QUOTE(ky33li @ Mar 21 2024, 07:23 AM)

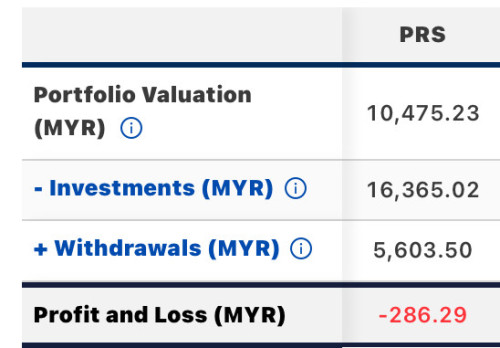

I average cimbPRS asia pac fund when china didnt perform well still down 15%. The only reason my portfolio recovered now is due to recent switching of funds to Principal Retire Easy 50, otherwise it wouldnt even recover this much.

Perhaps I am the only one who didnt manage by switching the funds. But let me ask who in this forum really earn GOOD returns from PRS? If the returns were so DAMN GOOD most people would not think twice just invest in PRS NOT EPF. What I am trying to say with the dismal performance on most funds, just don’t waste so much time on this. Out of 3 PRS funds i own (amPRS, affinPRS and CIMB Principal), amPRS (amtactical fund) still haven recovered, affinPRS (growth fund) probably show 3% return now and now CIMB Principal recovered due to switching to other fund.

You must be wondering why I didnt top up consistently, other than funds u bought from FSM it is so difficult to do the topping up if you buy from asset management firm directly like amprs, you probably have to fill up forms and call the company for that. I bet Government will extend the tax deduction for PRS funds so that asset management firm employees can keep the rice bowls.

But let me ask who in this forum really earn GOOD returns from PRS? If the returns were so DAMN GOOD most people would not think twice just invest in PRS NOT EPF.Perhaps I am the only one who didnt manage by switching the funds. But let me ask who in this forum really earn GOOD returns from PRS? If the returns were so DAMN GOOD most people would not think twice just invest in PRS NOT EPF. What I am trying to say with the dismal performance on most funds, just don’t waste so much time on this. Out of 3 PRS funds i own (amPRS, affinPRS and CIMB Principal), amPRS (amtactical fund) still haven recovered, affinPRS (growth fund) probably show 3% return now and now CIMB Principal recovered due to switching to other fund.

You must be wondering why I didnt top up consistently, other than funds u bought from FSM it is so difficult to do the topping up if you buy from asset management firm directly like amprs, you probably have to fill up forms and call the company for that. I bet Government will extend the tax deduction for PRS funds so that asset management firm employees can keep the rice bowls.

Returns are a subjective topic because there are various factors that may influence it i.e. your entry (and dollar cost averaging subsequent) and the manager's ability to manage the fund. For details of the fund's performance, you may refer to publicly available information such as FSM, factsheet, prospectus etc...

You must be wondering why I didnt top up consistently, other than funds u bought from FSM it is so difficult to do the topping up if you buy from asset management firm directly like amprs, you probably have to fill up forms and call the company for that.

There are a few ways you can do this:

1. you can sign-up and top-up via PPA website (for all fund houses with PRS) - https://www.ppa.my/ ;

2. for FSM, if you are not happy or find it difficult to monitor your funds, you can opt to transfer your holdings from X fund house to FSM. Complete the "Transfer In" form - https://www.fsmone.com.my/support/forms/funds , please check with FSM on how to complete the form and what documents are required; or

3. If you have AHAM funds, you can sign-up with i-access to create account. (https://iaccess.aham.com.my/).

This post has been edited by aurora97: Mar 21 2024, 09:17 AM

Mar 21 2024, 09:13 AM

Mar 21 2024, 09:13 AM

Quote

Quote

0.0241sec

0.0241sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled