Outline ·

[ Standard ] ·

Linear+

Public Mutual Funds, version 0.0

|

Gold_Moderator

|

Nov 25 2019, 09:13 PM Nov 25 2019, 09:13 PM

|

|

QUOTE(fuelsave @ Oct 11 2019, 11:12 AM) Someone shared with me say pm got a product something like a flexi fd, no fees and all. Comes with guaranteed interest and can withdraw anytime without fees. When ask about product name, he no share Money market. Daily interest. Withdraw t+1. No commission, that why your agent won't offer u free service. |

|

|

|

|

|

Gold_Moderator

|

Nov 25 2019, 09:16 PM Nov 25 2019, 09:16 PM

|

|

QUOTE(MUM @ Oct 11 2019, 06:57 PM)  Guaranteed interest ??:confused:  if yes guaranteed without any specific value...then there is.... but if want to have a guaranteed returns rate like FD (FD returns are made known before buying) .....then  ...even the money market funds are subjected to associated risk as specified in page 114 https://www.publicmutual.com.my/LinkClick.a...A%3d&portalid=0Yes, the interest into your account daily basic. You are see your money grow daily. No need wait for maturity to redeem like fd. Fd interest burn if redeem premature |

|

|

|

|

|

Gold_Moderator

|

Nov 25 2019, 10:48 PM Nov 25 2019, 10:48 PM

|

|

QUOTE(MUM @ Nov 25 2019, 10:15 PM) Please share the name of this unit trust fund.....  |

|

|

|

|

|

Gold_Moderator

|

Nov 25 2019, 10:51 PM Nov 25 2019, 10:51 PM

|

|

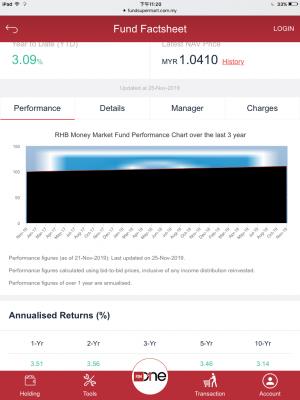

QUOTE(engyr @ Nov 25 2019, 10:43 PM) Public ecash deposit. Return roughly 3.4% p.a. based on past performance. 0% sales charge. *I am not agent, but I am using this. The fund I trust most at PMO. Yup, the interest rate is better than HLB fd. And the best part is interest come in daily. |

|

|

|

|

|

Gold_Moderator

|

Nov 25 2019, 11:22 PM Nov 25 2019, 11:22 PM

|

|

|

|

|

|

|

|

Gold_Moderator

|

Nov 25 2019, 11:47 PM Nov 25 2019, 11:47 PM

|

|

QUOTE(MUM @ Nov 25 2019, 11:34 PM) How these funds gives out interest into the account daily basis? These funds has better risk rating than fd? How much better returns these funds gives OVER the fd to justify those extra risk?....   You can see your money grow daily. Ya, got risk too. Once a week you will see your money shrink. |

|

|

|

|

|

Gold_Moderator

|

Nov 27 2019, 01:23 PM Nov 27 2019, 01:23 PM

|

|

QUOTE(engyr @ Nov 26 2019, 02:11 AM) You will see the nav increase most of the days . So far didn't aware the money shrink for this ecash deposit. Did aware it remains 0.0000 unchange for few days in a month. Most of the days it increase by 0.0001 per day. Risk compare with fd, No Pidm for money market fund. I do aware that money shrink from bond funds.  It's common. Because that day is pay day. |

|

|

|

|

|

Gold_Moderator

|

Nov 27 2019, 06:20 PM Nov 27 2019, 06:20 PM

|

|

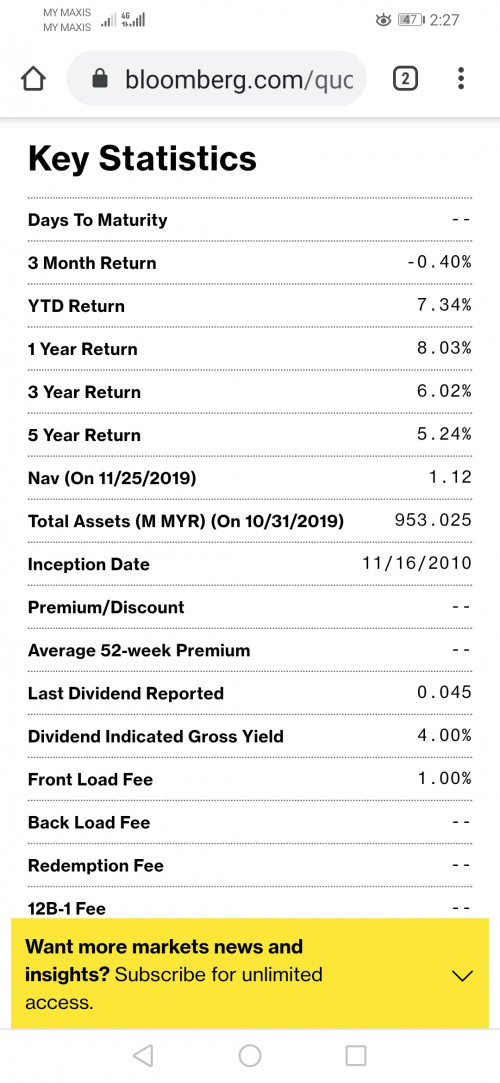

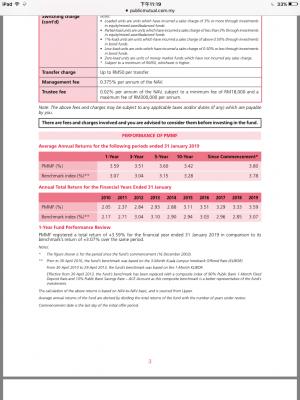

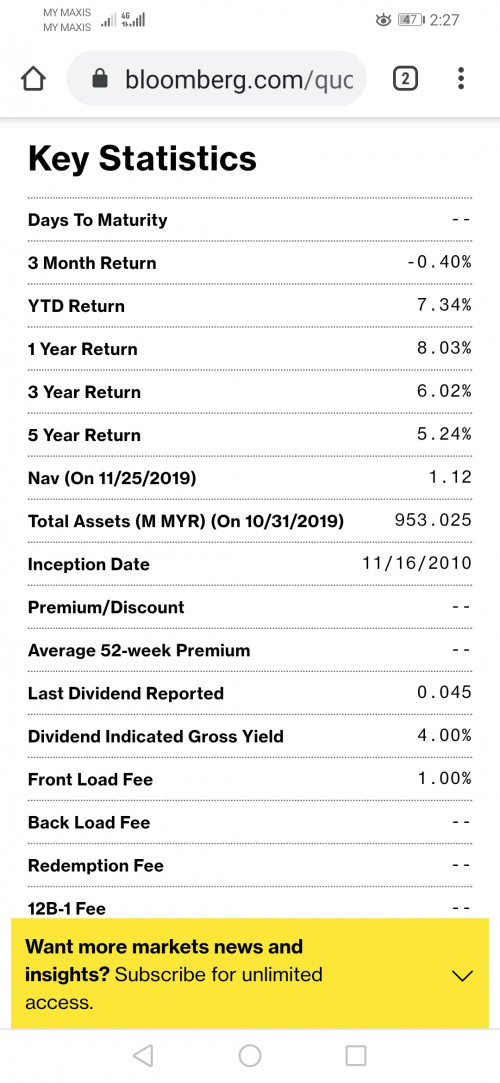

QUOTE(engyr @ Nov 27 2019, 02:26 PM) No. It was not payday. Fund nav drops. Public Islamic infrastructure bond fund financial year end at 30 Nov. Below is the data provided by blomberg. 3 months return -0.4% (excluding sale charge) .  Ya. I over look. He is refer to bond fund. What i mean is refer to money market. |

|

|

|

|

|

Gold_Moderator

|

Dec 3 2019, 02:06 PM Dec 3 2019, 02:06 PM

|

|

QUOTE(m3eshell10 @ Dec 2 2019, 06:30 PM) I'm wondering why people still buy PM when they impose high sales charges when you can get better performing funds at lower sales charge. I dunno though just starting to buy UT because of PRS. Regret put my first PRS investment in PM now everytime want to top up think about the sales charge 3% when FSM 0%. Money market, and bond can use to counter your sales chargers. |

|

|

|

|

Nov 25 2019, 09:13 PM

Nov 25 2019, 09:13 PM

Quote

Quote

0.0418sec

0.0418sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled