QUOTE(ky33li @ Mar 20 2024, 12:39 AM)

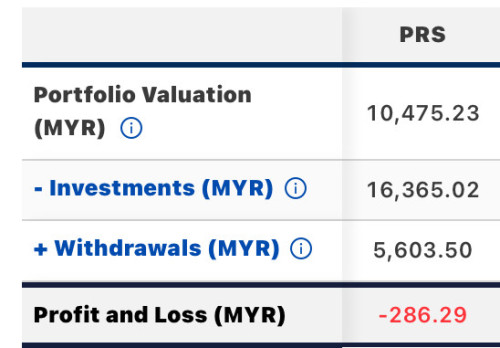

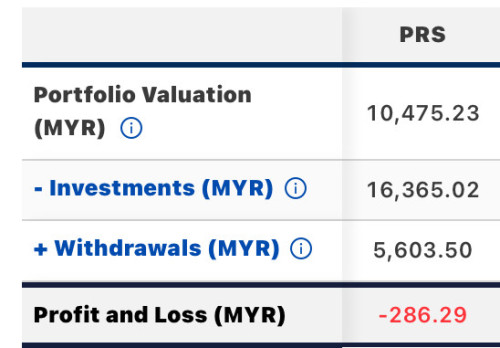

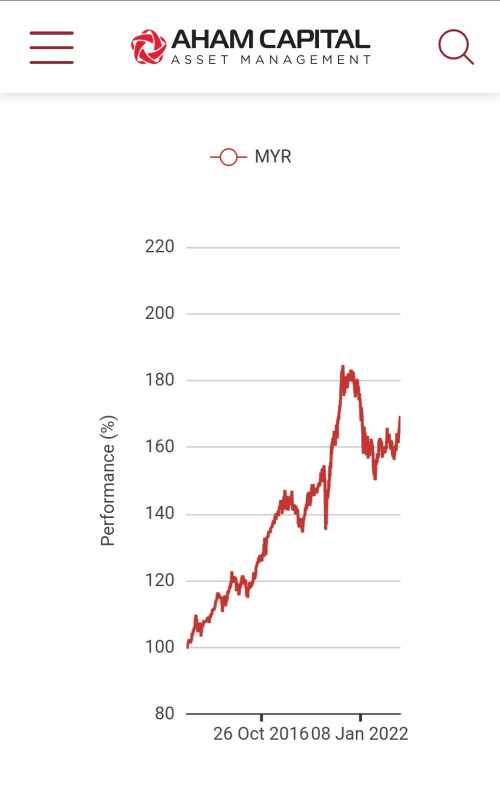

My portfolio barely recovered. I bought 2 PRS funds 8 years ago. I agree with Ramjade, most PRS funds sucks. For me the tax deduction isnt worth it at all given the opportunity costs I have lost and my portfolio cant even breakeven.

For me it's worth it. My return have always exceed EPF except for past 1-2 years (CIMB principal Asia Pacific fault).

But since I switch to retireeasy 50, my prs returns have pickup again.

Like I said, pay less tax and prs money is still your money at the end of the day. It's not govt money.

Mar 20 2024, 04:24 AM

Mar 20 2024, 04:24 AM

Quote

Quote

0.0243sec

0.0243sec

0.64

0.64

6 queries

6 queries

GZIP Disabled

GZIP Disabled