QUOTE(xander2k8 @ Nov 9 2023, 12:04 AM)

Brokerage is cheap but you have factor in FX spread 🤦♀️

Yes it is cheap but the FX spread is high 🤦♀️ that is where is they earn money

Yes US ETF are taxed 30% unless your brokerage is willing to claw back WHT is eligible hence why it is recommended Irish domiciled ETF for tax efficiency

You got burned by their aggressive portfolio is it? 🤦♀️

Their portfolio management is inconsistent hence why

QUOTE(abcn1n @ Nov 9 2023, 12:11 AM)

How did you get burned by FSM (don't need to answer if you don't want to)? Yes, am aware of Vuaa. Guess you prefer Cspx due to the narrower spread.

Dammm...forgot about fx spread. Yeah, most likely not worth it if thinking of the conversion. Thanks for the reminder. Guess FSM regular plan is out then

Entered in January 2020 with a lump sum and continued to DCA. I would understand it's going bad from the covid pandemic but nearing three years still in the red plus our currency dropping? No Bueno.

QUOTE(tadashi987 @ Nov 9 2023, 12:34 AM)

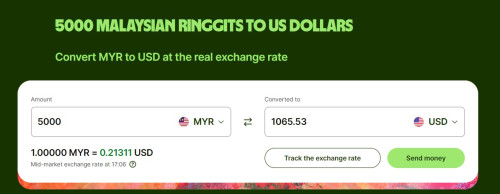

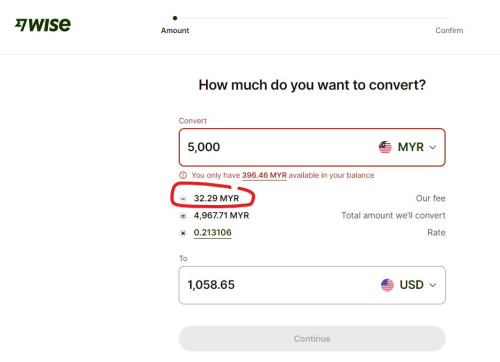

Well let’s verify with fact

I just tried with FSM cash account

5000MYR I can get 1059.70USD

Wise (if use IBKR you gonna use Wise to convert SGD anyway), I get around 1060.69USD

FSM spread is not that bad and almost on par with WISE per se

Correction. At the time of writing

Wise 5k myr = 1065.87 usd

FSM 5k myr = 10597.00 usd

I wouldn't say it's on par.

Plus fsm Investment Amount

USD 390.88

Processing Fee USD 3.80

Malaysia Stamp Duty USD 0.43

Total Investment Amount

USD 395.11

We charge Malaysia stamp duty when ikbr doesnt lol

This post has been edited by Avangelice: Nov 9 2023, 09:01 AM

Nov 9 2023, 12:11 AM

Nov 9 2023, 12:11 AM

Quote

Quote

0.0355sec

0.0355sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled