Outline ·

[ Standard ] ·

Linear+

Private Retirement Fund, What the hell is that??

|

Ramjade

|

Sep 27 2020, 04:28 PM Sep 27 2020, 04:28 PM

|

|

QUOTE(mbam @ Sep 27 2020, 12:29 PM) If 2020 onwards not tax deductible, is it worth it to go in now? Cos I might have to wait after 55 to withdraw them. It's 2021 which means you have 2 more years of income tax relief (buy in 2020 and 2021) Depends on how you look at it. For me anything that can lower my income tax, I am all ears regardless how long it have left. Trick is pick the right fund and get min 10%p.a Pick the wrong one and get negative or 0-3%p.a you which is pathetic. So if I am in your position I will continue buying until 2021. After that if no more income tax relief, I won't buy. Divert my rm3k into other investment stuff. |

|

|

|

|

|

familyfirst

|

Sep 29 2020, 01:55 PM Sep 29 2020, 01:55 PM

|

|

Thinking of buying Principal PRS Islamic fund this year. Ok ma?

|

|

|

|

|

|

GrumpyNooby

|

Sep 29 2020, 01:59 PM Sep 29 2020, 01:59 PM

|

|

QUOTE(familyfirst @ Sep 29 2020, 01:55 PM) Thinking of buying Principal PRS Islamic fund this year. Ok ma? Which Principal PRS Islamic fund? This post has been edited by GrumpyNooby: Sep 29 2020, 01:59 PM |

|

|

|

|

|

familyfirst

|

Sep 30 2020, 09:01 AM Sep 30 2020, 09:01 AM

|

|

QUOTE(GrumpyNooby @ Sep 29 2020, 01:59 PM) Which Principal PRS Islamic fund? Dont know if I should take Class A, C or X - any suggestions? |

|

|

|

|

|

teridoz23

|

Sep 30 2020, 09:54 AM Sep 30 2020, 09:54 AM

|

Getting Started

|

QUOTE(ironman16 @ Sep 26 2020, 12:41 PM) If u can timing the market, buy at the lowest point. 😁😁😁 If u can't timing the market, just like me lo, dca or if got dip like march, in again. Although PM recently is good but i won't consider bcoz the performance is only recently n come with sales charge oso, unless u can get the 0% sales charge for PRS 😁😁 Even u can timing the market but prs is for long term, like me still got almost 20 years to go, sure got up down up down ma. Tak akan when up i said my prs is pro n good, n down i sumpah itu prs providers n switch?? the 0 charge usually somewhere available end of the year...hopefully they do it soon |

|

|

|

|

|

!@#$%^

|

Sep 30 2020, 09:55 AM Sep 30 2020, 09:55 AM

|

|

no PRS topup promo this time round?

|

|

|

|

|

|

GrumpyNooby

|

Sep 30 2020, 09:57 AM Sep 30 2020, 09:57 AM

|

|

QUOTE(!@#$%^ @ Sep 30 2020, 09:55 AM) no PRS topup promo this time round? Usually it'll be in the month of December. |

|

|

|

|

|

MUM

|

Sep 30 2020, 10:06 AM Sep 30 2020, 10:06 AM

|

|

QUOTE(familyfirst @ Sep 30 2020, 09:01 AM) Dont know if I should take Class A, C or X - any suggestions? how big different is the fees charge between classes? how big different is the performance between classes?  This post has been edited by MUM: Sep 30 2020, 10:15 AM This post has been edited by MUM: Sep 30 2020, 10:15 AM |

|

|

|

|

|

a.lifehacks

|

Sep 30 2020, 10:09 AM Sep 30 2020, 10:09 AM

|

Getting Started

|

QUOTE(!@#$%^ @ Sep 30 2020, 09:55 AM) no PRS topup promo this time round? There is one for AmPRS. https://www.aminvest.com/eng/Pages/AmPRSBon...itCampaign.aspx |

|

|

|

|

|

!@#$%^

|

Sep 30 2020, 10:10 AM Sep 30 2020, 10:10 AM

|

|

QUOTE(GrumpyNooby @ Sep 30 2020, 09:57 AM) Usually it'll be in the month of December. QUOTE(a.lifehacks @ Sep 30 2020, 10:09 AM) i see. prefer from fundsupermart or eunittrust though |

|

|

|

|

|

ironman16

|

Sep 30 2020, 03:23 PM Sep 30 2020, 03:23 PM

|

|

QUOTE(teridoz23 @ Sep 30 2020, 09:54 AM) the 0 charge usually somewhere available end of the year...hopefully they do it soon U. Mean public mutual got 0% sales charge offer at year end? |

|

|

|

|

|

neo_6053

|

Oct 1 2020, 11:01 AM Oct 1 2020, 11:01 AM

|

|

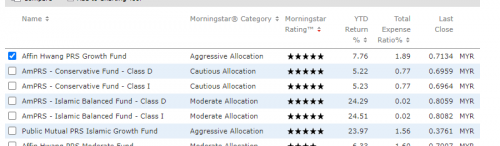

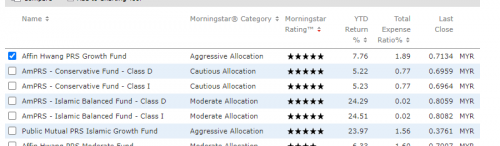

I saw these 2 are performing quite well, any comment? worth investing?

AmPRS - Islamic Equity Fund - Class D

AmPRS - Islamic Balanced Fund - Class D

|

|

|

|

|

|

ironman16

|

Oct 1 2020, 11:08 AM Oct 1 2020, 11:08 AM

|

|

QUOTE(neo_6053 @ Oct 1 2020, 11:01 AM) I saw these 2 are performing quite well, any comment? worth investing? AmPRS - Islamic Equity Fund - Class D AmPRS - Islamic Balanced Fund - Class D See long term, not recently 0 |

|

|

|

|

|

neo_6053

|

Oct 1 2020, 11:12 AM Oct 1 2020, 11:12 AM

|

|

QUOTE(ironman16 @ Oct 1 2020, 11:08 AM) See long term, not recently 0 yeah, it's annualized return has spike due to this year return. it seems the manager perform better in crisis. but when I check return from 2015-1-1 to 2019-12-31 (on FSM) AMPRS - ISLAMIC EQUITY FUND - CLASS D - 38.03% AFFIN HWANG PRS GROWTH FUND - 31.40% KENANGA ONEPRS GROWTH FUND - 31.43% not sure about other factors like sale charge etc, not sure which is good. https://worldbizweek.com/best-prs-private-r...cheme-malaysia/ |

|

|

|

|

|

neo_6053

|

Oct 1 2020, 11:14 AM Oct 1 2020, 11:14 AM

|

|

I bought AFFIN HWANG PRS GROWTH FUND 2 years back because FSM recommended fund. This year plan to buy other fund so that i will hold different company fund.

But not sure which is good.

|

|

|

|

|

|

MUM

|

Oct 1 2020, 11:19 AM Oct 1 2020, 11:19 AM

|

|

QUOTE(neo_6053 @ Oct 1 2020, 11:01 AM) I saw these 2 are performing quite well, any comment? worth investing? AmPRS - Islamic Equity Fund - Class D AmPRS - Islamic Balanced Fund - Class D can you accept the performance volatility of those funds? see the calendar year performance for some idea of it? try this morningstar site if you want to compare the performance of PRS funds... https://gllt.morningstar.com/e6qvxuu98r/fun...anguageId=en-GB Attached thumbnail(s)

|

|

|

|

|

|

ironman16

|

Oct 1 2020, 03:24 PM Oct 1 2020, 03:24 PM

|

|

I don't know how u ppl choose.

I definitely will choose the fund with consistent return in each calendar year. Not the highest nvm but consistently give me better return. I don't like low performance previous year but suddenly spike high fund.

### i don't choose Conservative fund. Prefer growth /moderate /equity.

This post has been edited by ironman16: Oct 1 2020, 03:25 PM

|

|

|

|

|

|

GrumpyNooby

|

Oct 1 2020, 03:27 PM Oct 1 2020, 03:27 PM

|

|

QUOTE(ironman16 @ Oct 1 2020, 03:24 PM) I don't know how u ppl choose. I definitely will choose the fund with consistent return in each calendar year. Not the highest nvm but consistently give me better return. I don't like low performance previous year but suddenly spike high fund. ### i don't choose Conservative fund. Prefer growth /moderate /equity. You should share which you bought in your PRS portfolio. |

|

|

|

|

|

CSW1990

|

Oct 1 2020, 03:55 PM Oct 1 2020, 03:55 PM

|

|

QUOTE(neo_6053 @ Oct 1 2020, 11:01 AM) I saw these 2 are performing quite well, any comment? worth investing? AmPRS - Islamic Equity Fund - Class D AmPRS - Islamic Balanced Fund - Class D 1. Depends on your age Take affin Huang prs as example. below 40 growth fund 40-50 moderate fund above 50 conservative fund 2. See their 5 years performance and allocation Personally I only hold affin Hwang growth PRS fund and Principal PRS plus Asia Pacific ex japan class C and top up these two as long as there is tax relief This post has been edited by CSW1990: Oct 1 2020, 03:55 PM |

|

|

|

|

|

neo_6053

|

Oct 1 2020, 04:02 PM Oct 1 2020, 04:02 PM

|

|

QUOTE(MUM @ Oct 1 2020, 11:19 AM) can you accept the performance volatility of those funds? see the calendar year performance for some idea of it? try this morningstar site if you want to compare the performance of PRS funds... https://gllt.morningstar.com/e6qvxuu98r/fun...anguageId=en-GBSeems if follow the star, not too bad.. hmm....  |

|

|

|

|

Sep 27 2020, 04:28 PM

Sep 27 2020, 04:28 PM

Quote

Quote

0.0187sec

0.0187sec

0.17

0.17

6 queries

6 queries

GZIP Disabled

GZIP Disabled