QUOTE(frankzane @ Dec 30 2021, 06:40 PM)

http://www.theedgemarkets.com/article/mof-...2xotDw.whatsappMOF: Individuals to be exempted from tax on foreign-sourced income

This post has been edited by WhitE LighteR: Dec 30 2021, 09:23 PM

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Dec 30 2021, 09:22 PM Dec 30 2021, 09:22 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(frankzane @ Dec 30 2021, 06:40 PM) http://www.theedgemarkets.com/article/mof-...2xotDw.whatsappMOF: Individuals to be exempted from tax on foreign-sourced income This post has been edited by WhitE LighteR: Dec 30 2021, 09:23 PM LoTek and tadashi987 liked this post

|

|

|

|

|

|

Dec 31 2021, 01:21 AM Dec 31 2021, 01:21 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(frankzane @ Dec 30 2021, 06:39 PM) No need because if the fund pays the tax you will received a tax voucher for your records which if IRB audits your account then you have the records to prove Btw, exemption is granted now for the next 5 years until next GE if BN or PN wins they will implement full force once they have majority in Parliament whereby the can amend the relevant easily then frankzane liked this post

|

|

|

Dec 31 2021, 09:13 AM Dec 31 2021, 09:13 AM

|

Junior Member

63 posts Joined: Feb 2021 |

QUOTE(MUM @ Dec 27 2021, 11:07 PM) preferably,.... 35% Asia Pac 20% US 10% China A shares 10% India 10% Tech 15% Global Reits QUOTE(adele123 @ Dec 27 2021, 11:35 PM) i started off in 2014 when i think ppl are into global titan funds and also greater china fund... i invest in neither because i think it was too volatile for my taste. i have made mistakes here and there. my UT portfolio gives about 5 to 6% IRR on average but recently dropped to 4%. i believe, if i reduce my malaysia exposure, overall return should be better. Right, decent enough, similar to asb/epf returns. Is that sufficient for your investment goals/objectives?i think for me now is, the focus should be around 5 to 6 funds max. di-worse-sification is a thing. i actually stop buying into local funds. my plan is to not increase my malaysian equity... increase my exposure with some bond funds also. continue to increase put money into asia pacific regularly. and i'm slowly increasing my stake into china heavy fund given recent drop in hk/china but doing via ETF instead. what i'm lacking is exposure to the USA in my opinion. I dont have a strategy. i just trial and error, see what i can do. Btw are you using the fsm brokerage for the ETFs (is it an international etf or bursa based)? Hahaha. Yes I totally get the whole trial and error thing. There doesn’t seem to be much content/ books on more in-depth mutual fund strategies etc (in comparison to stocks investing content at least). |

|

|

Dec 31 2021, 09:44 AM Dec 31 2021, 09:44 AM

|

All Stars

14,854 posts Joined: Mar 2015 |

QUOTE(george_dave91 @ Dec 31 2021, 09:13 AM) Oou that’s an interesting mix. You should be getting decent risk adjusted returns on that one right? How as it been so far? So do the REIT funds kinda act as a bond fund in your portfolio? Sorry I hv no idea how to calculate the risk adjusted return.Reits fund is more volatile than FI. My thought of having it is for diversification purposes on that posted idea port of mine This post has been edited by MUM: Dec 31 2021, 09:46 AM |

|

|

Dec 31 2021, 11:06 AM Dec 31 2021, 11:06 AM

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

Profit / Loss

MYR -2,145.76 (-6.59%) All because of Affin Hwang *.. Sigh |

|

|

Dec 31 2021, 12:09 PM Dec 31 2021, 12:09 PM

Show posts by this member only | IPv6 | Post

#29346

|

Senior Member

5,648 posts Joined: Mar 2011 From: Jalan Tijani |

Paper loss unless you sold it?

|

|

|

|

|

|

Dec 31 2021, 02:03 PM Dec 31 2021, 02:03 PM

|

Junior Member

664 posts Joined: Dec 2006 |

|

|

|

Jan 1 2022, 03:53 PM Jan 1 2022, 03:53 PM

|

Senior Member

1,012 posts Joined: Nov 2008 From: Subang Jaya |

Rough year expected for India market investors?

https://indianexpress.com/article/explained...n-2022-7698795/ https://www.aljazeera.com/news/2021/12/28/india-economy https://asia.nikkei.com/Opinion/2022-look-a...et-expectations |

|

|

Jan 2 2022, 02:11 AM Jan 2 2022, 02:11 AM

Show posts by this member only | IPv6 | Post

#29349

|

Junior Member

63 posts Joined: Feb 2021 |

QUOTE(MUM @ Dec 31 2021, 09:44 AM) Sorry I hv no idea how to calculate the risk adjusted return. Well essentially its any calculation/ratio that considers return in relation to risk taken. The sharpe ratio is one such example (and probably the most commonly used). Reits fund is more volatile than FI. My thought of having it is for diversification purposes on that posted idea port of mine Yeah I think REIT funds are good in that sense too, being a whole different asset and all. Having a mix of uncorrelated assets essentially lowers the volatility of a portfolio while either maintaining or maybe even improving returns, so goes the theory at least. But yea, seems like a good mix 👍 |

