QUOTE(bowranger @ Oct 2 2023, 10:51 PM)

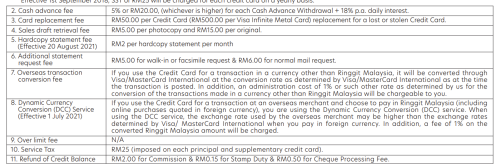

1% - mastercard/visa fees1% or more- bank fees

To save cost/fees, there is where wise shine.

This post has been edited by ericlaiys: Oct 2 2023, 11:18 PM

Credit Card Foreign Exchange Rate

|

|

Oct 2 2023, 11:18 PM Oct 2 2023, 11:18 PM

Return to original view | Post

#1

|

Senior Member

7,584 posts Joined: May 2012 |

|

|

|

|

|

|

Dec 29 2023, 12:27 AM Dec 29 2023, 12:27 AM

Return to original view | Post

#2

|

Senior Member

7,584 posts Joined: May 2012 |

sc jumpstart vs wise? which is better? anyone do any comparison between both

|

|

|

Dec 29 2023, 02:36 PM Dec 29 2023, 02:36 PM

Return to original view | Post

#3

|

Senior Member

7,584 posts Joined: May 2012 |

|

|

|

Dec 30 2023, 02:10 PM Dec 30 2023, 02:10 PM

Return to original view | Post

#4

|

Senior Member

7,584 posts Joined: May 2012 |

|

|

|

Jan 3 2024, 08:55 AM Jan 3 2024, 08:55 AM

Return to original view | Post

#5

|

Senior Member

7,584 posts Joined: May 2012 |

|

|

|

Jan 3 2024, 08:55 AM Jan 3 2024, 08:55 AM

Return to original view | Post

#6

|

Senior Member

7,584 posts Joined: May 2012 |

does anyone get cashback 5% on bill payment for SC Jumpstart?

|

|

|

|

|

|

Jan 4 2024, 07:19 AM Jan 4 2024, 07:19 AM

Return to original view | Post

#7

|

Senior Member

7,584 posts Joined: May 2012 |

|

|

|

Mar 7 2024, 10:16 PM Mar 7 2024, 10:16 PM

Return to original view | Post

#8

|

Senior Member

7,584 posts Joined: May 2012 |

|

|

|

Mar 14 2024, 12:07 PM Mar 14 2024, 12:07 PM

Return to original view | Post

#9

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(ClarenceT @ Mar 14 2024, 10:55 AM) Though AMEX may charge higher, but you may get 5x Treatpoints (worth 1%) vs. 1x Treatpoint (or 0.2% CB) for using Visa/MC. CC - confirmed higher 2% -2.5%TNG Visa & Wise (TransferWise) Visa Debit can give cheaper rate, better than using Visa/MasterCard credit card. e.g. S$2 TNG Visa RM7.06 Wise Visa Debit RM7.09 Public Bank Visa Credit RM7.15 debit card - depend. gxbank - zero fees + give u 1% cashback wise - some 0.xx% fees This post has been edited by ericlaiys: Mar 14 2024, 12:07 PM Nemozai liked this post

|

|

|

Mar 14 2024, 08:27 PM Mar 14 2024, 08:27 PM

Return to original view | Post

#10

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(Steve78 @ Mar 14 2024, 07:40 PM) If you check out the replies here, you'll see that SCB JumpStart and RHB MCA have the best forex rates going, and now GXBank has just stepped up to offer rates as good as SCB JumpStart's. gxbank better as got 1% cashback. dont forget u get 3% pa - daily bank in for saving money insideThese three currently offer the most competitive forex rates in the market. SC jumpstart - no 3% pa interest. very low interest if put money inside This post has been edited by ericlaiys: Mar 14 2024, 08:27 PM |

|

|

Mar 15 2024, 12:12 AM Mar 15 2024, 12:12 AM

Return to original view | Post

#11

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(Ramjade @ Mar 14 2024, 09:55 PM) still a long way. enjoy while still got time.SC Jumpstart tnc also going to change on sept. Now SC Privileges had a bad interest tnc till Jan 2025. so i wont surprise they did the same for jumpstart This post has been edited by ericlaiys: Mar 15 2024, 12:14 AM |

|

|

Apr 2 2024, 11:09 PM Apr 2 2024, 11:09 PM

Return to original view | Post

#12

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(Nemozai @ Apr 2 2024, 10:29 PM) Hello. I’m travelling to Europe this June. Want to ask the best conversion from MYR to Euro is GXBank or Jumpstart or RHB MCA or Wise or CC(with 2-5% CB)? gxbank + JumpstartCredit card conversion all bad right. Now for most CC the miles collection also becoming not worth it. Nemozai liked this post

|

|

|

May 2 2024, 08:30 AM May 2 2024, 08:30 AM

Return to original view | Post

#13

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(lowyat101 @ May 2 2024, 08:17 AM) Hi, may I know how does this combo work for the forex? As I see both seems to be saving account with debit card feature same like wise. zero fees, follow mastercard/visa market rate. On top, other benefitgxbank - got interest 3% on saving ACC jumpstart - got 5% cashback on online retail. Max rm 50 for 1k spent |

|

|

|

|

|

May 2 2024, 02:40 PM May 2 2024, 02:40 PM

Return to original view | Post

#14

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(lowyat101 @ May 2 2024, 09:40 AM) thanks, meaning either 1 of this (gxbank/jumpstart) is better that Wise in term of the exchange rate ya? as i see in Wise, there's a charge if want to deposit into the foreign account balance. yes - keep rmalso just to check, we just need to keep RM in this account (gxbank/jumpstart) and then use the debit card for overseas spending right? thanks better rate. u need to compare. i stopped using wise and use gxbank. gxbank 0 fees + 1% cashback [ also get when use oversea] So gxbank + point |

|

|

May 6 2024, 09:48 PM May 6 2024, 09:48 PM

Return to original view | Post

#15

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(datolee32 @ May 6 2024, 08:52 PM) don't forget gxbank give 1% cashback extra lowyat101 liked this post

|

|

|

Oct 11 2024, 09:23 AM Oct 11 2024, 09:23 AM

Return to original view | Post

#16

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(gclee @ Oct 11 2024, 07:48 AM) Newbie here. 1 - if u got cash. else u pay extra feesI'll be travelling to SG for few days and was thinking which way of spending will save me more : 1) Buy all my SGD and just travel like an old fashion. 2) Buy lesser amount of SGD, then spend part of my expenses via credit card (I have UOB visa & Maybank 2 Amex & Visa) This will be the first time I'm intend to use my credit card overseas, provided if it will save me more than using cash. Appreciate if I can have some useful info here. gclee liked this post

|

|

|

Oct 11 2024, 10:15 AM Oct 11 2024, 10:15 AM

Return to original view | Post

#17

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(gclee @ Oct 11 2024, 09:38 AM) How about using M2Amex by weekend? Will it be cheaper with the 5% rebate? If swipe at SG the transaction time should be same as My right? Amex is never good at oversea. too high fees. if u really want to use cc, use visa /mastercard Steve78 liked this post

|

|

|

Nov 4 2024, 10:50 AM Nov 4 2024, 10:50 AM

Return to original view | Post

#18

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(Yusaini1818 @ Nov 4 2024, 10:11 AM) Is it worthy to use an AEON credit card in Japan? If I'd run out of cash and want to buy unexpected shopping like cosmetics or a handbag, which card should I pick? i have card below: rhb and pbb fees is lower.1) HSBC Travel One 2) UOB infinite 3) Ambank Infinite 4) Aeon Platinum 5) Public Visa Signature Thanks to all Sifu. Most of the time I will use cash, but don't want changes too much JPY as it seems like keep dropping. HSBC, UOB -> high fees |

|

|

Nov 12 2024, 06:00 PM Nov 12 2024, 06:00 PM

Return to original view | Post

#19

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(JoNe91 @ Nov 12 2024, 05:11 PM) Hi All Sifus, Correct. 1% is admin fees + extra fees till 2% plus. So far only rhb and PBB not charge 1%. Majority around 2% plus.I have recently swiped a few transactions with UOB Prvi Elite card, and i have noticed that the conversion rate is a bit high, becuz the website only state like 1% admin fee, but i calculated it was like 2.2%. So i have called the UOB customer service and ask them how they charged it. They told me that on top of the 1% admin fee, the bank has charged a 1.22% fee (can't hear what she said it was called). However, i did ask her like how this rate is determined and whether it is stated on their website. She told me it's all depend on the bank and there is no way to check in advance, and no history for reference as well. She did show me where it was stated in their T&Cs.  " In addition, an administration cost of 1% or such other rate as determined by us for the conversion of the transactions made in a currency other than Ringgit Malaysia will be chargeable to you." She said the 1.22% is that "such other rat as determined by us" So they didn't really state like how much fee in the T&Cs, and they can charge whatever rate? I can't know what im being charged before i use the card? That why people use wise, GXBank, big pay for personal trip. Just wonder, you did not use other cc before at overseas? It is standard rate till 2.5% Bank love you to use at overseas coz they earn more This post has been edited by ericlaiys: Nov 12 2024, 06:03 PM |

|

|

Nov 12 2024, 10:59 PM Nov 12 2024, 10:59 PM

Return to original view | Post

#20

|

Senior Member

7,584 posts Joined: May 2012 |

QUOTE(JoNe91 @ Nov 12 2024, 08:41 PM) OK if they have been consistent in this rate, then it's fine. I'm just worried that they will suddenly charge a higher rate. The main problem is we only get to know the rate after we spent with the card. None of the bank will tell u the rate.Btw, thanks for confirming the 2.2% rate, now i'm less concerned since this has been consistently charged for everyone. I have no problem with the rate 2.22%, but my concern is they didn't state clearly in the T&Cs the rate they use for this "other rate", and there's no cap to it. |

| Change to: |  0.0638sec 0.0638sec

0.37 0.37

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 04:48 AM |