how do you guys check the return for a year (ie 2019)?

i tot FSM just give the return on your cost.

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jan 8 2020, 10:39 AM Jan 8 2020, 10:39 AM

Return to original view | Post

#1

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

how do you guys check the return for a year (ie 2019)?

i tot FSM just give the return on your cost. |

|

|

|

|

|

Apr 23 2020, 07:35 AM Apr 23 2020, 07:35 AM

Return to original view | Post

#2

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(engyr @ Apr 23 2020, 07:01 AM) Anyone had bought cimb principal prs from fundsupermart.com.my before? Can you visualise your investment at cimb click portal? I bought but i dont have cimb clicks. One of the worst bank i dealt with. I have a debit card with them, got clicks for a month suddenly can't access, after several calls end up tell me coz i dont have saving acc, must have. Lol But why you need this? View from fsm is good. |

|

|

Jun 11 2020, 10:31 PM Jun 11 2020, 10:31 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

Anyone know how does or when the annual management fee of fund get charged. Is it when they announce distribution and annouce the adjustment of the nav, they will adjust it with consideration of the fee? What if i sell before then?

|

|

|

Jun 11 2020, 10:41 PM Jun 11 2020, 10:41 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(GrumpyNooby @ Jun 11 2020, 10:33 PM) Annual management fee of the said fund is incurred on daily basis and it's reflected on the daily published fund price (NAV). Ooo. Learned some thing new and totally logical for it to count this way. Thanks bro.Meaning to say that the daily published NAV has taken into consideration the annual management fee and trustee fee. |

|

|

Jul 7 2020, 04:20 PM Jul 7 2020, 04:20 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

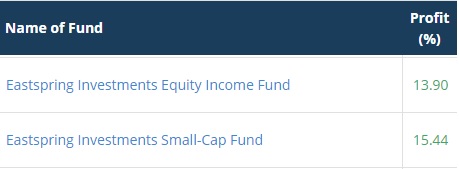

QUOTE(Red_rustyjelly @ Jul 6 2020, 11:15 PM) hi guys. how do you let go of funds at the right time? How to analyze when is right time? i have the small cap fund to.I have 2 funds that already hit 15%, i am thinking to take profit. But the daily increase getting addictive.  for me, yes, wait till momentum slow. |

|

|

Jul 17 2020, 08:18 PM Jul 17 2020, 08:18 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

|

|

|

Jul 17 2020, 08:25 PM Jul 17 2020, 08:25 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Nov 7 2020, 07:57 AM Nov 7 2020, 07:57 AM

Return to original view | Post

#8

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

No fund eligible eligible from epf in fsm that is in US region?

|

|

|

Nov 7 2020, 09:59 AM Nov 7 2020, 09:59 AM

Return to original view | Post

#9

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Nov 7 2020, 10:00 AM Nov 7 2020, 10:00 AM

Return to original view | Post

#10

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(yklooi @ Nov 7 2020, 08:12 AM) Well, only can buy those that epf approved. So not everything in fsm you can buy via epf. yklooi liked this post

|

|

|

Nov 11 2020, 07:59 AM Nov 11 2020, 07:59 AM

Return to original view | Post

#11

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

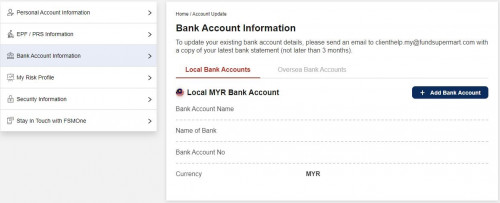

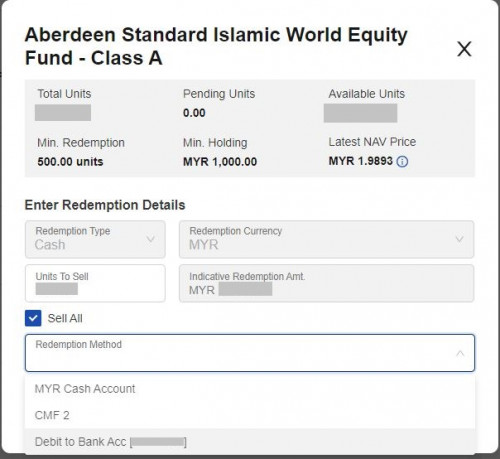

hi all,

all these while i just purchase prs and try to invest using epf in fsm. i received a letter from bank saying my house loan effective interest is about 3% only. intend to take abit and invest into UT via fsm. but unsure about redeeming and getting the money back once UT sold. would it go back to our bank account or what? whats the procedure? |

|

|

Nov 11 2020, 08:59 AM Nov 11 2020, 08:59 AM

Return to original view | Post

#12

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(GrumpyNooby @ Nov 11 2020, 08:04 AM) In FSM, did you nominate a bank account? no. not yet. If yes, you can set the instruction to transfer the sales proceed to the nominated bank account.  Sales order menu and redemption instruction:  thank you so much. was hoping for just a few lines of pointers so i can go check it out myself. this is more than that! thanks a lot! |

|

|

Jan 8 2021, 06:20 PM Jan 8 2021, 06:20 PM

Return to original view | Post

#13

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(WhitE LighteR @ Jan 8 2021, 06:14 PM) some fridays NAV is not updated.so far i only see Eastspring most prompt. WhitE LighteR liked this post

