Guys PRS investment can withdraw from EPF to invest?

Private Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Oct 19 2019, 11:25 AM Oct 19 2019, 11:25 AM

Return to original view | Post

#1

|

Senior Member

4,147 posts Joined: May 2005 |

Guys PRS investment can withdraw from EPF to invest?

|

|

|

|

|

|

Dec 9 2020, 06:28 PM Dec 9 2020, 06:28 PM

Return to original view | Post

#2

|

Senior Member

4,147 posts Joined: May 2005 |

I wanna open FSMone account to buy PRS. Any referral code to share with me? PM me

|

|

|

Dec 11 2020, 01:51 PM Dec 11 2020, 01:51 PM

Return to original view | Post

#3

|

Senior Member

4,147 posts Joined: May 2005 |

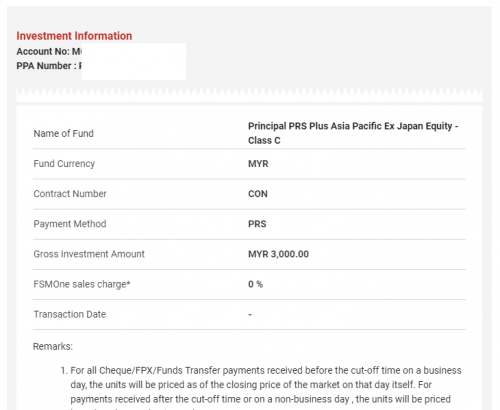

Guys i just bought 3k Principal PRS Plus Asia Pacific Ex Japan Equity - Class C using FSM.

Question, i know we can only take out the money when we reach 55 yrs old, but is it possible to sell this fund and buy another fund? just in case this "Principal PRS Plus Asia Pacific Ex Japan Equity - Class C" is not performing |

|

|

Dec 11 2020, 01:58 PM Dec 11 2020, 01:58 PM

Return to original view | Post

#4

|

Senior Member

4,147 posts Joined: May 2005 |

|

|

|

Dec 16 2020, 09:15 PM Dec 16 2020, 09:15 PM

Return to original view | Post

#5

|

Senior Member

4,147 posts Joined: May 2005 |

Just bought Principal PRS Plus Asia Pacific Ex Japan Equity - Class C immediately loss MYR -37.02 (-1.23%)

|

|

|

Dec 19 2020, 04:37 PM Dec 19 2020, 04:37 PM

Return to original view | Post

#6

|

Senior Member

4,147 posts Joined: May 2005 |

I realise PPA website and FSM website value is different. Which one is more updated?

|

|

|

|

|

|

Dec 22 2020, 01:12 PM Dec 22 2020, 01:12 PM

Return to original view | Post

#7

|

Senior Member

4,147 posts Joined: May 2005 |

Guys, is it true to do nomination we have no other way but to print out the PPA form, fill it up manually and courier it to them?

|

|

|

Dec 22 2020, 05:19 PM Dec 22 2020, 05:19 PM

Return to original view | Post

#8

|

Senior Member

4,147 posts Joined: May 2005 |

QUOTE(GrumpyNooby @ Dec 22 2020, 04:56 PM) Principal PRS Plus Asia Pacific Ex Japan Equity - Class C NAV (21/12/2020) dropped to 1.1815 But the distribution haven't credited to our account? That's why showing a huge loss now?Don't get surprised as part of it is due to distribution of RM 0.0723 per unit. |

|

|

Jan 6 2021, 09:59 PM Jan 6 2021, 09:59 PM

Return to original view | Post

#9

|

Senior Member

4,147 posts Joined: May 2005 |

QUOTE(GrumpyNooby @ Jan 5 2021, 08:37 AM) No wonder suddenly my portfolio positive. Thanks all for the recommendation. That's lumpsum RM3010 mid of December. Starting January 2021 I will put RM250 monthly into it. |

|

|

Jan 7 2021, 09:27 PM Jan 7 2021, 09:27 PM

Return to original view | Post

#10

|

Senior Member

4,147 posts Joined: May 2005 |

|

|

|

Jan 20 2021, 03:30 PM Jan 20 2021, 03:30 PM

Return to original view | Post

#11

|

Senior Member

4,147 posts Joined: May 2005 |

Guys how often does FSM update the PRS fund price?

|

|

|

May 10 2021, 09:54 AM May 10 2021, 09:54 AM

Return to original view | Post

#12

|

Senior Member

4,147 posts Joined: May 2005 |

I agree. Majority people buy PRS for tax relief only

|

|

|

Oct 6 2021, 05:17 PM Oct 6 2021, 05:17 PM

Return to original view | Post

#13

|

Senior Member

4,147 posts Joined: May 2005 |

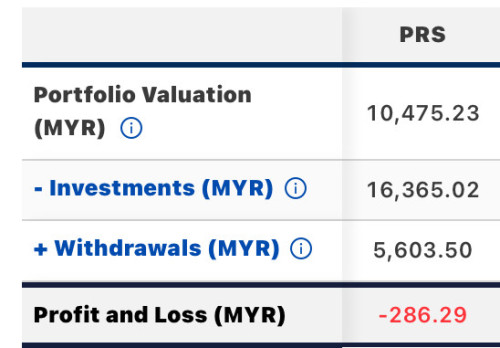

QUOTE(cklimm @ Oct 6 2021, 08:47 AM) So, for my 1st time, I have bought 3k with the fabled Principal APAC ex Japan PRS, I DCA monthly RM250 into this since January after buying lumpsum RM3k last december. Highest return was up to 11% but today drop until a merely 0.77%. Quite disappointed.Reason: seeing it dropped for more than 4% in 3 months, should be a decent entry point. Method: just tap and swipe with the FSM app, but signing with finger feels awkward, hope they accept the slightly warped fingnature  |

|

|

|

|

|

Mar 7 2022, 10:42 PM Mar 7 2022, 10:42 PM

Return to original view | Post

#14

|

Senior Member

4,147 posts Joined: May 2005 |

My PRS drop a lot lately. Been DCA since 2020

Principle PRS plus Asia Pacific Ex Japan Equity Class C |

|

|

Mar 8 2022, 12:23 PM Mar 8 2022, 12:23 PM

Return to original view | Post

#15

|

Senior Member

4,147 posts Joined: May 2005 |

Is it normal PRS will deduct RM8 for the first month of the year? What is that for? Everytime i invest RM250, i check at ppa.my it only shows RM242 for jan every year.

|

|

|

Mar 14 2024, 05:24 PM Mar 14 2024, 05:24 PM

Return to original view | Post

#16

|

Senior Member

4,147 posts Joined: May 2005 |

QUOTE(Ramjade @ Mar 14 2024, 04:56 PM) You can select which fund your ILP invest in. You can even switch. Normally it's the agent who choose. I have checked. Majority of the funds given like 99% all Malaysia focus only. Zurich has a fund which is invested in US. I switched to that and never looked back. Previously was on Malaysia focus funds and it perform like crap. |

|

|

Mar 19 2024, 04:31 PM Mar 19 2024, 04:31 PM

Return to original view | Post

#17

|

Senior Member

4,147 posts Joined: May 2005 |

Once no more tax relief, PRS can close shop. No reason for anyone to buy other than for the tax relief kelvinfixx liked this post

|

|

|

Mar 20 2024, 11:10 AM Mar 20 2024, 11:10 AM

Return to original view | Post

#18

|

Senior Member

4,147 posts Joined: May 2005 |

QUOTE(ky33li @ Mar 20 2024, 12:39 AM) My portfolio barely recovered. I bought 2 PRS funds 8 years ago. I agree with Ramjade, most PRS funds sucks. For me the tax deduction isnt worth it at all given the opportunity costs I have lost and my portfolio cant even breakeven. I think it all depends on your tax rate. Let's say your tax rate is 25%, you already saved RM750 in taxes by investing 3k. Can compounding interest in FD beat that? I don't think so. guy3288 and wongmunkeong liked this post

|

|

|

Mar 21 2024, 10:45 PM Mar 21 2024, 10:45 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

4,147 posts Joined: May 2005 |

Question. Let’s say I buy PRS from two different fund house. Annual fee I have to pay RM8x2?

|

|

|

Mar 21 2024, 11:09 PM Mar 21 2024, 11:09 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

4,147 posts Joined: May 2005 |

|

| Change to: |  0.1300sec 0.1300sec

0.36 0.36

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 04:06 AM |