QUOTE(Nom-el @ Aug 5 2015, 12:23 PM)

It is true that most banks' min deposit requirement for 1 month FD is 5k. However, there are some banks which only require 1k for 1 month FD. They are: -

i) AmBank Islamic

ii) RHB Islamic

iii) BSN

iv) Bank Islam

v) Al-Rajhi Bank

I placed min RM 500 for 1 year board rate at 3.3% with UOB few months ago.i) AmBank Islamic

ii) RHB Islamic

iii) BSN

iv) Bank Islam

v) Al-Rajhi Bank

OCBC FD Promo, valid from August until end of Nov

(1) 6 months at 4.00%, min RM 10K

(2) 13 months (previously 12 months) at 4.2%, min RM 10K

(3) 3 months up to effective rate 3.925%, 50% to FD at 4.8%; 50% to saving (smart savers max rate 3.05%)

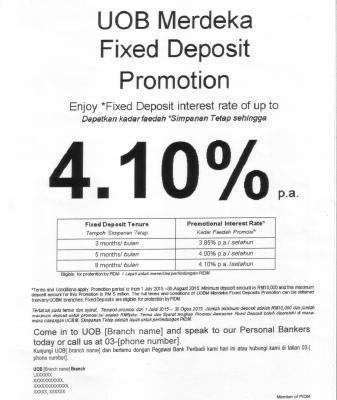

UOB Merdeka FD Promo, valid from 1 July until 30 August

(1) 3 months at 3.85%, min RM 10K

(2) 5 months at 4.00%, min RM 10K

(3) 8 months at 4.10%, min RM 10K

According to UOB staff, most FD depositors placed either 3 months or 5 months..

This post has been edited by BoomChaCha: Aug 6 2015, 12:07 AM

Aug 6 2015, 12:02 AM

Aug 6 2015, 12:02 AM

Quote

Quote

0.0296sec

0.0296sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled