QUOTE

Summary

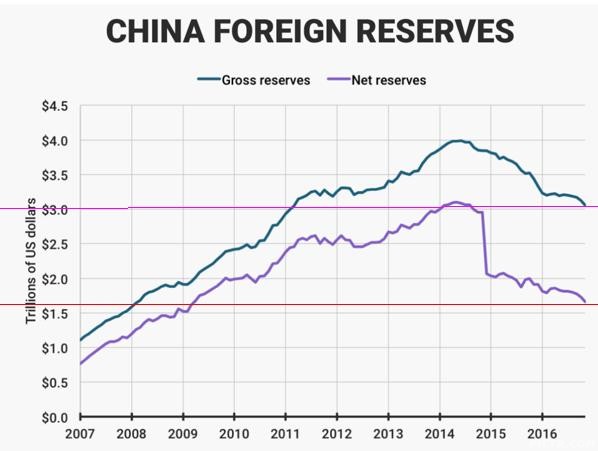

- China, the currency manipulator, has spend $1 trillion in propping up the yuan in two years. It's forex reserves declined from $4 trillion to $3 trillion.

- How long can they keep this up?

- Unlike earlier episodes, when markets sold off hard on news of this kind, markets haven't budged. For how long?

- China, the currency manipulator, has spend $1 trillion in propping up the yuan in two years. It's forex reserves declined from $4 trillion to $3 trillion.

- How long can they keep this up?

- Unlike earlier episodes, when markets sold off hard on news of this kind, markets haven't budged. For how long?

China Just Blew Through A Quarter Of Its Foreign Currency Reserves

We seem to have yet again an acceleration in the outflow of Chinese capital, putting huge pressure on the yuan, the forex reserves, as well as the authorities.

These reserves decreased in November by a whopping $69.1 billion, to $3.05 trillion. This is down a whopping $1 trillion from its peak in 2014.

Up to half of the November decline could have been the result of the rise of the dollar, which reduces the value of the non-dollar forex reserves, and capital losses on fixed income instruments.

The picture is even worse if one considers net reserves (gross reserves minus foreign debt) which now stand at just $1.7 trillion.

They spend these reserves on defending the yuan, which has kept on sliding lower nevertheless. The losses are even more remarkable given China's still sizable current account surplus.

Somebody should tell the incoming US government, because President elect Trump was tweeting against China's currency policy only a few days ago. There is actually additional pressure from the rising dollar, anticipating Fed interest rate hikes and a reflationary policy package of the incoming US government.

China fixes its currency to a basket of 13 trade-weighted currencies, and the rising dollar means that the yuan gradually depreciates against the US dollar automatically when the dollar rises against these other currencies (like euro, yen, Swiss frank, a couple of Asian currencies like the Hong Kong dollar, the Thai baht, etc.).

Read more: http://seekingalpha.com/article/4029095-ch...rrency-reserves

Dec 8 2016, 09:01 PM, updated 9y ago

Dec 8 2016, 09:01 PM, updated 9y ago

Quote

Quote

0.0209sec

0.0209sec

0.43

0.43

5 queries

5 queries

GZIP Disabled

GZIP Disabled