QUOTE(MUM @ Nov 23 2021, 06:16 PM)

unless you can have foresight....

when you are investing in investment that are not denominated in the local currency...

there is ALWAYS a currency risk factor....

which can be both GOOD and BAD depending on the trend.

this currency risk can impact the investment returns in either make it worst or amplify its returns

googled and found this

Foreign Currency Effects

Advantages Resulting from Foreign Currency Effects

Disadvantages Resulting from Foreign Currency Effects

Foreign Currency Effects Example

if you really want to maximise returns by trying to time the forex movement, then why not try to time the movement of that investment too (UT/ETF)??

if you want to time the entry of your investment,.....then that is not the maxim (rule of conduct) of most people that do DCA...

What you have said is true. In fact when I read FSM articles they already said if suppose the stock is in CNH, even if the fund is say SGD denominated, the fund manager will still take your Sing dollars and convert so as to buy that stock. That is why some UT has this XXX and then XXXX-H aka hedged.when you are investing in investment that are not denominated in the local currency...

there is ALWAYS a currency risk factor....

which can be both GOOD and BAD depending on the trend.

this currency risk can impact the investment returns in either make it worst or amplify its returns

googled and found this

Foreign Currency Effects

Advantages Resulting from Foreign Currency Effects

Disadvantages Resulting from Foreign Currency Effects

Foreign Currency Effects Example

if you really want to maximise returns by trying to time the forex movement, then why not try to time the movement of that investment too (UT/ETF)??

if you want to time the entry of your investment,.....then that is not the maxim (rule of conduct) of most people that do DCA...

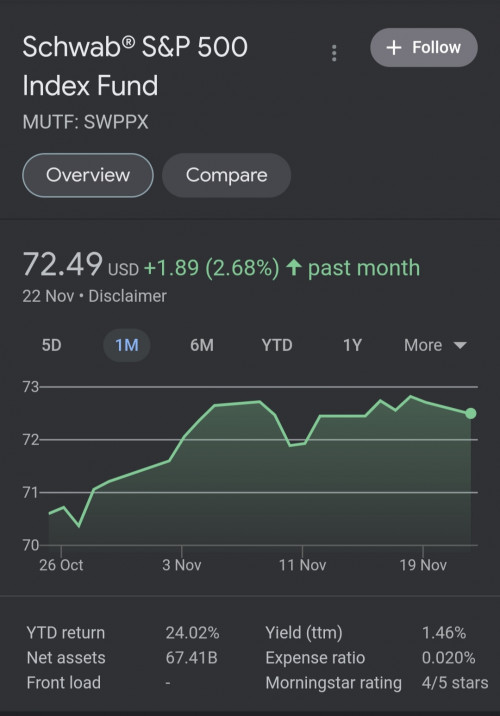

Back to earlier topic on DCA I do practice monthly DCA (time salary comes in) like most ppl. Just happen for my foreign currency denominated UT/ETF, I take a slightly more frequent weekly or fortnightly DCA. So was asking investors here for foreign currency denominated UT/ETF do you all also do monthly DCA or like me invest more frequent. Or none of you invest in UT/ETF that is of foreign currency ?

Also to clarify although I do weekly DCA the total amount will be about the same as monthly DCA. E.g X dollars for monthly will be about X dollars / 4 for each weekly DCA.

Nov 23 2021, 07:22 PM

Nov 23 2021, 07:22 PM

Quote

Quote

0.0286sec

0.0286sec

0.50

0.50

6 queries

6 queries

GZIP Disabled

GZIP Disabled