Outline ·

[ Standard ] ·

Linear+

Conditional High Yield Savings Account

|

a.lifehacks

|

Oct 9 2020, 06:34 PM Oct 9 2020, 06:34 PM

|

Getting Started

|

Is anyone here using Citibank Step-Up Interest Account? (Interest Rate up to 2.3%pa with minimum monthly incremental balance RM500- 12x continuously monthly rm500 top up) https://www.citibank.com.my/english/deposit...est-account.htmAnother alternative to RHB Bonus Saver Account (used to be 2.45%pa, NOW 1.5%pa). This post has been edited by a.lifehacks: Oct 9 2020, 06:35 PM |

|

|

|

|

|

lifekiat

|

Oct 13 2020, 04:41 PM Oct 13 2020, 04:41 PM

|

New Member

|

Want to ask:

for RHB smart account, the 3 bills monthly include other bank credit card bill/payement?

|

|

|

|

|

|

GrumpyNooby

|

Oct 13 2020, 05:13 PM Oct 13 2020, 05:13 PM

|

|

QUOTE(lifekiat @ Oct 13 2020, 04:41 PM) Want to ask: for RHB smart account, the 3 bills monthly include other bank credit card bill/payement? Here's what the T&C said: 3.5 In relation to the stipulate requirements in Table 1 requirements for “PAY” category: 3.5.1 “PAY” means the payment made from the Account of the Accountholder via RHB Now or RHB Now Mobile Banking to pay utilities bill or other bills under participating billing organizations. “Pay” is divided into two categories as shown in the table below.  https://www.rhbgroup.com/files/personal/cur...2019_Eng_BM.pdf https://www.rhbgroup.com/files/personal/cur...2019_Eng_BM.pdf |

|

|

|

|

|

lifekiat

|

Oct 13 2020, 06:59 PM Oct 13 2020, 06:59 PM

|

New Member

|

QUOTE(GrumpyNooby @ Oct 13 2020, 05:13 PM) Here's what the T&C said: 3.5 In relation to the stipulate requirements in Table 1 requirements for “PAY” category: 3.5.1 “PAY” means the payment made from the Account of the Accountholder via RHB Now or RHB Now Mobile Banking to pay utilities bill or other bills under participating billing organizations. “Pay” is divided into two categories as shown in the table below.  https://www.rhbgroup.com/files/personal/cur...2019_Eng_BM.pdf https://www.rhbgroup.com/files/personal/cur...2019_Eng_BM.pdfThanks for reply. But still don’t really understand the banking terms, so the payment to other bank credit card count? |

|

|

|

|

|

M.I.3

|

Nov 1 2020, 10:26 PM Nov 1 2020, 10:26 PM

|

Getting Started

|

QUOTE(hakkai0810 @ Oct 3 2020, 12:08 AM) HSBC amanah perks@work promotion is back until july 2021 3.25% max with criteria below 1) 1.75% for incremental balance 2) 0.75% for paying 3 bill 3) 0.75% for spending 1k using hsbc amanh credit /debit card. Quite a good deal when alternate with RHB / Std chart. https://www.hsbcamanah.com.my/accounts/perk...tep-up-savings/Hi, any minimum amount for bill payment? |

|

|

|

|

|

hakkai0810

|

Nov 1 2020, 11:25 PM Nov 1 2020, 11:25 PM

|

|

QUOTE(M.I.3 @ Nov 1 2020, 10:26 PM) Hi, any minimum amount for bill payment? I paid Rm2 for each biller  |

|

|

|

|

|

mamamia

|

Nov 1 2020, 11:31 PM Nov 1 2020, 11:31 PM

|

|

QUOTE(hakkai0810 @ Nov 1 2020, 11:25 PM) I paid Rm2 for each biller  Salary must credit to HSBC? Too bad as my co has fixed bank for salary crediting.. |

|

|

|

|

|

hakkai0810

|

Nov 2 2020, 12:18 AM Nov 2 2020, 12:18 AM

|

|

QUOTE(mamamia @ Nov 1 2020, 11:31 PM) Salary must credit to HSBC? Too bad as my co has fixed bank for salary crediting.. The CS told me before like can using instant transfer but i didnt inquire further. Mayb can call up the bank to ask further |

|

|

|

|

|

MGM

|

Nov 2 2020, 03:39 AM Nov 2 2020, 03:39 AM

|

|

1st time i faced IBFT that didnt transfer funds instantly. 2 days ago Saturday night i need to IBFT from my SC PSA acc to few receipients urgently, but funds deducted but not transfer. Called CS n was told can only be resolved on next working day. Really salute. Now thinking of switching to another bank. Anyone faced such situation?

|

|

|

|

|

|

GrumpyNooby

|

Nov 2 2020, 07:02 AM Nov 2 2020, 07:02 AM

|

|

QUOTE(hakkai0810 @ Nov 2 2020, 12:18 AM) The CS told me before like can using instant transfer but i didnt inquire further. Mayb can call up the bank to ask further 3.25% pa is only applicable for HSBC Amanah Premier Account-i and HSBC Amanah Advance Account-i only? And for these two account, one needs to attain membership for Premier and Advance, right? If you're just attaching HSBC Amanah Basic Savings Account-i, the max attainable interest is just 1.75% pa. Premier Membership: Maintain AUM of RM 250k or earns a monthly gross salary of RM16,500 and above Advance Membership: Maintain AUM of RM 100k or earns a monthly gross salary of RM5,000 and above Normal (Basic): Earns a monthly gross salary of RM 3,000 and above and holds HSBC Amanah Credit Card-i Step Up Campaign T&C: https://cdn.hsbcamanah.com.my/content/dam/h...savings-tnc.pdfPerks@ Work T&C: https://cdn.hsbcamanah.com.my/content/dam/h...twork-terms.pdf |

|

|

|

|

|

taiping...

|

Nov 2 2020, 09:53 AM Nov 2 2020, 09:53 AM

|

|

QUOTE(MGM @ Nov 2 2020, 03:39 AM) 1st time i faced IBFT that didnt transfer funds instantly. 2 days ago Saturday night i need to IBFT from my SC PSA acc to few receipients urgently, but funds deducted but not transfer. Called CS n was told can only be resolved on next working day. Really salute. Now thinking of switching to another bank. Anyone faced such situation? SC internet banking does hav a lot of problem My dad facing some problems as well |

|

|

|

|

|

hakkai0810

|

Nov 2 2020, 09:53 AM Nov 2 2020, 09:53 AM

|

|

QUOTE(GrumpyNooby @ Nov 2 2020, 07:02 AM) 3.25% pa is only applicable for HSBC Amanah Premier Account-i and HSBC Amanah Advance Account-i only? And for these two account, one needs to attain membership for Premier and Advance, right? If you're just attaching HSBC Amanah Basic Savings Account-i, the max attainable interest is just 1.75% pa. Premier Membership: Maintain AUM of RM 250k or earns a monthly gross salary of RM16,500 and above Advance Membership: Maintain AUM of RM 100k or earns a monthly gross salary of RM5,000 and above Normal (Basic): Earns a monthly gross salary of RM 3,000 and above and holds HSBC Amanah Credit Card-i Step Up Campaign T&C: https://cdn.hsbcamanah.com.my/content/dam/h...savings-tnc.pdfPerks@ Work T&C: https://cdn.hsbcamanah.com.my/content/dam/h...twork-terms.pdfYa, if earn below 5k i think RHB Smart/ Std Chart is good to go |

|

|

|

|

|

smartfreak

|

Nov 5 2020, 07:43 AM Nov 5 2020, 07:43 AM

|

|

QUOTE(MGM @ Nov 2 2020, 03:39 AM) 1st time i faced IBFT that didnt transfer funds instantly. 2 days ago Saturday night i need to IBFT from my SC PSA acc to few receipients urgently, but funds deducted but not transfer. Called CS n was told can only be resolved on next working day. Really salute. Now thinking of switching to another bank. Anyone faced such situation? Faced SC PSA fund transfer issue once last time, money was refunded back to me. QUOTE(smartfreak @ Jan 26 2020, 01:18 PM) Looks like SCB PSA instant transfer feature is having issues today. Instant transfer status still stuck as "submitted" since morning. Anyone having instant transfer feature issue using standard charted saving account today? |

