QUOTE(Gold_Moderator @ Nov 25 2019, 09:16 PM)

Yes, the interest into your account daily basic. You are see your money grow daily. No need wait for maturity to redeem like fd. Fd interest burn if redeem premature

QUOTE(Gold_Moderator @ Nov 25 2019, 10:48 PM)

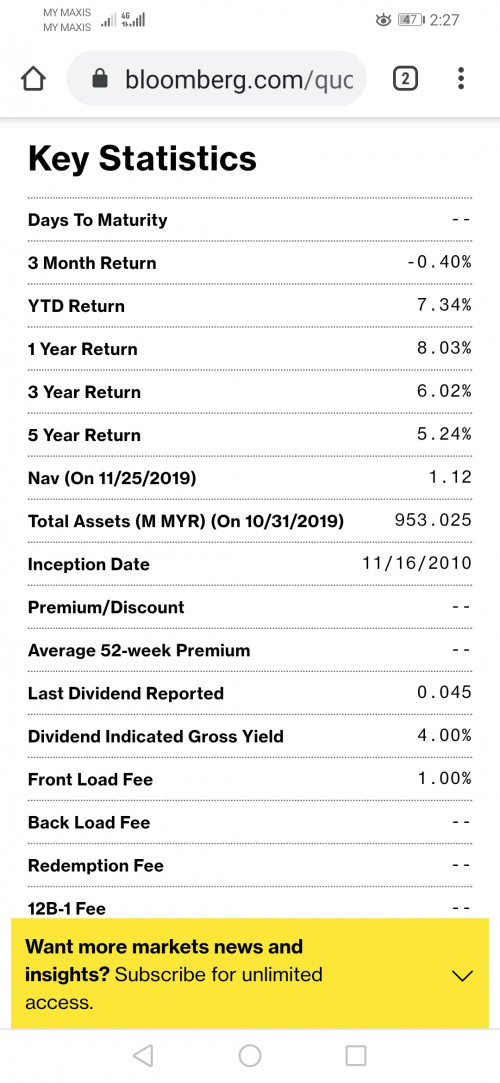

How these funds gives out interest into the account daily basis?These funds has better risk rating than fd?

How much better returns these funds gives OVER the fd to justify those extra risk?....

This post has been edited by MUM: Nov 25 2019, 11:43 PM

Nov 25 2019, 11:34 PM

Nov 25 2019, 11:34 PM

Quote

Quote

0.0218sec

0.0218sec

0.28

0.28

6 queries

6 queries

GZIP Disabled

GZIP Disabled