Yiu do know they have 3 branches in Penang right? 2 on the island, 1 on mainland. |

| Change to: |  0.0288sec 0.0288sec

1.02 1.02

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 12:36 PM |