Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

sirius2017

|

May 18 2023, 04:23 PM May 18 2023, 04:23 PM

|

Getting Started

|

QUOTE(joeblow @ May 18 2023, 04:00 PM) I suspected so since Feb is short month. Anyway I lazy to go compute and can only trust the bank not to miscalculate. Thank you for the info. This is an interesting point. Previously when I placed, the maturity date fell on Sat and I can only suck thumb. But today I placed 1 FD and instructed them to make the maturity date on 20th May 2024. Initially they claim it is system generated, but I think can be manually override. Depends on the person who key in the system I think. So yeah please instruct them and check for the dates yourself. For your case I think you either use Rentas or Bank Cheque right? I did an online fund transfer from another bank a/c (matured FD, roll over rate only 2.85%) in the morning today to my BI saving account. I did have an BI saving a/c with Online Internet ID. Btw, I did try to do an online placement for BI FD 12 months. Rate given is only 3.10%. So, promptly cancel and head to the BI branch. Teller confirm this 12mth 4.5% is only available OTC. |

|

|

|

|

|

sirius2017

|

May 18 2023, 04:30 PM May 18 2023, 04:30 PM

|

Getting Started

|

QUOTE(romuluz777 @ May 18 2023, 01:20 PM) PIDM coverage is up to RM250K per depositor per member bank. If the bank had conventional and Islamic product, there is a separate 250K insurance limit for these categories. PIDM FAQ |

|

|

|

|

|

sibeh hoseh

|

May 18 2023, 04:34 PM May 18 2023, 04:34 PM

|

Getting Started

|

QUOTE(CommodoreAmiga @ May 17 2023, 07:21 AM) Can goes either way. No sure win. Seems like wait also a risk if the rate go down further Have no other options but to just go ahead with the best possible rate now Thanks |

|

|

|

|

|

sibeh hoseh

|

May 18 2023, 04:34 PM May 18 2023, 04:34 PM

|

Getting Started

|

QUOTE(AVFAN @ May 17 2023, 10:03 AM) nobody knows.... central bankers can change their minds anytime. US Fed guys previously alluded to no more hikes but latest comments are hawkish, possible another hike coming in June. BNM... RM now at 4.52x... depreciating 0.5% every week.... u decide if BNM will raise in July... Heard that England is ready for another push in rate soon |

|

|

|

|

|

BWassup

|

May 18 2023, 05:42 PM May 18 2023, 05:42 PM

|

|

QUOTE(joeblow @ May 18 2023, 02:55 PM) No sir, 6 months at BI I don't know what's the rate. I meant 6 months ago I put in 1.5 years at 4.4% fresh fund otc. After 6 months they pay me interest but it is a little bit short of 4.4% for 6 months... I better post less to have less misunderstanding... You got many people excited for nothing bro!  But don't stop posting  |

|

|

|

|

|

nexona88

|

May 18 2023, 05:58 PM May 18 2023, 05:58 PM

|

|

QUOTE(BWassup @ May 18 2023, 05:42 PM) You got many people excited for nothing bro!  But don't stop posting  I'm one of them... Now back to BSN 6m then 😜 MBSB also out.... Because it's for auro-renew FD |

|

|

|

|

|

BWassup

|

May 18 2023, 06:08 PM May 18 2023, 06:08 PM

|

|

QUOTE(nexona88 @ May 18 2023, 05:58 PM) I'm one of them... Now back to BSN 6m then 😜 MBSB also out.... Because it's for auro-renew FD Did you ask MBSB already, cannot get 4.25%? Make a lot of noise maybe they will give  I mean, it's not fair to you |

|

|

|

|

|

BoomChaCha

|

May 18 2023, 06:39 PM May 18 2023, 06:39 PM

|

|

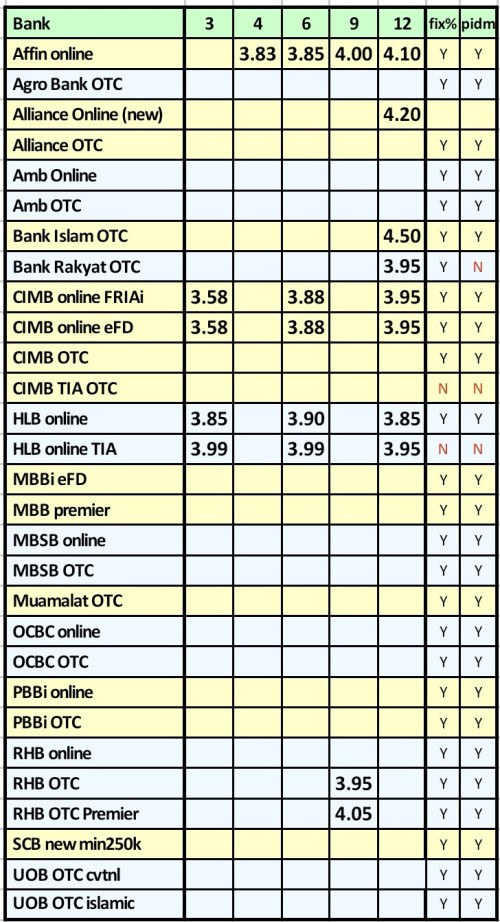

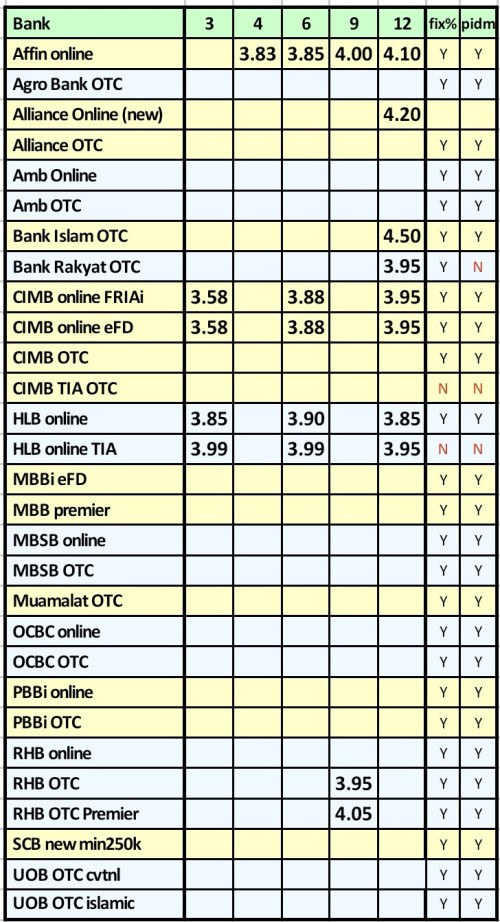

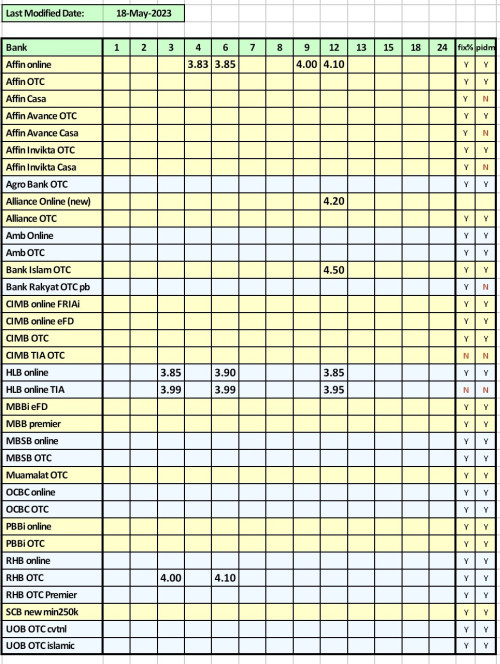

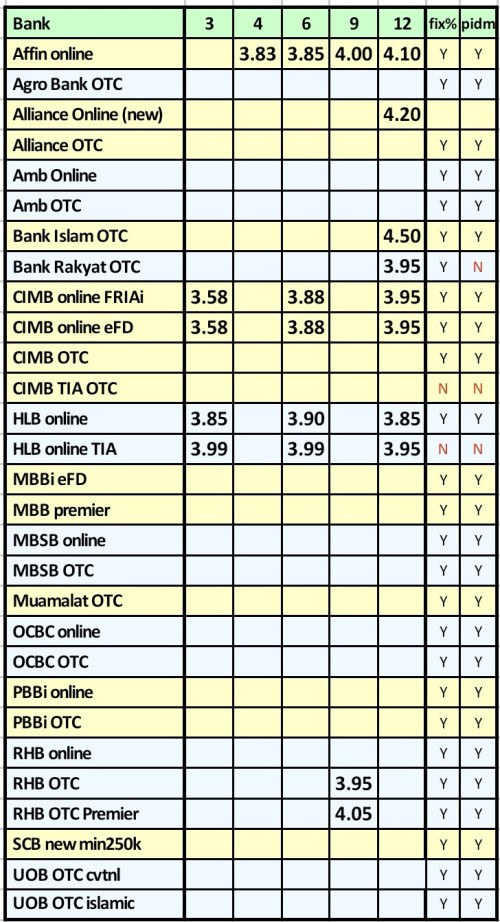

QUOTE(cclim2011 @ May 18 2023, 04:04 PM) hello. long no update. someone reminded. didnt follow much coz was pursuing BI only lol. let mr know on any promotion to update.  Bank Rakyat is 3.95% 12 months |

|

|

|

|

|

BWassup

|

May 18 2023, 06:46 PM May 18 2023, 06:46 PM

|

|

QUOTE(cclim2011 @ May 18 2023, 04:04 PM) hello. long no update. someone reminded. didnt follow much coz was pursuing BI only lol. let mr know on any promotion to update.  Think the RHB 3 & 6 month promo rates ended in April, quota full. Can someone confirm? |

|

|

|

|

|

rocketm

|

May 18 2023, 08:25 PM May 18 2023, 08:25 PM

|

|

QUOTE(cclim2011 @ May 18 2023, 05:04 PM) hello. long no update. someone reminded. didnt follow much coz was pursuing BI only lol. let mr know on any promotion to update.  