QUOTE(Boon3 @ Jun 3 2020, 06:30 PM)

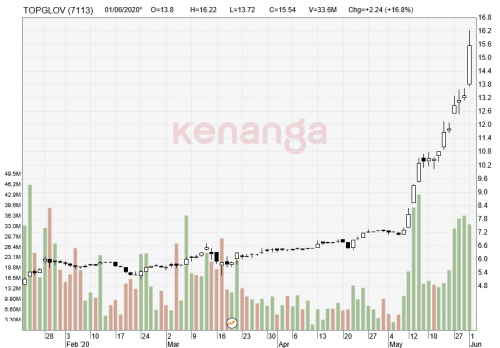

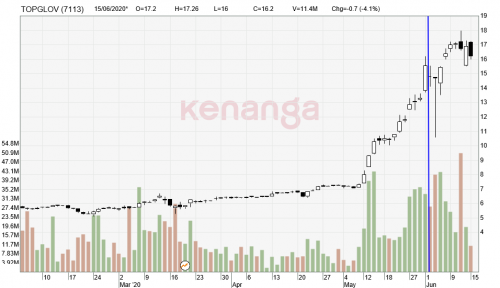

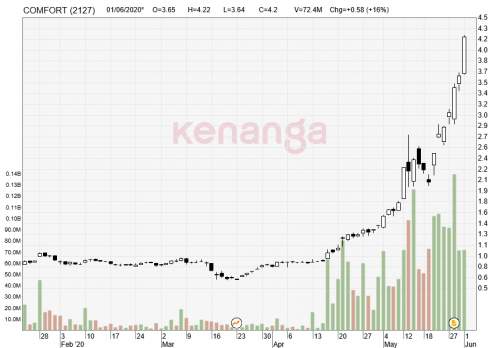

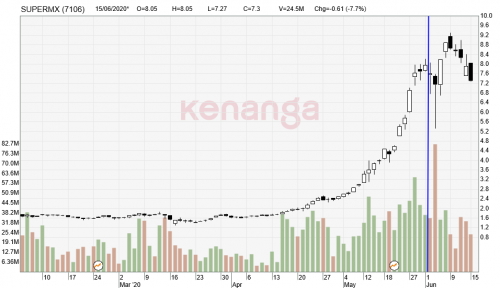

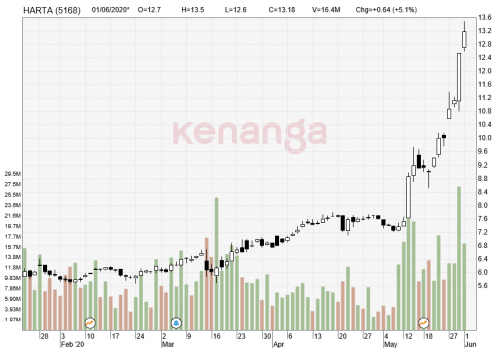

Those postings started from that one post on what homework I would have done during the start of the crisis, ie betting on the glove sector. It's still the same play. One swing at the bat. That's all. Now if I had to swing, it was either one of those. Why not Kossan? Fundamentals wasn't attractive enough to be considered. If you wanna bet, bet on the top horses. It will payoff.

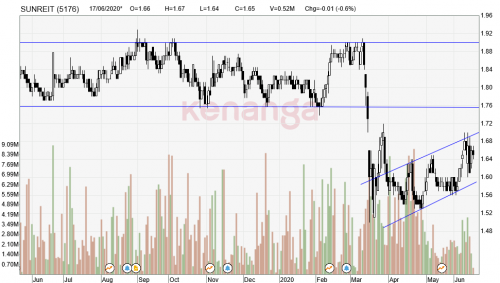

And when I did the sector scan, I only looked at those stocks to gauge the sentiments of the sector, although I only swung at one of them.

That's how I fish.... and pls don't ask which one. lol.

Anyway, do you see how simple it was? You don't need to trade 4 or 5 stocks. Just 1 will do. Get it right, sit on it.... and then you are done for the year (or until the next opportunity). Bottom line, trade less. Do not over trade! Bet on just one. Risk is really the same...

ps.... market sentiments is ... really bubbly. A lot of newcomers playing... millennials ... talking ayam... lol ...

try not to get caught up with the frenzy, ya!

always trade in bigger lots. since homework is already done, just trade according to setups. And when I did the sector scan, I only looked at those stocks to gauge the sentiments of the sector, although I only swung at one of them.

That's how I fish.... and pls don't ask which one. lol.

Anyway, do you see how simple it was? You don't need to trade 4 or 5 stocks. Just 1 will do. Get it right, sit on it.... and then you are done for the year (or until the next opportunity). Bottom line, trade less. Do not over trade! Bet on just one. Risk is really the same...

ps.... market sentiments is ... really bubbly. A lot of newcomers playing... millennials ... talking ayam... lol ...

try not to get caught up with the frenzy, ya!

Jun 3 2020, 07:50 PM

Jun 3 2020, 07:50 PM

Quote

Quote

0.0283sec

0.0283sec

1.31

1.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled