QUOTE(wodenus @ Dec 9 2016, 08:43 AM)

Duplicated.This post has been edited by puchongite: Dec 9 2016, 08:51 AM

FundSuperMart v16 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Dec 9 2016, 08:50 AM Dec 9 2016, 08:50 AM

Show posts by this member only | IPv6 | Post

#2341

|

All Stars

33,696 posts Joined: May 2008 |

|

|

|

|

|

|

Dec 9 2016, 08:58 AM Dec 9 2016, 08:58 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(puchongite @ Dec 9 2016, 07:54 AM) Haven't you read the case of people posted here that they tried to use the ninja switching and ended up losing more money ? You are pretty much deluded to use the words "switching for free". agree with your deduction. i think a guy was caught unawares doing the ninja trick during the voting for POTUS and he lost a substantial amount of money from that endeavor. The credit system should only be use "by-the-way", ie if one is indeed wanting to switching from small cap to eastspring bond, then go ahead and earn some credit. But to "purposely" exploit it, hmmm, the result isn't always predictable due to the moving Nav prices during the various transaction dates. On the otherhand, have you tried to look at how you could use the 0% SC of eUT to perform switching ? You can practically move out your entire portfolio to totally different portfolio in 3 or 4 days without incurring any SC, across different fund managers and across bond and equity. For example, you can't switch your entire investment in RHB AIF to Manulife India or eastspring smallcap to ponzi 2.0, all in one move, 0 % SC ! Think about it, how about that ? remember when things comes free and you try to abuse the system, there will be safety measures to curb their loses and that means your money. also one day they are gonna just stop the credit system altogether not sure with our sister fsm in Hong Kong and Singapore if they are abusing their sides of things too |

|

|

Dec 9 2016, 09:14 AM Dec 9 2016, 09:14 AM

|

All Stars

24,387 posts Joined: Feb 2011 |

QUOTE(puchongite @ Dec 9 2016, 07:54 AM) Haven't you read the case of people posted here that they tried to use the ninja switching and ended up losing more money ? You are pretty much deluded to use the words "switching for free". How do you do that? The credit system should only be use "by-the-way", ie if one is indeed wanting to switching from small cap to eastspring bond, then go ahead and earn some credit. But to "purposely" exploit it, hmmm, the result isn't always predictable due to the moving Nav prices during the various transaction dates. On the otherhand, have you tried to look at how you could use the 0% SC of eUT to perform switching ? You can practically move out your entire portfolio to totally different portfolio in 3 or 4 days without incurring any SC, across different fund managers and across bond and equity. For example, you can't switch your entire investment in RHB AIF to Manulife India or eastspring smallcap to ponzi 2.0, all in one move, 0 % SC ! Think about it, how about that ? |

|

|

Dec 9 2016, 09:22 AM Dec 9 2016, 09:22 AM

|

All Stars

33,696 posts Joined: May 2008 |

|

|

|

Dec 9 2016, 09:34 AM Dec 9 2016, 09:34 AM

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(puchongite @ Dec 9 2016, 08:50 AM) You need to be a bit more verbose. Your terse replies are always ambiguous. Which scheme loses 10 days and which loses more days ? Yes I write like I speak lol. Pressed for time these days, don't feel like explaining much. T+4 sell, a few days to credit to savings, T+4 buy.. missing ten days from investment. Those could be the best ten days of the year |

|

|

Dec 9 2016, 09:36 AM Dec 9 2016, 09:36 AM

|

Senior Member

4,174 posts Joined: Dec 2008 |

|

|

|

|

|

|

Dec 9 2016, 09:38 AM Dec 9 2016, 09:38 AM

|

Senior Member

4,726 posts Joined: Jul 2013 |

QUOTE(elea88 @ Dec 9 2016, 09:36 AM) Eastspring small cap.QUOTE(river.sand @ Dec 9 2016, 08:02 AM) Not only that. With Trump elected POTUS, I doubt oil prices have much room to go up. perhaps now it's time for me to switch into this fund. I need to switch out of the EI AsiaPac Target Fund.Kecian kapchai, used to be one of the most popular funds here... |

|

|

Dec 9 2016, 09:43 AM Dec 9 2016, 09:43 AM

|

Senior Member

4,174 posts Joined: Dec 2008 |

QUOTE(Avangelice @ Oct 22 2016, 06:04 PM) [attachmentid=7838138] hi, can u let me know how to generate your this chart? is it within FSM or you do yourself? i cannot find it.[attachmentid=7838139] [attachmentid=7838140] I hardly ask for help with analysis of my portfolio but can some kind soul let me know if I'm doing everything right before the end of this year? |

|

|

Dec 9 2016, 09:44 AM Dec 9 2016, 09:44 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Dec 9 2016, 09:45 AM Dec 9 2016, 09:45 AM

|

Senior Member

4,174 posts Joined: Dec 2008 |

|

|

|

Dec 9 2016, 09:48 AM Dec 9 2016, 09:48 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(adele123 @ Dec 9 2016, 09:38 AM) Eastspring small cap. I'm in the same camp as you, sell when high, buy when low. But obviously we are not in the popular camp perhaps now it's time for me to switch into this fund. I need to switch out of the EI AsiaPac Target Fund. Yes, for the next few months MY EQ may not do very well, but as election approaches, the usual modus operandi is to pump up the market to keep the election machine running. Of course the question remain to be, would all stars align or not lor |

|

|

Dec 9 2016, 09:58 AM Dec 9 2016, 09:58 AM

|

All Stars

24,387 posts Joined: Feb 2011 |

QUOTE(repusez @ Dec 9 2016, 03:02 AM) this is where your credit system can be use to offset the sales charges, for eg, eastspring small cap switch to eastspring bond earns you credit , and later you can use the credit to offset the switch from eastspring bond to other eastspring equity fund like small cap, global leaders and etc. If I switch from Eastspring smallcap > Eastspring emerging market, kena charge 2% some more?applicable to both epf and cash funds. i think previously Xuzen advocate buying from eastspring for EPF funds as they have a range of funds to buy using EPF funds, for RHB need to pay rm 25 per switch. The credit system is the one thing that separates eunittrust from FSM, eunittrust don't has it, and for FSM you can use credit system to perform the ninja switching for free. Btw, if I want to buy those "sophisticated investment" by FSM do they really ask for RM3m proof (don't have RM3m) but interested in one of the fund. |

|

|

Dec 9 2016, 10:00 AM Dec 9 2016, 10:00 AM

|

Junior Member

368 posts Joined: Jun 2013 |

Same, not in the popular camp here and contradict with Xuzen's plan, but I am planning to pump into that fund when everyone is selling. Don't think Malaysia is all doom and gloom.

|

|

|

|

|

|

Dec 9 2016, 10:01 AM Dec 9 2016, 10:01 AM

|

Junior Member

17 posts Joined: May 2015 |

Does anyone had problem login to FSM MY website today? or is it just me

|

|

|

Dec 9 2016, 10:03 AM Dec 9 2016, 10:03 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Dec 9 2016, 10:12 AM Dec 9 2016, 10:12 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Ramjade @ Dec 9 2016, 09:58 AM) If I switch from Eastspring smallcap > Eastspring emerging market, kena charge 2% some more? 1. You example is a Intra fundhouse switch, no sales chargeBtw, if I want to buy those "sophisticated investment" by FSM do they really ask for RM3m proof (don't have RM3m) but interested in one of the fund. 2. The wholesale fund is restricted to HNWI to protect the retail investors, the idea is, these ppl with so much money won't feel the pinch if they lose from the wholesale fund. So if retail investors proceed to claim they are HNW, I don't think they really check. If I remember correctly, SC vetting and requirements is also less stringent for wholesale funds. |

|

|

Dec 9 2016, 10:21 AM Dec 9 2016, 10:21 AM

|

Junior Member

17 posts Joined: May 2015 |

|

|

|

Dec 9 2016, 10:23 AM Dec 9 2016, 10:23 AM

|

All Stars

24,387 posts Joined: Feb 2011 |

QUOTE(dasecret @ Dec 9 2016, 10:12 AM) 1. You example is a Intra fundhouse switch, no sales charge Thanks. Because the same fund on FSM SG doesn't need to be HNWI. Just need min SGD1000. Since I don't have access to FSM SG yet, might as well invest in the same fund as those sold on FSM SG. Need a short time parking place.2. The wholesale fund is restricted to HNWI to protect the retail investors, the idea is, these ppl with so much money won't feel the pinch if they lose from the wholesale fund. So if retail investors proceed to claim they are HNW, I don't think they really check. If I remember correctly, SC vetting and requirements is also less stringent for wholesale funds. |

|

|

Dec 9 2016, 10:38 AM Dec 9 2016, 10:38 AM

|

All Stars

48,521 posts Joined: Sep 2014 From: REality |

|

|

|

Dec 9 2016, 10:45 AM Dec 9 2016, 10:45 AM

Show posts by this member only | IPv6 | Post

#2360

|

Senior Member

664 posts Joined: Jun 2009 |

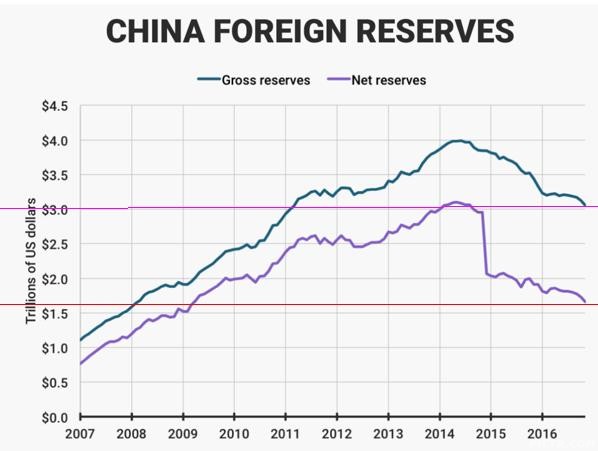

https://forum.lowyat.net/topic/4142101

QUOTE(news channel @ Dec 8 2016, 09:01 PM)  China Just Blew Through A Quarter Of Its Foreign Currency Reserves We seem to have yet again an acceleration in the outflow of Chinese capital, putting huge pressure on the yuan, the forex reserves, as well as the authorities. These reserves decreased in November by a whopping $69.1 billion, to $3.05 trillion. This is down a whopping $1 trillion from its peak in 2014. Up to half of the November decline could have been the result of the rise of the dollar, which reduces the value of the non-dollar forex reserves, and capital losses on fixed income instruments. The picture is even worse if one considers net reserves (gross reserves minus foreign debt) which now stand at just $1.7 trillion. They spend these reserves on defending the yuan, which has kept on sliding lower nevertheless. The losses are even more remarkable given China's still sizable current account surplus. Somebody should tell the incoming US government, because President elect Trump was tweeting against China's currency policy only a few days ago. There is actually additional pressure from the rising dollar, anticipating Fed interest rate hikes and a reflationary policy package of the incoming US government. China fixes its currency to a basket of 13 trade-weighted currencies, and the rising dollar means that the yuan gradually depreciates against the US dollar automatically when the dollar rises against these other currencies (like euro, yen, Swiss frank, a couple of Asian currencies like the Hong Kong dollar, the Thai baht, etc.). Read more: http://seekingalpha.com/article/4029095-ch...rrency-reserves |

|

Topic ClosedOptions

|

| Change to: |  0.0309sec 0.0309sec

0.95 0.95

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 12:09 AM |