Deleted

This post has been edited by kart: Dec 24 2020, 07:49 AM

Conditional High Yield Savings Account

Conditional High Yield Savings Account

|

|

Dec 23 2020, 02:51 PM Dec 23 2020, 02:51 PM

|

Senior Member

1,599 posts Joined: Aug 2014 |

Deleted

This post has been edited by kart: Dec 24 2020, 07:49 AM |

|

|

|

|

|

Dec 29 2020, 10:27 AM Dec 29 2020, 10:27 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

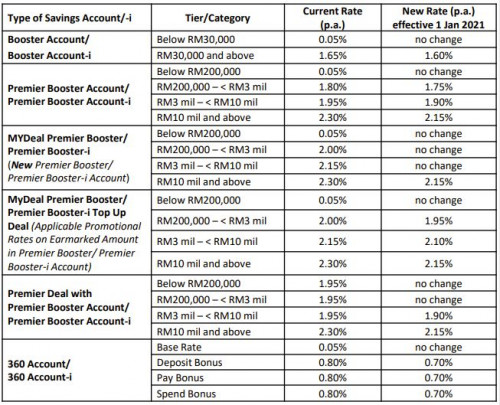

[28/12/2020] REVISION ON INTEREST RATES / PROFIT RATES FOR OCBC 360 ACCOUNT/-i, BOOSTER ACCOUNT/-i, PREMIER BOOSTER ACCOUNT/-i EFFECTIVE 1 JANUARY 2021

We are revising Interest Rates/Profit Payments starting 1 January 2021 for the following accounts -  PDF link: https://www.ocbc.com.my/assets/pdf/Accounts...nt_28122020.pdf |

|

|

Jan 5 2021, 07:14 PM Jan 5 2021, 07:14 PM

Show posts by this member only | IPv6 | Post

#663

|

All Stars

12,387 posts Joined: Feb 2020 |

RinggitPlus Readers’ Choice Awards 2020: Affin Duo, Maybank, TNG eWallet Emerge As Big Winners

Best High Interest Savings Account (HISA) In Malaysia: Hong Leong Pay & Save (22.1%) - A surprising winner in this category, Hong Leong Bank’s Pay & Save High Interest Savings Account (HISA) just about nipped ahead in first place by a mere 0.2% of votes ahead of the OCBC 360 account (21.9%). - HISAs usually require account holders to perform some basic tasks/transactions to unlock more interest, and you can take a look at the best ones in our Best High Interest Savings Accounts article. In the case of the HLB Pay & Save, account holders can unlock up to 2.25% p.a. interest by performing 3 tasks: Deposit, Pay, and Spend. There’s an additional 0.9% p.a. unlocked as well if account holders invest in share trading. Article link: https://ringgitplus.com/en/blog/ringgitplus...ig-winners.html This post has been edited by GrumpyNooby: Jan 5 2021, 07:18 PM |

|

|

Jan 6 2021, 02:17 PM Jan 6 2021, 02:17 PM

|

Senior Member

1,599 posts Joined: Aug 2014 |

For RHB Smart Account and RHB Smart Account-i:

https://www.rhbgroup.com/others/highlights/...nt-i/index.html QUOTE ANNOUNCEMENT Amended Personal Banking Standard Terms & Conditions for RHB Smart Account/-i PART B. Specific Terms and Conditions for RHB Smart Account PART D. RHB Islamic Bank Berhad’s Services for RHB Smart Account-i 18 December 2020 Dear Valued Customers, We would like to inform you that the Terms and Conditions for RHB Smart Account and RHB Smart Account-i will be revised effective 14th January 2021. You may review the revised Terms and Conditions via this link from 14th January 2021 onwards. Thank you. This post has been edited by kart: Jan 6 2021, 04:00 PM |

|

|

Jan 8 2021, 05:31 PM Jan 8 2021, 05:31 PM

|

Senior Member

6,426 posts Joined: Jun 2005 |

QUOTE(kart @ Jan 6 2021, 02:17 PM) For RHB Smart Account and RHB Smart Account-i: OMG, seem like the rate is reducing... https://www.rhbgroup.com/others/highlights/...nt-i/index.html But, it mentioned the revised TnC will be effective 14 Jan 2021 n revised tnc will only available on 14 Jan 2021?? Is this consider giving 21 days notice without telling what are the revised terms? This post has been edited by mamamia: Jan 8 2021, 08:09 PM |

|

|

Jan 15 2021, 11:06 AM Jan 15 2021, 11:06 AM

|

Senior Member

6,426 posts Joined: Jun 2005 |

QUOTE(kart @ Jan 6 2021, 02:17 PM) For RHB Smart Account and RHB Smart Account-i: Now change to 17 Jan 2021https://www.rhbgroup.com/others/highlights/...nt-i/index.html QUOTE We would like to inform you that the Terms and Conditions for RHB Smart Account and RHB Smart Account-i will be revised effective 17th January 2021. You may view the revised Terms and Conditions via this link after 17th January 2021. |

|

|

|

|

|

Jan 18 2021, 11:32 AM Jan 18 2021, 11:32 AM

Show posts by this member only | IPv6 | Post

#667

|

Junior Member

701 posts Joined: Oct 2009 |

|

|

|

Jan 18 2021, 11:47 AM Jan 18 2021, 11:47 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Leroi2x @ Jan 18 2021, 11:32 AM) 2% Save Bonus is even better than PSA at 0.9% oa Leroi2x liked this post

