QUOTE(1mr3tard3d @ Mar 6 2025, 12:30 AM)

u r right about this and your concern about the discrepancy in EA form is valid, perhaps visit the nearest LHDN branch and seek for advice?

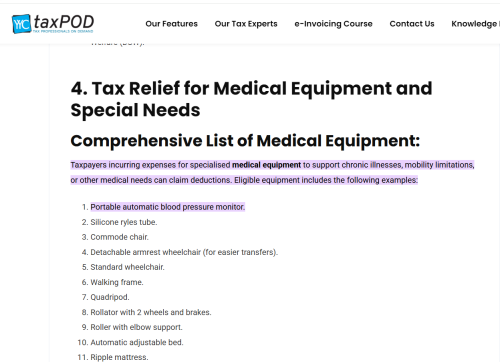

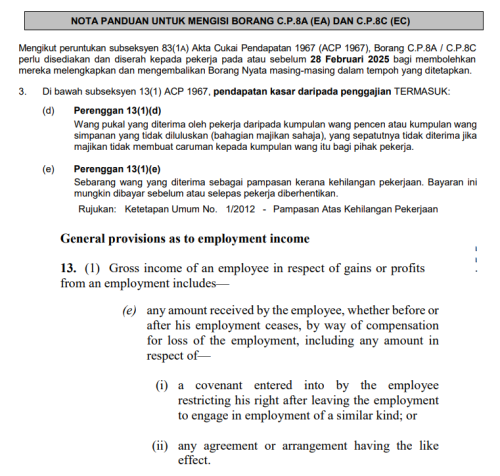

theoretically, the 'Pampasan kerana kehilangan pekerjaan' in section B.6 of EA is referring to s13(1)(e)

» Click to show Spoiler - click again to hide... «

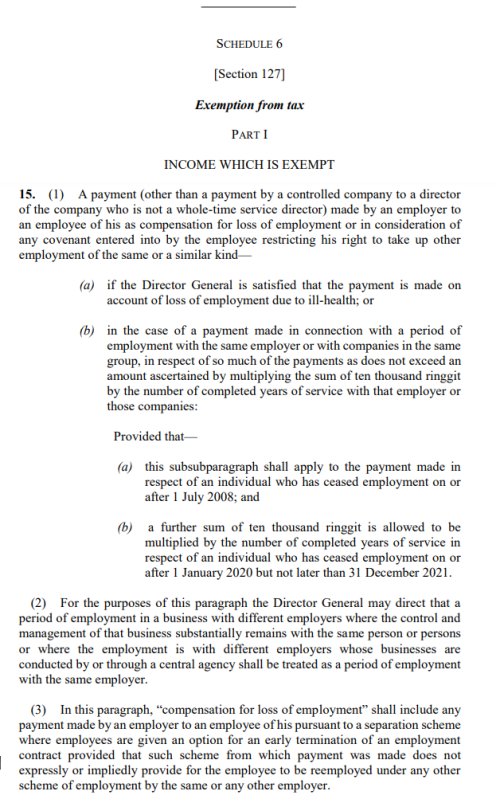

form EA guidebut since u r eligible under paragraph 15 of Schedule 6

» Click to show Spoiler - click again to hide... «

the compensation shall not be included in B.6 of EA

Thank you very much for your detailed explanation, 1mr3tard3d.

Just as you advised, I would seek advice directly from LHDN.

In the meantime, should I request my former company to remove the MSS compensation, from 'Pampasan kerana kehilangan pekerjaan' in EA Form? 'Pampasan kerana kehilangan pekerjaan' should be zero.

Or, should I request my former company to state the MSS compensation in Section F of EA Form, under 'Jumlah Elaun / Perkuisit / Pemberian / Manfaat Yang Dikecualikan Cukai'?

My concern is that since I am no longer an employee of my former company, my former company may not bother to amend EA form. If such is the case, can I make a complaint to LHDN, because my former company refuses to rectify the incorrect EA form?

Thank you for your advice, once again.

This post has been edited by kart: Mar 10 2025, 03:45 PM

This post has been edited by kart: Mar 10 2025, 03:45 PM

Mar 8 2025, 04:50 PM

Mar 8 2025, 04:50 PM

Quote

Quote

0.0215sec

0.0215sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled