so anything above 3.5% or so, better just do own method instead of annuity

QUOTE(magika @ Dec 13 2012, 10:43 AM)

Private Retirement Scheme Started?

|

|

Dec 13 2012, 10:53 AM Dec 13 2012, 10:53 AM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

ok that's about right... my calculation shows RM4063 payout per year for 15 years.

so anything above 3.5% or so, better just do own method instead of annuity QUOTE(magika @ Dec 13 2012, 10:43 AM) |

|

|

|

|

|

Dec 13 2012, 11:07 AM Dec 13 2012, 11:07 AM

|

Senior Member

2,612 posts Joined: Apr 2012 |

|

|

|

Dec 13 2012, 11:21 AM Dec 13 2012, 11:21 AM

|

Senior Member

2,547 posts Joined: Sep 2011 |

|

|

|

Dec 13 2012, 11:34 AM Dec 13 2012, 11:34 AM

|

Senior Member

2,612 posts Joined: Apr 2012 |

QUOTE(lowyat101 @ Dec 13 2012, 11:21 AM) Bank Rakyat offers 4.60% for more than 60 months deposit and still negotiable. Interest can be paid monthly.MBSB offers 4.7x% if not mistaken. For more info http://forum.lowyat.net/topic/2451962/+1420 My actual posting on calculation is meant to just to reconfirm my formula in Excel which is done manually. I do appreciate the feedback and has redone my calculations accordingly. Just for info I did the formula below 20 mins therefore a few errors has occured which is good for my learning process. Primarily one should know how to calculate as all sorts of schemes, PRS, Income Builder, Assurance & whatsnot are in the market and are powerfully promoted by Banks. This post has been edited by magika: Dec 13 2012, 11:35 AM |

|

|

Dec 13 2012, 11:48 AM Dec 13 2012, 11:48 AM

|

Junior Member

67 posts Joined: Jan 2006 |

QUOTE(penangmee @ Dec 11 2012, 11:36 PM) For the Hwang's Growth Fund, its not specifically stated but among the permitted investments are units/shares in collective investment schemes. Hwang's fund actually feeding into their existing fund which already have track record.Growth fund feed into: 35% Hwang Select Opportunity Fund 35% Hwang Asia Quantum 30% Hwang Select Bond Fund Moderate Fund 40% Hwang Select Dividend Fund 30% Hwang Select Balanced Fund 30% Hwang Select Bond Fund Conservative Fund 40% Hwang AIIMAN Income Plus Fund 20% Hwang AIIMAN Cash Fund 20% Hwang AIIMAN Growth Fund 20% Direct Bond Investment Added on December 13, 2012, 11:58 am QUOTE(poolcarpet @ Dec 12 2012, 09:10 AM) I'm planning to go for hwangim growth. Any known issues or negative points? If it's not doing well, can switch to another prs in the fiture just have to pay some $, i think rm25+25+sales charge for the other. 0% sales charge for hwangim too good to say no to QUOTE(j.passing.by @ Dec 12 2012, 01:37 PM) This is when you would want to monitor the fund more closely and do some switching instead of allowing your money to slide down in a bearish downturn. No doubt all the funds will slide downwards, but the more conservative funds will slide lesser. My company, Standard Financial Planner(SFP) is a Licensed Corporate Private Retirement Advisory Firm by Securities Commission and Federation of Investment Managers Malaysia (FIMM). SFP is able to represent your interest and minimize your hazzle to deal with multiple providers as we are authorised to market multiple PRS scheme. Currently we have Hwang, Manulife and CIMB. Added on December 13, 2012, 12:00 pm QUOTE(endau02 @ Dec 12 2012, 04:00 PM) lets say someone who is old like 60yrs old. currently this is actually a loophole, they can withdraw anytime and enjoy the tax relief as long as they are still paying tax.they earn quite alot and buy dis fund. when can they take out their money? This post has been edited by bkwu: Dec 13 2012, 12:00 PM |

|

|

Dec 13 2012, 12:28 PM Dec 13 2012, 12:28 PM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

Mine shows the same too

great minds think alike? QUOTE(magika @ Dec 13 2012, 11:07 AM) Added on December 13, 2012, 12:34 pmSo assuming 4.60%, using own method of 'annuity' investment, deposit RM3k per year for 10 years then let it continue to grow till 55 and then withdraw yearly for 15 years.... Total amount invested: RM30000 'Payout' per month: RM5694.70 Total payout : RM85420.50 Not too bad. But own method does not have tax relief, no protection component, plus it will take a lot of discipline to save the RM3k (without threat of penalty or policy lapse) and also even more discipline to take out only RM5694.70 at 56 years old when you are staring at RM50k one lump sum I think PRS is still better than annuity, since potential returns can be higher if it can be around 8-9% it will be fantastic returns for the RM30k invested upon retirement, easily quadruple.... QUOTE(magika @ Dec 13 2012, 11:34 AM) Bank Rakyat offers 4.60% for more than 60 months deposit and still negotiable. Interest can be paid monthly. This post has been edited by poolcarpet: Dec 13 2012, 12:34 PMMBSB offers 4.7x% if not mistaken. For more info http://forum.lowyat.net/topic/2451962/+1420 My actual posting on calculation is meant to just to reconfirm my formula in Excel which is done manually. I do appreciate the feedback and has redone my calculations accordingly. Just for info I did the formula below 20 mins therefore a few errors has occured which is good for my learning process. Primarily one should know how to calculate as all sorts of schemes, PRS, Income Builder, Assurance & whatsnot are in the market and are powerfully promoted by Banks. |

|

|

|

|

|

Dec 13 2012, 03:54 PM Dec 13 2012, 03:54 PM

|

Senior Member

2,612 posts Joined: Apr 2012 |

QUOTE(poolcarpet @ Dec 13 2012, 12:28 PM) Added on December 13, 2012, 12:34 pmSo assuming 4.60%, using own method of 'annuity' investment, deposit RM3k per year for 10 years then let it continue to grow till 55 and then withdraw yearly for 15 years.... Total amount invested: RM30000 'Payout' per month: RM5694.70 Total payout : RM85420.50 Not too bad. Mine From 21 year payout is at begining of the year while yours is at end of the year.. 21 year onwards payout from year start = RM5,444.30 pa 21 year onwards payout from year end = RM5694.70 pa This post has been edited by magika: Dec 13 2012, 04:05 PM |

|

|

Dec 13 2012, 04:07 PM Dec 13 2012, 04:07 PM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

yeah small minor details there, not really important in my opinion

QUOTE(magika @ Dec 13 2012, 03:54 PM) Oh now I see why our calculation is different ! This post has been edited by poolcarpet: Dec 13 2012, 04:07 PMMine From 21 year payout is at begining of the year while yours is at end of the year.. 21 year onwards payout from year start = RM5,444.30 pa 21 year onwards payout from year end = RM5694.70 pa |

|

|

Dec 13 2012, 04:20 PM Dec 13 2012, 04:20 PM

|

Senior Member

2,612 posts Joined: Apr 2012 |

QUOTE(poolcarpet @ Dec 13 2012, 04:07 PM) yeah small minor details there, not really important in my opinion That depends on particular individual and does not apply to all. For instance I have not made a single withdrawal for anything on my EPF eventhough is eligible for certain withdrawal. Other than PRS, in which the returns have not been proven (though the least they can do is guarantee capital preservation), additional contributions to EPF will be the alternative to PRS. EPF have been proven thru past records of being capable of paying out reasonable dividends. However DIY PRS will still be better as no definite lock in period. For those enthusing on greater returns, then DIY in Unit Trust will give better flexibility. It comes to the question of what is PRS, is it modified version of Income Builder plus Unit Trust ? Ha..ha.. |

|

|

Dec 13 2012, 04:34 PM Dec 13 2012, 04:34 PM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

Based on my understanding, PRS does NOT offer guaranteed capital preservation.... the risk is no different from unit trusts...

EPF is paying out about 5% dividend, don't think that's too fantastic actually... PRS is one way of locking down your money until retirement QUOTE(magika @ Dec 13 2012, 04:20 PM) That depends on particular individual and does not apply to all. For instance I have not made a single withdrawal for anything on my EPF even This post has been edited by poolcarpet: Dec 13 2012, 04:35 PMthough is eligible for certain withdrawal. Other than PRS, in which the returns have not been proven (though the least they can do is guarantee capital preservation), additional contributions to EPF will be the alternative to PRS. EPF have been proven thru past records of being capable of paying out reasonable dividends. However DIY PRS will still be better as no definite lock in period. For those enthusing on greater returns, then DIY in Unit Trust will give better flexibility. It comes to the question of what is PRS, is it modified version of Income Builder plus Unit Trust ? Ha..ha.. |

|

|

Dec 13 2012, 04:47 PM Dec 13 2012, 04:47 PM

|

Junior Member

9 posts Joined: Dec 2012 |

QUOTE(magika @ Dec 13 2012, 09:53 AM) Just calculating for pasting the time. How do you calculate the percentage? Where do you get 3.15 and 4.60? Sorry if I am at the wrong channel.FD Deposit (Own PRS Management) # Age 35 # Deposit RM3k for 10 years @ 3.15% pa compounding. # Payout at age 55 for 15 years. Total possible payout using own PRS Management is = RM5578.00 yearly for 15 years. At current optimum interest rate available at 4.60% . FD Deposit (Own PRS Management) # Age 35 # Deposit RM3k for 10 years @ 4.60% pa compounding. # Payout at age 55 for 15 years. Total possible payout using own PRS Management is = RM7374.00 yearly for 15 years. |

|

|

Dec 13 2012, 05:00 PM Dec 13 2012, 05:00 PM

|

Senior Member

2,612 posts Joined: Apr 2012 |

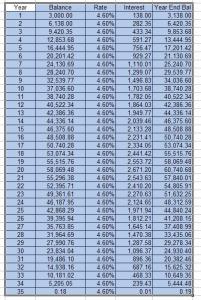

QUOTE(supamachine @ Dec 13 2012, 04:47 PM) How do you calculate the percentage? Where do you get 3.15 and 4.60? Sorry if I am at the wrong channel. The initial calculation my formula was wrong as did the manual formula too fast.Fixed Deposit rates 3.15% is conservative rates for the purpose of calculation. Fixed Deposit Rates for >60 months deposit is available so can deposit for 35 years tenure if you please. The actual calculation from the above (after correcting my formuls ) is begining of 21 year upto 35 year , the payout anually is :- RM5,444.30 pa for 4.60% pa FD RM3,998.69 pa for 3.15% pa FD Note that 3.15% pa FD rates is not realistic for 21 to 35 years deposit. >4.60% pa is available at certain banks for tenure ablove 60 months. This post has been edited by magika: Dec 13 2012, 05:12 PM Attached thumbnail(s)

|

|

|

Dec 14 2012, 12:56 PM Dec 14 2012, 12:56 PM

|

Senior Member

1,542 posts Joined: Jan 2005 From: Seri Kembangan |

Anyone already invested in PRS? Where could you obtain the account opening form? Could pay with credit card or must be cheque or cash?

|

|

|

|

|

|

Dec 14 2012, 01:18 PM Dec 14 2012, 01:18 PM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

If you are going for Hwang IM, just call them 1-800-222-777 and they can actually arrange for agent to meet up with you to fill in the form.

Payment is via cheque to "Hwang Investment Management Berhad" need to include RM10 for account opening fee, e.g. if investing RM3000 cheque should be for RM3010. Just need photocopy of IC front and back on single page, and fill up 2 forms when you meet the agent. Not sure about the rest but think some people mention they walk in and can open on the spot also for other PRS providers. QUOTE(netcrawler @ Dec 14 2012, 12:56 PM) |

|

|

Dec 14 2012, 02:09 PM Dec 14 2012, 02:09 PM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Dec 14 2012, 03:12 PM Dec 14 2012, 03:12 PM

|

Junior Member

489 posts Joined: Nov 2012 |

|

|

|

Dec 18 2012, 10:44 AM Dec 18 2012, 10:44 AM

|

Senior Member

2,991 posts Joined: Jun 2007 |

I cannot decide whether to invest in:

1. Hwang IM: No sales charge, but higher management fee, or 2. Public Mutual: High sales charge, but lower management fee. Which one would you choose and why? Stats according to this link: http://www.ppa.my/index.php/providers-and-...fee-comparison/ |

|

|

Dec 18 2012, 12:54 PM Dec 18 2012, 12:54 PM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

HwangIM : 0% sales charge, 1.8% annual management fee, 0.04% annual trustee fee, 0.04% PPA fee = total 1.88% pa

PM: 3% sales charge, 1.5% annual management fee, 0.06% annual trustee fee, 0.04% PPA fee = total 1.6% pa Difference pa is 0.28%, but with PM you have a disadvantage of -3% at the beginning. My reasoning: 1. If I think PM will give me better returns than HwangIM over 10 years, then I'll go for PM cause after about 11 years, PM's extra sales charge would be equalized by HwangIM's higher annual fees. 2. If you have a long way to go to retirement, e.g. >15 years, maybe can consider PM cause in the long run it is cheaper than HwangIM. Remember whatever $ you put in cannot be touched till 55 so the lower the fee the better - this is assuming the sales charge/annual management fee remains the same for the next >15 years. 3. Having said the above, you can also switch anytime to different providers subject to RM25 (HwangIM/PM) +RM25 (PPA). Personally I'll go for HwangIM for now - hopefully this can pressure PM and other providers to lower their sales charge Disclaimer: I am NOT a financial expert or consultant. These are just based on my layman understanding. QUOTE(simplesmile @ Dec 18 2012, 10:44 AM) I cannot decide whether to invest in: 1. Hwang IM: No sales charge, but higher management fee, or 2. Public Mutual: High sales charge, but lower management fee. Which one would you choose and why? Stats according to this link: http://www.ppa.my/index.php/providers-and-...fee-comparison/ |

|

|

Dec 18 2012, 04:52 PM Dec 18 2012, 04:52 PM

|

Senior Member

2,991 posts Joined: Jun 2007 |

Thanks for reply. I think I'll take the PM PRS scheme. The deciding factor is the length of time I buy into the fund. I'm 34 and it's another 25 years before I reach retirement age of 60. So, having a lower management fee definitely is more advantage.

QUOTE(poolcarpet @ Dec 18 2012, 12:54 PM) HwangIM : 0% sales charge, 1.8% annual management fee, 0.04% annual trustee fee, 0.04% PPA fee = total 1.88% pa PM: 3% sales charge, 1.5% annual management fee, 0.06% annual trustee fee, 0.04% PPA fee = total 1.6% pa Difference pa is 0.28%, but with PM you have a disadvantage of -3% at the beginning. My reasoning: 1. If I think PM will give me better returns than HwangIM over 10 years, then I'll go for PM cause after about 11 years, PM's extra sales charge would be equalized by HwangIM's higher annual fees. 2. If you have a long way to go to retirement, e.g. >15 years, maybe can consider PM cause in the long run it is cheaper than HwangIM. Remember whatever $ you put in cannot be touched till 55 so the lower the fee the better - this is assuming the sales charge/annual management fee remains the same for the next >15 years. 3. Having said the above, you can also switch anytime to different providers subject to RM25 (HwangIM/PM) +RM25 (PPA). Personally I'll go for HwangIM for now - hopefully this can pressure PM and other providers to lower their sales charge Disclaimer: I am NOT a financial expert or consultant. These are just based on my layman understanding. |

|

|

Dec 18 2012, 09:59 PM Dec 18 2012, 09:59 PM

|

Senior Member

1,559 posts Joined: Apr 2007 |

Just managed to go thru every posts. There are some who are concern about the performance due to small fund size or this is relatively new in the market without past track records.

I wouldn't give my opinion on whether big or small fund size easier to manage/perform as it's largely depending on the fund manager. Whether it's safe to invest with new funds, different people have different views. However, for those who are concern on the fund size and worry about the performance of new fund, you can go for HwangIM as their PRS are feeder funds to their existing Unit Trusts Funds. So far there are a total 4 out of 8 providers have launched their PRS Products, namely CIMB-Principal Asset Management, HwangIM, Manulife & Public Mutual. HwangIM & Manulife are offering 0% sales charge. More details on the sales charge and relevant fee can refer to http://www.ppa.my/index.php/providers-and-...fee-comparison/ Which is the best among the four? Well, I can't answer that. Depends whether you prefer 0 sales charge/lower management fee/feeder funds etc. Some might prefer Public Mutual due to their largest market share in UT, some might prefer Manulife due to their expertise in handling similar scheme in other countries such as Hong Kong & Indonesia, some prefer HwangIM based on the track record of the fund that they are feeding on. |

| Change to: |  0.0301sec 0.0301sec

0.35 0.35

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 05:58 PM |