I requested to switch funds on 16/3/19.

Until now, transaction status still floating.

How many days Public mutual process normally?

Public Mutual Funds, version 0.0

Public Mutual Funds, version 0.0

|

|

Mar 19 2019, 07:02 PM Mar 19 2019, 07:02 PM

Return to original view | Post

#1

|

Junior Member

590 posts Joined: Dec 2015 |

I requested to switch funds on 16/3/19.

Until now, transaction status still floating. How many days Public mutual process normally? |

|

|

|

|

|

Mar 19 2019, 09:06 PM Mar 19 2019, 09:06 PM

Return to original view | Post

#2

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(MUM @ Mar 19 2019, 07:36 PM) while waiting for experienced sifus responses, Yes, I expected transaction is clear today. Till now, it is still floating transaction.my wild guess is.... you apply to sell on 16/3 (Saturday) depending on the fund itself, the actual sell may just trigger on Monday. (18/3) the Nav of Monday will only be known most probably on Tuesday 19/3 the fund house can just do the transaction based on the known Monday's Nav |

|

|

Jun 4 2019, 07:27 PM Jun 4 2019, 07:27 PM

Return to original view | Post

#3

|

Junior Member

590 posts Joined: Dec 2015 |

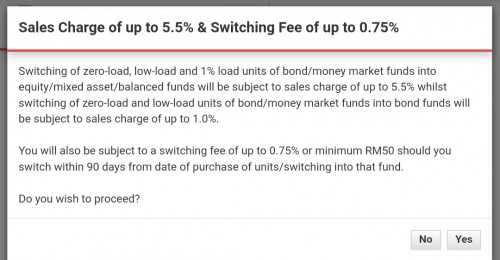

QUOTE(ChessRook @ Feb 22 2019, 01:45 PM) Thats why you need to 3) Important to rebalance every year. Every time your equity fund goes above a certain percentage that you plan. Then sell part of your equity UT to the % that was planned and invest that amount into safer options such as bond funds and FD. You do this vice versa also when UT equity drops and then sell part of your safe investments and then buy the more risky assets. Thus, you follow the saying buy low and sell high. One also rebalances due to changes in our lives and as we age closer to retirement. As we get closer to retirement. We want to increase X% and reduce Y%. Number 1, 3 and X% in safe investments are meant to protect our risky investments. One only invest in Y% of risky investments when one can afford to hold until a better situation. QUOTE(basSist @ Feb 22 2019, 01:39 PM) Keyword: TP- take the god damn profit. And bond/fixed income portion comes into the play which provide you income and cushion when you need to take out the cash during red market.  Many people recommend buy equity fund. Change equity fund to bond fund when economic is bad. Change bond fund to equity fund when economic is good. From the screenshot, we need to pay sales charge when change from bond fund to equity. My understanding is You invest RM1000 to equity fund, sales charge 5.5% When you change from equity fund to bond fund, you need to pay up to 0.75%. When you change from bond fund to equity fund, you need to pay up to 5.5%. Do you think it is better we redeem/sell the units when the market is bad, and buy back again when we want to invest again? This post has been edited by engyr: Jun 4 2019, 08:49 PM |

|

|

Jun 28 2019, 08:09 PM Jun 28 2019, 08:09 PM

Return to original view | Post

#4

|

Junior Member

590 posts Joined: Dec 2015 |

Deleted

This post has been edited by engyr: Jul 6 2019, 08:40 PM |

|

|

Jul 6 2019, 08:31 PM Jul 6 2019, 08:31 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

590 posts Joined: Dec 2015 |

Is pb aiman sukuk closed down for purchase? Cannot open account at pmo online.

QUOTE(fnm83 @ Dec 30 2018, 11:14 AM) Epf earn better than 90% of unit trust.https://www.freemalaysiatoday.com/category/...rust-investing/ My suggestion : do not touch epf. Only invest in unit trust if got extra money. This post has been edited by engyr: Jul 6 2019, 08:39 PM |

|

|

Jul 28 2019, 06:30 PM Jul 28 2019, 06:30 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

590 posts Joined: Dec 2015 |

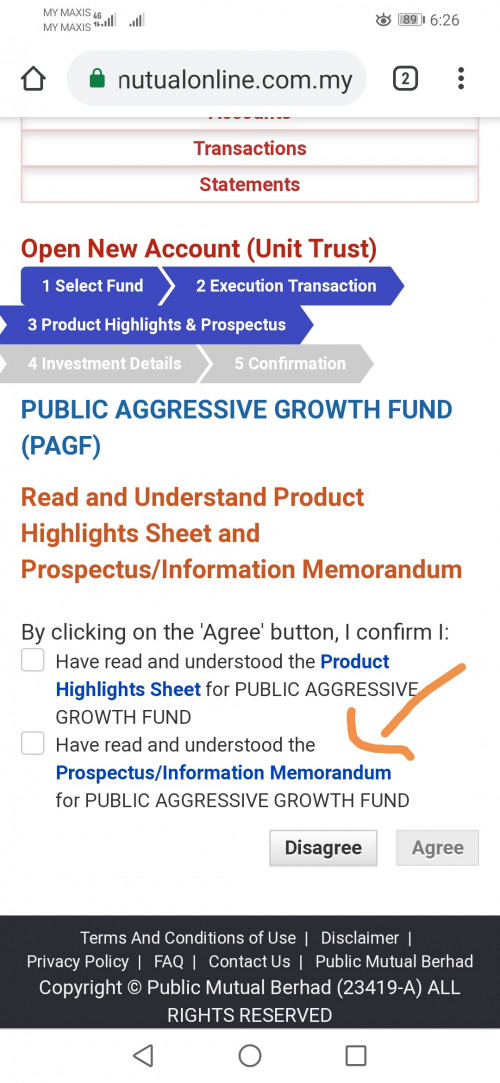

QUOTE(YoungMan @ Jul 28 2019, 04:01 PM) For those using PMO, a few questions. You can click invest /dda-->open new account - - >select fund-->yes-->click on the perspectus where to download fund perspectus for a particular fund? How do you sort fund by performance and view it for 3, 5 and 10 years? Thank you.  You can view the fund performance by click at the resource.  This post has been edited by engyr: Jul 28 2019, 06:32 PM |

|

|

|

|

|

Aug 10 2019, 08:50 PM Aug 10 2019, 08:50 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(YoungMan @ Aug 7 2019, 09:44 AM) Thank you. Yes I do have other equity fund, even Manulife as mentioned in your pic. This Public U.S equity is just a small portion. Luckily I read your comment before signing up DDA. The DDA is actually for another fund, it's just that seeing my 5% bleed every months feels like a lot of money wasted in the long term. Also I just found out DDA cannot cancel online, must go to PM branch and fill form which to me is unacceptable. Come on, PMO should implement their service better and not half-baked like this. Yes, you can enrol it online but you need to sign the form to cancel it. End up I didn't enrol DDA. This post has been edited by engyr: Aug 10 2019, 08:51 PM |

|

|

Aug 16 2019, 09:30 PM Aug 16 2019, 09:30 PM

Return to original view | Post

#8

|

Junior Member

590 posts Joined: Dec 2015 |

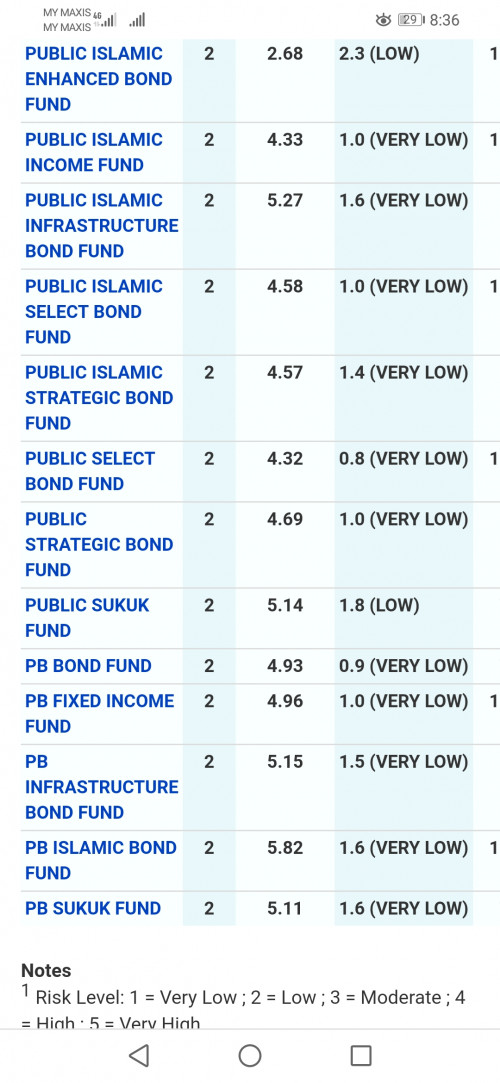

QUOTE(Aurora Boreali @ Aug 16 2019, 08:45 PM) Public Bond Fund 1 year return is 7.46%. That already beats most equity funds' performance in the past 1 year. Yes. Bond funds performance is better than equity funds.Sales charge is 1% versus 5.5% for equity funds. Agents will encourage you to buy equity funds or mixed asset fund. But I will choose bond funds only. This post has been edited by engyr: Aug 16 2019, 09:32 PM |

|

|

Aug 22 2019, 08:49 PM Aug 22 2019, 08:49 PM

Return to original view | Post

#9

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

Aug 29 2019, 07:52 AM Aug 29 2019, 07:52 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(ytan053 @ Aug 29 2019, 07:17 AM) Beg to differ. Why still wanna become full-flegded agent who is tied to one principal when in the CUTA rep can have access to multiple fundhouse instead of one fundhouse? Epf did a good job.The reason why epf launched this is to slowly eliminate tied agent, eventually, it is fsm who wins as they are the one who developed the epf e-mis for epf. Not only that, there r other moves that they hasn't play yet. Stay tune for the next update probably by end of this year. I bought pb fund 8 years ago. My agent didn't contact me for past 7 years. She is enjoying carrier benefit without doing anything. It is time to eliminate bad agents by reducing the sales charge and management fee. |

|

|

Sep 25 2019, 06:44 PM Sep 25 2019, 06:44 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

590 posts Joined: Dec 2015 |

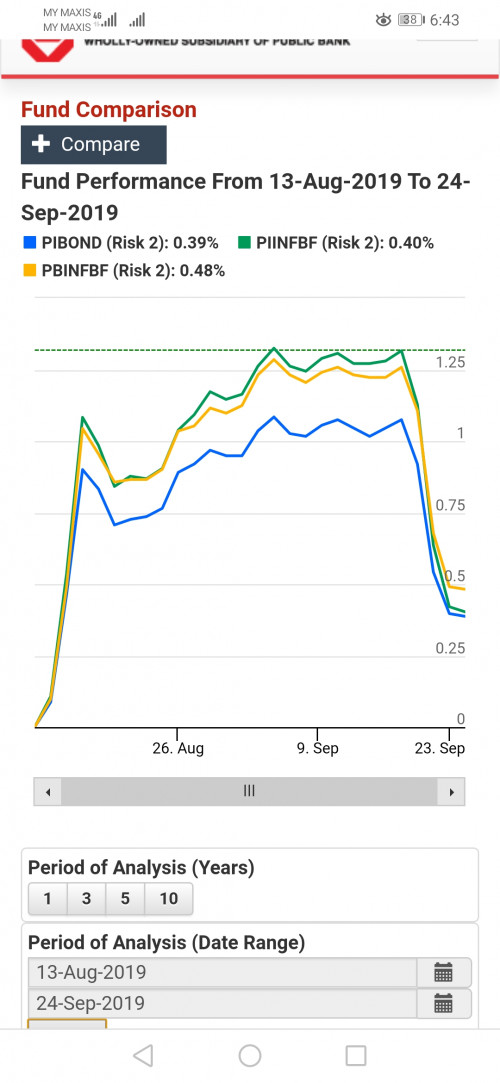

QUOTE(j.passing.by @ Aug 16 2019, 02:07 PM) Just for the record... It seem like bond funds violate like equity fund. The daily increment for some bonds funds yesterday was extraodinary high. While mm funds are about 0.01% daily (which would be about 3.65% annualised), the bond funds were about 3 times higher in the past 12 months, around 0.03% to 0.04% daily. Yesterday's daily increments were akin to equity funds... PB AIMAN SUKUK FUND 0.53% PB SUKUK FUND 0.26% PB INFRASTRUCTURE BOND FUND 0.39% PUBLIC ISLAMIC BOND FUND 0.38% PUBLIC ISLAMIC INFRASTRUCTURE BOND FUND 0.43% PUBLIC SUKUK FUND 0.37% (Note: PB Aiman Sukuk is closed to new investments.) Any comments?  This post has been edited by engyr: Sep 25 2019, 06:45 PM |

|

|

Sep 29 2019, 09:33 AM Sep 29 2019, 09:33 AM

Return to original view | IPv6 | Post

#12

|

Junior Member

590 posts Joined: Dec 2015 |

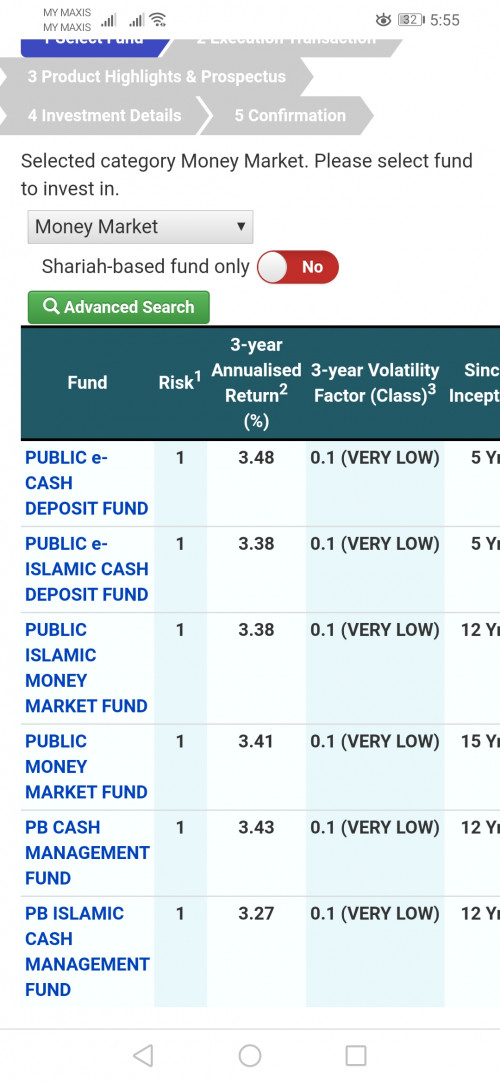

QUOTE(smwah @ Sep 29 2019, 08:07 AM) My in law want to support his relative, and instend buy ut for my child. So I no idea which public fund to go. Prob is the relative still new. My in law plan is just monthly rm200 for maybe 5 years. Can consider bond fund or money market fund. Bond fund 1% sales charge, money market fund 0% sales charges.So any sifu suggestion. Equity fund sales charge 5.5%. Not easy to earn after deduct 5.5% sales charge. Whether you earn or lost money, your agent will earn. I was so regret to buy equity fund. |

|

|

Sep 29 2019, 07:35 PM Sep 29 2019, 07:35 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(smwah @ Sep 29 2019, 01:58 PM) So any product recomend for bond, money market or equity. The amount investniw not big, monthly purcha se aroudn 200 for maybe 10 years. Only invest at the things that you know well. Since you are making favour for your relative, you can ask him for product prospectus & annual report. |

|

|

|

|

|

Oct 6 2019, 09:56 PM Oct 6 2019, 09:56 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(boldsouljah @ Oct 6 2019, 09:47 PM) Sorry, mine is the EPF scheme. I have been putting money into PM from my EPF for the past 7 years, So now i have around 74k, and it shows Total Returns : -RM6454 Epf annual return range from 5.7-6.9%.Here you lost 8.7%. Wait for klse goes up then shift back to epf. This post has been edited by engyr: Oct 6 2019, 09:57 PM |

|

|

Oct 10 2019, 07:50 AM Oct 10 2019, 07:50 AM

Return to original view | Post

#15

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(enkil @ Oct 7 2019, 12:19 AM) QUOTE(boldsouljah @ Oct 7 2019, 08:59 AM) That's what my agent told me. He said should keep pumping money in PM or else the negative will be more. QUOTE(wongmunkeong @ Oct 8 2019, 07:53 AM) so.. the CONsultan said to dig the hole deeper, thus it would not be bigger? You need to judge yourself. Whether you earn or loss, your agent will earn 3%.cool logic momma told me to stop digging if i wanted to get out of a hole.. and climb out to look around for better pursuits - and maybe, cover the dang hole if nothing better to do. Epf investment around 6% p.a. You need to earn more than 9% to beat epf. Now epf sales charge 0.5% is better. But epf performed better than 90% unit trust last year. https://www.freemalaysiatoday.com/category/...rust-investing/ This post has been edited by engyr: Oct 10 2019, 07:52 AM |

|

|

Oct 11 2019, 05:58 PM Oct 11 2019, 05:58 PM

Return to original view | Post

#16

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(fuelsave @ Oct 11 2019, 11:12 AM) Someone shared with me say pm got a product something like a flexi fd, no fees and all. Comes with guaranteed interest and can withdraw anytime without fees. When ask about product name, he no share Public e cash deposit fund is good. Zero sale charges. It is a money market fund. Annual return is >3%, better than one month fd interest. Agent will not recommend it as they don't earn sales charge. Benefit of fd. 1)got pidm 2)can withdraw immediately if you don't mind to lost interest Benefit of money market 1)will get interest if you redempt anytime Redemption 0% Website stated 10 days redemption, I got the money after 2 days withdrawal.  This post has been edited by engyr: Oct 11 2019, 06:00 PM |

|

|

Oct 20 2019, 12:30 PM Oct 20 2019, 12:30 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(kueks @ Oct 20 2019, 12:15 PM) ic, hmm but since every month also subject to 5.5% interest charge, still can earn ? since market is not so good based on news xD reply in purple xD QUOTE(yklooi @ Oct 20 2019, 12:24 PM) the stated allocation and the holdings like DBS and Singapore allocation is NOT fixed and can be changed by the Fund Manager without notice. Direct debit authorisation also subjected to upto 5.5% sales charge. Good idea to get black and white from agent, force him to refund your sales charge.you need to callup the agent to confirm the no monthly sales charges of 5.5%,...preferably thru whats app or email...so that got recorded communication. according to the product highlight sheet...there is a sales charge of each purchase. not sure if can still earn after the 5.5% sales charge... but if 1 time sales charge if amortise it to 20 yrs, then very little percents only. but if 5.5% each month on each top up of RM100....... :confused: |

|

|

Nov 3 2019, 09:42 AM Nov 3 2019, 09:42 AM

Return to original view | Post

#18

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(j.passing.by @ Jul 19 2017, 03:08 PM) Things are looking bright this year, most of the equity funds are giving good YTD returns so far... and as usual when things are going well, a new fund is being launched by Public Mutual. I didn't saw switching charge in the product highlight sheet. Is switching allowed for this fund?.Capitalise on Public e-Flexi Allocation Fund for higher potential growth: - Only RM100 to start the investment. - Up to 98% in equity or fixed income securities. - Up to 30% in foreign markets. - Up to 3.75% sales charge. - Initial Issue Price: RM0.25 per unit during Offer Period (14 July to 3 August 2017). - Invest via Public Mutual Online Comments: - This is a active allocation fund which can swings from totally from equity to fixed income securities... the other permanent 2% of the fund is in liquid assets. - This is the only fund in Public Mutual that has redemption charges. If it is redeem within 2 years, there is a 2% charge. - It is mainly a local fund investing into the local Bursa, and it is allowed to invest up to 30% into foreign equities. - As stated above (in blue), it has a lower sales charge than usual as it is via its online service. ================= Cheers. QUOTE(MUM @ Oct 20 2019, 12:48 PM) put in Jan 100, next 12 months Jan Thus, not worth to invest by using EPF money.Put in Feb, next 12 month Feb so on so on since TS mentioned 20 yrs, thus if he is 35 now, then self contributing to EPF is a better option a simple and approximate calculation only.... if put in each month RM 100 @ 6% EPF rate = RM 106 after 12 months if put in each month RM100 @ - 5.5% SC, his actual investment value is RM100 - RM 5.50 = RM 94.50 this RM 94.50 each month MUST make 12.2% in the next 12 months to make same as EPF. (94.50 x 12.2% = RM 106.03) each month, each top up of RM100 must make 12.2% in the next 12 month This post has been edited by engyr: Nov 3 2019, 09:43 AM |

|

|

Nov 25 2019, 10:43 PM Nov 25 2019, 10:43 PM

Return to original view | Post

#19

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

Nov 26 2019, 02:11 AM Nov 26 2019, 02:11 AM

Return to original view | IPv6 | Post

#20

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(MUM @ Nov 25 2019, 11:34 PM) How these funds gives out interest into the account daily basis? These funds has better risk rating than fd? How much better returns these funds gives OVER the fd to justify those extra risk?.... QUOTE(Gold_Moderator @ Nov 25 2019, 11:47 PM) You will see the nav increase most of the days . So far didn't aware the money shrink for this ecash deposit. Did aware it remains 0.0000 unchange for few days in a month. Most of the days it increase by 0.0001 per day. Risk compare with fd, No Pidm for money market fund. I do aware that money shrink from bond funds.  This post has been edited by engyr: Nov 26 2019, 08:05 AM |

| Change to: |  0.0955sec 0.0955sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 07:11 AM |