|

|

Jan 2 2022, 03:41 AM Jan 2 2022, 03:41 AM

Show posts by this member only | IPv6 | Post

#29350

|

All Stars

14,854 posts Joined: Mar 2015 |

QUOTE(george_dave91 @ Jan 2 2022, 02:11 AM) Well essentially its any calculation/ratio that considers return in relation to risk taken. The sharpe ratio is one such example (and probably the most commonly used). individual funds can get the risk return metric value like 3-Yr Annualised Volatility & 3-Yr Sharpe Ratio from FSM....but how to calculated them in the portfolio basis when the portfolio consisted of a few funds? Yeah I think REIT funds are good in that sense too, being a whole different asset and all. Having a mix of uncorrelated assets essentially lowers the volatility of a portfolio while either maintaining or maybe even improving returns, so goes the theory at least. But yea, seems like a good mix 👍 |

|

|

Jan 3 2022, 08:37 PM Jan 3 2022, 08:37 PM

Show posts by this member only | IPv6 | Post

#29351

|

Senior Member

8,188 posts Joined: Apr 2013 |

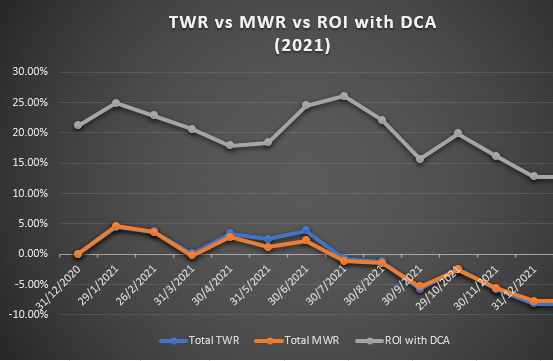

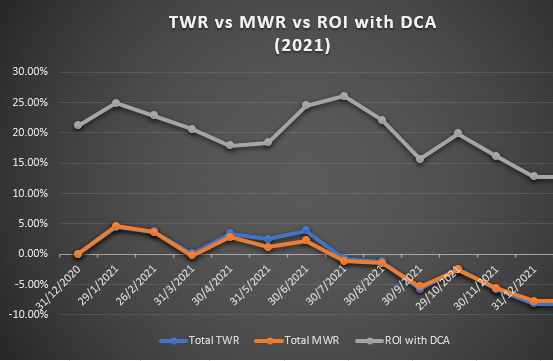

Just for Shiok sendiri.... my 2021 happenings ....... got Attached thumbnail(s)

WhitE LighteR and WhitE LighteR liked this post

|

|

|

Jan 4 2022, 10:43 AM Jan 4 2022, 10:43 AM

Show posts by this member only | IPv6 | Post

#29352

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

|

|

|

Jan 4 2022, 11:50 AM Jan 4 2022, 11:50 AM

Show posts by this member only | IPv6 | Post

#29353

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Jan 4 2022, 02:51 PM Jan 4 2022, 02:51 PM

|

Junior Member

219 posts Joined: Sep 2010 |

Any new re: what had happened to RHB Islamic Bond?

-14.59% in one go.... not a distribution |

|

|

Jan 4 2022, 03:15 PM Jan 4 2022, 03:15 PM

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(ROSS_Solar @ Jan 4 2022, 02:51 PM) related?CIMB says MEX RM1.3b Islamic Bonds Suspended i think RHB bond fund holds quite a bit of MEX. This post has been edited by encikbuta: Jan 4 2022, 03:16 PM |

|

|

Jan 4 2022, 03:28 PM Jan 4 2022, 03:28 PM

|

Junior Member

219 posts Joined: Sep 2010 |

QUOTE(encikbuta @ Jan 4 2022, 03:15 PM) yeah, probably... RHB management sucks big time. Why the heck they subscribe so much of a single issuer?-15% this year, -8% last year... so 23% of fund were MEX bonds, i guess. |

|

|

Jan 4 2022, 04:00 PM Jan 4 2022, 04:00 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

My port end 2021 in a disappointing manner. YTD TWR : -8.18 % MoM Change TWR : -2.39 % YTD MWR : -7.75 % MoM Change MWR : -2.16 % ROI with DCA since start tracking : 12.75 % MoM Change : -3.39 % Just to console myself. I try to see the 1 positive for this year. 2020 combined profits breakdown : Realized profit : 2020.20 Unrealized profit : 9853.99 2021 combined profits breakdown : Realized profit : 7730.77 Unrealized profit : -3967.39 |

|

|

Jan 4 2022, 07:10 PM Jan 4 2022, 07:10 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(WhitE LighteR @ Jan 4 2022, 04:00 PM)  My port end 2021 in a disappointing manner. YTD TWR : -8.18 % MoM Change TWR : -2.39 % YTD MWR : -7.75 % MoM Change MWR : -2.16 % ROI with DCA since start tracking : 12.75 % MoM Change : -3.39 % Just to console myself. I try to see the 1 positive for this year. 2020 combined profits breakdown : Realized profit : 2020.20 Unrealized profit : 9853.99 2021 combined profits breakdown : Realized profit : 7730.77 Unrealized profit : -3967.39 WhitE LighteR liked this post

|

|

|

Jan 4 2022, 09:50 PM Jan 4 2022, 09:50 PM

Show posts by this member only | IPv6 | Post

#29359

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

|

|

|

Jan 5 2022, 03:47 PM Jan 5 2022, 03:47 PM

|

Junior Member

89 posts Joined: Mar 2011 |

Hi, may i know what is your view on 2022 prospect?

US is expected to stop the QE starting this month and slowly increase the interest rate. Should i reduce the equity holdings? |

| Change to: |  0.0288sec 0.0288sec

0.41 0.41

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 04:59 PM |