QUOTE(Boon3 @ May 14 2020, 09:49 AM)

Hahaha.... firstly, I apologise for answering you here. I post it here cause I can find what I had posted b4 much easier.

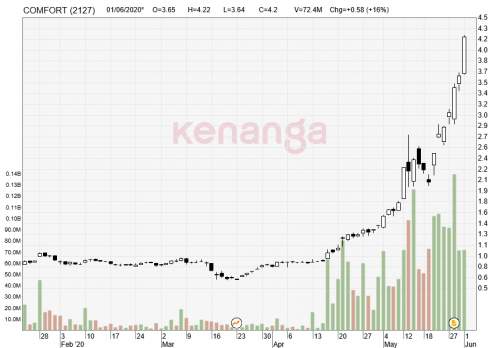

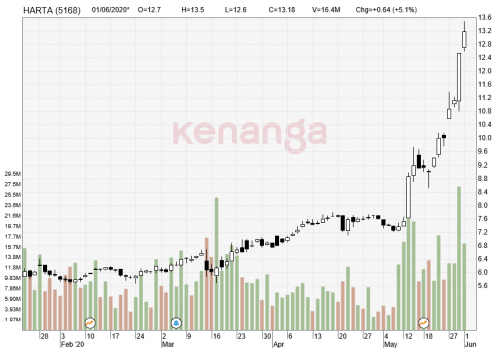

The following is what one probably should have done.... a few months back, before this 19 became a full blown pandemic, the obvious question or logical one is should one whack on the glove sector? or related sector such as medical supplies etc etc....

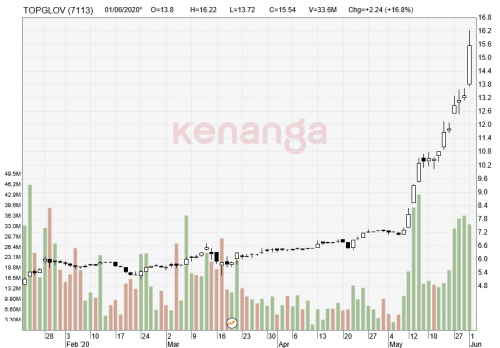

For reference ... we have the SARS outbreak ... which happened during 2002-2004.... so the homework has to be done on the leader of the pack, TOPG.

in 2001, it was reporting a total net profit of 17 million. The year when the outbreak started, its net profit grew to 20 million and then 25 million the next year, then explolded to 39 million... and by 2006, with sales reaching almost a billion, its profits grew to 78 million. (numbers were taken from Bursa website and it was from the quarterlies (too lazy to click on annual) ...

so in terms of profits, SARS did had a really positive impact on TOPG.

** ok.. the argument is ... of course .... those were days when TOPG is in its infant stage. It was a baby company then. TOPG now have sales of over 1.2 billion per quarter. Yup, that's how much it has grown. So obviously there will be a BIG DANGER if one blindly assumes that TOPG profit will experience as an explosive growth as during the SARS era.

** 19 is different. It's worldwide and is there any impact on TOPG workforce and any raw material supply concern?

And next, of course, we need to have an indicator or picture of how TOPG fared during those SARS period....

Multibagger!!! A big one....

Well ..... this is what I would have done ......

But still, i stand by my analysis that valuation is too rich. Even if it manages to double its profit, the PE would still be 30+. And i doubt at its size and its output capacity it can double its profit that easily like during the SARS period. Also, this is an anomaly, when the pandemic is over, who will be left holding all theses highly valued glove counters when demand return to normal ?

Anyway the market liked the covid19 story and feel that manufacturing is limitless with no constraint. So i guess sometime it defy logic.

May 14 2020, 10:20 AM

May 14 2020, 10:20 AM

Quote

Quote

0.0226sec

0.0226sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled