QUOTE(T231H @ Sep 10 2016, 06:47 PM)

since you will be moving/switching/relocating your EQ funds around.....

I believes you want to take the benefits of the 0.57% SC.

if you can....and if time allows....

don't inter switch direct from EQ of FH A to EQ of FH B

by doing so you will need to pay 0.57% SC

try intra switch from EQ of FH A to FI of FH A,...(wait a few days), then inter switch again that FI of FH A to EQ of FH B....

with this you will still need to pay 0.57% SC BUT you will gain "credit points"...which will be useful later.

courtesy of "Vanguard"

Thanks! That's the magic Vanguard pulled a couple of threads back I think. Very cool idea indeed. Yea I have been stalking this thread since I started investing FSM. Way better than the boring textbook. Hahaha

QUOTE(T231H @ Sep 10 2016, 06:56 PM)

RHB Asian Income Fund is a balanced fund (FI & EQ)

so your weightage of 20% EQ in Asia X Jpn seems not correct

Sorry I think I am a little lost here on what you mean. Do you mean I should be increasing my % in EQ since Asian Income Fund is a balanced fund is that right?

I dropped RHB ATR in favor of Asian Income Fund since the latter has FI effect and more stable than that ATR bond fund. That way I need not go to heavy on my dedicated bond funds and still get to decrease my portfolio's risk level akin to EQ60%:FI40%. Although technically is is EQ75%:FI25%. I hope that's how it works out.

QUOTE(lukenn @ Sep 10 2016, 07:43 PM)

* Past performance not indicative of future returns.

** Not intended as an offer or solicitation for sale.

Hi, thanks for the reminder and input. I appreciate it.

I am aware of that part. Just needed some sort of guideline from the simulator since past good performance could mean better FM and more effective management which could *crosses fingers* translate to future gain. Hopefully.

It's all a gamble anyways. As no one could predict the market nor the future.

QUOTE(j.passing.by @ Sep 10 2016, 08:06 PM)

VA may sounds good in theory, but what is its advantage over DCA, especially if the regular amount to put in is "tiny" like a few hundred ringgits? If a fund dropped 10% or 1k in value this month, are you ready to pour in 1k next month when the regular investment budget is only $400?

Being very objective and unemotional would means sticking to the set plan. The plan may be this, out of the savings from monthly salary, some is put in fd or fixed income funds, some in equity funds, say $400. So without fail, whether sunshine or earthquake, must buy $400 worth of equity funds every month.

This would be DCA style.

We can varies it slightly by choosing say 4 funds out of our existing 5 funds to put the $400 (with $100 per fund or S200 into 2 funds each.) How the 2 or more funds is selected out of the 5 funds is not upmost important. Every method will have its own weakness - sometimes you win, sometimes you lose, sometimes we get lucky, sometimes not - this is the reason why we do it DCA, not one-time lumpsum.

(If it is a regional fund, sometimes I looked into the stock index for that particular market... for example choose the fund with its market index below the 200-day MA.

https://sg.finance.yahoo.com/q/ta?t=2y&l=on...&s=%5EAXJO&ql=1 )

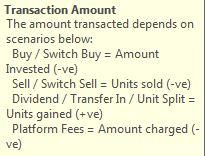

Now, with VA, you will need to put in some calculations and more effort in knowing the current values of the funds. Because VA is "topping up" the fund to the desired level. (The desired level can be a fixed number or percentage or a constant value. It can also be an increasing value... ie. you want it to grow 4% or 5% every year.)

As said, are you ready to "top-up" when the fund drops more than your planned budget?

Very good point there. Thank you for your kind input. Will need to plan very carefully. Learning lots here thanks to everyone being very helpful. I am very grateful for this thread.

Another reason I need start doing VA and not DCA a fixed amount each month is because it is about time for my rebalancing. To sharpen my aim. As I noticed my portfolio isn't very effective at the moment and it has been almost a year. So time to CSI it a bit. Hahaha. I will shift back to DCA once my portfolio is balanced once again to brave the market.

I am going to note down your comment here for reference. TQ

QUOTE(xuzen @ Sep 10 2016, 08:27 PM)

Looks OK. At least you have got the basic asset allocation theory right.

Xuzen

Thank you for your input. Really appreciate it.

I am glad to know at least now the asset allocation is correctly done.

QUOTE(lukenn @ Sep 11 2016, 02:42 AM)

For RM3-5m you can choose your manager, through a private mandate.

Sounds like someone is trying to sell you an equity fund, when what you really need is a bond fund/MMF....

Anyway, thats a bit of an over generalization, to say the least. If you really understand how UTs and asset classes work, portfolios can be maintained from overnight, or till the cows come home. It really depends on what the goal/purpose is. Sometimes UT is the correct tool, sometimes its not.

I'm guessing you read this in an article written by someone who lives/invests/retired in a mature economy?

Give chance a bit lah, I wanna be a well respected otai here on LYN, like you, Xuzen and Pinky.

Yes that is true. Portfolio holding duration is really up to the investor's aims. Mine is 7 years at least.

I hope switching out from RHB ATR to RHB Asian Income Fund would give me a smoother jounery. I really don't see how ATR can be called a Bond Fund at all. Its volitlity is worst than many other EQ with higher risk rating.

QUOTE(T231H @ Sep 11 2016, 03:19 PM)

when the "Grand Master JEDI" said "Looks OK. At least you have got the basic asset allocation theory right. "

I will "TAK Mahu" says looks OK to the below allocation....

Both looks almost identical.....

DAMN...I believes many investors wished to have the wisdom & knowledge to starts something like these when they started out.

The next difficult part is emotional pull to tweak or "pull out" when the corrections happens, which happened quite frequently for the past 2 years...

Yup. Very glad I finally got that down. Haha.

The portfolio by moon0620 seems almost like my initial portfolio aka too many global funds. And rather heavy on it for current climate. Is that right? Hmm it is also heavy on overseas funds. Pretty high risk taker here I think. Well then again, everyone has different goals and horizon to look at.

And I am no sifu. Just a small fish. UT nooby.

Sep 10 2016, 11:40 PM

Sep 10 2016, 11:40 PM

Quote

Quote

0.0294sec

0.0294sec

1.11

1.11

6 queries

6 queries

GZIP Disabled

GZIP Disabled