QUOTE(xiaomoon @ Jan 13 2025, 08:41 AM)

hlb im card, but recently got ppl do compare seem like got hidden fee, rate still wise/gx/tng visa better

You cant expect a Credit Card to be the same as a debit Card. Debit Card you are using your own Money.Credit Card Foreign Exchange Rate

|

|

Feb 20 2025, 02:57 AM Feb 20 2025, 02:57 AM

Show posts by this member only | IPv6 | Post

#2021

|

Junior Member

347 posts Joined: Dec 2023 From: Kuala Lunpur |

|

|

|

|

|

|

Feb 20 2025, 08:15 AM Feb 20 2025, 08:15 AM

|

Senior Member

1,459 posts Joined: Feb 2012 |

|

|

|

Feb 20 2025, 08:24 AM Feb 20 2025, 08:24 AM

|

Senior Member

1,185 posts Joined: Nov 2020 |

recently my dad got apply the new cimb world elite ah, zero percent foreign transaction fee they claim

will test it out didnt realise hsbc was 1.25, but with apple pay that is my go to for years |

|

|

Mar 12 2025, 08:40 PM Mar 12 2025, 08:40 PM

|

Senior Member

926 posts Joined: Aug 2013 |

Whilst browsing through T&C of ambank credit cards I noticed that the document is silent on the charge for foreign transactions for the following credit cards

