QUOTE(MilesAndMore @ Oct 31 2014, 01:21 AM)

Aiya paiseh

Bro

alexwsk,

Human Nature etc. are the ones keeping this section active these days

Anyway, i'm going to get this card soon. Probably going to cancel my Citibank Cash Back VISA Platinum as Maybank Islamic MasterCard Ikhwan also gives 5% for groceries besides petrol.

More importantly, with the MBB Islamic MC Ikhwan, you no need to go beg for annual fee waiver like Citibank CB Plat.

QUOTE(MGM @ Oct 31 2014, 06:18 AM)

Decision, decision. If comes 1-4-2015 and no more rm50 GovST, which are the cards to cut NOW b4 the card issuers charge this rm50 and annual fees?

For me, probably those hardly used cards and with high AF,like AMexPlatinum, RHB Platinum, CitiPremiermilesVS, AEON Gold, all due in the coming months.

Maybe will keep AEON Gold since AF & GST easily waived. The other 3 cards more for PPL access, maybe will reapply after 1-4-2015.

Bro, I see you collecting cards that grant FREE airport lounge access

- no need tell me why as I can figure it out from your past posts.

Assuming you terminate the AMEX Plat, Citibank PRemierMiles VS and RHB Plat, that would save you RM150 which you can then go use at McD or other restaurants.

msa9696 reported back in July (see below spoiler) that Citi gave him a hard time when he requested for his Premier Miles annual fee to be waived.

» Click to show Spoiler - click again to hide... «

QUOTE(msa9696 @ Jul 16 2014, 09:59 PM)

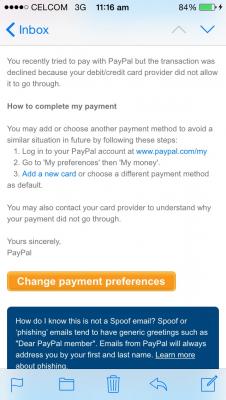

Sorry I have no time to go through if this has been posted, but I think I really need to share it here so that everyone is aware that Citibank is refusing to waive annual fee this year.

This is what I posted on their Facebook:-

"I believe that many have faced the same problem with Citibank, on their latest decision not to waive any annual fee. This is totally unethical considering the fact that they have made many promises when I questioned on the annual fee for the past few years. They have been committing to us that they will waive the fee as long as we call in and are actively using the card, so far no problem. This was also one of the main reasons I have not cancelled my card, as they have made all these promises. Moreover, I spend a lot as this is the only card I’m using. However, this year they decided otherwise, probably due to narrowing margin and they pass the cost to the customers. This is real nonsense. I don’t think any of us should give in to this.

They called me to explain all those nonsense and justification on how good is my Citibank Premiermiles card, treating me like an idiot who do not know the competition. Told me all those benefits compared to other banks, again downplaying our awareness that many other banks having similar or better benefits. Offered me 50% off the annual fee. Offered to convert my Premiermiles card to other life time waiver points earning card. My answer to all these is a big NO.

Eventually they agreed to waive the annual fee and I will transfer all my miles and cancel the card immediately. Shame on Citibank. I think all victims out there, you should lodge a report on them and go hard to the social media to spread their unethical business practice. Stop applying Citibank card unless you wish to pay RM 600 per year (i.e for Premier Miles)."

Oct 30 2014, 11:55 AM

Oct 30 2014, 11:55 AM

Quote

Quote

0.0345sec

0.0345sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled