I know about the sales charge. You can't calculate this way, because we are looking at this year by year. If you calculate this way, then similarly your total management fee goes up tremendously i.e. the total management fee for 3k x 10 is NOT only RM698.40 - you can't just take RM46.56 x 15 because in yr 2 you now have RM6k worth.. and yr 3 you have RM9k worth and so on. At the 10th year, with RM30k your management fee under Hwang would be RM564 PER YEAR, while under PM it's RM468 PER YEAR. Difference of RM96 PER YEAR. Assuming you have another 25 yrs to go to retirement, we are talking about RM1440 EXTRA for Hwang compared to PM, even after including the sales charge.

QUOTE(turbopips @ Dec 20 2012, 01:43 PM)

PM:

Yr 1 sales charge - RM90

Annual management/trustee/ppa fee (1.60% of RM2910 cause RM90 reduced under sales charge) - RM46.56

Total management/trustee/ppa fee over 15 yrs - RM698.40

Total sales charge over 15 years = RM90 *15 = RM1350Hwang:

Yr 1 sales charge - RM0

Annual management/trustee/ppa fee (1.88%) - RM56.40

Total management/trustee/ppa fee over 15 yrs - RM846

Total sales charge over 15 years = RM0 *15 = RM0U for forgot about sales charge RM90 to be paid every year assuming u invest RM3k every yr.

Added on December 20, 2012, 3:19 pmvery nice spreadsheet, this is my understanding as well. up front higher sales charge is a disadvantage over lower management fee IN THE LONG RUN, meaning talking about >20 yrs, because sales charge is based on the initial fund which is RM3k up to RM30k in total, but management fee is based on the value of the fund year after year.

Extreme example, let's say the fund returns 9.6% pa and after 15 yrs it's quadrupled, meaning now it's worth RM120k.

We still have paid a total of RM900 for PM sales charge and RM0 for Hwang.

but calculate the management fee for PM and Hwang on year 15 alone....

PM : RM120k x 1.6% = RM1920

Hwang : RM120k x 1.88% = RM2256

difference of RM336 there... just for ONE year. Assume another 10 yrs to go and it remains at 120k, that would mean extra RM3360 just on management fees alone for Hwang for year 16 to 25...

now go a little more crazy and assume fund is now 10x the initial RM30k upon retirement, so now the annual charges just for the final year...

PM : RM300k x 1.6% = RM4800

Hwang: RM300k x 1.88% = RM5640

difference of RM840.... your FINAL YEAR management fee almost wiped out the RM900 initial sales charge....

hope my understanding is correct, please feel free to correct if wrong.

and still i think we've had fantastic discussion on this, honestly think it really doesn't matter which provider we go for, because we won't know who can perform better. All these discussions are based on the unrealistic fact that both will give you same returns, which i think is not possible

QUOTE(kochin @ Dec 20 2012, 01:45 PM)

» Click to show Spoiler - click again to hide... «

» Click to show Spoiler - click again to hide... «

turbopips and poolcarpet boss,

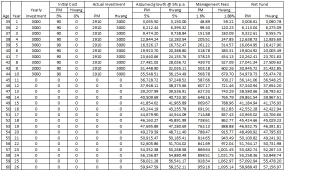

assuming all else being equal, please review my spreadsheet as attached.

This is based on the following assumption:

1. Yearly investment of RM3k for 10 years (align with current tax relief break as announced recently).

2. Assume no change in fees imposed by PM and Hwang (Initial cost for PM at 3%, management fees of PM - 1.6% and Hwang - 1.88%)

3. Assume same growth for both funds at 5% yearly

From my spreadsheet you would be able to see the breakeven for all things being equal, Hwang holds the advantage for the first 15 years wherelse PM holds the advantage for longer term.

Please also note that from Year 9 onwards, Hwang's management fees would be higher than PM's initial cost price of RM90 per annum.

Again the differences is quite marginal and all boils back down to performance of the fund ultimately.

Please feel free to correct if there is any flaws in my analysis.

Thank you.

Added on December 20, 2012, 3:22 pmi think if we are talking about just 10 yrs, then yes it is very possible zero upfront will beat upfront fee. however, i believe most of us discussing this is more than 10 yrs away from retirement, possibly 20 or 25 or even more for some of us. so if you do this little magic below with n=20, what would the results be?

QUOTE(xuzen @ Dec 20 2012, 03:00 PM)

Let'c compare:

Public Mutual Growth Fund vs Hwang Growth

Both start at zero present value. Let's assume both the fund will give an average return of 10% per annum for 10 years (N = 10). The annual payment is RM 3,000.00.

With a sales charge of 3%, the PMT for Pub-Mut will be RM 3,000/1.03 = RM 2,912.62, Hwang PMT = RM 3,000.00

So we have, N = 10, Mode = Begin since we put the money at the beginning of the period.

For Pub-Mut, the annual expense ratio is 1.56%; whereas for Hwang is 1.84%

Public Mutual, the real effective rate of return will be, i = (10 - 1.56)/1.0156 = 8.31%

For Hwang, the real effective rate of return will be, i = (10 - 1.84)/1.0184 = 8.01%

For Pub-Mut:

PV = 0; PMT = 2,912.62; N = 10; i = 8.31%; Mode = Begin; Find FV = RM 46,378.45

For Hwang:

PV = 0; PMT = 3,000; N = 10; i = 8.01%; Mode = Begin; Find FV = RM 46,963.11

Conclusion:

Hwang wins Pub-Mut i.e., zero upfront fee wins over upfront fee.

Xuzen

P/S: The above calculation is based on my trustee little friend aka Monsieur Hewlett-Packard 10B-II

Dec 20 2012, 12:43 PM

Dec 20 2012, 12:43 PM

Quote

Quote

0.0261sec

0.0261sec

0.49

0.49

6 queries

6 queries

GZIP Disabled

GZIP Disabled