just how does one determine if a low, medium or high risk PFS fund is really good enough?

Affin Hwang Asset Management Bhd chief marketing distribution officer Chan Ai Mei reminds contributors that unlike the EPF, the PRS lacks a capital or minimum-return guarantee. “All investments carry some sort of risk and contributions to the PRS funds are not excluded. Thus, it is important that contributors understand the risks involved, have basic knowledge of investments and engage a provider that understands their needs and requirements. In short, choose wisely and invest regularly,” she says.

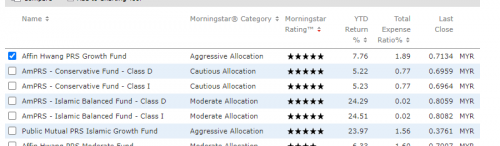

According to Morningstar’s monthly PRS performance report, more than one-third (24) of the 56 PRS funds saw a cumulative return of less than 3% over a one-year period ended 31 Jan 2017 — lower than local fixed deposit rates.

Over a two-year period, 20 funds saw a cumulative return of less than 3%. Of these funds, 11 recorded negative returns. Over a three-year period, 22 funds registered returns of less than 3%.

http://www.theedgemarkets.com/article/cove...80%99s-next-prsWill the performance of this fund good to buy and hold?

Investment involves risk. The price of securities may go down as well as up, and under certain circumstances an investor may sustain a total or substantial loss of investment.

Past performance is not necessarily indicative of the future or likely performance of the fund.

Investors should read the relevant fund's prospectus for details before making any investment decision.

An Investor should make an appraisal of the risks involved in investing in these products and should consult their own independent and professional advisors, to ensure that any decision made is suitable with regards to their circumstances and financial position.

I think it is a "good" fund to step into if one has not into investing or have experienced UT investing yet...

yeah, i have no experience in UT at all. But just trust the expert review (ofcoz knowingly there is risk involved) I think I will buy into this since whatever study I do in this short time will never exceed whatever the expert team has already done. Just have to prepare for the worse and hope that whatever fund they recommend is not because of marketing or what. Thanks for advice

Sep 27 2017, 11:44 AM

Sep 27 2017, 11:44 AM

Quote

Quote

0.1395sec

0.1395sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled