QUOTE(BlueSpark @ Sep 12 2020, 11:32 AM)

There is server maintenance scheduled for today.FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Sep 12 2020, 01:39 PM Sep 12 2020, 01:39 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(BlueSpark @ Sep 12 2020, 11:32 AM) There is server maintenance scheduled for today. CQT liked this post

|

|

|

|

|

|

Sep 12 2020, 04:26 PM Sep 12 2020, 04:26 PM

Show posts by this member only | IPv6 | Post

#23202

|

Junior Member

430 posts Joined: Sep 2009 |

Cool, all good now

|

|

|

Sep 13 2020, 12:34 AM Sep 13 2020, 12:34 AM

|

Senior Member

4,725 posts Joined: Jul 2013 |

QUOTE(lee82gx @ Sep 11 2020, 10:50 AM) Mine is doing about the same as you. Except my Dynamic AP income fund was doing more like 6%, since I started DCA'ing in 2016 instead of 2014. I have not made much new investment. Only DCA small cap, 200 per month and 3k a year for prs cimb ap version. Mother fund stopped basically. KGF lacklustre performance has discourage me from new money.I'm still having some KGF, and my intention is to convert it to Kenanga OnePRS growth fund. Since I don't have much PRS funds anyway this year. EI small cap, having a good run due to our Covid moratorium perhaps gonna end soon. Nothing excites me from the Eastspring overall portfolio these days. Sold or am in process of selling my Dynamic AP funds. My personal conclusion here is no funds should be held more than 5 years (Malaysian active managed funds that don't feed to super large funds). Just feels like once they reach a peak momentum (IRR>10%) and cap size (close to or above 500mil) then they will shrink balls and just ride the market benchmark. Really hoping that others can chime in on my sentiment and prove me wrong...haha. Oh yeah, one more thing. I find that once the funds are linked to PRS, you can expect it to follow market benchmark eventually. (And no index is greater than SP 500 lol) I somehow agree with you, the bigger they get, the slower they are. By slow i mean low return. It could be own observation bias. But i somehow feel cimb ap is not the case... No doubt the return is influence by weakness of myr but the return has still been better than my local funds. 8% truly satisfied. Keeps my entire portfolio up at 6%, weigh down by KGF. Maybe at the right time. I will let go of KGF in the near future. Just not sure where to invest next. Regret not going for more china exposure. Haha. |

|

|

Sep 13 2020, 10:52 AM Sep 13 2020, 10:52 AM

Show posts by this member only | IPv6 | Post

#23204

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(adele123 @ Sep 13 2020, 12:34 AM) I have not made much new investment. Only DCA small cap, 200 per month and 3k a year for prs cimb ap version. Mother fund stopped basically. KGF lacklustre performance has discourage me from new money. Why do you say the Ap income fund is dragged down by MYR weakness. I would think the opposite no? When you buy 0.25USD per 1MYR, later it becomes 1.2MYR per 0.25USD.I somehow agree with you, the bigger they get, the slower they are. By slow i mean low return. It could be own observation bias. But i somehow feel cimb ap is not the case... No doubt the return is influence by weakness of myr but the return has still been better than my local funds. 8% truly satisfied. Keeps my entire portfolio up at 6%, weigh down by KGF. Maybe at the right time. I will let go of KGF in the near future. Just not sure where to invest next. Regret not going for more china exposure. Haha. What you lose is purchasing power as the same 1.2MYR can only buy the same amount of 0.25USD shares / candy / whatever. But that only happens when you or CIMB management cash out. Yeah. I stopped fresh funds from going into KGF, AP Income, small cap for a few years now. Pretty sure I gotten better returns elsewhere for the time being. The question is what do I think going forward which is still negative for them. |

|

|

Sep 13 2020, 01:22 PM Sep 13 2020, 01:22 PM

Show posts by this member only | IPv6 | Post

#23205

|

Senior Member

4,725 posts Joined: Jul 2013 |

QUOTE(lee82gx @ Sep 13 2020, 10:52 AM) Why do you say the Ap income fund is dragged down by MYR weakness. I would think the opposite no? When you buy 0.25USD per 1MYR, later it becomes 1.2MYR per 0.25USD. Haha. You misunderstood. i mean the good return is due to weakness of myr. But weakness of myr really not a good thing for us, as a whole. So still a happy smile but with a sigh situationWhat you lose is purchasing power as the same 1.2MYR can only buy the same amount of 0.25USD shares / candy / whatever. But that only happens when you or CIMB management cash out. Yeah. I stopped fresh funds from going into KGF, AP Income, small cap for a few years now. Pretty sure I gotten better returns elsewhere for the time being. The question is what do I think going forward which is still negative for them. wongmunkeong liked this post

|

|

|

Sep 13 2020, 04:35 PM Sep 13 2020, 04:35 PM

|

Senior Member

1,770 posts Joined: Dec 2010 From: ~Where White Knights in Shining Armour Unite~ |

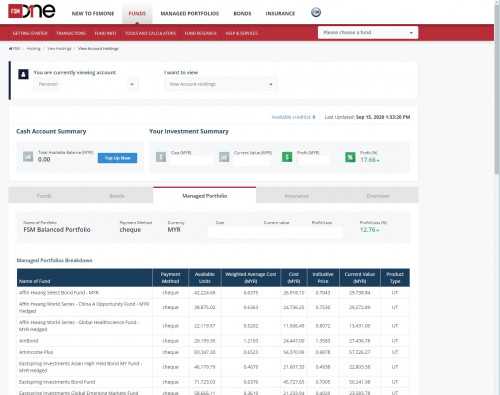

Hey y'all, anyone of you have used FSM's portfolio services?

Hows the feedback from the ground? I am looking towards either a portfolio service like FSM/Stashaway vs a basket of FSM UT selections to make up my portfolio, then i will top-up yearly. Thanks for sharing ideas! |

|

|

|

|

|

Sep 13 2020, 07:22 PM Sep 13 2020, 07:22 PM

|

All Stars

14,873 posts Joined: Mar 2015 |

QUOTE(GloryKnight @ Sep 13 2020, 04:35 PM) Hey y'all, anyone of you have used FSM's portfolio services? FSM managed portfolio is just few years old....currently since the last 3 yrs, the markets had been volatile, thus i think the performance depends on when you "entered".Hows the feedback from the ground? I am looking towards either a portfolio service like FSM/Stashaway vs a basket of FSM UT selections to make up my portfolio, then i will top-up yearly. Thanks for sharing ideas! if you know not much about investing and does not want to spend more time to gain hands on emotional experience,...you can opt for FSM managed port or Stashaway if you had some experience in UT investing with positive results,...you can have a basket of selected UT funds for your DIY UT portfolio. |

|

|

Sep 14 2020, 09:13 AM Sep 14 2020, 09:13 AM

|

Senior Member

2,232 posts Joined: May 2006 From: Petaling Jaya |

QUOTE(GloryKnight @ Sep 13 2020, 04:35 PM) Hey y'all, anyone of you have used FSM's portfolio services? as explained, it depends when you enter and top up. I have managed portfolio since they started but i just let it sit there without top up. Sometime hovering between negative and positive, i thought it was worst than FD. this year did a major top up after the covid crash, manage to reach +12% for now.Hows the feedback from the ground? I am looking towards either a portfolio service like FSM/Stashaway vs a basket of FSM UT selections to make up my portfolio, then i will top-up yearly. Thanks for sharing ideas! Also started Stashaway this year after covid, also around 14% now. performance wise feel both same same. stashaway is relatively new, just hope they don't gulung tikar like the roboadvisor in SG. but i will stick to monthly DCA now instead of yearly top up. i think is a nice tool for ppl who don't know which fund to choose. This post has been edited by Amanda85: Sep 14 2020, 09:21 AM qt2100 liked this post

|

|

|

Sep 15 2020, 01:37 PM Sep 15 2020, 01:37 PM

|

Junior Member

219 posts Joined: Sep 2010 |

QUOTE(GloryKnight @ Sep 13 2020, 04:35 PM) Hey y'all, anyone of you have used FSM's portfolio services? Well, far from being perfect, but not too bad considering recent covid-related turbulenceHows the feedback from the ground? I am looking towards either a portfolio service like FSM/Stashaway vs a basket of FSM UT selections to make up my portfolio, then i will top-up yearly. Thanks for sharing ideas! mine is about 3 year old balanced  |

|

|

Sep 16 2020, 10:28 AM Sep 16 2020, 10:28 AM

Show posts by this member only | IPv6 | Post

#23210

|

Senior Member

3,968 posts Joined: Nov 2007 |

QUOTE(adele123 @ Sep 11 2020, 09:45 AM) just curious, what got you to make the decision? because covid? actually i do feel it's not the fund's fault. i had >8% IRR back in 2017. but the market that KGF invest in, it's just not so great also. so now 4% only... SGIH |

|

|

Sep 16 2020, 03:12 PM Sep 16 2020, 03:12 PM

|

Senior Member

4,999 posts Joined: Jan 2003 |

KGF is investing in Malaysia. How do you expect KGF to perform when Malaysia market itself is so bad.

If I'm not mistaken Malaysia returns was one of the lowest in 2018 and 2019. |

|

|

Sep 16 2020, 04:11 PM Sep 16 2020, 04:11 PM

|

Senior Member

7,565 posts Joined: May 2012 |

QUOTE(Drian @ Sep 16 2020, 03:12 PM) KGF is investing in Malaysia. How do you expect KGF to perform when Malaysia market itself is so bad. Invest when bad and will give good return. It will have high revenue when rebound.If I'm not mistaken Malaysia returns was one of the lowest in 2018 and 2019. This post has been edited by ericlaiys: Sep 16 2020, 04:12 PM |

|

|

Sep 16 2020, 10:06 PM Sep 16 2020, 10:06 PM

|

Senior Member

4,999 posts Joined: Jan 2003 |

|

|

|

|

|

|

Sep 16 2020, 11:26 PM Sep 16 2020, 11:26 PM

|

Senior Member

7,565 posts Joined: May 2012 |

|

|

|

Sep 16 2020, 11:38 PM Sep 16 2020, 11:38 PM

|

All Stars

14,873 posts Joined: Mar 2015 |

QUOTE(ericlaiys @ Sep 16 2020, 04:11 PM) QUOTE(Drian @ Sep 16 2020, 10:06 PM) The question is when it will rebound and if it rebounds will it be able to make up all the losses when it was bad. QUOTE(ericlaiys @ Sep 16 2020, 11:26 PM) is KGF focused mandate is low, awaiting for a rebound? (so as to "Invest when bad and will give good return. It will have high revenue when rebound."?)or is KFG the only one that is below par compared to its peers that focused on the same mandate? (if only KGF has lose it shine when comparing with peers for the last 2~3 yrs, then, it may needs to further evaluate for there is an opportunity cost of holding it now, for there maybe "better" same mandated funds out there now) |

|

|

Sep 17 2020, 12:14 AM Sep 17 2020, 12:14 AM

Show posts by this member only | IPv6 | Post

#23216

|

Senior Member

1,749 posts Joined: Oct 2007 |

anyone invested in: EASTSPRING INVESTMENTS GLOBAL BALANCED TARGET RETURN FUND? Any experts here have any thoughts on this?

|

|

|

Sep 17 2020, 12:33 AM Sep 17 2020, 12:33 AM

|

All Stars

14,873 posts Joined: Mar 2015 |

|

|

|

Sep 17 2020, 08:30 AM Sep 17 2020, 08:30 AM

|

All Stars

10,340 posts Joined: Jan 2003 |

|

|

|

Sep 17 2020, 08:46 AM Sep 17 2020, 08:46 AM

Show posts by this member only | IPv6 | Post

#23219

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(WhitE LighteR @ Sep 17 2020, 08:30 AM) I agak agak think, agar agar is also correct, for jelly is flexible or not solid, thus his agar agar guess can imply,Non solid, non confirmed state of guesses... 😂 But, I think you are more correct. WhitE LighteR liked this post

|

|

|

Sep 17 2020, 01:45 PM Sep 17 2020, 01:45 PM

Show posts by this member only | IPv6 | Post

#23220

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:00 PM |

| Change to: |  0.0263sec 0.0263sec

0.45 0.45

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 10:22 AM |