QUOTE(viktorherald @ Oct 18 2023, 11:08 AM)

Don’t bother buying funds in UT 🤦♀️ 90% loss making while in good times barely makes around FD rates 🤦♀️Go and learn and buy stocks and ETFs itself

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Oct 18 2023, 03:24 PM Oct 18 2023, 03:24 PM

Show posts by this member only | IPv6 | Post

#30521

|

Senior Member

4,673 posts Joined: Jan 2003 |

QUOTE(viktorherald @ Oct 18 2023, 11:08 AM) Don’t bother buying funds in UT 🤦♀️ 90% loss making while in good times barely makes around FD rates 🤦♀️Go and learn and buy stocks and ETFs itself GregPG01 liked this post

|

|

|

|

|

|

Oct 18 2023, 11:04 PM Oct 18 2023, 11:04 PM

Show posts by this member only | IPv6 | Post

#30522

|

Senior Member

5,559 posts Joined: Aug 2011 |

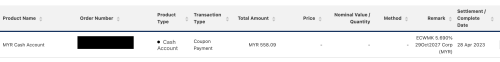

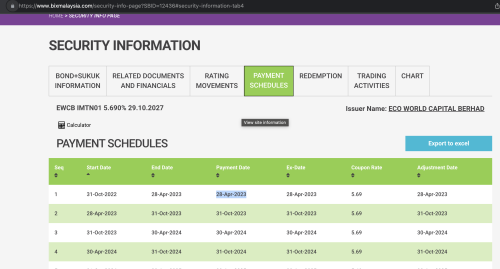

Has anyone used Bond Express to purchase bonds before? How's your experience?

In the case of coupon payments, will they be sent to FSM cash account or direct bank transfer? How soon are these payments effected? |

|

|

Oct 19 2023, 09:10 AM Oct 19 2023, 09:10 AM

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(contestchris @ Oct 18 2023, 11:04 PM) Has anyone used Bond Express to purchase bonds before? How's your experience? it will be sent to ur FSM cash account, i got it within the same day from the coupon payment dayIn the case of coupon payments, will they be sent to FSM cash account or direct bank transfer? How soon are these payments effected?   |

|

|

Oct 19 2023, 09:30 AM Oct 19 2023, 09:30 AM

Show posts by this member only | IPv6 | Post

#30524

|

Senior Member

5,559 posts Joined: Aug 2011 |

|

|

|

Oct 19 2023, 09:53 AM Oct 19 2023, 09:53 AM

|

Junior Member

302 posts Joined: Mar 2010 |

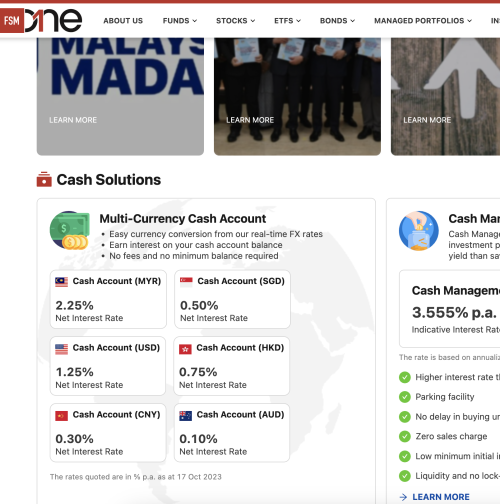

QUOTE(contestchris @ Oct 19 2023, 09:30 AM) 1. How long to cash out to bank account? 1. so far from my experience cashing out from cash account to bank account, is instant within few min.2. Any interest rate earned on cash balances? 3. Can set instruction to automatically trf to bank account? https://www.fsmone.com.my/support/frequentl...tUniqueKey=2475 2. the interest rate of the cash account is on their homepage, it changed a few time this year due to OPR changes. 3. dont think there is such feature  contestchris liked this post

|

|

|

Oct 20 2023, 11:30 PM Oct 20 2023, 11:30 PM

Show posts by this member only | IPv6 | Post

#30526

|

Senior Member

5,559 posts Joined: Aug 2011 |

Hi may I ask about the bond platform fees of 0.045% per quarter.

I just purchased a bond today. I see that the platform fees are notified on 15th of the quarter month (in this case October 2023) and then charged on the 25th. Will I need to pay platform fees this time then? What happens if got zero money to pay the platform fees? They will do forced selling? |

|

|

|

|

|

Oct 21 2023, 08:52 AM Oct 21 2023, 08:52 AM

Show posts by this member only | IPv6 | Post

#30527

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(contestchris @ Oct 20 2023, 11:30 PM) Hi may I ask about the bond platform fees of 0.045% per quarter. https://www.fsmone.com.my/support/frequentl...tUniqueKey=2507I just purchased a bond today. I see that the platform fees are notified on 15th of the quarter month (in this case October 2023) and then charged on the 25th. Will I need to pay platform fees this time then? What happens if got zero money to pay the platform fees? They will do forced selling? 33. When and how to I pay for the platform fee? The quarterly platform fee will be calculated during the 25th of the months of January, April, July and October. Payment of the platform fee will follow this sequence. Cash Acc (bond currency) on quarterly basis >> Cash Acc (MYR) on quarterly basis >> Coupon Payment (will be accumulated till coupon paid out) >> Upon Redemption (will be accumulated till redemption) |

|

|

Oct 21 2023, 10:17 AM Oct 21 2023, 10:17 AM

Show posts by this member only | IPv6 | Post

#30528

|

Senior Member

5,559 posts Joined: Aug 2011 |

QUOTE(zebras @ Oct 21 2023, 08:52 AM) https://www.fsmone.com.my/support/frequentl...tUniqueKey=2507 Sorry I don't understand the sequence meaning. Can pls explain a bit33. When and how to I pay for the platform fee? The quarterly platform fee will be calculated during the 25th of the months of January, April, July and October. Payment of the platform fee will follow this sequence. Cash Acc (bond currency) on quarterly basis >> Cash Acc (MYR) on quarterly basis >> Coupon Payment (will be accumulated till coupon paid out) >> Upon Redemption (will be accumulated till redemption) |

|

|

Oct 21 2023, 07:05 PM Oct 21 2023, 07:05 PM

Show posts by this member only | IPv6 | Post

#30529

|

Senior Member

5,559 posts Joined: Aug 2011 |

Not sure how good the Topicana perps maturing next year are but I went for it

|

|

|

Oct 21 2023, 10:47 PM Oct 21 2023, 10:47 PM

Show posts by this member only | IPv6 | Post

#30530

|

Senior Member

1,016 posts Joined: Nov 2008 From: Subang Jaya |

Ranting/venting a bit tonight.

I had been previously holding: AmTactical Bond Class B (ATBCB) AmDynamic Bond (ADB) Somewhere around mid 2021 I sold off all of ADB and kept ATBCB Since late 2021 ATBCB then nosedived spectacularly, while ADB went up steadily I'm trying to understand how is this possible when both of them are similar (majority allocation in corporate bonds) Is is something to do with ATBCB allocating foreign bonds and local Gov bonds? When reading the annual report, ATBCB keeps pointing to US treasury rates for the decline, but then so many other bonds are doing well? :grrrr: |

|

|

Oct 22 2023, 11:49 AM Oct 22 2023, 11:49 AM

Show posts by this member only | IPv6 | Post

#30531

|

Senior Member

5,559 posts Joined: Aug 2011 |

QUOTE(zebras @ Oct 21 2023, 08:52 AM) https://www.fsmone.com.my/support/frequentl...tUniqueKey=2507 What happens if you have zero money in your cash account and never top up to pay for the quarterly fees?33. When and how to I pay for the platform fee? The quarterly platform fee will be calculated during the 25th of the months of January, April, July and October. Payment of the platform fee will follow this sequence. Cash Acc (bond currency) on quarterly basis >> Cash Acc (MYR) on quarterly basis >> Coupon Payment (will be accumulated till coupon paid out) >> Upon Redemption (will be accumulated till redemption) |

|

|

Oct 22 2023, 12:14 PM Oct 22 2023, 12:14 PM

|

All Stars

14,929 posts Joined: Mar 2015 |

From that same link, ....

Mentioned, .... Important Note Please ensure that you have sufficient monies in the Cash Account (bond currency) by 22nd of the deduction month if you do not wish to pay using the following options. FSM reserves the rights to do ad-hoc platform fee reduction upon bonds redemption. |

