QUOTE(Ramjade @ Sep 23 2016, 10:11 PM)

Hi, Thanks for the reply. Much appreciated it. Cause actually I am looking so see whether I am right or not. Like the DCA vs lumpsum. Both methods work. We have proof from both side. DCA works if you have heart of steel. Lumpsum technique works IF can be done like 3-4x/year (again there's proof) if one refuse to take a loss (from observation - when profit hits a certain self target, run)

Also there's a matter of taking profit. Some said hold. Some said skim profit. But if skimming profit, isn't one taking the principal too which will spoil the effect of compounding interest. All too technical calculations as I don't have any financial background. Anyway, I know already what I want already after reading a bit.

I think you guys must have mistaken me here. I am talking about lumpsum RM100k. My lumpsum is only like RM200/each time.

This is what I meant -> Instead of buying the fund now at expensive price say this month (RM100/month - DCA style), keep it in CMF/eGIA-i. For me, I choose eGIA-i as it give the highest interest (don't get me started on this) and when next month comes and opportunity comes, one lump sum RM200 inside. I am thinking more along the way of VA.

When I look at the people's posting of tables of (-), board rates, promo rates FD returns, all make me

Because for me personally, I set my own benchmark that a UT MUST beat FD/EPF/ASX FP. Because no point investing so difficult (emotional challenges) when there are simple stuff which get you there too. My teacher used to say why kill a mosquito with a machine gun (making things hard when things are simple) and till this day.

You asked me to forked out lumpsum also I scared

From my observation, adults just want their money to be safe (the ones I know and observed)

Hey, I am open to discussion. Sorry if it seems like personal post. lol

Thank you again.

Sure if you choose to lump sum and hold it through the ups and downs. you might earn more.

However, by doing that you are giving up the opportunity to take advantage of the down time to pump in to polish your return.

This is the advantage DCA have over one lumpsum, by taking advantage of the volatile market.

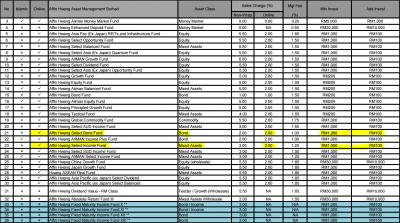

Given your risk appetite, there are quite some funds that can easily achieve your target in the long run (according to historical performance anyway)

Instead of putting them in FD/EPF/ASX FP, why not put that small lump sum you can afford to get a head start for it to have a return substantially better then the previous vehicles?

Since you are still a student, you can just start with small capital on one fund, and when you have extra money in the future, explore and invest more.

Don't worry about the market timing since no one can accurately estimate the timing of ups and downs.

Just like other pro here says, invest when u have the capital, and withdraw when u need the money.

Given your age, don't over worried the risk to suppress the potential return you could gain

Sep 9 2016, 08:15 AM

Sep 9 2016, 08:15 AM

Quote

Quote

0.1021sec

0.1021sec

0.97

0.97

7 queries

7 queries

GZIP Disabled

GZIP Disabled