Can include CIMB efd https://www.cimb.com.my/en/personal/promoti...fd-efria-i.htmleFD/eFRIA-i Tenure Campaign Rates (% p.a.) Minimum Deposit Placement Amount Three (3) Months 3.58% p.a. RM1,000 Six (6) Months 3.88% p.a. RM1,000 Twelve (12) Months 3.95% p.a. RM1,000 |

|

|

|

|

|

adele123

|

May 18 2023, 08:45 PM May 18 2023, 08:45 PM

|

|

QUOTE(frankliew @ May 12 2023, 12:38 PM) RHBFD Promotion 11/5/23 to 15/6/23 Premier Min 10k - 9 month 4.05% Non Premier Min 5k - 9 month 3.95% Online - coming soon QUOTE(cclim2011 @ May 18 2023, 04:04 PM) hello. long no update. someone reminded. didnt follow much coz was pursuing BI only lol. let mr know on any promotion to update.  As above QUOTE(BWassup @ May 18 2023, 06:46 PM) Think the RHB 3 & 6 month promo rates ended in April, quota full. Can someone confirm? |

|

|

|

|

|

sirius2017

|

May 18 2023, 08:56 PM May 18 2023, 08:56 PM

|

Getting Started

|

QUOTE(BWassup @ May 18 2023, 06:46 PM) Think the RHB 3 & 6 month promo rates ended in April, quota full. Can someone confirm? Ya, this RHB 3M @ 4.00%, 6M @ 4.10% no longer available for online eFD online placement. Prior last month, was available. Campaign period supposedly up to 31/7/23. Probably quota full. |

|

|

|

|

|

adele123

|

May 18 2023, 09:41 PM May 18 2023, 09:41 PM

|

|

QUOTE(sirius2017 @ May 18 2023, 08:56 PM) Ya, this RHB 3M @ 4.00%, 6M @ 4.10% no longer available for online eFD online placement. Prior last month, was available. Campaign period supposedly up to 31/7/23. Probably quota full. 4.05% for 3 months actually. The expiry was 31 may based on original. But yes, ended. |

|

|

|

|

|

cclim2011

|

May 18 2023, 11:19 PM May 18 2023, 11:19 PM

|

|

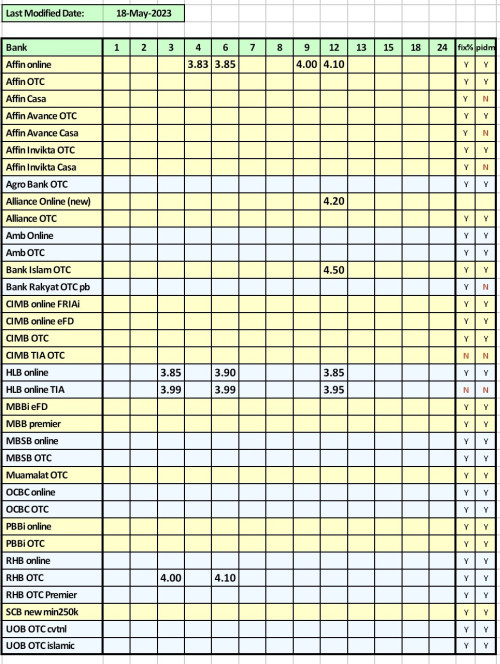

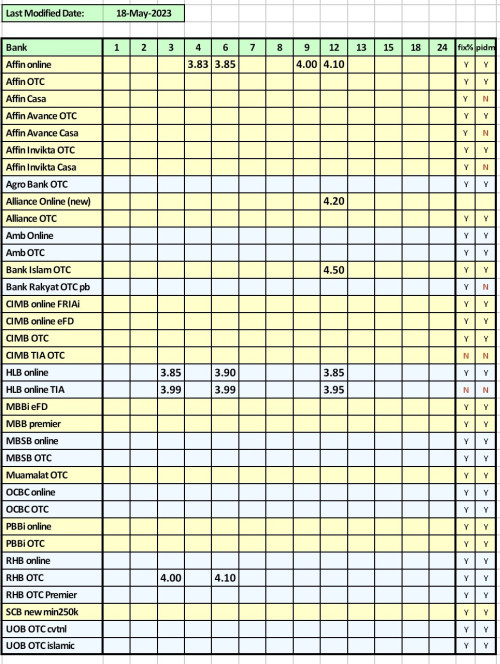

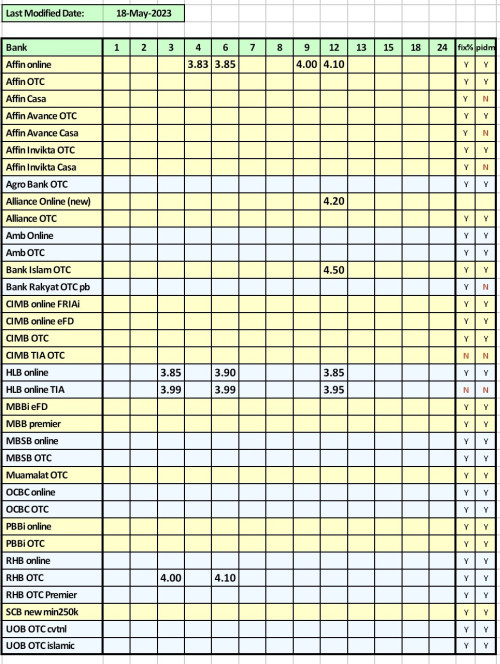

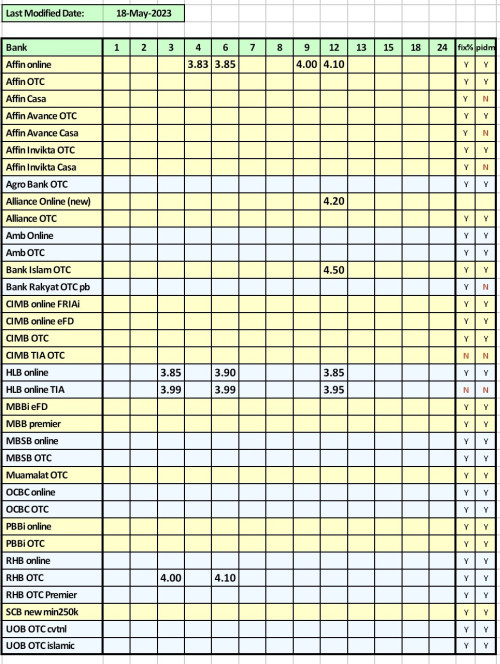

thanks for the input ya. updated as below. let's promote bank islam 4.5 haha none of the cimb officers in the branch knew about this 4.5%  |

|

|

|

|

|

SUSguy3288

|

May 19 2023, 01:34 AM May 19 2023, 01:34 AM

|

|

QUOTE(nexona88 @ May 16 2023, 10:37 AM) Personally I don't think another hike next meeting It's very close to previous unexpected hike.... Interbank interest rate keep going down.... from 3.57 when OPR was up 0.25 all the way down so fast.... Attached thumbnail(s)

|

|

|

|

|

|

sirius2017

|

May 19 2023, 07:10 AM May 19 2023, 07:10 AM

|

Getting Started

|

QUOTE(cclim2011 @ May 18 2023, 11:19 PM) thanks for the input ya. updated as below. let's promote bank islam 4.5 haha none of the cimb officers in the branch knew about this 4.5%  HLB TIA is actual an investment product, not a deposit product as per HLB product disclosure sheet. The principal and returns of the investment are not guaranteed and placements are not covered by PIDM. HLB TIA Product Disclosure Sheet |

|

|

|

|

|

cybpsych

|

May 19 2023, 09:07 AM May 19 2023, 09:07 AM

|

|

QUOTE(cybpsych @ May 18 2023, 07:42 AM) same same  saved my time from moving fund around  seems like eTD will auto-extend to next working day if maturity falls on weekend  |

|

|

|

|

|

nexona88

|

May 19 2023, 09:08 AM May 19 2023, 09:08 AM

|

|

QUOTE(guy3288 @ May 19 2023, 01:34 AM) Interbank interest rate keep going down.... from 3.57 when OPR was up 0.25 all the way down so fast.... One of the reasons why the FD rates is not very interesting 😔 |

|

|

|

|

|

weidasdnbhd

|

May 19 2023, 10:36 AM May 19 2023, 10:36 AM

|

Getting Started

|

QUOTE(sirius2017 @ May 18 2023, 04:23 PM) I did an online fund transfer from another bank a/c (matured FD, roll over rate only 2.85%) in the morning today to my BI saving account. I did have an BI saving a/c with Online Internet ID. Btw, I did try to do an online placement for BI FD 12 months. Rate given is only 3.10%. So, promptly cancel and head to the BI branch. Teller confirm this 12mth 4.5% is only available OTC. Hi, So do you mean you have SA with BI, you just transfer fund from another bank to BI, and you go to BI to place a FD at 4.5% without bringing any cash or cheque as the fund was deducted from your SA? |

|

|

|

|

|

CommodoreAmiga

|

May 19 2023, 10:51 AM May 19 2023, 10:51 AM

|

|

QUOTE(weidasdnbhd @ May 19 2023, 10:36 AM) Hi, So do you mean you have SA with BI, you just transfer fund from another bank to BI, and you go to BI to place a FD at 4.5% without bringing any cash or cheque as the fund was deducted from your SA? Yes. That's what i do for most banks including BI. |

|

|

|

|

May 18 2023, 04:23 PM

May 18 2023, 04:23 PM

Quote

Quote

0.0347sec

0.0347sec

0.88

0.88

6 queries

6 queries

GZIP Disabled

GZIP Disabled