QUOTE(yklooi @ Jan 6 2021, 07:38 AM)

what ever suit your true risk appetite & risk capacity and the need of your portfolio would be good

you have a Global Tech fund,...and a China A share fund....looks like they are not corelated much

what more do you have and at what % of allocation for each of those funds that you have for your UT portfolio?

btw,...are you

GANESHWARAN KANA ?

just thinking of the author of that article as mentioned in post 24813, page 1241 as in link posted by T231h

I'm GANESH KUMAR and not GANESHWARAN KANA.

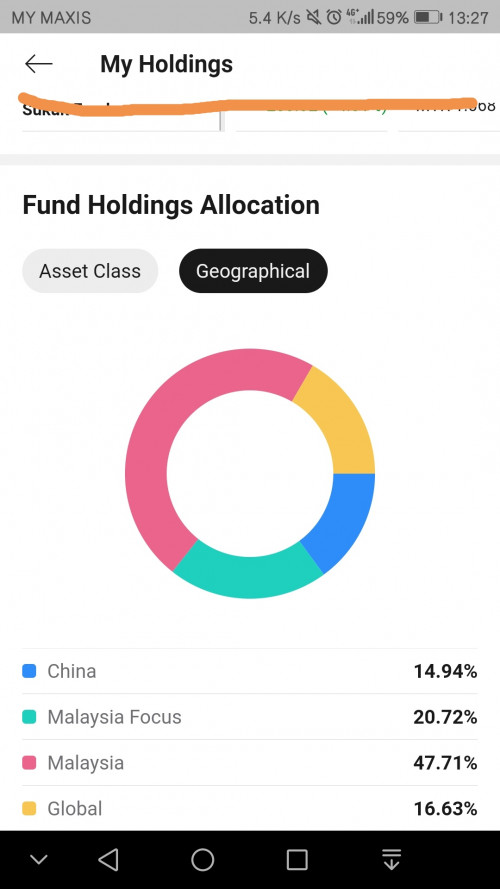

Out of my portfolio of RM35k

these are my allocations.

1) Affin Hwang World Series - Global Disruptive Innovation Fund - MYR Hedged=14.28%

2) AmanahRaya Syariah Trust Fund=16.5%

3) AmDynamic Bond=19.00%

4) InterPac Dana Safi=8.57%

5) Principal Islamic Lifetime Enhanced Sukuk Fund=18.76%

6) United Malaysia Fund = 22%

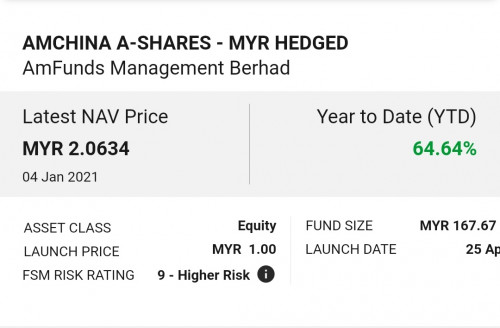

now thinking of adding AM CHINA A-SHARES MYR HEDGED to my portfolio.

Need some opinions

Jan 2 2021, 11:44 AM

Jan 2 2021, 11:44 AM

Quote

Quote

0.7116sec

0.7116sec

1.12

1.12

7 queries

7 queries

GZIP Disabled

GZIP Disabled