QUOTE(Boon3 @ Apr 25 2019, 10:49 PM)

I would like to suggest something for you.

Try test out this theory first.

So you have those few suggested stocks.

1. Back test.

Look at the 6 months chart. Assuming one bought 6 months ago... how?

2. Paper test based on current prices. Yes, mark down the current prices you would buy these stocks. Wait 6 months then analyse the results.

How? Would this be a sound idea?

ps Blue chips can be steady but they can also fall one...

Hey boon,

Was tied up with work.

Yep I got your point. I do admit that the market is not doing very well. And especially today where the leader market has drop near to 1600 level.

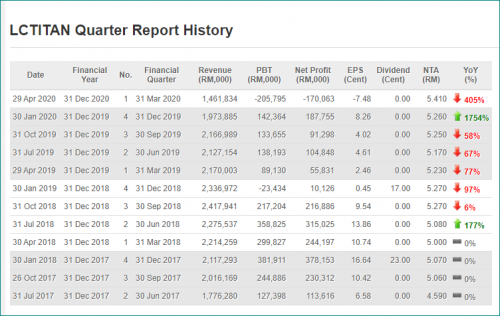

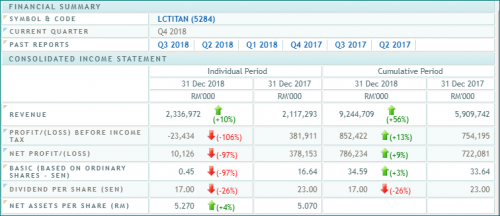

Looking at 6 month chart, yes its losing. 1 year, that's bad. Looking at 5 years charts. Not that bad right after all?

However, this is not a trading ideas yea. Don't get me wrong 1st. What I suggest is just a hedging suggestion. While you are waiting for your perfect stock to trade, you can opt to put 30 - 50 percent of your capital in while waiting, not 100 percent in.

Well, some will argue, might as well do real trading, buying the sticks which recoded down rather than doing paper trade but buying other klse stocks? OK. I'll stop here. If those people like to do it, let them do it.

I believe cash is still needed to punt,not exchanging shares entirely.

Ok now back to. Trading shall we?

Trading? I think is not as simple as that. Some technical required. And importantly, many advise needed. 😄 I'm still looking and lurking for healthy advice here.

This post has been edited by squarepilot: May 13 2019, 11:21 PM

Dec 22 2017, 10:10 AM

Dec 22 2017, 10:10 AM

Quote

Quote

0.2199sec

0.2199sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled