seem like 'better' provider have highest sales charge of 3%

is it still okay to go with provider with 3% in the long run?

Private Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Aug 2 2020, 12:33 AM Aug 2 2020, 12:33 AM

Return to original view | Post

#1

|

Senior Member

1,315 posts Joined: Aug 2007 |

seem like 'better' provider have highest sales charge of 3%

is it still okay to go with provider with 3% in the long run? |

|

|

|

|

|

Aug 20 2020, 03:28 PM Aug 20 2020, 03:28 PM

Return to original view | Post

#2

|

Senior Member

1,315 posts Joined: Aug 2007 |

QUOTE(Ramjade @ Aug 4 2020, 12:25 PM) Use FSM or eUT to buy PRS at 0%. So even if the fund is making 3%p.a who cares. You already make money. The thing is avoid paying service charge at all cost. Some reference to sharehttps://www.fundsupermart.com.my/fsmone/res...commended-funds https://www.eunittrust.com.my/Home/Banner1 https://www.ppa.my/wp-content/uploads/2020/...ormance-All.pdf |

|

|

Nov 22 2020, 08:06 PM Nov 22 2020, 08:06 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

1,315 posts Joined: Aug 2007 |

Tried to register account from PRS https://prsenrolment.ppa.my/

Seem force to choose the PRS Provider & Fund. Cannot skip ? |

|

|

Nov 22 2020, 10:11 PM Nov 22 2020, 10:11 PM

Return to original view | Post

#4

|

Senior Member

1,315 posts Joined: Aug 2007 |

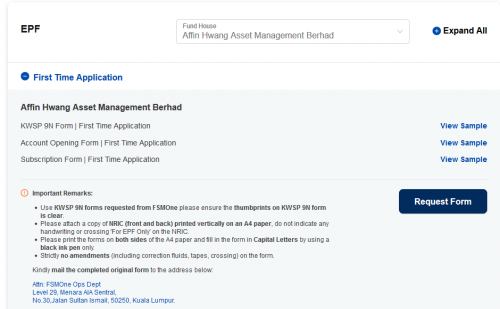

QUOTE(ironman16 @ Nov 22 2020, 09:27 PM) Situation is first timerTried fsmone earlier but seem need they will send snail mail ?  So thought faster if PRS can do everything online. --------------------------------------- Just saw this. can do online for certain provider. Formless PRS application is applicable via FSMOne Mobile Website on certain Fund House, please click this link HERE for more information. This post has been edited by onthefly: Nov 22 2020, 10:45 PM |

|

|

Dec 1 2020, 12:17 AM Dec 1 2020, 12:17 AM

Return to original view | Post

#5

|

Senior Member

1,315 posts Joined: Aug 2007 |

QUOTE(ironman16 @ Nov 30 2020, 03:35 PM) i will suggest u this: for long term which would be better between1. Affin Hwang PRS Growth Fund (if wanna return high a bit) 2. Affin Hwang PRS Moderate Fund (my favor n consistent) 3. Principal PRS Plus Moderate - Class C others not recommend for u if u want conservative / moderate Affin Hwang PRS Growth with moderate Fund ? moderate has lower management fees by 0.3 compare to growth Would that make moderate be "better" if i want to go long term? appreciate any thoughts or feedback |

|

|

Dec 1 2020, 01:39 AM Dec 1 2020, 01:39 AM

Return to original view | Post

#6

|

Senior Member

1,315 posts Joined: Aug 2007 |

QUOTE(victorian @ Dec 1 2020, 12:37 AM) With more active management (more buy and sell transaction), of course more fees will be incurred. Conservative will have the lowest management fee, would you say that it is the best because it is cheap? the return for both Conservative and growth seem close. so if factor in additional 0.3conservation might potentially be better Will need to check what is inside both funds |

|

|

|

|

|

Dec 1 2020, 02:23 PM Dec 1 2020, 02:23 PM

Return to original view | Post

#7

|

Senior Member

1,315 posts Joined: Aug 2007 |

QUOTE(ironman16 @ Dec 1 2020, 02:16 PM) i think thats the way.....normally ur PPA account is PPA<IC number> maybe he testing. like for Stashway i put rm100 for see see first. but no fees involved lai think later PM will snail mail/email u the receipt n anything about the account..... Why dun just open PMO account n buy PRS through PMO?.....pusing pusing u.... Why dun buy through FSM which is 0% sales charge? (but Public not in FSM list, if u insist Public oso) why u buy RM100.50 only? why dun just 3k one shot? u happily pay RM 0.5 every time u making top up ?.....BTW is ur money, its ok....just curious....... |

|

|

Dec 2 2020, 12:16 AM Dec 2 2020, 12:16 AM

Return to original view | Post

#8

|

Senior Member

1,315 posts Joined: Aug 2007 |

can use joint account to purchase fund on fsm right ?

|

|

|

Dec 4 2020, 12:46 AM Dec 4 2020, 12:46 AM

Return to original view | Post

#9

|

Senior Member

1,315 posts Joined: Aug 2007 |

|

|

|

Dec 4 2020, 01:49 AM Dec 4 2020, 01:49 AM

Return to original view | Post

#10

|

Senior Member

1,315 posts Joined: Aug 2007 |

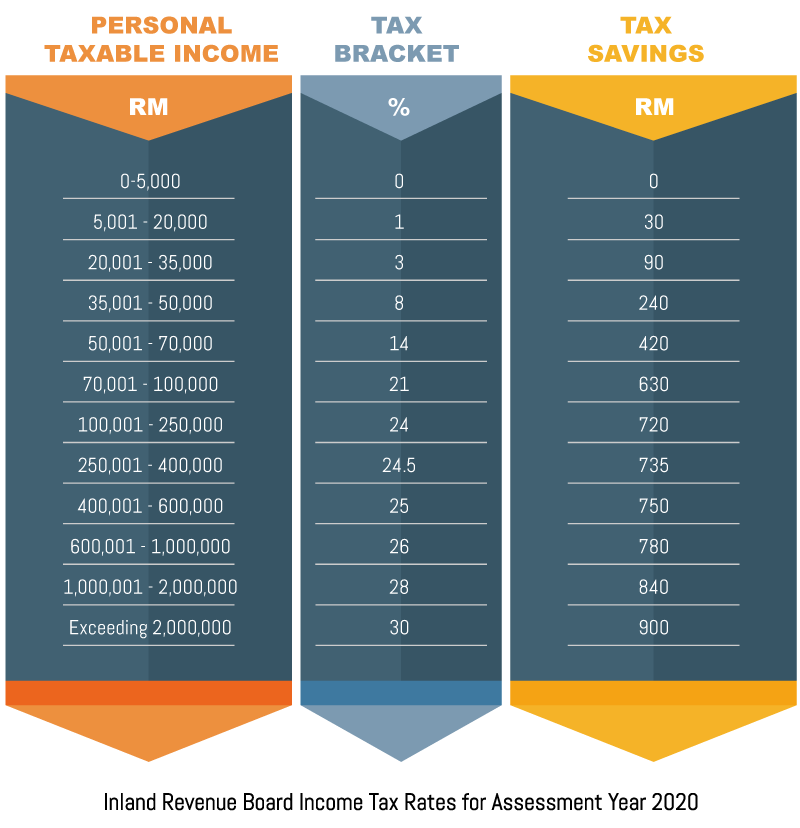

QUOTE(victorian @ Dec 4 2020, 12:49 AM) yeplike for PRS if in 24% bracket, you "earn" rm720 Is there any such table for 4k for EPF? Thinking to invest some, also force to lock in some money  https://www.ppa.my/prs-tax-relief/ |

|

|

Dec 4 2020, 12:39 PM Dec 4 2020, 12:39 PM

Return to original view | Post

#11

|

Senior Member

1,315 posts Joined: Aug 2007 |

QUOTE(QSYT @ Dec 4 2020, 11:07 AM) depend your situation like risk, age, etcyou can have look at https://gllt.morningstar.com/e6qvxuu98r/fun...anguageId=en-GB and fsmone. Few recommendation also in this thread WaNaWe900 liked this post

|

|

|

Dec 6 2020, 12:54 AM Dec 6 2020, 12:54 AM

Return to original view | Post

#12

|

Senior Member

1,315 posts Joined: Aug 2007 |

Been few days, i have not receive email on the promotion tng rm40. Invested 3k in a single transaction.

https://www.fsmone.com.my/funds/research/ar...Insurance=false how long will fsmone provide the rm40 for funding 3k in a single transaction ? QUOTE(blibala @ Dec 5 2020, 09:21 PM) You might want to invest before 11th December to get rm40 tng promotion from fsmoneThis post has been edited by onthefly: Dec 6 2020, 12:57 AM |

|

|

Dec 10 2020, 12:25 AM Dec 10 2020, 12:25 AM

Return to original view | Post

#13

|

Senior Member

1,315 posts Joined: Aug 2007 |

QUOTE(Cyclopes @ Dec 4 2020, 05:07 AM) side track,How to invest 4k into epf for the tax relief ?Is it this ? https://www.imoney.my/articles/beginners-guide-epf-i-invest ok i think i found my answer  https://www.kwsp.gov.my/member/contribution...lf-contribution it seem self contribution to EPF is less popular, my aim is for tax relief likr PRS. is there better option around? This post has been edited by onthefly: Dec 10 2020, 01:13 AM |

|

|

|

|

|

Dec 10 2020, 10:26 PM Dec 10 2020, 10:26 PM

Return to original view | Post

#14

|

Senior Member

1,315 posts Joined: Aug 2007 |

QUOTE(GrumpyNooby @ Dec 10 2020, 06:58 AM) If you have maxed out tax relief for EPF via normal salary deduction by your employer, this self contribution won't be beneficial from the perspective of tax saving as EPF tax relief is meant for both channels (via salary contribution, via additional self contribution and via voluntary self contribution for self-employed). oh i see, so the 4000 tax relief is counted/inclusive from my Monthly Tax Deduction.QUOTE(T231H @ Dec 10 2020, 06:59 AM) Are you employed & need to contribute monthly to epf? yes employed, and have Monthly Tax DeductionIf, yes.. Is your annual statutory epf contribution amount already exceeded the limits set by lhdn for tax reduction under epf? i think exceed 4k tax relief. No wonder seldom see discussion on this. Thanks for the feedback. Lucky didnt self contribute for nothing This post has been edited by onthefly: Dec 10 2020, 10:26 PM |

|

|

Jan 4 2021, 05:39 PM Jan 4 2021, 05:39 PM

Return to original view | Post

#15

|

Senior Member

1,315 posts Joined: Aug 2007 |

anybody got news for last year promote for rm40 tng

|

|

|

Jan 9 2021, 12:17 AM Jan 9 2021, 12:17 AM

Return to original view | Post

#16

|

Senior Member

1,315 posts Joined: Aug 2007 |

if get PRS via fsmone wont consider right

|

|

|

Jan 10 2021, 11:05 PM Jan 10 2021, 11:05 PM

Return to original view | Post

#17

|

Senior Member

1,315 posts Joined: Aug 2007 |

i understand that usually end of the year got promotion like fsmone rm40 tng card.

how about early/mid of the year ? |

|

|

Apr 9 2021, 12:41 AM Apr 9 2021, 12:41 AM

Return to original view | Post

#18

|

Senior Member

1,315 posts Joined: Aug 2007 |

Anybody know next promo for PRS? I only aware year end got.

|

|

|

Apr 18 2021, 02:58 PM Apr 18 2021, 02:58 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

1,315 posts Joined: Aug 2007 |

Wanting to put in 3k for PRS earlier this year instead of some promotion ( year end ) as they said time in market > timing the market.

Biggest point is for tax relief. Still relatively new to fact sheet but Principal PRS Plus Asia Pac Ex Jpn Eq is still the clear winner if using pass records...but having invest the same provider for 2nd year will incur a mere RM8. No issue with that but earlier thought was wanting to have different fund from last year for diversity So anybody has other PRS fund to look at or any other insights ? Criteria is growth/equity/aggressive fund outside of Malaysia. This post has been edited by onthefly: Apr 18 2021, 02:59 PM |

|

|

Apr 20 2021, 11:21 PM Apr 20 2021, 11:21 PM

Return to original view | Post

#20

|

Senior Member

1,315 posts Joined: Aug 2007 |

QUOTE(silentz @ Apr 20 2021, 03:08 PM) Seems like buying PRS from any platform will hv no big diff? FSM = 0% sales chargeAdvantage buying from FMS or SA is due the sales charge n fees? PPA PRS = Differs. refer to this diagram https://www.ppa.my/prs-providers/fees-comparison/ StashAway you can create a portfolio and name it "retirement fund". |

| Change to: |  0.0411sec 0.0411sec

0.43 0.43

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 11:33 PM |