|

|

Oct 22 2023, 05:25 PM Oct 22 2023, 05:25 PM

|

Senior Member

4,495 posts Joined: Mar 2014 |

QUOTE(RigerZ @ Oct 21 2023, 10:47 PM) Ranting/venting a bit tonight. I was looking at the portfolio of the 2 bond funds. The main difference I can see is that ATBC has a larger exposure to foreign bonds (im guessing USD dominated, and probably China domicile USD bonds). ADB is concentrated on Malaysian corporates. I had been previously holding: AmTactical Bond Class B (ATBCB) AmDynamic Bond (ADB) Somewhere around mid 2021 I sold off all of ADB and kept ATBCB Since late 2021 ATBCB then nosedived spectacularly, while ADB went up steadily I'm trying to understand how is this possible when both of them are similar (majority allocation in corporate bonds) Is is something to do with ATBCB allocating foreign bonds and local Gov bonds? When reading the annual report, ATBCB keeps pointing to US treasury rates for the decline, but then so many other bonds are doing well? :grrrr: It has been a bad 2 years for bonds in general, but especially for USD denominated ones as US interest rates has gone to the roof (from 0 to 5.25%). Malaysian bonds are fairing better because BNM hike was quite moderate in comparison (1.75 to 3). There is an inverse relationship between interest rate n bond prices. The higher the interest, the bigger the price drop |

|

|

|

|

|

Oct 22 2023, 09:40 PM Oct 22 2023, 09:40 PM

Show posts by this member only | IPv6 | Post

#30534

|

Senior Member

1,016 posts Joined: Nov 2008 From: Subang Jaya |

QUOTE(Cubalagi @ Oct 22 2023, 05:25 PM) I was looking at the portfolio of the 2 bond funds. The main difference I can see is that ATBC has a larger exposure to foreign bonds (im guessing USD dominated, and probably China domicile USD bonds). ADB is concentrated on Malaysian corporates. Hmm yes. I have noticed all the other bond funds doing well are very heavily/ only allocating local bonds. Such is my luck I sold off the wrong fund at the right time It has been a bad 2 years for bonds in general, but especially for USD denominated ones as US interest rates has gone to the roof (from 0 to 5.25%). Malaysian bonds are fairing better because BNM hike was quite moderate in comparison (1.75 to 3). |

|

|

Oct 23 2023, 10:36 AM Oct 23 2023, 10:36 AM

|

Junior Member

820 posts Joined: Aug 2006 |

QUOTE(ironman16 @ Jan 14 2021, 12:11 PM) United Great Dragon Fund - MYR Hedged (A share) -49.26% as of now.New fund available on FSM start 14 jan 2021 Just wondering why nobody mention, suddenly saw bro Grumpy post on other side forum. Thanks @GrumpyNooby baru nampak @MUM oledi mention...... Hope it wont let me down seen i very support ...... UOBAM Malaysia launches United Great Dragon Fund KUALA LUMPUR: UOB Asset Management (M) Bhd (UOBAM Malaysia) has launched the United Great Dragon Fund to provide retail investors with access to China-listed companies set to become the future growth drivers of China’s economy. The fund invests primarily in UOB Asset Management Ltd’s United China A-Shares Innovation Fund (target fund), which focuses on companies in China’s A-shares market. "These companies are likely to be major beneficiaries of technology, innovation and long-term growth trends such as rising consumer affluence and growing urbanisation,” UOBAM Malaysia said in a statement today. Chief executive officer Lim Suet Ling said China offers long-term potential for Malaysian investors who seek to capitalise on its growth opportunities. She said the country is forecast to replace the United States as the world’s largest economy by 2028, as it shifts from an export-driven economy to one that focuses on high-growth industries driven by technological advancements. https://www.thestar.com.my/business/2021/01...eat-dragon-fund |

|

|

Oct 23 2023, 10:40 AM Oct 23 2023, 10:40 AM

Show posts by this member only | IPv6 | Post

#30536

|

All Stars

24,382 posts Joined: Feb 2011 |

|

|

|

Oct 23 2023, 01:24 PM Oct 23 2023, 01:24 PM

Show posts by this member only | IPv6 | Post

#30537

|

Senior Member

4,673 posts Joined: Jan 2003 |

|

|

|

Oct 24 2023, 09:20 AM Oct 24 2023, 09:20 AM

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

Oct 24 2023, 01:06 PM Oct 24 2023, 01:06 PM

Show posts by this member only | IPv6 | Post

#30539

|

Senior Member

4,673 posts Joined: Jan 2003 |

QUOTE(zebras @ Oct 24 2023, 09:20 AM) You can bottom fish 🤦♀️ but I wouldn’t because CCP under Emperor Xi with its inconsistencies in policies 🤦♀️ he can yield the power anytime if something not in his favor The only company in China I am very firm believe now is CATL but is very high in valuation atm |

|

|

Nov 1 2023, 09:53 AM Nov 1 2023, 09:53 AM

|

Junior Member

302 posts Joined: Mar 2010 |

https://www.fsmone.com.my/funds/research/ar...m1-pr?src=funds

is this now the cheapest way to invest in US ETF for long term?  |

| Change to: |  0.0697sec 0.0697sec

0.50 0.50

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 03:54 AM |