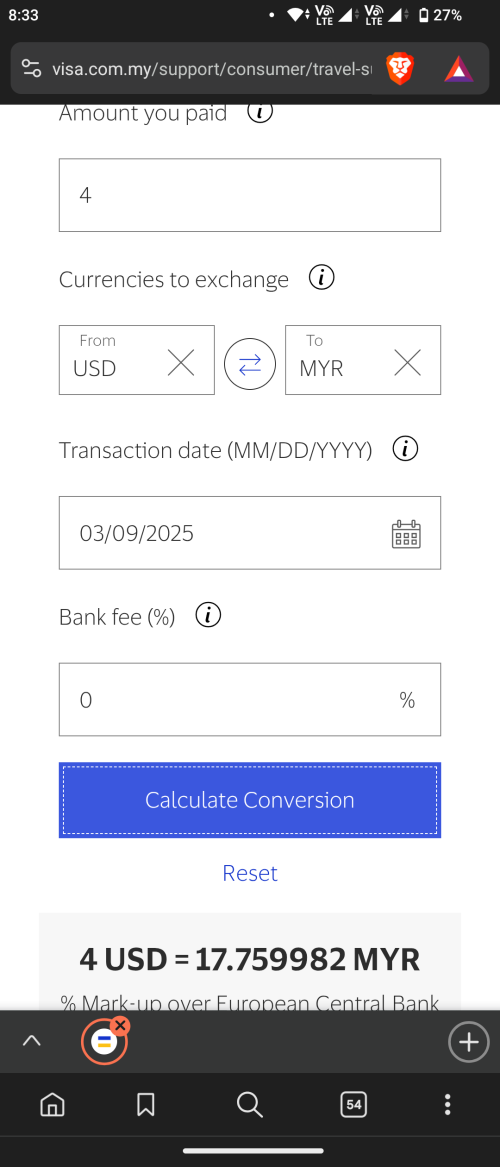

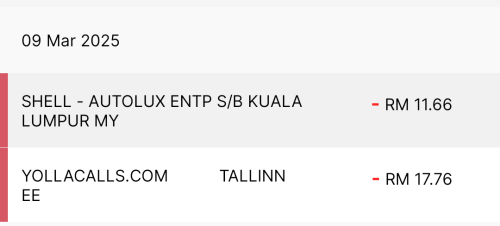

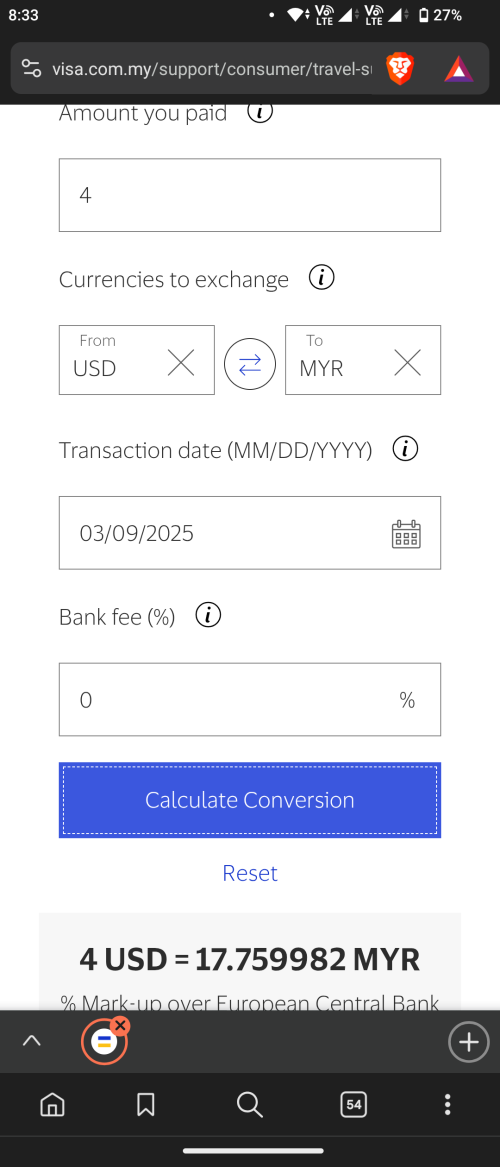

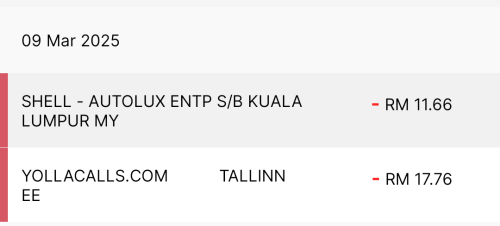

Ambank M-card, Ambank Bonuslink, Ambank True https://www.ambank.com.my/docs/ambankretail...vrsn=1db6b770_2 This is in contrast to 1% charge on other ambank credit cards. I was curious if it is really 0 charge or there'll actually some other hidden charges. Applied Ambank Bonuslink card, and tried using it. Lo and behold it's really 0% charge. And yup no other charges too. [url=https://pictr.com/image/xhrkig]  [/url] [/url] This post has been edited by Mr Gray: Mar 12 2025, 08:46 PM |

|

|

Mar 13 2025, 10:48 AM Mar 13 2025, 10:48 AM

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(Mr Gray @ Mar 12 2025, 08:40 PM) Whilst browsing through T&C of ambank credit cards I noticed that the document is silent on the charge for foreign transactions for the following credit cards thanks for sharing. Ambank M-card, Ambank Bonuslink, Ambank True https://www.ambank.com.my/docs/ambankretail...vrsn=1db6b770_2 This is in contrast to 1% charge on other ambank credit cards. I was curious if it is really 0 charge or there'll actually some other hidden charges. Applied Ambank Bonuslink card, and tried using it. Lo and behold it's really 0% charge. And yup no other charges too.   so now confirm BL don't charge cross border fee and forex exchange fee. you have try other ambank cards? is it the same 0%? |

|

|

Mar 13 2025, 11:51 AM Mar 13 2025, 11:51 AM

Show posts by this member only | IPv6 | Post

#2026

|

Junior Member

89 posts Joined: Feb 2019 |

QUOTE(Mr Gray @ Mar 12 2025, 08:40 PM) Whilst browsing through T&C of ambank credit cards I noticed that the document is silent on the charge for foreign transactions for the following credit cards Thanks for your precious feedback. So far, only Bank Rakyat and Ambank's certain credit cards have zero overseas conversion rate, for credit card only, right?Ambank M-card, Ambank Bonuslink, Ambank True https://www.ambank.com.my/docs/ambankretail...vrsn=1db6b770_2 This is in contrast to 1% charge on other ambank credit cards. I was curious if it is really 0 charge or there'll actually some other hidden charges. Applied Ambank Bonuslink card, and tried using it. Lo and behold it's really 0% charge. And yup no other charges too.   |

|

|

|

|

|

Mar 13 2025, 01:07 PM Mar 13 2025, 01:07 PM

Show posts by this member only | IPv6 | Post

#2027

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(skty @ Mar 13 2025, 10:48 AM) thanks for sharing. Don't have other ambank cards, but ambank true and ambank m card should also have zero charge as per the T&Cso now confirm BL don't charge cross border fee and forex exchange fee. you have try other ambank cards? is it the same 0%? skty liked this post

|

|

|

Mar 20 2025, 11:46 PM Mar 20 2025, 11:46 PM

|

Junior Member

198 posts Joined: Oct 2005 |

anyone tried on HLB card? example HLB infinite

|

|

|

Mar 21 2025, 02:21 PM Mar 21 2025, 02:21 PM

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(outsiders_86 @ Mar 20 2025, 11:46 PM) (i) 1% transaction fee charged by Visa or Mastercard International; and(ii) 1% foreign exchange conversion mark-up imposed by the Bank (not applicable to Mastercard/ Visa I’m Card). So total charge between 1-2%. HLB Infinite 2%. |

|

|

May 27 2025, 11:55 AM May 27 2025, 11:55 AM

|

Senior Member

1,151 posts Joined: Mar 2013 |

long time no people update the best card for travel?

i still use the sc jumpstart debit card. any other good card which better than it? thanks |

|

|

May 27 2025, 04:30 PM May 27 2025, 04:30 PM

Show posts by this member only | IPv6 | Post

#2031

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(jkngo2003 @ May 27 2025, 11:55 AM) long time no people update the best card for travel? Depend on what you want. If you want to save money on foreign exchange rate, jumpstart is quite a good card. I use it for all my overseas purchases.i still use the sc jumpstart debit card. any other good card which better than it? thanks But if want airmiles, then sorry lo. |

|

|

May 28 2025, 09:55 AM May 28 2025, 09:55 AM

|

Senior Member

3,879 posts Joined: Jul 2005 |

QUOTE(jkngo2003 @ May 27 2025, 11:55 AM) long time no people update the best card for travel? i use Wise Card, TNG Visa & GX Bank DC since they offer 0% forex markup.i still use the sc jumpstart debit card. any other good card which better than it? thanks i think their rate is among the best in town This post has been edited by sjz: May 28 2025, 09:55 AM |

|

|

May 28 2025, 10:13 AM May 28 2025, 10:13 AM

Show posts by this member only | IPv6 | Post

#2033

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

|

|

|

May 28 2025, 10:52 PM May 28 2025, 10:52 PM

Show posts by this member only | IPv6 | Post

#2034

|

Junior Member

143 posts Joined: Jul 2011 |

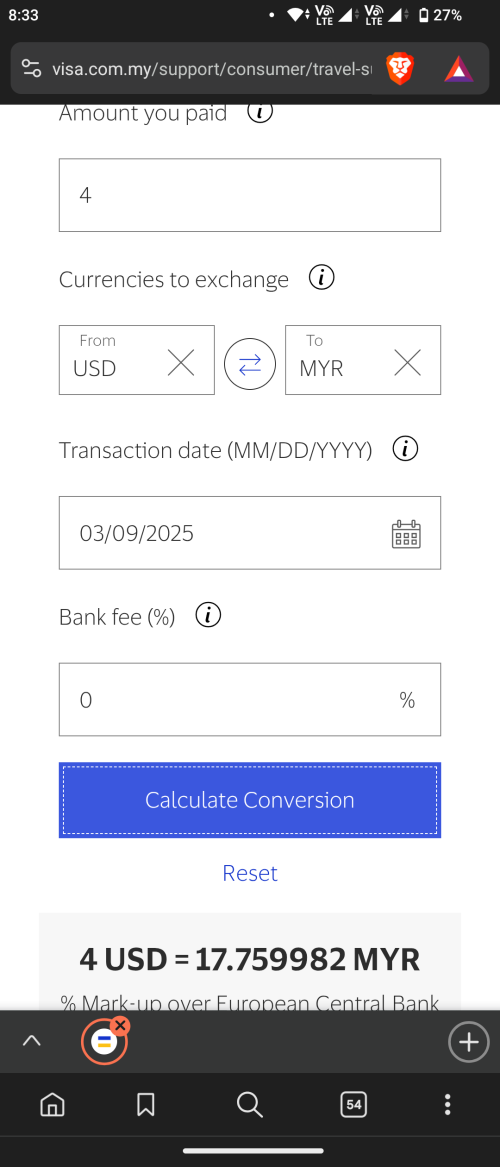

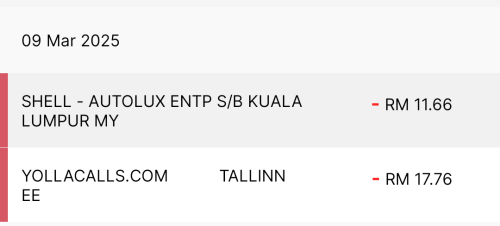

QUOTE(sjz @ May 28 2025, 09:55 AM) i use Wise Card, TNG Visa & GX Bank DC since they offer 0% forex markup. Wise doesn’t apply a markup on forex rates, but it does charge a fee for each transaction, check it here https://wise.com/my/pricing/card-fees?sourc...GBP&track=falsei think their rate is among the best in town sjz liked this post

|

|

|

May 29 2025, 10:46 AM May 29 2025, 10:46 AM

|

Senior Member

3,879 posts Joined: Jul 2005 |

QUOTE(Steve78 @ May 28 2025, 10:52 PM) Wise doesn’t apply a markup on forex rates, but it does charge a fee for each transaction, check it here https://wise.com/my/pricing/card-fees?sourc...GBP&track=false the fee they charge is only about ~0.5%.while their exchange rate is same as market rate (eg xe.com) This post has been edited by sjz: May 29 2025, 10:48 AM |

|

|

May 29 2025, 04:37 PM May 29 2025, 04:37 PM

Show posts by this member only | IPv6 | Post

#2036

|

All Stars

26,533 posts Joined: Jan 2003 |

My foreign transaction is not posted yet. Is checking the available credit limit balance an accurate way to determine the final posted amount? Or will the floating value still change?

|

|

|

May 29 2025, 05:20 PM May 29 2025, 05:20 PM

|

All Stars

65,365 posts Joined: Jan 2003 |

QUOTE(Human Nature @ May 29 2025, 04:37 PM) My foreign transaction is not posted yet. Is checking the available credit limit balance an accurate way to determine the final posted amount? Or will the floating value still change? floating amt/forex still based on initial txn took placefinal posting will be the most accurate as forex will fluctuate. Human Nature liked this post

|

|

|

Jun 1 2025, 08:11 PM Jun 1 2025, 08:11 PM

Show posts by this member only | IPv6 | Post

#2038

|

Junior Member

143 posts Joined: Jul 2011 |

|

|

|

Jun 1 2025, 09:15 PM Jun 1 2025, 09:15 PM

Show posts by this member only | IPv6 | Post

#2039

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Jun 2 2025, 08:27 AM Jun 2 2025, 08:27 AM

Show posts by this member only | IPv6 | Post

#2040

|

Senior Member

3,879 posts Joined: Jul 2005 |

QUOTE(Steve78 @ Jun 1 2025, 08:11 PM) Anyone who actually checked would see that Wise is typically more expensive than XE.com, never the same. taken into account 0.5%, yes it would be different.else, the rate is very same as XE.com. a very good example, as we speak now, Wise rate RM1= 0.2066 EUR Xe.com RM1 = 0.20664214 EUR VISA rate 1 MYR = 0.209731 EUR Mastercard rate 1 MYR = 0.21 EUR This post has been edited by sjz: Jun 2 2025, 08:43 AM |

| Change to: |  0.0177sec 0.0177sec

1.09 1.09

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 03:37 PM |