Outline ·

[ Standard ] ·

Linear+

Are property prices going to up further? V4, nothing's gonna stop us now

|

BEANCOUNTER

|

Nov 20 2011, 11:33 AM Nov 20 2011, 11:33 AM

|

|

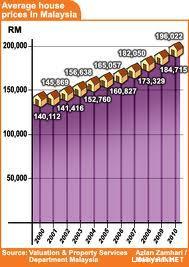

the average pricing indicator is so misleading...

it must have included those si beh far property prices that nobody wants... like sg buaya and bukit beruntung....

|

|

|

|

|

|

dlyw1103

|

Nov 20 2011, 12:13 PM Nov 20 2011, 12:13 PM

|

|

By Living Matters

By ANGIE NG | Nov 19, 2011

A more balanced development helps

--------------------------------------------------------------------------------

The Klang Valley has grown tremendously in many fronts, both organically from a natural increase in the local population, inter-state migration, and more robust economic and development activities.

There is also a higher influx of foreigners to our shores in the last one to two years.

Looking at the rapid pace of change and development around us, I believe the gravitational centre of the Klang Valley needs to be shifted from the present mostly developed and rather congested cities, especially Kuala Lumpur and Petaling Jaya, to more well spaced out and uncrowded areas.

With quite a number of high impact and transformational projects in the pipeline for implementation, the availability of land will be able to accommodate the big infrastructure and development projects without having to encroach into our present living landscape.

One of the ways this can be done is by ensuring that high impact development projects that have the potential to spawn new economic activities and attract people to set up homes and businesses should be spread out to corridors which are still relatively untapped and inhibited.

As we know the ongoing development of new infrastructure and property projects is mainly concentrated in the central and southern corridors that include Kuala Lumpur, Petaling Jaya, Puchong, Cyberjaya, Putrajaya, right down to Nilai in Negri Sembilan. The western corridor towards the Port Klang area is also seeing greater growth and development.

Meanwhile the northern and eastern corridors are still relatively untapped and efforts should be expended to bring more “enabling” projects to those parts of the Klang Valley.

Unlike some countries where land is a rare commodity, Malaysia is blessed with vast tracts of land that are suitable for development, and the question that has been asked many times is this: Why is there land shortage as well as inflated land cost and property prices in the country then?

Rightly speaking, there should not be any land or property shortage if more land is opened up for development and developers continue to launch township products that include landed properties that are in short supply.

Many of us must have noticed that the number of new greenfield township projects has quite suddenly grounded to a halt in the past three years, as most developers have shifted their focus to building small niche projects instead.

In a way, this has tremendously reduced the supply of property, especially landed housing units, over the past two years.

One of the plausible ways to address the current land and property shortage is to “plant the seeds of development” by spreading out some of the high impact government projects in the undeveloped corridors as catalyst of change and development.

Infrastructure projects such as new highways, and good public transport system such as the mass rapid transit or bullet train project, are some of the initiatives that can spawn wider growth corridors.

Besides the natural “organic” pace of development, efforts to expedite the development process of the cities in the Klang Valley include high impact infrastructure projects, such as the My Rapid Transit (MRT) project.

The MRT is one of the biggest infrastructure projects that has been planned for the country to act as the backbone of the Klang Valley’s public transport system.

To ensure that it serves its purpose well into decades to come, it is imperative for the project planners to plan the project not just to cater to the needs of the present population but more importantly, the needs of the growing Klang Valley populace in many years to come.

The question is whether it should just concentrate on the well populated and busy areas or that is should also ply the other sparsely populated areas.

Instead of building most of the rail tracks and stations in the “already occupied” and developed parts of the city, I believe the MRT should also traverse through the less occupied corridors of the Klang Valley to spread development there.

That way it will have more greenfield land and flexibility to master plan for a more holistic and integrated MRT network, with the necessary ancillary supporting structures such as the terminals and car parks, to promote a higher use of the public transport system.

Although in terms of capacity, it may be under utilise initially, its usage is bound to pick up steam once more economic activities start to take shape and the population starts to grow.

When demand increases, new land will bound to be opened and developers will find it feasible to undertake big township projects again. With higher supply, prices will also be back to its lower equilibrium.

|

|

|

|

|

|

ccslink

|

Nov 20 2011, 12:18 PM Nov 20 2011, 12:18 PM

|

|

Here's an excerpt from today's yahoo finance - can u see what BNM is also doing?

Real Estate: Why Home Prices Won't Bottom Out

ReutersBy John Wasik | Reuters – Fri, Nov 18, 2011 1:10 PM EST

Watching the U.S. home market struggle to rebound is like listening to children in the back of a car. No, we're not there yet.

The National Association of Realtors reported that ten real estate markets are "leading the nation toward a general recovery and stability of the housing sector," but myriad problems are going to weigh down the housing market for months to come.

The lingering malaise in the economy has triggered a new wave of defaults and foreclosures. After five straight quarterly drops, foreclosures nationwide shot up 14 percent from the second to third quarter this year, according to data released by Realtytrac, the foreclosure information service, in October.

While RealtyTrac doesn't foresee that the latest foreclosure wave will equal the severity of the 2007-2010 pattern -- in which three million borrowers lost their homes -- it's going to slam on the brakes where areas are getting hit the hardest.

In theory, it should be a good time to buy a home. In the worst-hit areas, properties have lost more than half their value.

Yet as the average 30-year mortgage rate has slipped below 4 percent, the combination of employment insecurity and unusually tight standards for lending are discouraging buyers en masse. Lenders are asking for extensive income verification and tax returns. One lender I contacted for refinancing even wanted me to get an accountant to certify that I wasn't lying to the IRS.

|

|

|

|

|

|

CyrusChang

|

Nov 20 2011, 10:25 PM Nov 20 2011, 10:25 PM

|

|

Think from opposite site, how many people want the property price go down in long run?

|

|

|

|

|

|

insaint708

|

Nov 20 2011, 11:15 PM Nov 20 2011, 11:15 PM

|

Getting Started

|

looks like market not going down... alot of new properties launching with high price... min 700k at least..

|

|

|

|

|

|

chengcheng

|

Nov 20 2011, 11:44 PM Nov 20 2011, 11:44 PM

|

Getting Started

|

QUOTE(insaint708 @ Nov 20 2011, 11:15 PM) looks like market not going down... alot of new properties launching with high price... min 700k at least.. It maybe a last push... It will be riskier... To get in now. But I maybe wrong... Who knows! |

|

|

|

|

|

rubrubrub

|

Nov 20 2011, 11:54 PM Nov 20 2011, 11:54 PM

|

|

QUOTE(CyrusChang @ Nov 20 2011, 10:25 PM) Think from opposite site, how many people want the property price go down in long run? not whether people want or not but it is impossible with inflation and the constant devaluing of money. |

|

|

|

|

|

katijar

|

Nov 21 2011, 08:18 AM Nov 21 2011, 08:18 AM

|

|

in future, when investors come and they will be shocked, "What? Rental price is same as Singapore? ok, forget it. Bye."

|

|

|

|

|

|

dlyw1103

|

Nov 21 2011, 08:29 AM Nov 21 2011, 08:29 AM

|

|

Feng shui experts: Politics and global economy unstable in 2012

By JOSEPH KAOS Jr

joekaosjr@thestar.com.my

KUALA LUMPUR: The Dragon year of 2012 will prove to be a volatile year for the global economy, but Malaysia will be spared the worse aspects of it, Malaysian environology experts predicted.

Master David Koh (pic), a renowned feng shui master and founder of the Malaysian Institute of Geomancy Sciences (MINGS), predicted that 2012 will be a tough year for Malaysian politicians from either side of the divide as they face an imminent general election.

“We also predict the eventual winners will only win marginally,” he told a press conference during the MINGS 2012 outlook talk here yesterday.

Koh said the global economy will be volatile because of the poor economic performance of the United States and also the Euro currency.

“This will affect Southeast Asia, but Malaysia will be the more stable country among the others,” said the 65-year-old, who studied geomancy since the age of five.

He noted that Malaysia was still able to experience growth despite the global recession this year.

“However, 2012 will still be an improved year than 2011 globally as it slowly recovers from the recession,” he added.

Koh also said investors need to be more wary when putting their money in property in 2012.

MINGS president Joe Choo said forecast showed that properties located in the east and southeast will be the best to invest in.

“Property sector in East Malaysia, especially Sabah, is booming. In the Klang Valley, areas like Semenyih, Kajang and Seri Kembangan will see good returns,” he said, adding that there will not likely be a burst in the property bubble in 2012.

“Property prices will not see much increase in the high-end sector.

“The best growth will be in mid-range properties,” he said.

MINGS was founded by Koh in 1998 and promotes awareness in the ancient art and science of environology, which is also known as geomancy or feng shui.

|

|

|

|

|

|

sampool

|

Nov 21 2011, 08:37 AM Nov 21 2011, 08:37 AM

|

|

http://www.businessweek.com/news/2011-11-2...r-on-curbs.html“A lot of the city’s entrepreneurs invested in the property market with the capital they earned from their own business,” Mizuho’s Shen said. “With the tightening of credit, they started to sell off properties.”

Added on November 21, 2011, 8:41 amQUOTE(chengcheng @ Nov 21 2011, 12:44 AM) It maybe a last push... It will be riskier... To get in now. But I maybe wrong... Who knows! as long as the rental can support the monthly bank loan after 10% down payment, it still consider save... and vise versa. This post has been edited by sampool: Nov 21 2011, 08:41 AM

|

|

|

|

|

|

frederic9

|

Nov 21 2011, 11:00 AM Nov 21 2011, 11:00 AM

|

|

property prices going UP, but rentals going DOWN. :3 so developers/sellers win, owners lose.  |

|

|

|

|

|

katijar

|

Nov 21 2011, 11:05 AM Nov 21 2011, 11:05 AM

|

|

QUOTE(frederic9 @ Nov 21 2011, 11:00 AM) property prices going UP, but rentals going DOWN. :3 so developers/sellers win, owners lose.  true story? |

|

|

|

|

|

omyfish

|

Nov 21 2011, 11:12 AM Nov 21 2011, 11:12 AM

|

|

QUOTE(sampool @ Nov 21 2011, 08:37 AM) http://www.businessweek.com/news/2011-11-2...r-on-curbs.html“A lot of the city’s entrepreneurs invested in the property market with the capital they earned from their own business,” Mizuho’s Shen said. “With the tightening of credit, they started to sell off properties.”

Added on November 21, 2011, 8:41 amas long as the rental can support the monthly bank loan after 10% down payment, it still consider save... and vise versa. Monthly installment for a 700k property with 10% down payment (35 years) is around RM3000 (Not including maintenance fees). How many person can afford the rental there?

Added on November 21, 2011, 11:13 amQUOTE(katijar @ Nov 21 2011, 11:05 AM) Not true. The rental never go down, only the return ROI is going down. This post has been edited by omyfish: Nov 21 2011, 11:19 AM |

|

|

|

|

|

frederic9

|

Nov 21 2011, 12:08 PM Nov 21 2011, 12:08 PM

|

|

Do note that:

Every month NOT rented = rental = 0.

IF rental prices NEVER increase = loss from inflation.

It's like saying, sales UP but profit DOWN, duh?

|

|

|

|

|

|

dlyw1103

|

Nov 21 2011, 12:36 PM Nov 21 2011, 12:36 PM

|

|

QUOTE(omyfish @ Nov 21 2011, 11:12 AM) Monthly installment for a 700k property with 10% down payment (35 years) is around RM3000 (Not including maintenance fees). How many person can afford the rental there?

Added on November 21, 2011, 11:13 amNot true. The rental never go down, only the return ROI is going down. rental might also go down if there is an oversupply situation |

|

|

|

|

|

airline

|

Nov 21 2011, 01:21 PM Nov 21 2011, 01:21 PM

|

|

QUOTE(omyfish @ Nov 21 2011, 11:12 AM) Monthly installment for a 700k property with 10% down payment (35 years) is around RM3000 (Not including maintenance fees). How many person can afford the rental there?

Added on November 21, 2011, 11:13 amNot true. The rental never go down, only the return ROI is going down. 700k buy to rent out not worth the time. unless klcc or mont kiara |

|

|

|

|

|

katijar

|

Nov 21 2011, 02:06 PM Nov 21 2011, 02:06 PM

|

|

QUOTE(airline @ Nov 21 2011, 01:21 PM) 700k buy to rent out not worth the time. unless klcc or mont kiara unless it is ONe Menerung. CAn rent for 70k per month |

|

|

|

|

|

sampool

|

Nov 21 2011, 02:18 PM Nov 21 2011, 02:18 PM

|

|

QUOTE(katijar @ Nov 21 2011, 03:06 PM) unless it is ONe Menerung. CAn rent for 70k per month i tot 18k/month...  |

|

|

|

|

Nov 20 2011, 10:02 AM, updated 14y ago

Nov 20 2011, 10:02 AM, updated 14y ago

Quote

Quote

0.0289sec

0.0289sec

0.24

0.24

6 queries

6 queries

GZIP Disabled

GZIP Disabled