dow jones 14k is sup sup sui la by next year

u claim to be working for central bank & if we r in a secular bear market. y is dog jones going above 13k

shouldn't it be at 10k to be in your definiton of a bear market

all the super negative pessimistic forumers alwiz like to read old lagging fundamental data

the share market index operates in future time anticipating future news

but leceh la explain to u. u should know better, since u work for central bank

asia financial crisis is yr2008, all came out from it on a stronger footing

http://finance.yahoo.com/echarts?s=^JKSE+I...urce=undefined;but I know u r making tons of duit via fixed deposit interest

Almost 100,000ha of padi land in the peninsula – the equivalent of 50,000 football fields – have given way to industrial and housing development over the last 15 years

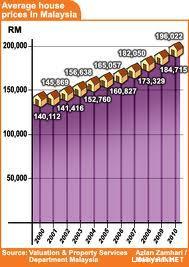

http://thestar.com.my/news/story.asp?file=...9222&sec=nationAccording to the Statistics Department, the population grew an average of 2% a year between 2000 and 2010, from 23.3 million to 28.3 million

epf & sp setia action, I got no problem, in 10 years time, we discuss again on it

seriously, where were u during the 1985 & 1997 bolehland economic crisis?

pls tell me, which part of your example shows bolehland is similar to uk, japan or china?

http://www.investopedia.com/articles/econo...p#axzz1qa4KqoQTQUOTE(debtismoney @ Mar 28 2012, 05:41 PM)

We are due for another stock market bull run?

In a 0% interest rate environment, the world major stock markets are not even through the peak in 2007, bull run? We are in a secular bear market since 2000 dude.

The UK household debt to income level is one of the worst in the world! Haven't you read the news about UK households are using credit cards to pay mortgage repayments, and taking on interest only mortgages? How far the UK housing market can go? They are hitting a wall head on now. Go buy UK property with your both hands like EPF and SP Setia did

S&P500 went up 22% in less than 80 days

S&P500 went up 22% in less than 80 days without a drawdown, since you are a chartist/tech guy, you really think this is normal? All shorts have been shaken out, and it's sucking in retail investors (those like to read charts) while big boys are selling. It's time to crash the market might be a more likely scenario.

The west are solving debt crisis with more debt, they are just buying time. Mathematically they would have to default, it is either print digital money into oblivion or declare bankrupt. It's a matter of when not if.

If the government (Chinese & Malaysian) did not do anything to curb lending, and let the housing bubble keeps inflating further. The consequence will be a lot more destructive. Look at Japan, house prices plunged 80% from the peak 20 years ago... because Japanese government did nothing.

Nov 20 2011, 10:02 AM, updated 14y ago

Nov 20 2011, 10:02 AM, updated 14y ago

Quote

Quote

0.0513sec

0.0513sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled