QUOTE(MilesAndMore @ Nov 25 2020, 08:43 PM)

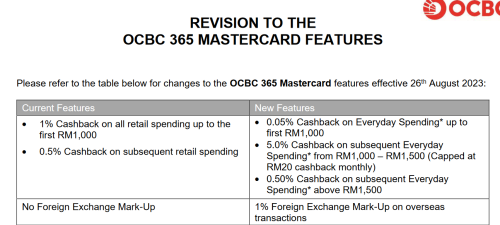

Do you have OCBC debit MasterCard ? It claims to have 0% foreign transaction fee too.

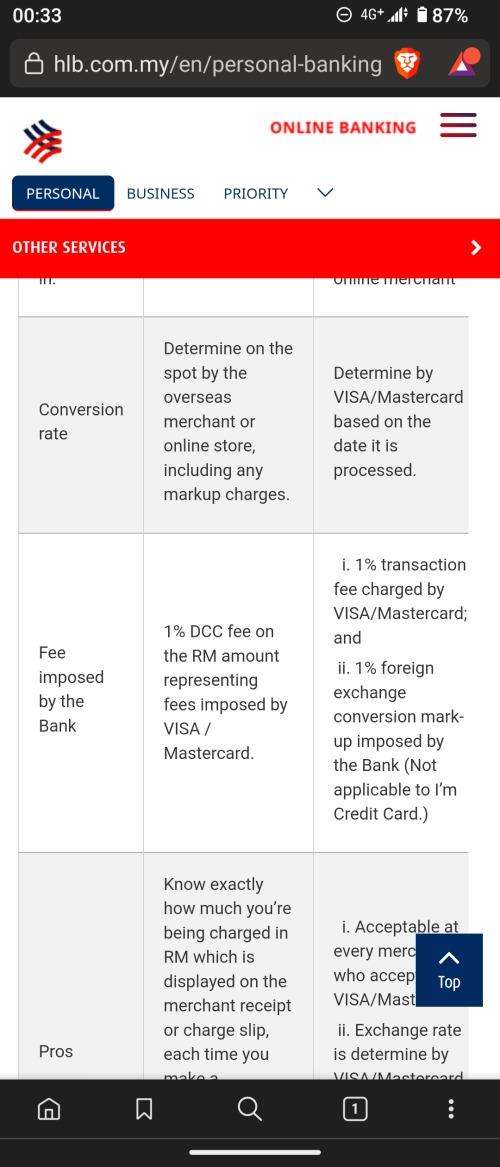

Hong Leong I’m MasterCard is another credit card that claims to have 0% foreign transaction fee. I had used it in THB but the final amount was far higher than MasterCard’s rate on posting date.

I’m MasterCard actually has a 1% fee, not sure what it is, maybe admin fee.Hong Leong I’m MasterCard is another credit card that claims to have 0% foreign transaction fee. I had used it in THB but the final amount was far higher than MasterCard’s rate on posting date.

Aug 12 2022, 11:02 PM

Aug 12 2022, 11:02 PM

Quote

Quote

0.0617sec

0.0617sec

0.17

0.17

7 queries

7 queries

GZIP Disabled

GZIP Disabled