QUOTE(boldsouljah @ Oct 6 2019, 11:09 PM)

When you say dump, you mean bring back the cash to EPF and lose RM6.7k.

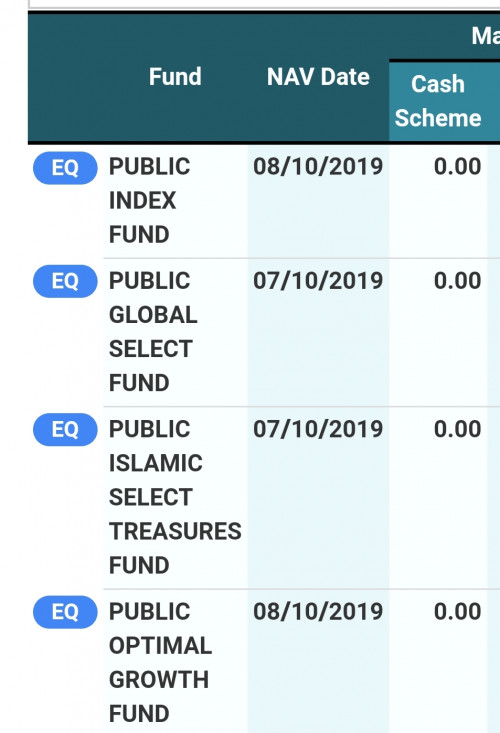

No chance for this value to go up at all? (For Public Index Fund) ?

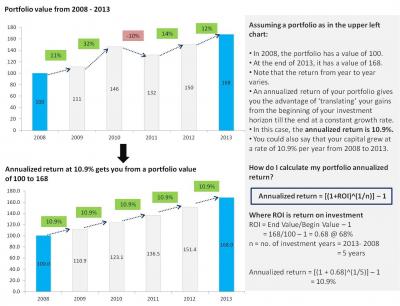

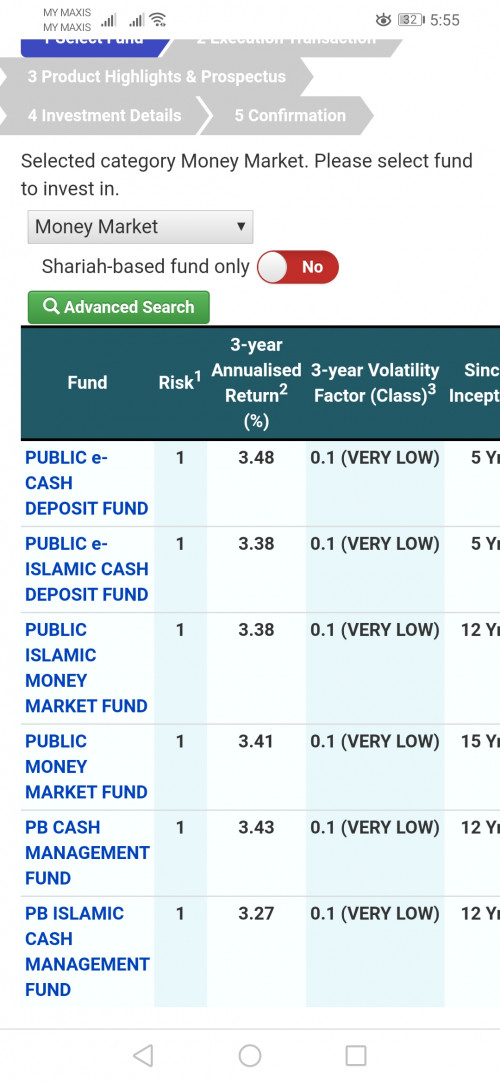

I think it is very unlikely it will go up in the next few years, and it is most likely that it will not go up more than EPF.

If you look at the performance chart, it is now at the same profit level since 2013. In other words, no profit since 2013. With EPF, you would got 6years x6% = 36% since then. You would have done better with even FD. To be fair, the mandate is too narrow.

PM funds are under-performing with over-priced service charge so they can pay the agents to go and

con persuade un-suspecting investors.

A cut-loss decision should not be based on how much you have already lost, but on future potential. If no potential, your loss would be even higher because you need to also consider opportunity costs.

That's only my opinion, of course. What you actually do with your money, you have to decide.

Oct 6 2019, 11:16 PM

Oct 6 2019, 11:16 PM

Quote

Quote

0.0356sec

0.0356sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled