QUOTE(lukenn @ Jan 13 2016, 11:49 PM)

I've been seeing a lot of talk regarding

RHB Asian Total Return Fund, and I have to admit I kena influenced. "Sum yuk yuk" by the looks of the performance numbers and wanted to make an allocation. So I did some research, and I'm sharing my summary :

1. Feeds into United Asian Bond Fund.

2. United Asian Bond fund

- has SGD, USD class

- fixed income only

- size ok : SGD 170m+

- track record long : 15 years

- allocation : overweight china, overweight financials

- Average maturity : 8.2 yrs

- Average YTM : 5.2%

3. Areas of concern : allocation, maturity, YTM

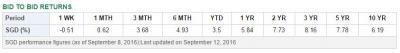

4. Below are the 1 year charts :

- Top orange = SGD/MYR vs RHB ATR vs UOB ABF - SGD Class

- Bottom orange = USD/MYR vs RHB ATR vs UOB ABF - USD Class

[attachmentid=5796483]

Prognosis : too late.

Option : buy in SGD.

QUOTE(lukenn @ Sep 12 2016, 03:22 AM)

Actually ATR is behaving as expected. Unfortunately, for most investors, diligence stops at performance tables, without knowing the how and why.

I did my own dd early this year on ATR

here, if you're interested. The diagrams will answer your question.

Also, your making it sound like volatility is a bad thing. It just needs to be managed, not avoided. 😁😁

Timely reminder there. So assuming I didn't quite missed the boat and currently has 16% IRR for this fund. What's your recommendation, hold or sell? USD n SGD inching higher

Selling a reasonably healthy fund seems to be counter intuitive to me

QUOTE(yuatyi @ Sep 12 2016, 12:12 PM)

Point taken. Thanks.

My concern it more to how ATR's volatility fits into my particular portfolio. More on its effect on my entire portfolio when taken in as FI. Not exactly saying ATR is a bad fund. It has got great track record and a FSM recommended fund. That's why I was said a few threads back that maybe that fund was initially recommended to me as part of my portfolio since I have 7 years horizon to make it work out'

Thanks for sharing that link. It's very informative. Just as expected, ATR works great with longer horizon. I like that it has SGD class as well as MYR but not very comfortable that it overweight China. Then again who knows maybe the dragon would rise again in very near future. As I have to rebalance my portfolio now I need to review having ATR as part of it. I am aware that volatility is an expectation in EQ funds and UT itself. And I just need to make the best of it through proper diversification and fund allocation/rebalancing to minimize the risk exposure for greater results.

I really appreciate your kind input. Hope to receive more guidance in future.

1. The RHB ATR feeds into the SGD class

2. I think he was talking about the gains in 2014-2015 mainly came from forex gains against SGD, and USD (RMB loosely pegged to USD); hence why missed the boat if you try to buy it in 2016.

As a result, the investment horizon may not be so critical here

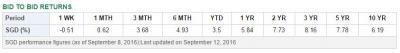

The United Asian Bond (SGD) class returns as attached

The longer term annualised return is still about 6%-8%. Not too bad, but not what you would get in 2015

p/s: Merely translating techie greek-like language into layman terms

Could have done it completely wrong though

Sep 12 2016, 03:43 AM

Sep 12 2016, 03:43 AM

Quote

Quote

0.0311sec

0.0311sec

1.38

1.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled