Outline ·

[ Standard ] ·

Linear+

Credit Cards HSBC Credit Cards V.2, Read the T&C before applying!

|

cute_boboi

|

Dec 13 2021, 09:46 PM Dec 13 2021, 09:46 PM

|

|

QUOTE(matrix88 @ Dec 10 2021, 06:18 PM) lousy card, I saw 25 ringgit charged to my card statement, called CS to cancel my card, CS told me the 25 ringgit need to be paid in order to cancel the card. the card had not been used since Aug 2021, I do not need the card, thus want to cancel it, anyone faced this before? Search this thread under my name. I did it after lodging complain with BNM. |

|

|

|

|

|

eikozai

|

Dec 13 2021, 10:44 PM Dec 13 2021, 10:44 PM

|

|

QUOTE(cute_boboi @ Dec 13 2021, 09:46 PM) Search this thread under my name. I did it after lodging complain with BNM. The rm25 is charged by government. I always ring them up to waive it off, and HSBC is willing to provide 'rebate' after i paid it up in the first place. Been using HSBC credit cards since the last 11 years, been good so far. No bad experiences with them, yet. 1 thing short is 0% interests instalment facilityhave very limited participating merchants. |

|

|

|

|

|

ChiaW3n

|

Dec 14 2021, 01:48 AM Dec 14 2021, 01:48 AM

|

|

I am not sure if should I keeping this rewards point card or should I activate this amanah card where both of these cards don’t share the credit limit, I am thinking just keep either one, if any sifu here can enlighten me?

|

|

|

|

|

|

cute_boboi

|

Dec 14 2021, 10:22 AM Dec 14 2021, 10:22 AM

|

|

QUOTE(eikozai @ Dec 13 2021, 10:44 PM) The rm25 is charged by government. I always ring them up to waive it off, and HSBC is willing to provide 'rebate' after i paid it up in the first place. Been using HSBC credit cards since the last 11 years, been good so far. No bad experiences with them, yet. 1 thing short is 0% interests instalment facilityhave very limited participating merchants. Correct is charge by government. However as a CC user, we have the right to cancel the CC. Also the SST is charge in advance for the 12 months ahead. If I don't want to continue the CC, I don't have to pay the SST even though it is in statement. Bank should just cancel the CC and SST, just like all the other banks. But HSBC made it difficult for consumers. Hence, just check this thread under my name on how to complain to BNM if anyone wants to cancel the CC and don't want to pay the SST. |

|

|

|

|

|

stuffx

|

Dec 14 2021, 11:28 AM Dec 14 2021, 11:28 AM

|

|

QUOTE(cute_boboi @ Dec 14 2021, 10:22 AM) Correct is charge by government. However as a CC user, we have the right to cancel the CC. Also the SST is charge in advance for the 12 months ahead. If I don't want to continue the CC, I don't have to pay the SST even though it is in statement. Bank should just cancel the CC and SST, just like all the other banks. But HSBC made it difficult for consumers. Hence, just check this thread under my name on how to complain to BNM if anyone wants to cancel the CC and don't want to pay the SST. Actually from my experience, HSBC is the easiest bank to “waive” SST. I just sent them a message via HSBC app requesting for waiver. I didn’t put so much hope but they replied positively to give RM25 rebate within 4-6 weeks. But I think the decision to give that rebate depends on our usage as well. |

|

|

|

|

|

eikozai

|

Dec 14 2021, 11:58 AM Dec 14 2021, 11:58 AM

|

|

QUOTE(cute_boboi @ Dec 14 2021, 10:22 AM) Correct is charge by government. However as a CC user, we have the right to cancel the CC. Also the SST is charge in advance for the 12 months ahead. If I don't want to continue the CC, I don't have to pay the SST even though it is in statement. Bank should just cancel the CC and SST, just like all the other banks. But HSBC made it difficult for consumers. Hence, just check this thread under my name on how to complain to BNM if anyone wants to cancel the CC and don't want to pay the SST. i see.. Since its charged, you can call them up first for waiver/rebate program. Then fulfill the 3 transactions regardless amounts, and it will perform the full refund in rebate form to you. Once u received the amount, you can cancel your card then. Easy and no need go through so many channels just for the sake of same result. The RM25, rebated into your credit card, u just top it to any eWallet accounts and make use of it from there lo. Unless the RM25 is final life saving funds for you, then u can go through the long way with BNM escalations, but it will takes longer time though with much more hassles. |

|

|

|

|

|

_kilakila_

|

Dec 14 2021, 01:03 PM Dec 14 2021, 01:03 PM

|

|

Just applied HSBC CC, hopefully can get approved and get the RM500 cashback  |

|

|

|

|

|

eikozai

|

Dec 14 2021, 04:58 PM Dec 14 2021, 04:58 PM

|

|

I just wanna check if there's anyone using both Platinum and Signature cards can share which one have better benefits?

I jut get offered by the bank for Signature through telemarketing, so was thinking to consolidate all the CCs under 1 card.

On the other hand, is it just me that felt the VISA have better promotions and campaigns than the Mastercard from HSBC?

|

|

|

|

|

|

helloworld92 P

|

Dec 14 2021, 05:10 PM Dec 14 2021, 05:10 PM

|

New Member

|

QUOTE(eikozai @ Dec 14 2021, 04:58 PM) I just wanna check if there's anyone using both Platinum and Signature cards can share which one have better benefits? I jut get offered by the bank for Signature through telemarketing, so was thinking to consolidate all the CCs under 1 card. On the other hand, is it just me that felt the VISA have better promotions and campaigns than the Mastercard from HSBC? i had platinum, amanah and signature at one point. consolidated amanah into signature and planning for platinum next. platinum and signature both are collecting points card but i think signature have better benefits like complimentary premium lounge access things like that |

|

|

|

|

|

eikozai

|

Dec 14 2021, 05:14 PM Dec 14 2021, 05:14 PM

|

|

QUOTE(helloworld92 @ Dec 14 2021, 05:10 PM) i had platinum, amanah and signature at one point. consolidated amanah into signature and planning for platinum next. platinum and signature both are collecting points card but i think signature have better benefits like complimentary premium lounge access things like that Ya, i consolidated the Amanah into Platinum as well. The cashback amount are not significant. So you are keeping the Platinum or consolidating Platinum into Signature? |

|

|

|

|

|

helloworld92 P

|

Dec 14 2021, 06:00 PM Dec 14 2021, 06:00 PM

|

New Member

|

QUOTE(eikozai @ Dec 14 2021, 05:14 PM) Ya, i consolidated the Amanah into Platinum as well. The cashback amount are not significant. So you are keeping the Platinum or consolidating Platinum into Signature? Ya agreed on the cashback amount, too little. Gonna consolidate the platinum into signature too. too many cc  |

|

|

|

|

|

cute_boboi

|

Dec 14 2021, 11:08 PM Dec 14 2021, 11:08 PM

|

|

QUOTE(eikozai @ Dec 14 2021, 11:58 AM) i see.. Since its charged, you can call them up first for waiver/rebate program. Then fulfill the 3 transactions regardless amounts, and it will perform the full refund in rebate form to you. Once u received the amount, you can cancel your card then. Easy and no need go through so many channels just for the sake of same result. The RM25, rebated into your credit card, u just top it to any eWallet accounts and make use of it from there lo. Unless the RM25 is final life saving funds for you, then u can go through the long way with BNM escalations, but it will takes longer time though with much more hassles. Why would I still want to continue using the card if my decision is to cancel the card ?  Less hassle to complain to BNM than making those spendings, then wait for statement, remember to make payments, wait months for the rebate, then top-up somewhere, then submit card cancellation ???, etc. Much easier to just: 1) Lodge complain at BNM website with details 2) Reply 1-2 emails Done. |

|

|

|

|

|

ChiaW3n

|

Dec 15 2021, 02:41 AM Dec 15 2021, 02:41 AM

|

|

QUOTE(helloworld92 @ Dec 14 2021, 06:00 PM) Ya agreed on the cashback amount, too little. Gonna consolidate the platinum into signature too. too many cc  Maybe I also can consider to consolidate my amanah to platinum, really too many cc! My amanah card not even activated 😹😹 |

|

|

|

|

|

bcy750 P

|

Dec 15 2021, 11:24 AM Dec 15 2021, 11:24 AM

|

New Member

|

Hi all,

Just curious how this actually works:

1) first year annual fee waived

2) no annual fee after 12X swipes in a year.

Let's say I got my new HSBC card approved and activated on 15 Dec 2021. Later I have more than 12 eligible swipes between 15 Dec 2021 up to 14 Dec 2022.

So am I eligible for annual fee waiver for the 2nd year (assuming 2nd year cycle will start on 15 Dec 2022), since I have made more than 12 swipes in a year before the anniversary?

Or, in order to waive the 2nd year annual year, the 12 swipes need to happen within the 2nd year, which mean the swipes must between 15 Dec 2022 to 14 Dec 2023 instead?

|

|

|

|

|

|

sadukarzz

|

Dec 20 2021, 03:46 PM Dec 20 2021, 03:46 PM

|

|

Anyone that has applied for their CC and did not receive any updates after >2 weeks?

I received the SMS but forever stuck on clarification - queries.

Also tried to:

- Chat > No avail, CS don't know dip shit about their call automation system led me to holland.

- Call > Can't even get to speak to a freaking human.

Anyone knows of a way to get through?

Am getting frustrated planned to use the CC for immediate spending but its taking too long and I want to withdraw my application.

|

|

|

|

|

|

dh13

|

Dec 22 2021, 12:18 PM Dec 22 2021, 12:18 PM

|

|

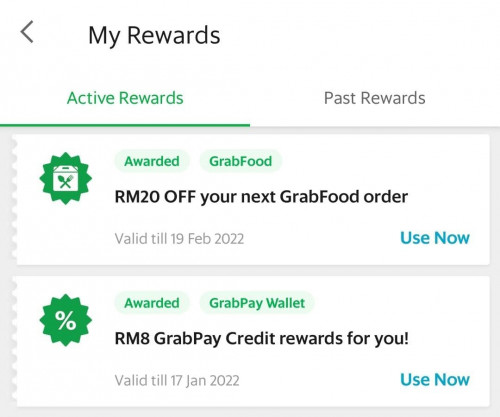

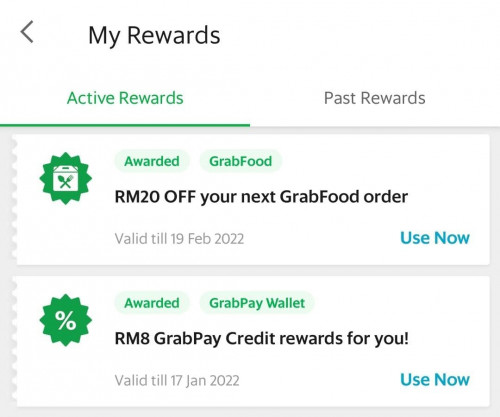

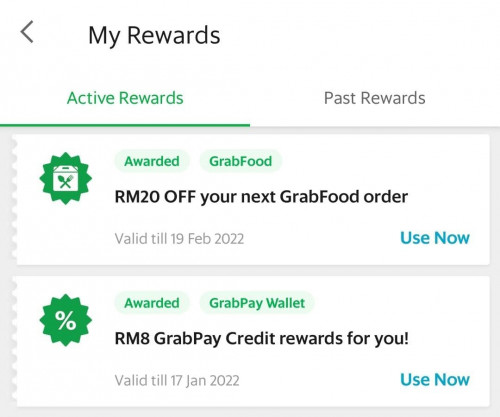

QUOTE(Vieon @ Dec 6 2021, 08:39 PM) Probably this month GRAB just assume all fullyredeemed and don't want to admit their system is having issue. QUOTE(starry-starry @ Dec 10 2021, 05:15 PM) I have already both RM15 & RM20 vouchers FINALLY!!! QUOTE(tifosi @ Dec 10 2021, 05:46 PM) When is the expiry of the RM 20 yeah? I got one in my account (expiring Dec 30) but I think that's the last month's one, right. QUOTE(lowyat101 @ Dec 13 2021, 06:40 PM) i haven't got mine too, i guess it's not coming already QUOTE(ChiaW3n @ Dec 13 2021, 06:59 PM) I think it’s the system glitches, this month a lot of people complaining not getting it despite reloading on the dot Wow.. Just received the RM20 vouchers.. finally after 3 weeks   |

|

|

|

|

|

ChiaW3n

|

Dec 22 2021, 12:48 PM Dec 22 2021, 12:48 PM

|

|

QUOTE(dh13 @ Dec 22 2021, 12:18 PM) Wow.. Just received the RM20 vouchers.. finally after 3 weeks   Same suddenly I received a pop up with RM20 grab food voucher yay! |

|

|

|

|

|

Barricade

|

Dec 22 2021, 06:07 PM Dec 22 2021, 06:07 PM

|

|

QUOTE(Dexter @ Sep 23 2021, 09:46 AM) Look like markdown point currently for Lazada. Lazada RM100 Voucher Redeem with points 50,000, Now: 35,000. 1.4% rebate equivalent. For reward cash rm50 for 24,000 pts is equal to 1% rebate. So far, I tested BigPay, ShopeePay, KiplePay, Boost and Lazada Wallet able to get 5x points. I didn't try for TNG & GrabPay due to I allocated other CC to reload them. Thanks. It says that extra points is capped at 15,000 per month for online. Does it mean the max I should spend is RM3750 in order to get 3,750+15,000 points? This post has been edited by Barricade: Dec 22 2021, 06:18 PM |

|

|

|

|

|

wym6977

|

Dec 23 2021, 01:20 PM Dec 23 2021, 01:20 PM

|

|

QUOTE(Barricade @ Dec 22 2021, 06:07 PM) Thanks. It says that extra points is capped at 15,000 per month for online. Does it mean the max I should spend is RM3750 in order to get 3,750+15,000 points? Ya, that's right. 15000 pts (3750X4) + 3750 pts (X1). If spend further, only get X1 pts. |

|

|

|

|

|

mitodna

|

Dec 23 2021, 01:53 PM Dec 23 2021, 01:53 PM

|

|

QUOTE(sadukarzz @ Dec 20 2021, 03:46 PM) Anyone that has applied for their CC and did not receive any updates after >2 weeks? I received the SMS but forever stuck on clarification - queries. Also tried to: - Chat > No avail, CS don't know dip shit about their call automation system led me to holland. - Call > Can't even get to speak to a freaking human. Anyone knows of a way to get through? Am getting frustrated planned to use the CC for immediate spending but its taking too long and I want to withdraw my application. I received call around 2 weeks. There is something off with the application, seems they like to call the office number and validate office e-mail (that went to spam mail) |

|

|

|

|

Dec 13 2021, 09:46 PM

Dec 13 2021, 09:46 PM

Quote

Quote

0.0303sec

0.0303sec

0.73

0.73

6 queries

6 queries

GZIP Disabled

GZIP Disabled