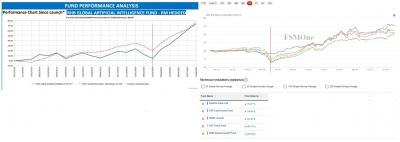

QUOTE(yklooi @ Nov 21 2020, 09:39 AM)

looks like end MARCH 2020 was the Magic trigger for many fundsThis post has been edited by MUM: Nov 21 2020, 10:11 AM

Attached thumbnail(s)

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Nov 21 2020, 10:04 AM Nov 21 2020, 10:04 AM

Show posts by this member only | IPv6 | Post

#24041

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(yklooi @ Nov 21 2020, 09:39 AM) looks like end MARCH 2020 was the Magic trigger for many fundsThis post has been edited by MUM: Nov 21 2020, 10:11 AM Attached thumbnail(s)

WhitE LighteR liked this post

|

|

|

|

|

|

Nov 21 2020, 10:29 AM Nov 21 2020, 10:29 AM

|

Junior Member

313 posts Joined: Mar 2010 From: Kuala Lumpur |

QUOTE(MUM @ Nov 21 2020, 10:04 AM) looks like end MARCH 2020 was the Magic trigger for many funds Due to covid 19, more people are working from home and the need to expedite digital transformation for companies. Hence the demand for data storage increases and also the relevant technology to upgrade existing infrastructure. That's why software companies are doing well and you can see demand for skills in data science increased. Tesla has the technologies to disrupt the way we live in future and we are talking about electric cars with battery cost so low that it can replace fossil fuel. I am not saying it will change drastically overnight but lots of things are happening behind the scene now. Even Singapore are inviting Hyundai to set up EV manufacturing facility. Remember what happen to Nokia phones? Kena tapao when smart phones are launched.For Alibaba and Apple stocks yes no doubt they are great companies but they are also influenced by personal consumption. Their profits are determined when people spend more or less. When you have better choice for tech funds why choose the conventional ones? You can check out other disruptive technology funds for research your further such as Nikko Ark Innovation Technology and Blackrock Next Generation Fund. Go google nikko ark funds on youtube and you will understand the disruptive technologies are slowly changing our lives. Yes disruptive technologies are already happening in previous years but covid 19 actually shake our traditiona business model where companies now can adopt work from home to reduce cost in renting or owning properties. Why do you think Warren Buffet bought snowflake which is another software company? Many traditional jobs are going to disappear in coming years. This post has been edited by ky33li: Nov 21 2020, 10:34 AM |

|

|

Nov 21 2020, 10:34 AM Nov 21 2020, 10:34 AM

Show posts by this member only | IPv6 | Post

#24043

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(ky33li @ Nov 21 2020, 10:29 AM) Due to covid 19, more people are working from home and the need to expedite digital transformation for companies. Hence the demand for data storage increases and also the relevant technology to upgrade existing infrastructure. That's why software companies are doing well and you can see demand for skills in data science increased. Tesla has the technologies to disrupt the way we live in future and we are talking about electric cars with battery cost so low that it can replace fossil fuel. I am not saying it will change drastically overnight but lots of things are happening behind the scene now. Even Singapore are inviting Hyundai to set up EV manufacturing facility. Remember what happen to Nokia phones? Kena tapao when smart phones are launched. For Alibaba and Apple stocks yes no doubt they are great companies but they are also influenced by personal consumption. Their profits are determined when people spend more or less. When you have better choice for tech funds why choose the conventional ones? will this HOT theme of "anything Disruptive" be just for this season? You can check out other disruptive technology funds for your further such as Nikko Ark Innovation Technology and Blackrock Next Generation Fund. Go google nikko ark funds on youtube and you will understand the disruptive technologies are slowly changing our lives. is it just a NAME that attracts ?.....just like "Innovation funds" or IT and Tech funds during the 1990s? |

|

|

Nov 21 2020, 01:32 PM Nov 21 2020, 01:32 PM

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(ericlaiys @ Nov 21 2020, 09:23 AM) you can ericlaiys Thanks. T+3 [is the 3 working days or 3 days (inclusive of Saturday and Sunday)? I bought it on 18/11 before 3pm]1. select cash account before buy 2. T+3 (depend on fund). On last day of 3 day, based on my observation From FSM : "FPX payment method is not available for this Purchase Order (PO) as the previous attempt to make payment was not completed or unsuccessful. You will not able to make a payment for the same PO using FPX. You may continue with this PO by mailing cheque and upload your bank-in slip OR if you would like to make payment via FPX, kindly place a new order." LOL, who mails cheque nowadays for this type of thing. QUOTE(T231H @ Nov 21 2020, 07:52 AM) try this (per image) for your question 1 Thanks. This FSM really as per your question 2...as per their FAQs: "Your buy orders will only be transacted when payment is received.....before the cut off time and any buy order received after cut off time will process on the next business day". "If we receive your payment before the cutoff time on a business day, your units will be priced as of the closing price of the market on that day itself. For payments received after the cutoff time or on a non-business day, your units will be priced based on the next business day. Given that the fund management companies require time to consolidate, calculate and verify unit prices with independent trustees, you will only know the exact unit price two working days later. You will receive an email from us once your units have been priced." QUOTE(ky33li @ Nov 21 2020, 08:16 AM) RHB Artificial Intelligence Fund performs better than TA technology fund simply because the tech funds selected are much better than TA. both are feeder funds one managed by Allianz while the other Janus. As i know Allianz is one of top fund managers in the world but not Janus. Have always avoided AI /disruptive funds. Guess, I should have looked into it more.QUOTE(ky33li @ Nov 21 2020, 08:58 AM) Let's see which fund performs better incoming year but i am very sure Allianz Intelligence Fund returns will surpass Janus Technology Fund. You can check asset under both fund managers Allianz EURO2268billion vs Janus of USD374billion. Just YTD alone Allianz Artificial Intelligence Fund return is 60% vs Janus of only 30%. You have to look at underlying securities. you must invest in tech funds that are growing in demand especially into cloud services which are disruptive in nature (such as tesla talking about autonomous driving, producing cheaper batteries) and not those into boring old apple, alibaba shares... Currently, funds are doing rotational play from tech into value investing and also certain emerging market where stocks have not risen.This post has been edited by abcn1n: Nov 21 2020, 01:34 PM |

|

|

Nov 21 2020, 02:00 PM Nov 21 2020, 02:00 PM

Show posts by this member only | IPv6 | Post

#24045

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(abcn1n @ Nov 21 2020, 01:32 PM) ericlaiys u can reply an email to complain to their CS haha, every new website sure comes with some user experience drawdown and hiccup Thanks. This FSM really vmad.gif Change the 'method'. I'm sure I'm not the only one that encountered this problem. Previously automatically will just deduct from cash account (and show as cheque/FPX once everything processed). Now it seems automatic deduction is through FPX. The option to pay by cash is not even highlighted and will only be shown if we click on cheque/FPX first, then only can see the cash method and then select cash from there. Really stupid. If I were the boss, I would have fired the person/tech guy that design/approve it. Ok, end of rant and sorry for the rant. This post has been edited by tadashi987: Nov 21 2020, 02:01 PM |

|

|

Nov 21 2020, 04:01 PM Nov 21 2020, 04:01 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

I am now 8% in tech of my total equity investment... should I increase more?

|

|

|

|

|

|

Nov 21 2020, 04:06 PM Nov 21 2020, 04:06 PM

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

Nov 21 2020, 04:08 PM Nov 21 2020, 04:08 PM

Show posts by this member only | IPv6 | Post

#24048

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Kaka23 @ Nov 21 2020, 04:01 PM) how many % has this tech fund gives you?how many more % of this tech fund do you want to add? after adding this new % into that tech fund, how many % will it increase your portfolio ROI % (if the performance results were to be the same as previously)? |

|

|

Nov 21 2020, 04:11 PM Nov 21 2020, 04:11 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(Kaka23 @ Nov 21 2020, 04:01 PM) I am holding about 12% now for US tech. I aim to increase between 15-20% at least. Its just infortunate that in term of risk to reward, china and greater china looks more attractive now. together i hold about 40% of my portfolio in there. |

|

|

Nov 21 2020, 04:28 PM Nov 21 2020, 04:28 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(yklooi @ Nov 21 2020, 04:08 PM) how many % has this tech fund gives you? I planning to increase until 25% or so...how many more % of this tech fund do you want to add? after adding this new % into that tech fund, how many % will it increase your portfolio ROI % (if the performance results were to be the same as previously)? So I will have Asia ex Japan, China/Greater China, Malaysia and Tech evenly distributed percentage. Tech has given me 12 - 20% profit until now (depending on which funds) I don't track how many % ROI it will effect my overall portfolio, I just expecting at least another 12 - 20% profit per annum. QUOTE(WhitE LighteR @ Nov 21 2020, 04:11 PM) I am holding about 12% now for US tech. I aim to increase between 15-20% at least. When do you plan to increase 15-20%, within 3 - 6 months time?Its just infortunate that in term of risk to reward, china and greater china looks more attractive now. together i hold about 40% of my portfolio in there. I am doing regular savings for tech every month.. but amount not so significant. If doing it another 2 years also will not increase to my plan percentage. So now thinking if want to put bigger amount within these 3 months.. so I can meet my target %. |

|

|

Nov 21 2020, 04:43 PM Nov 21 2020, 04:43 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(Kaka23 @ Nov 21 2020, 04:28 PM) I planning to increase until 25% or so... its highly likely within this 3 months. timing is not something i can accurately predict unfortunately. hopefully there will be some pullback for me to enter. i feel US still quite fragile n tech has run away quite high. i really want to see another US stimulus to push the market another leg higher.So I will have Asia ex Japan, China/Greater China, Malaysia and Tech evenly distributed percentage. Tech has given me 12 - 20% profit until now (depending on which funds) I don't track how many % ROI it will effect my overall portfolio, I just expecting at least another 12 - 20% profit per annum. When do you plan to increase 15-20%, within 3 - 6 months time? I am doing regular savings for tech every month.. but amount not so significant. If doing it another 2 years also will not increase to my plan percentage. So now thinking if want to put bigger amount within these 3 months.. so I can meet my target %. btw, i wouldnt worry so much about the amount. as long as u use this as practice to mentally train your mind to seek for best yield thats all that matters. building a portfolio is a skill u can carry life long. |

|

|

Nov 21 2020, 04:52 PM Nov 21 2020, 04:52 PM

Show posts by this member only | IPv6 | Post

#24052

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Kaka23 @ Nov 21 2020, 04:28 PM) I planning to increase until 25% or so... (very rough estimation)So I will have Asia ex Japan, China/Greater China, Malaysia and Tech evenly distributed percentage. Tech has given me 12 - 20% profit until now (depending on which funds) I don't track how many % ROI it will effect my overall portfolio, I just expecting at least another 12 - 20% profit per annum. .................. currently you have 8% at tech you want to increase to 25% ....about 3x tech gives you 12~20% profit...assumed to be 20% profit to your current 8% tech which is about 1.6% added to your portfolio ROI assuming yr port has 10 000 and 800 is Tech 20% of this 800 is 160 profit thus is 1.6% of your 10k port. adding your port to 25% with 1700 added into 800.... = 2500 assuming same 20% ROI ..... 500 profit instead of 160 your total in port is 10000 + 1700 = 11700, thus 500 of 11700 is 4.25% profit instead of 1.6% if you want at least another 12~20% profit for your overall port..... This post has been edited by yklooi: Nov 21 2020, 05:04 PM |

|

|

Nov 22 2020, 07:28 AM Nov 22 2020, 07:28 AM

|

Junior Member

313 posts Joined: Mar 2010 From: Kuala Lumpur |

https://www.thestar.com.my/news/focus/2020/...ow-its-changing

What did a I say about Artificial Intelligence? Even Malaysia job market require such skilled people as stated in the article. |

|

|

|

|

|

Nov 22 2020, 11:24 AM Nov 22 2020, 11:24 AM

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(ky33li @ Nov 22 2020, 07:28 AM) https://www.thestar.com.my/news/focus/2020/...ow-its-changing Are these AI or healthcare things, a "newly invented" or "realised" things that resulted them being "hotly chased" after recently (since March) ?What did a I say about Artificial Intelligence? Even Malaysia job market require such skilled people as stated in the article. Why they aren't that hot previously (abt 2 years back)? |

|

|

Nov 22 2020, 12:06 PM Nov 22 2020, 12:06 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(MUM @ Nov 22 2020, 11:24 AM) Are these AI or healthcare things, a "newly invented" or "realised" things that resulted them being "hotly chased" after recently (since March) ? You must be wondering and referencing to the trend movements as in image posted in Yr post 24042 above or/and as per 1 of the image in post 24032...? HahaWhy they aren't that hot previously (abt 2 years back)? This post has been edited by yklooi: Nov 22 2020, 12:19 PM |

|

|

Nov 22 2020, 12:08 PM Nov 22 2020, 12:08 PM

|

Junior Member

313 posts Joined: Mar 2010 From: Kuala Lumpur |

QUOTE(MUM @ Nov 22 2020, 11:24 AM) Are these AI or healthcare things, a "newly invented" or "realised" things that resulted them being "hotly chased" after recently (since March) ? Perhaps you should read about what data science is about? You look at current trend on E-wallets, finch companies or even e-commerce sites? What is most valuable to these companies? DATA of course!Why they aren't that hot previously (abt 2 years back)? Even Tony Fernandes sold data to raise funds for his current company AirAsia as the airline had so customer data. https://www.thestar.com.my/business/busines...or-airasia-data Why there is news on data leakages? or for that matter SCAM on consumers whether from telcos or banks? Because DATA is the most valuable thing now. If you master the skill of analysing these datas, you will be highly in demand in your job skill. The demand for data has been on-going already it is just that due to Covid-19, company has no choice but to digitise its business operation, which also include handling of data!!! The language these days are IT programming language and if you are able to master this important skill you will have no problem in finding a job. Like i said, traditional jobs are going to slowly disappear.... with more AI coming... |

|

|

Nov 22 2020, 12:49 PM Nov 22 2020, 12:49 PM

Show posts by this member only | IPv6 | Post

#24057

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(ky33li @ Nov 22 2020, 12:08 PM) Perhaps you should read about what data science is about? You look at current trend on E-wallets, finch companies or even e-commerce sites? What is most valuable to these companies? DATA of course! regarding this data science about data security issues.....Even Tony Fernandes sold data to raise funds for his current company AirAsia as the airline had so customer data. https://www.thestar.com.my/business/busines...or-airasia-data Why there is news on data leakages? or for that matter SCAM on consumers whether from telcos or banks? Because DATA is the most valuable thing now. If you master the skill of analysing these datas, you will be highly in demand in your job skill. The demand for data has been on-going already it is just that due to Covid-19, company has no choice but to digitise its business operation, which also include handling of data!!! The language these days are IT programming language and if you are able to master this important skill you will have no problem in finding a job. Like i said, traditional jobs are going to slowly disappear.... with more AI coming... I think Malaysia has this Personal Data Protection Act in place since 2013. Since if Malaysia has it in place, i am sure many other countries would already have something similar like that before 2013 or after that. i think this act should have the requirement to protect data holistically including software, hardware and human just in case there are those that are worrying about jobs being disappeared with the arrival of AI... try this for some ease of mind.... what traditional jobs will continue to exist with the arrival of AI ? https://www.google.com/search?ei=lOu5X6iTG_...Q4dUDCA0&uact=5 YES, "some" will be lost but not ALL. losses are some times good as it will reduce the labour shortage in the market and keep the labour cost down too. |

|

|

Nov 22 2020, 01:32 PM Nov 22 2020, 01:32 PM

|

Senior Member

2,429 posts Joined: Jul 2007 |

Is there any money market fund with 10-30% of bond portion for slight upside on FSM platform to keep short term funds?

|

|

|

Nov 22 2020, 01:50 PM Nov 22 2020, 01:50 PM

Show posts by this member only | IPv6 | Post

#24059

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(jutamind @ Nov 22 2020, 01:32 PM) Is there any money market fund with 10-30% of bond portion for slight upside on FSM platform to keep short term funds? maybe this?it did mention 70% and 30% https://www.fsmone.com.my/funds/tools/facts...t?fund=MYLIBMEF Attached thumbnail(s)

|

|

|

Nov 22 2020, 03:19 PM Nov 22 2020, 03:19 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(yklooi @ Nov 21 2020, 04:52 PM) (very rough estimation) Thanks for the estimation.. my hopes is the 12 - 20% are coming on all the equities region and sector that I am investing in (asia ex japan, china/greater china, malaysia and tech), not only from techcurrently you have 8% at tech you want to increase to 25% ....about 3x tech gives you 12~20% profit...assumed to be 20% profit to your current 8% tech which is about 1.6% added to your portfolio ROI assuming yr port has 10 000 and 800 is Tech 20% of this 800 is 160 profit thus is 1.6% of your 10k port. adding your port to 25% with 1700 added into 800.... = 2500 assuming same 20% ROI ..... 500 profit instead of 160 your total in port is 10000 + 1700 = 11700, thus 500 of 11700 is 4.25% profit instead of 1.6% if you want at least another 12~20% profit for your overall port..... WhitE LighteR liked this post

|

| Change to: |  0.0265sec 0.0265sec

0.29 0.29

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 10:54 PM |