|

|

|

Jan 18 2021, 12:54 PM Jan 18 2021, 12:54 PM

Show posts by this member only | IPv6 | Post

#669

|

Junior Member

313 posts Joined: Mar 2010 From: Kuala Lumpur |

Including base rate of 0.25%, total is 3.25%

|

|

|

Jan 18 2021, 03:20 PM Jan 18 2021, 03:20 PM

Show posts by this member only | IPv6 | Post

#670

|

Newbie

23 posts Joined: Jul 2018 |

Standard Chartered is revising their T&C for Privilege Saver on 1st Feb

All up to 100k: Base: 0.05 Deposit: 0.9 Debit 5x: 0.9 Credit 1k: 0.9 Invest: 2% with 30k/yr Insurance, or 30k UT (valid for 3 months only) (Seems crazy high requirement for year round. 120k per year to get 2% fully) Gonna miss the 1k/month for 20k 2% |

|

|

Jan 18 2021, 03:26 PM Jan 18 2021, 03:26 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(2xMachina @ Jan 18 2021, 03:20 PM) Standard Chartered is revising their T&C for Privilege Saver on 1st Feb You'll continue to enjoy the "old" Invest Bonus plan till fulfillment reaches:All up to 100k: Base: 0.05 Deposit: 0.9 Debit 5x: 0.9 Credit 1k: 0.9 Invest: 2% with 30k/yr Insurance, or 30k UT (valid for 3 months only) (Seems crazy high requirement for year round. 120k per year to get 2% fully) Gonna miss the 1k/month for 20k 2% 21. Existing Accountholders who have signed-up the Eligible Unit Trust or an Eligible Insurance / Takaful Policy in year 2020 and 2021 under previous Privilege$aver campaign (1 Feb 2020 to 31 Jan 2021) will continue to enjoy Bonus Interest/Hibah on the Wealth category for 12 months as per the conditions set forth under the previous Privilege$aver campaign (1 Feb 2020 to 31 Jan 2021). |

|

|

Jan 18 2021, 06:48 PM Jan 18 2021, 06:48 PM

Show posts by this member only | IPv6 | Post

#672

|

Junior Member

507 posts Joined: Jun 2015 |

QUOTE(mamamia @ Jan 15 2021, 11:06 AM) QUOTE(Leroi2x @ Jan 18 2021, 11:32 AM) QUOTE(GrumpyNooby @ Jan 18 2021, 11:47 AM) QUOTE(ky33li @ Jan 18 2021, 12:54 PM) RHB's latest T&C (updated 17 Jan 2021) is up on the website. Interest rate for Smart Account removed. I believe the 3.25% rate is outdated rate that was not updated properly in the previous T&C. Leroi2x liked this post

|

|

|

Jan 18 2021, 07:24 PM Jan 18 2021, 07:24 PM

Show posts by this member only | IPv6 | Post

#673

|

Junior Member

701 posts Joined: Oct 2009 |

|

|

|

|

|

|

Jan 18 2021, 07:30 PM Jan 18 2021, 07:30 PM

|

All Stars

17,500 posts Joined: Feb 2006 From: KL |

|

|

|

Jan 18 2021, 07:43 PM Jan 18 2021, 07:43 PM

Show posts by this member only | IPv6 | Post

#675

|

Junior Member

701 posts Joined: Oct 2009 |

|

|

|

Jan 18 2021, 07:47 PM Jan 18 2021, 07:47 PM

|

All Stars

17,500 posts Joined: Feb 2006 From: KL |

|

|

|

Jan 18 2021, 10:11 PM Jan 18 2021, 10:11 PM

|

Senior Member

1,599 posts Joined: Aug 2014 |

As per RHB's latest T&C (updated 17 Jan 2021), there is no change to the features of RHB Smart Account / RHB Smart Account-i, right?

As I quickly glanced through the new T&C, the new interest rate is not stated. |

|

|

Jan 21 2021, 09:22 PM Jan 21 2021, 09:22 PM

Show posts by this member only | IPv6 | Post

#678

|

Junior Member

654 posts Joined: May 2020 |

Hi, all. i have question to ask:-

Deposit a minimum account balance of RM2,000 monthly to get 1.80% p.a.* and to qualify for other bonus payouts. Is this deposit of RM 2,000 similar to PSA? Can deposit then withdraw Pay a minimum of 3 bills monthly via RHB Now Internet or Mobile Banking and get 0.5% p.a.* What is the minimum amount to pay the bill? If TNB, can i repeat to pay it 3 times? |

|

|

Jan 26 2021, 10:50 PM Jan 26 2021, 10:50 PM

|

Senior Member

1,509 posts Joined: Sep 2019 |

QUOTE(datolee32 @ Jan 21 2021, 09:22 PM) Hi, all. i have question to ask:- Yes for all.Deposit a minimum account balance of RM2,000 monthly to get 1.80% p.a.* and to qualify for other bonus payouts. Is this deposit of RM 2,000 similar to PSA? Can deposit then withdraw Pay a minimum of 3 bills monthly via RHB Now Internet or Mobile Banking and get 0.5% p.a.* What is the minimum amount to pay the bill? If TNB, can i repeat to pay it 3 times? QUOTE(smartfreak @ Jul 19 2020, 09:30 AM) datolee32 liked this post

|

|

|

Jan 26 2021, 11:30 PM Jan 26 2021, 11:30 PM

Show posts by this member only | IPv6 | Post

#680

|

All Stars

17,500 posts Joined: Feb 2006 From: KL |

any news about rhb smart account?

|

| Change to: |  0.0232sec 0.0232sec

0.61 0.61

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 04:27 AM |