QUOTE(lowdensity @ Mar 7 2017, 09:04 PM)

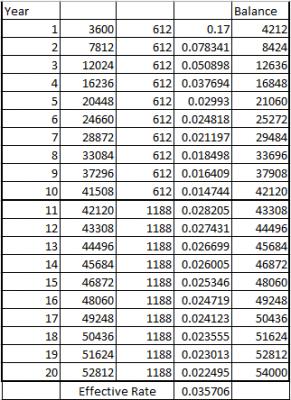

FYI Effective Rate 3.57%

This post has been edited by IamNOT: Mar 8 2017, 09:15 AM

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Mar 8 2017, 09:14 AM Mar 8 2017, 09:14 AM

|

Junior Member

283 posts Joined: Aug 2008 From: Malacca |

|

|

|

|

|

|

Mar 8 2017, 09:43 AM Mar 8 2017, 09:43 AM

|

Senior Member

2,337 posts Joined: Oct 2014 |

|

|

|

Mar 8 2017, 10:27 AM Mar 8 2017, 10:27 AM

|

Senior Member

1,311 posts Joined: Oct 2012 |

Thanks to people like I Am Not. Not everyone can be generous in sharing real info and some a quick to ask you to move on to another thread - which is true but its also ok to help out a little. This forum is still the best place for advise. Thanks.

|

|

|

Mar 8 2017, 12:07 PM Mar 8 2017, 12:07 PM

|

Senior Member

2,012 posts Joined: Dec 2007 From: Fairytale |

QUOTE(c_subra @ Mar 7 2017, 05:06 PM) Hi, Thanks for clarification.I have a question there is a investment plan from insurance co. i.e. invest 3600.00 per year for 10 years, and returns is 17% (612.00). This is guaranteed for 10 years. the next 10 years, return is 33% (1188.00) per year. End of 20th year the investment of 36000.00 returned. Q: is this better than FD investment or I am missing something here? Advice is appreciated. Thanks Good for newbie. |

|

|

Mar 8 2017, 12:09 PM Mar 8 2017, 12:09 PM

|

Senior Member

2,012 posts Joined: Dec 2007 From: Fairytale |

QUOTE(user123456 @ Mar 5 2017, 10:25 AM) 1. Real-time Electronic Transfer of Funds and Securities System (RENTAS)? Instant transfer? Cutoff time? Thanks..this is good info to add to first post2. RENTAS Can be done online or Over the counter (OTC)? 3. RENTAS RM5.30 per transaction? 4. RENTAS maximum transfer limit daily? 5. RENTAS can be performed at all banks? how to check which bank offers RENTAS? Some of the daily cap for interbank transfer (online) that I know of.. cimbclicks IBG Instant Transfer (Subject to daily combined limit of RM30k) maybank2u IBG Instant Transfer (Subject to daily combined limit of RM30k) hongleongconnect Interbank GIRO (IBG) Instant Transfer (Subject to daily combined limit of RM50k) PBe Interbank GIRO (IBG) Instant Transfer RENTAS Subject to daily combined limit RM20k (with PAC)* RM50k (with SecureSign)** |

|

|

Mar 8 2017, 12:11 PM Mar 8 2017, 12:11 PM

|

All Stars

17,498 posts Joined: Feb 2006 From: KL |

|

|

|

|

|

|

Mar 8 2017, 12:26 PM Mar 8 2017, 12:26 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

it is very common they play with words.

you want long term, better dump your money into EPF. |

|

|

Mar 8 2017, 12:55 PM Mar 8 2017, 12:55 PM

|

Newbie

4 posts Joined: Jul 2011 |

Hi All,

Sincerely would like to thank all the forumer's for your advise. Q: Too good to be true. A: From the advises, it does't look like a good plan, better to put in FD (compounded int) will give better returns. Also as pointed out the effective rate is roughly around 3.57% Q: In 11th year, you already invested 36,000. Is 1,188 still 33% of 36,000? A: Yes, from 11th to 20th you get a fixed amt 1188.00 FYI:Best to re-post your question here, Insurance Talk V4 A: Apologies, next time will do that. Some of the replies here have answered my question. Not sure if I will get different answers. Once again thanks for valuable replies. |

|

|

Mar 8 2017, 03:35 PM Mar 8 2017, 03:35 PM

Show posts by this member only | IPv6 | Post

#1169

|

Senior Member

852 posts Joined: Jan 2003 |

|

|

|

Mar 8 2017, 04:37 PM Mar 8 2017, 04:37 PM

|

Junior Member

143 posts Joined: Aug 2012 |

QUOTE(LostAndFound @ Mar 6 2017, 03:59 PM) Not everyone is looking at their investment/savings to get them rich. If you're a high earner your time is probably better spent earning than trying to get additional X% in investment (that's why hiring financial planner to spend that time for you is worth it for some). Haha that would bring us to the Shares or Unit Trust thread regarding with remisiers & fund managers to bet on..lolHopefully I can be a high earner in the future ^^ QUOTE(Bonescythe @ Mar 6 2017, 11:21 PM) If that FD amount is really really big.. why not ? But of course, you are not trying to get rich, because already rich.. Yah, last time when young I always wonder why people who win jackpot cannot stay rich5m x 4% = 200k p.a Not bad lor if say RM1,000,000 x 4%p.a = RM40,000 per year or RM3,333 per month which is higher than most degree holders starting salary Then I got older & found out about taxes & annuity & how small our ringgit is >.< QUOTE(ps007 @ Mar 7 2017, 01:12 PM) Lol same lah, though I don't even have 10% of what you have, still testing the waters and playing at the shore firstQUOTE(IamNOT @ Mar 8 2017, 09:14 AM) Thanks bro you rock, there was this RM1 per day thing by Public Bank previously that only payout after 6yrs, within 5yrs you take you get zero >.<always good to have sifus advice here |

|

|

Mar 8 2017, 04:51 PM Mar 8 2017, 04:51 PM

|

Junior Member

454 posts Joined: Nov 2010 From: SEA |

|

|

|

Mar 9 2017, 02:23 PM Mar 9 2017, 02:23 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

Just done mine today.

HLB OTC 6 month FD at 4% min 10k This post has been edited by WhitE LighteR: Mar 9 2017, 06:40 PM |

|

|

Mar 9 2017, 03:36 PM Mar 9 2017, 03:36 PM

Show posts by this member only | IPv6 | Post

#1173

|

Junior Member

158 posts Joined: Jan 2010 |

is that for online placement?

|

|

|

|

|

|

Mar 9 2017, 03:58 PM Mar 9 2017, 03:58 PM

|

Newbie

4 posts Joined: Jul 2011 |

|

|

|

Mar 9 2017, 04:41 PM Mar 9 2017, 04:41 PM

Show posts by this member only | IPv6 | Post

#1175

|

Junior Member

158 posts Joined: Jan 2010 |

|

|

|

Mar 9 2017, 06:41 PM Mar 9 2017, 06:41 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

|

|

|

Mar 9 2017, 08:50 PM Mar 9 2017, 08:50 PM

Show posts by this member only | IPv6 | Post

#1177

|

Junior Member

232 posts Joined: Jul 2015 |

US going to raise rates 50 - 75 basis points this year....

Hence, BNM going to raise at lease 25 basis points.... 4.35p.a is a fool hearty deal. |

|

|

Mar 9 2017, 09:30 PM Mar 9 2017, 09:30 PM

|

Senior Member

1,757 posts Joined: May 2011 |

|

|

|

Mar 9 2017, 11:40 PM Mar 9 2017, 11:40 PM

|

Junior Member

68 posts Joined: Oct 2010 |

QUOTE(??!! @ Mar 6 2017, 12:37 AM) CIMB RM called to inform new promo May I know which CIMB branch offered 4.15% FD12 months 4.15% min 10k fresh fund Not sure if it's just for PB customers. For non PB customers, can still try asking; esp if you have bigger amount to place. Previously,managed to get PB promo rates for relatives who are non PB customers . |

|

|

Mar 10 2017, 12:58 AM Mar 10 2017, 12:58 AM

Show posts by this member only | IPv6 | Post

#1180

|

Senior Member

1,624 posts Joined: Apr 2011 |

QUOTE(pearl_white @ Mar 9 2017, 08:50 PM) US going to raise rates 50 - 75 basis points this year.... Very unlikely BNM will follow FED because our economy is not performing well. Last year inflation was up due to GST. This year inflation will continue worsen due to weak ringgit. We are seeing a cost push inflation and Malaysia economy is moving towards the down turn phase, increasing the OPR will worsen the economy further.Hence, BNM going to raise at lease 25 basis points.... 4.35p.a is a fool hearty deal. US reported high oil inventory and this will affect the oil prices and hurt the country revenues. To stimulate the economy, government is depending on China on its fscal policy as government has no excess money on spending. BNM has to play with the OPR on its monetary policy to spur growth. Increasing the OPR will reduce the money supply in the market and will drive down the economy. Personnaly I think the OPR will remain throughout in the next 6 months. if Malaysia economy can recover in 2-3 years with GDP climbing up and with a demand pull inflation, then only a big increase in OPR is possible. There are also other external factors which will affect the OPR. Ringgit exchange rate, BREXIT effects (BNM reacted to it when British voted BREXIT), South China Sea tension, Trump economic policy, global economy etc. Ideally 36 months at 4.35% is good to lock in but now Am offer is 60 months. Nobody has the crystall ball. If one perceives the economy will not be doing well in the next 5 years, 4.35% is a good rate. This post has been edited by gsc: Mar 10 2017, 01:23 AM |

| Change to: |  0.0218sec 0.0218sec

0.51 0.51

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 01:50 AM |