|

|

|

|

|

|

Jan 22 2021, 05:43 PM Jan 22 2021, 05:43 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(vanitas @ Jan 22 2021, 04:33 PM) Just a word of advice, a lot of believers like that across US ETF, bitcoin, or even now UT (??).. i dont get this message, future is not guaranteed, its a given fact. The reality is future is not guaranteed despite how many believers talk the same thing. You might wait forever (within your lifetime) and the price never went back, although the chance is very very low. But the chance getting higher if you doesn't have much time to wait (getting older, need to spend for house or kids, accidental and emergency expense, lose job forced retired etc). US etf was once lagged since subprime mortgage crisis till the rise of Apple / smartphone. That's around 10 years. Bitcoin was lagged since 2017 till 2020. 3 years. But it is still new, if you compare Gold which similar to bitcoin as store of value, I think previously rise for 10 to 20 years, which at that point everyone also talk about buy gold, then drop and lagged for like 10 years. For UT, Malaysia market once having the longest bull market in the world, like 12 years, until now soon longest bear in the world. You may find a lot of stories in public mutual thread since they serve the longest business in UT, how many people doesn't make money after 10 years. Just for anyone to reference, since everyone was talk about how much they made in various investments easily, and recently, but never zoom out. so what you want people to do? when earn sad, when lose sad? so lead a sad life regardless? anyone should monitor their portfolio from time to time. its not like "oh its UT, lets invest, and forgot about it for 10 years". its one's responsibility to look at his/her investment from time to time and do what they deem necessary. WhitE LighteR liked this post

|

|

|

Jan 25 2021, 08:44 PM Jan 25 2021, 08:44 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Jan 26 2021, 06:53 PM Jan 26 2021, 06:53 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

|

|

|

Jan 26 2021, 06:58 PM Jan 26 2021, 06:58 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

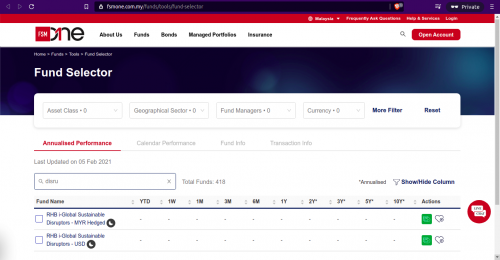

Hi All,

I have been using FSM since 2016 (i think?_ mainly on PRS. Only last year i started exploring i-invest using epf mid/late last year. i have been interested in UT in the US market but since PRS and i-invest are limited, there is virtually no fund eligible under those 2 category. in conjunction with the promo that FSM have until end of month (0% sales), and i have some extra fund to invest this month, anyone can give some pointers on any fund (preferably exposure to US market) to i should look into? i will look into it further myself, but just need some pointers. i wont take this as a buy call. dont worry. |

|

|

Jan 26 2021, 07:45 PM Jan 26 2021, 07:45 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(WhitE LighteR @ Jan 26 2021, 07:01 PM) if i recall correctly, there is only 1 fund available to epf that has exposure to US. that is principal global titan. For this im looking for any fund under fsm that focus on US. Coz this would be using my own 'pocket' money, not epf.but the performance is not good. |

|

|

Feb 9 2021, 09:42 PM Feb 9 2021, 09:42 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(poooky @ Feb 9 2021, 09:22 PM) Thanks for the replies everyone. However, the Fund Selector still doesn't return the intended when searching the keywords. For example, searching for 'disruption', the only funds returns are the RHB - Sustainability ones. Am I doing it wrong? The search includes one filter by default and affin disruptive fund is filtered out due to that. Toggle some of the filters off. I cant remember which one. That's a good point about balancing our own portfolio by investing in pure equities fund alongside pure bond/fi funds. I've since re-evaluated my goals and gone into Affin Hwang World Series - Global Disruptive Innovation Fund, and Affin Hwang Aiiman Asia (ex Japan) Growth Fund. I'm thinking of adding one or two more 'safe' funds, possibly the RHB China Bond Fund and/or Amanahraya Syariah Trust Fund for an 90/10 or 80/20 equities/bonds mix. An earlier user commented that both the RHB China Bond Fund and the Amanahraya Syariah Trust Fund gave ~10% and ~4% returns respectively which seems abnormally good for bond/FI funds. What are you thoughts? would this 80/20 or 90/10 mix be a decent portfolio? I'm looking for longer term investments possibly 5 to 10 years where I'll be making periodic deposits. Would the 80/20 portfolio be suitable? Also when is the right time to sell? Is it safe to stay in a fund for decades/infinitely just topping up periodically without closely monitoring the market? or do we need to keep an eye on the market, and sell at the high, pocket the gains and put the rest into another fund at the low? In this case, is it ever 'too late' to invest a fund? for example, tech sector may be overvalued now and those investing now at the high take on more risk as the market may correct. Or maybe investing in a bond fund right before the bonds mature? Another question, anyone can share their thoughts on diverting a portion of EPF money into a low/med risk approved fund? yes ~6% pa is good, and more fees are incurred when investing in a fund, but at the very least we get to retain some control over our EPF money, and in a way it is hedging against the possibility of EPF funds disappearing in the future because it is being used to shore up the country's financial coffers. Or is this a moot point? |

|

|

Feb 18 2021, 05:39 PM Feb 18 2021, 05:39 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

4,352 posts Joined: Oct 2010 From: KL |

QUOTE(mitkey06 @ Feb 18 2021, 02:59 PM) if bought PRS have to wait until 55 yo? then its too late to withdraw. cant they allow sell and switch fund ? you need to go and learn what is the term and concept of PRS JinXXX and wongmunkeong liked this post

|

| Change to: |  0.0681sec 0.0681sec

0.87 0.87

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 02:09 AM |