|

|

|

|

|

GrumpyNooby

|

Nov 6 2020, 09:56 AM Nov 6 2020, 09:56 AM

|

|

QUOTE(GrumpyNooby @ Aug 12 2020, 08:13 PM) This campaign is extended to 31/01/2021: Campaign period: From 1 November 2020 until 31 January 2021. *Terms and conditions apply.  Campaign link: https://www.uob.com.my/personal/promotions/stash-up.page |

|

|

|

|

|

MilesAndMore

|

Nov 10 2020, 03:16 PM Nov 10 2020, 03:16 PM

|

Look at all my stars!!

|

QUOTE(GrumpyNooby @ Nov 2 2020, 07:02 AM) Premier Membership: Maintain AUM of RM 250k or earns a monthly gross salary of RM16,500 and above The TRB for HSBC Premier is RM200,000, not 250k. QUOTE(GrumpyNooby @ Nov 2 2020, 07:02 AM) Advance Membership: Maintain AUM of RM 100k or earns a monthly gross salary of RM5,000 and above The TRB for HSBC Advance is RM30,000, not 100k. |

|

|

|

|

|

GrumpyNooby

|

Nov 10 2020, 03:26 PM Nov 10 2020, 03:26 PM

|

|

QUOTE(MilesAndMore @ Nov 10 2020, 03:16 PM) The TRB for HSBC Premier is RM200,000, not 250k. The TRB for HSBC Advance is RM30,000, not 100k. What is TRB? |

|

|

|

|

|

cklimm

|

Nov 10 2020, 07:12 PM Nov 10 2020, 07:12 PM

|

|

QUOTE(GrumpyNooby @ Nov 10 2020, 03:26 PM) total relationship balance |

|

|

|

|

|

GrumpyNooby

|

Nov 11 2020, 07:34 PM Nov 11 2020, 07:34 PM

|

|

|

|

|

|

|

|

GrumpyNooby

|

Nov 16 2020, 12:44 PM Nov 16 2020, 12:44 PM

|

|

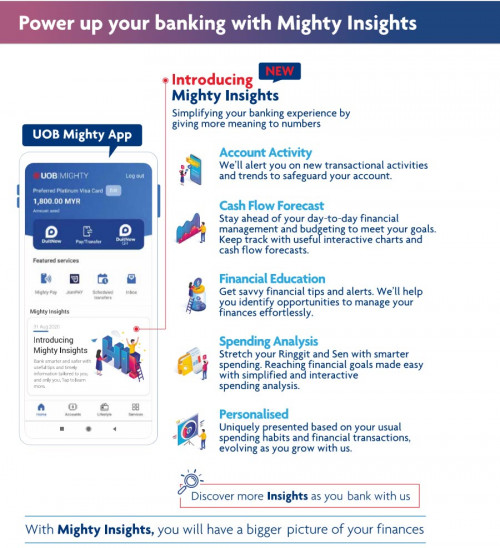

MIGHTY ASSISTANCE BY MY SIDE WITH ONE ACCOUNT Earn 20% p.a. Bonus Interest for 20 days with ONE Account in just 2 simple steps. Sign up online and be rewarded with RM30 Lazada e-Cash Voucher*.     Campaign period: From now until 31 December 2020. * Eligible customer shall deposit and maintain at least RM1,000 in UOB ONE Account. For avoidance of doubt, UOBM will be using Monthly Average Balance (MAB) the next calender month after UOB ONE Account is opened for calculation. Terms and conditions apply. Member of PIDM. Protected by PIDM up to RM250,000 for each depositor. Sign up online gift T&C: https://www.uob.com.my/web-resources/person...her-tnc-eng.pdfONE-derful Account Opening T&C: https://www.uob.com.my/web-resources/person...omo-tnc-eng.pdfCampaign link: https://www.uob.com.my/personal/promotions/...-highlight.page

|

|

|

|

|

Oct 9 2020, 06:34 PM

Oct 9 2020, 06:34 PM

Quote

Quote

0.0251sec

0.0251sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled