QUOTE(shankar_dass93 @ Dec 6 2016, 10:42 PM)

Greetings Guys,

So i just created a FSM account a few weeks back and have decided to invest in a few funds as a means of diversifying my investments. Was browsing thru this thread and would sincerely appreciate some guidance/help from yourself.

I've set an investment horizon of roughly around 3 to 5 years time in which I may have to cash out the given investment.

Tried shortlisting 2 equity funds, namely: TA's Global Technology Fund and Manulife's India Equity Fund and I've decided to split my investment amount equally within both funds.

Any advice if I'm too late in jumping into the ship ?

Thanks!

Welcome to FSM, the premier DIY platform for UTF participation.

Three to five years are usually a good time horizon. Anything shorter, look elsewhere as there are better products for those short-term

speculation investment.

So, why TA GTF & Manulife India? Is it because these two fund name appear a lot in this thread?

OK, lets say you have decided to split 50:50, do you know what is the average return and historical volatility?

No? Yes?

Anyway for the benefit of doubt, look at some of the screen shot below to see some of the numbers.

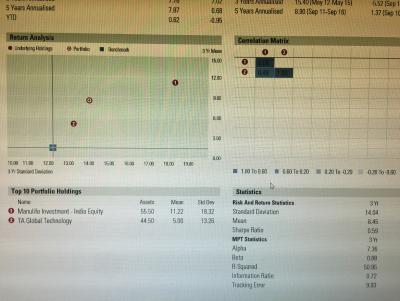

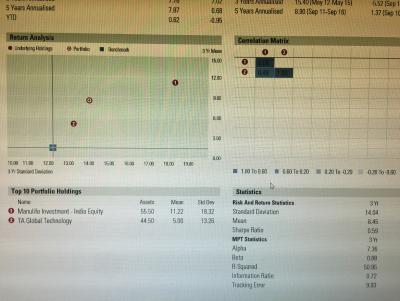

Image number one is the FSM webpage showing the annualized performance of TA GTF & Manulife India Equity Fund. Notice that their individual risk to reward ratio are 1.12 & 1.17 respectively.

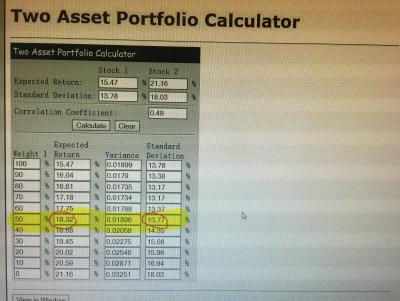

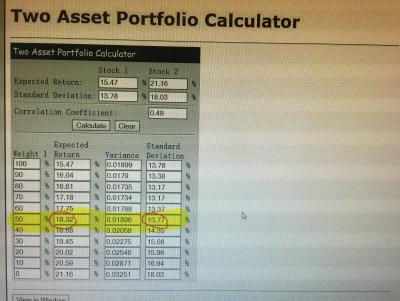

Image number two is the two asset portfolio calculator and the combined 50:50 two UTF has a historical return of 18.32% per year and a standard deviation aka volatility aka "riskiness" of 13.77 percent. This gives a risk to reward ratio of 18.32 divided by 13.77 equal to 1.33. Note that because you have combined two moderately correlated UTF's your combined risk to reward ratio has improved compared to the individual component. This means that the sum of part is greater than each individual part. Congrats, this means that your chosen fund gives you good diversification.

Image number three is a screen shot of correlation coefficient matrix obtained from morning star webpage. The correlation coefficient between TA GTF and Manulife India Fund is 0.49 which is considered moderately low correlation.

Finally, the question you need to answer: If your combined selection has historically return a ROI of 18.32 percent but it can swing + / - 13.77%, or lets say if you put in RM 100K, it can go up RM 118K but also swing from to RM 86.78K to RM 132K. Can you stomach this type of risk? If you are comfortable.... then go ahead.

Xuzen

This post has been edited by xuzen: Dec 7 2016, 12:10 PM Attached thumbnail(s)

Dec 7 2016, 10:25 AM

Dec 7 2016, 10:25 AM

Quote

Quote

0.0300sec

0.0300sec

0.62

0.62

6 queries

6 queries

GZIP Disabled

GZIP Disabled