QUOTE(hsyong @ Mar 11 2020, 09:24 PM)

Sales charge is one time only right? That means deduct sales charge only for the first year's returns.

QUOTE(hsyong @ Mar 11 2020, 09:29 PM)

Ah, yes, that's a good way of putting it.

QUOTE(j.passing.by @ Mar 11 2020, 09:27 PM)

The sales charge or service charge is only one time.

If you hold the fund several years, you 'amortized' it over several years.

Yes, it charge once.

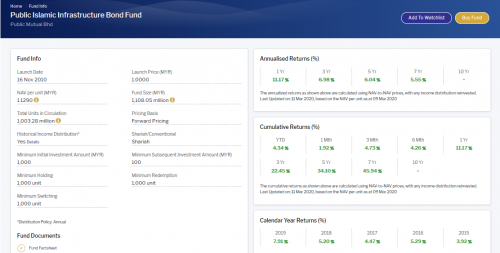

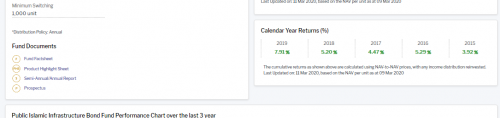

If you invest 1 year in equity fund, if the fund earns 10%, you earn 4.5% only. If the fund lost 10%, you will loss 15.5%.

If you invest 10 years, if the fund earn 60% over 10 years, ypu earn 54.5%, which is 5.45%p.a, not 6%. If the fund earn 30% over 10 years, you earn 24.5%, which is 2.45% p.a, not 3%.

Feb 28 2020, 03:04 PM

Feb 28 2020, 03:04 PM

Quote

Quote

0.0323sec

0.0323sec

0.38

0.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled