Outline ·

[ Standard ] ·

Linear+

Credit Card Foreign Exchange Rate

|

Steve78

|

Jun 2 2025, 07:58 PM Jun 2 2025, 07:58 PM

|

Getting Started

|

QUOTE(sjz @ Jun 2 2025, 08:27 AM) taken into account 0.5%, yes it would be different. else, the rate is very same as XE.com. a very good example, as we speak now, Wise rate RM1= 0.2066 EUR Xe.com RM1 = 0.20664214 EUR VISA rate 1 MYR = 0.209731 EUR Mastercard rate 1 MYR = 0.21 EUR Wise shows you the market rate but adds extra charges, it’s only fair to include those fees on the rate when comparing it with other options. Also, the Mastercard rate today is 1 Malaysian Ringgit = 0.209731 Euro today, not sure where your rate is coming from.  This post has been edited by Steve78: Jun 2 2025, 08:01 PM

This post has been edited by Steve78: Jun 2 2025, 08:01 PM |

|

|

|

|

|

Ramjade

|

Jun 2 2025, 10:40 PM Jun 2 2025, 10:40 PM

|

|

QUOTE(sjz @ Jun 2 2025, 08:27 AM) taken into account 0.5%, yes it would be different. else, the rate is very same as XE.com. a very good example, as we speak now, Wise rate RM1= 0.2066 EUR Xe.com RM1 = 0.20664214 EUR VISA rate 1 MYR = 0.209731 EUR Mastercard rate 1 MYR = 0.21 EUR Wise add on fees while JumpStart doesn't add on fees. |

|

|

|

|

|

!@#$%^

|

Jun 2 2025, 10:57 PM Jun 2 2025, 10:57 PM

|

|

QUOTE(Ramjade @ Jun 2 2025, 10:40 PM) Wise add on fees while JumpStart doesn't add on fees. but i suggest do comparison between wise and 0% fee mastercard rate. depending on the time of the day/week, one will be cheaper than the other. i made a mistake of not checking. made a usd1600 purchase on sunday, ended up about rm70 more as compared to wise when i used gxcard, which is the same amount as the mastercard site. checked again on next day monday morning, mastercard still showed the same 'weekend' rate. |

|

|

|

|

|

Ramjade

|

Jun 3 2025, 01:22 AM Jun 3 2025, 01:22 AM

|

|

QUOTE(!@#$%^ @ Jun 2 2025, 10:57 PM) but i suggest do comparison between wise and 0% fee mastercard rate. depending on the time of the day/week, one will be cheaper than the other. i made a mistake of not checking. made a usd1600 purchase on sunday, ended up about rm70 more as compared to wise when i used gxcard, which is the same amount as the mastercard site. checked again on next day monday morning, mastercard still showed the same 'weekend' rate. Wise memang expensive. That's why I never use wise at all. |

|

|

|

|

|

Human Nature

|

Jun 3 2025, 08:40 AM Jun 3 2025, 08:40 AM

|

|

QUOTE(Human Nature @ May 29 2025, 04:37 PM) My foreign transaction is not posted yet. Is checking the available credit limit balance an accurate way to determine the final posted amount? Or will the floating value still change? Ambank is super slow in reflecting foreign transaction. Transaction made on 28 May is still floating. |

|

|

|

|

|

!@#$%^

|

Jun 3 2025, 09:59 AM Jun 3 2025, 09:59 AM

|

|

QUOTE(Ramjade @ Jun 3 2025, 01:22 AM) Wise memang expensive. That's why I never use wise at all. i was saying gxbank was about 1% more expensive than wise on that particular day. no harm to check, really. |

|

|

|

|

|

anndroid

|

Jun 10 2025, 12:17 PM Jun 10 2025, 12:17 PM

|

Getting Started

|

QUOTE(Mr Gray @ Mar 13 2025, 01:07 PM) Don't have other ambank cards, but ambank true and ambank m card should also have zero charge as per the T&C QUOTE(Human Nature @ Jun 3 2025, 08:40 AM) Ambank is super slow in reflecting foreign transaction. Transaction made on 28 May is still floating. Does your ambank cards (which one?) still show 0% foreign transaction fee? As im seriously considering to apply for it as i'm using Wise alot. |

|

|

|

|

|

Human Nature

|

Jun 10 2025, 03:16 PM Jun 10 2025, 03:16 PM

|

|

QUOTE(anndroid @ Jun 10 2025, 12:17 PM) Does your ambank cards (which one?) still show 0% foreign transaction fee? As im seriously considering to apply for it as i'm using Wise alot. No idea how to check. But it took them 7 days to post the transaction and by the time the rate already increased. |

|

|

|

|

|

anndroid

|

Jun 10 2025, 03:25 PM Jun 10 2025, 03:25 PM

|

Getting Started

|

QUOTE(Human Nature @ Jun 10 2025, 03:16 PM) No idea how to check. But it took them 7 days to post the transaction and by the time the rate already increased. Perhaps u can check by looking at the statement. the currency price and final MYR price. from there we can see whats the exchage rate. |

|

|

|

|

|

Human Nature

|

Jun 10 2025, 03:36 PM Jun 10 2025, 03:36 PM

|

|

QUOTE(anndroid @ Jun 10 2025, 03:25 PM) Perhaps u can check by looking at the statement. the currency price and final MYR price. from there we can see whats the exchage rate. Here's two sample: Transaction Date: 5 May Posted Date: 10 May 1000 Yen RM30.46 Transaction Date: 28 May Posted Date: 4 June 3000 Yen RM90.48 Would you be able to calculate? |

|

|

|

|

|

anndroid

|

Jun 10 2025, 04:04 PM Jun 10 2025, 04:04 PM

|

Getting Started

|

QUOTE(Human Nature @ Jun 10 2025, 03:36 PM) Here's two sample: Transaction Date: 5 May Posted Date: 10 May 1000 Yen RM30.46 Transaction Date: 28 May Posted Date: 4 June 3000 Yen RM90.48 Would you be able to calculate? If i base on the 28 May transaction, its about RM1.75 more expensive than Wise. It's not bad for a credit card i think cause hard to tell which fx date they grab it from. Which ambank cc is this? |

|

|

|

|

|

Human Nature

|

Jun 10 2025, 04:24 PM Jun 10 2025, 04:24 PM

|

|

QUOTE(anndroid @ Jun 10 2025, 04:04 PM) If i base on the 28 May transaction, its about RM1.75 more expensive than Wise. It's not bad for a credit card i think cause hard to tell which fx date they grab it from. Which ambank cc is this? Spb VI |

|

|

|

|

|

Mr Gray

|

Jun 22 2025, 10:18 AM Jun 22 2025, 10:18 AM

|

|

QUOTE(anndroid @ Jun 10 2025, 12:17 PM) Does your ambank cards (which one?) still show 0% foreign transaction fee? As im seriously considering to apply for it as i'm using Wise alot. These 3 ambank cards have 0% foreign transaction fee. 1. Ambank True Card 2. Ambank M Card 3. Ambank Bonuslink Card All other ambank cards have 1% charge. And I'm personally using Ambank Bonuslink. This post has been edited by Mr Gray: Jun 22 2025, 10:20 AM |

|

|

|

|

|

Fantasia

|

Jul 17 2025, 05:48 PM Jul 17 2025, 05:48 PM

|

|

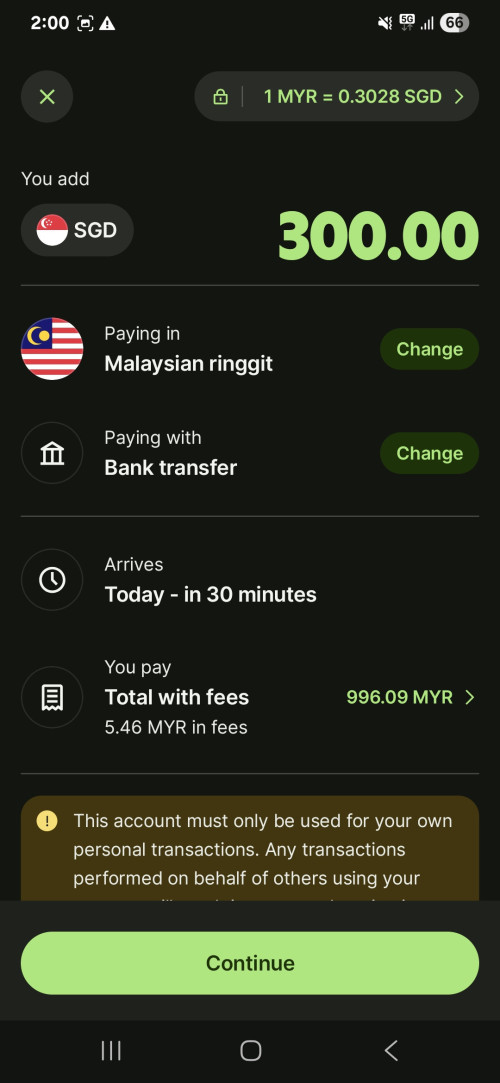

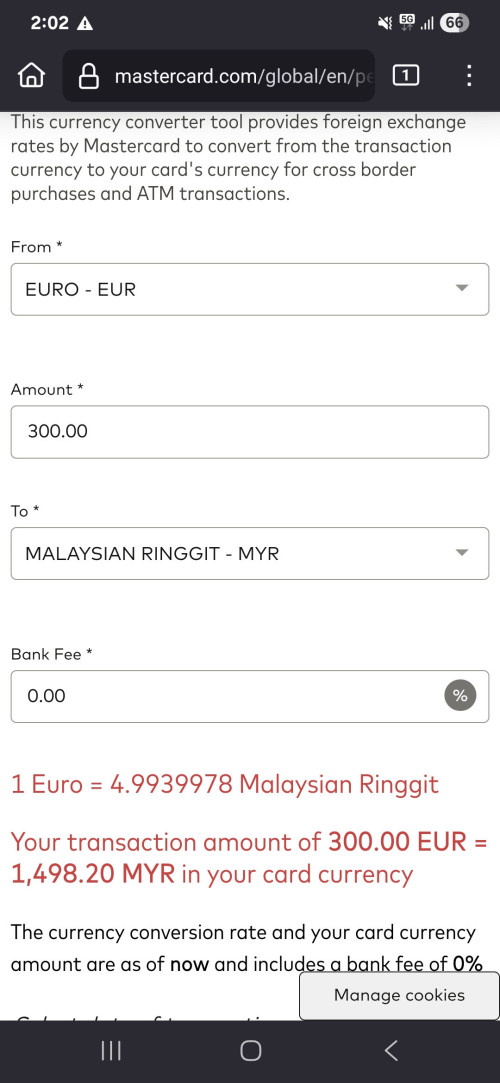

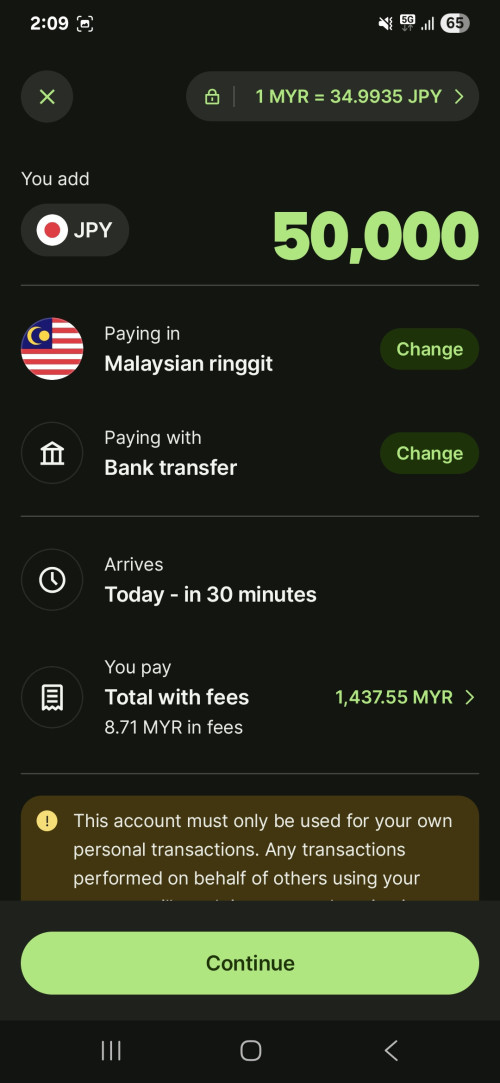

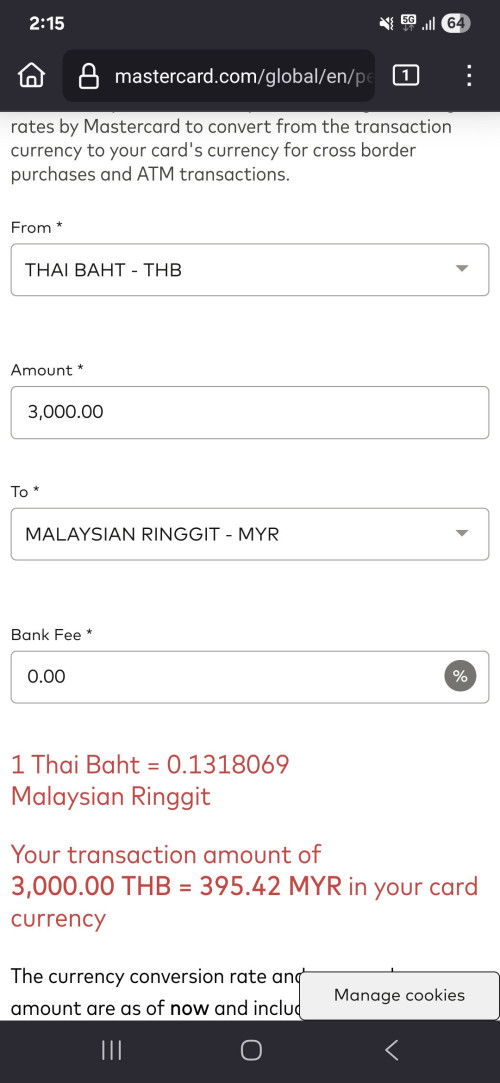

|

|

|

|

|

|

Fantasia

|

Jul 17 2025, 05:50 PM Jul 17 2025, 05:50 PM

|

|

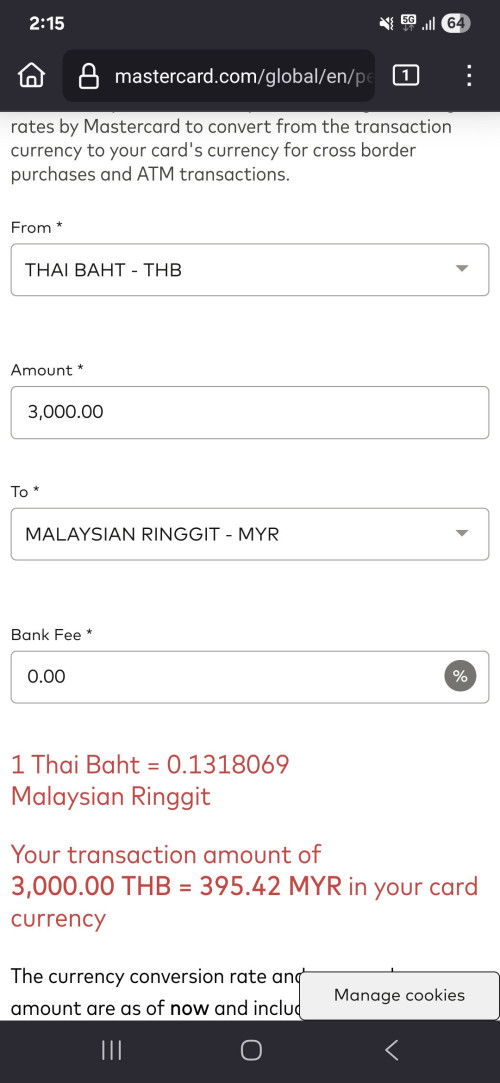

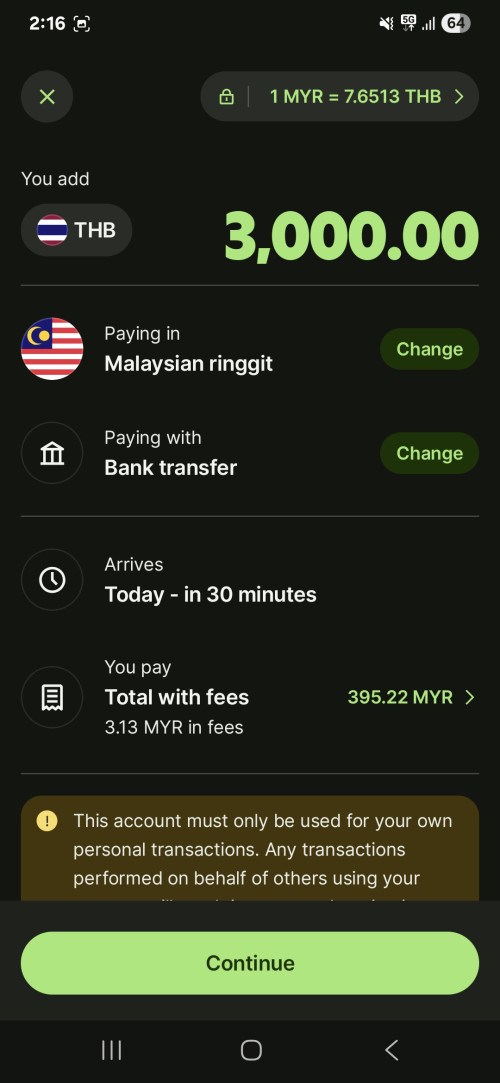

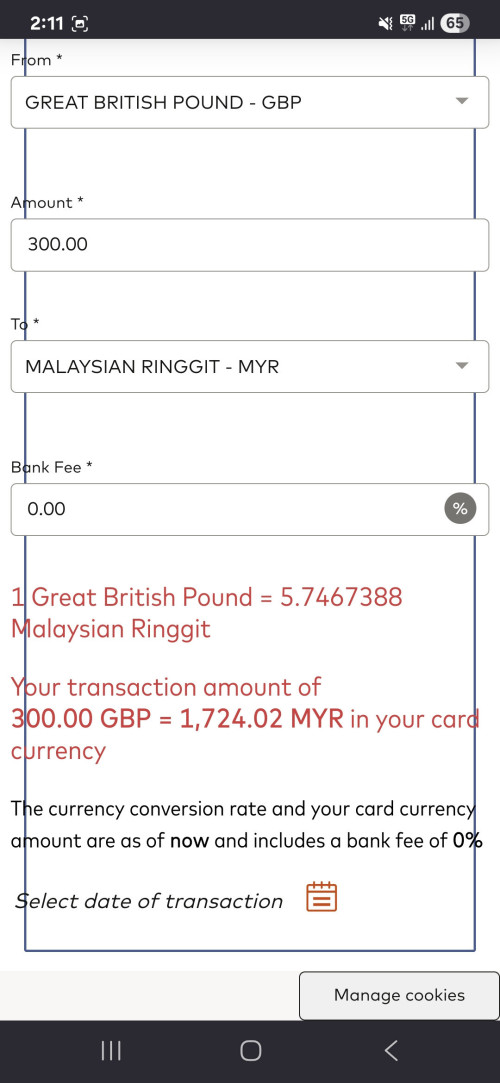

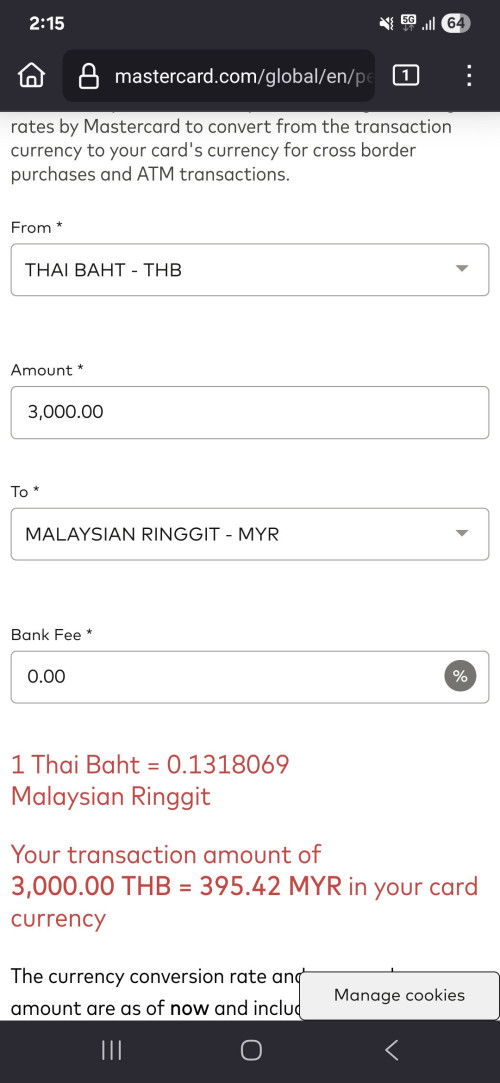

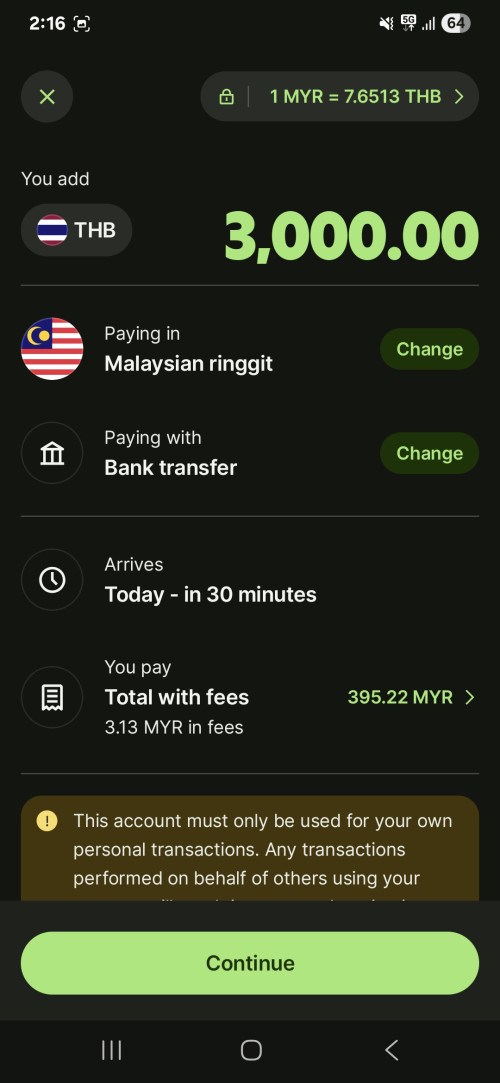

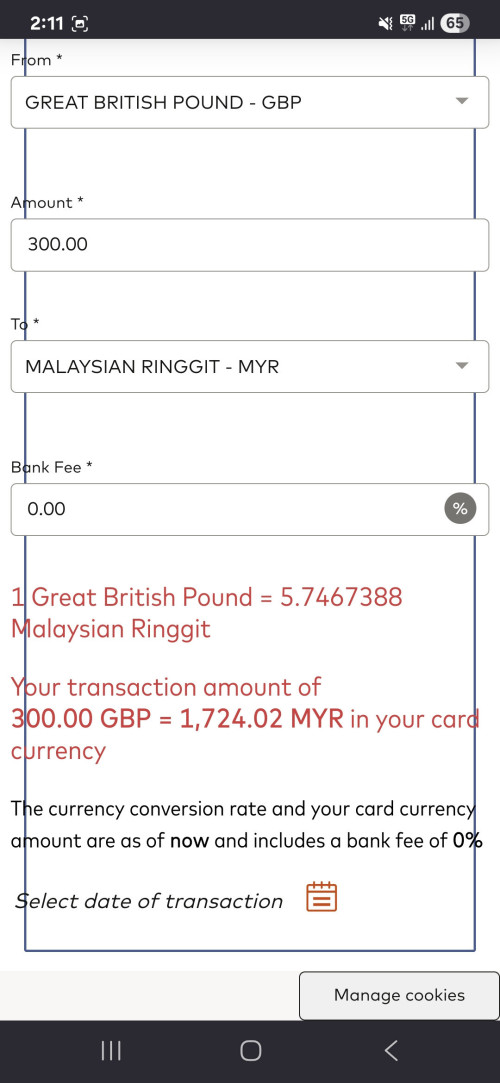

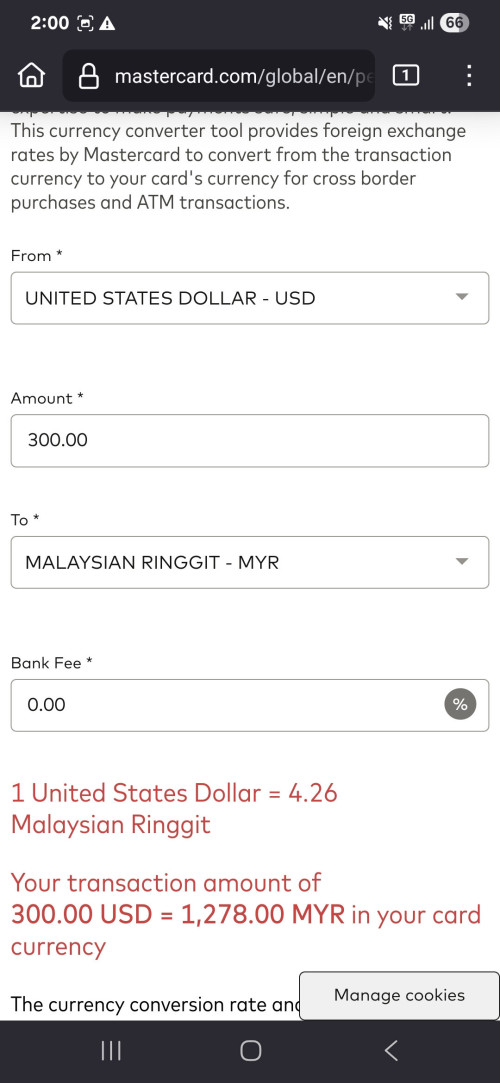

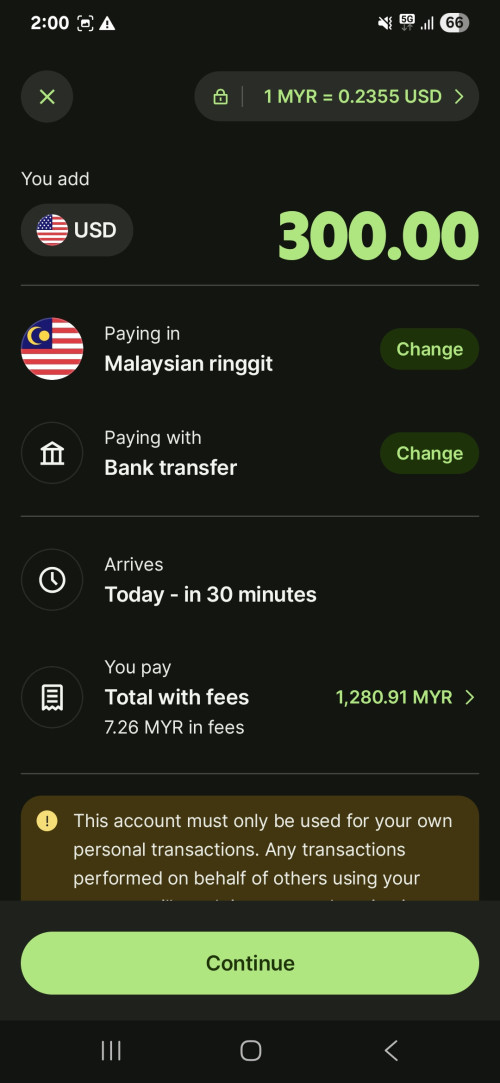

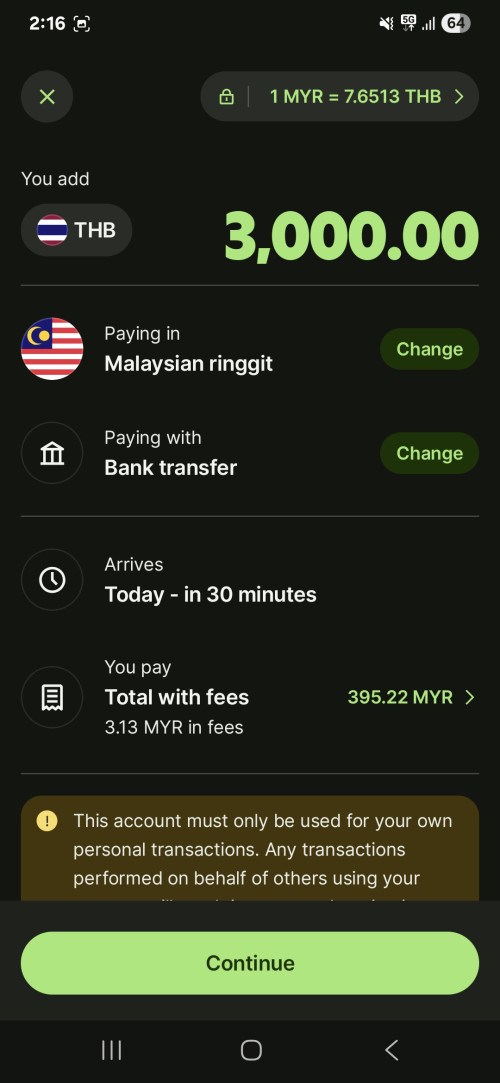

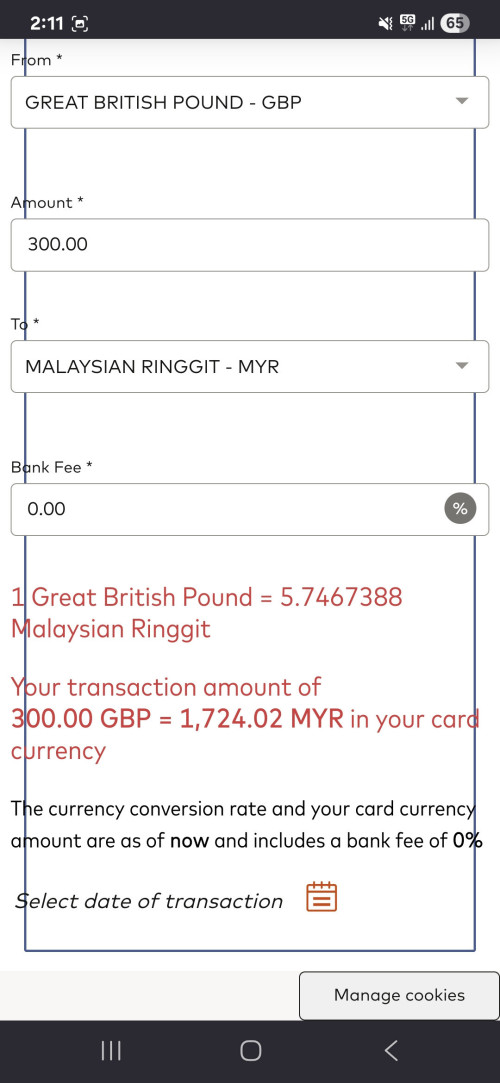

Continued from previous post due to number of picture limitationBaht:   GBP:   It seems like even with recent fee increased, Wise can still be cheaper for some currencies while Mastercard is not always cheaper than Wise even without conversion fee. Did I make any mistake in this comparison?

|

|

|

|

|

|

jhleo1

|

Jul 19 2025, 09:19 PM Jul 19 2025, 09:19 PM

|

|

I tested USD n SGD, wise rate still more expensive. QUOTE(Fantasia @ Jul 17 2025, 05:50 PM) Continued from previous post due to number of picture limitationBaht:   GBP:   It seems like even with recent fee increased, Wise can still be cheaper for some currencies while Mastercard is not always cheaper than Wise even without conversion fee. Did I make any mistake in this comparison? |

|

|

|

|

|

Fantasia

|

Jul 21 2025, 11:35 PM Jul 21 2025, 11:35 PM

|

|

QUOTE(jhleo1 @ Jul 19 2025, 09:19 PM) I tested USD n SGD, wise rate still more expensive. I think it also depend on the time you check the exchange rate. I found that almost all currency is more expensive in Wise if you check it at night while if I check it in the afternoon, Wise some time can be slightly cheaper. Another thing I found out is, USD is always more expensive in Wise no matter what time you check. |

|

|

|

|

|

virgoguy

|

Sep 8 2025, 09:11 AM Sep 8 2025, 09:11 AM

|

|

12/08/25 RHB visa infinite

39332 Yen

Charged RM 1157.41

Visa calculator: RM 1134.60

Mark up over visa: 2.01%

I called bank for clarity. The bank insist that they only charge 1% on top of the visa rate. I compared the visa rate provided by the bank is actually already mark up 1%. Does that mean visa also charge 1%?

|

|

|

|

|

|

ClarenceT

|

Sep 8 2025, 11:38 AM Sep 8 2025, 11:38 AM

|

|

QUOTE(virgoguy @ Sep 8 2025, 09:11 AM) Does that mean visa also charge 1%? Around +1% hidden charged by Visa International if use a credit card. Not limited to RHB. Cheaper if use debit card or prepaid card. |

|

|

|

|

|

synical

|

Sep 18 2025, 12:59 PM Sep 18 2025, 12:59 PM

|

|

I guess UOB is really charging 2.22%...

Date: 17/9/2025

5427 JPY

Charged RM 160.23

When I keyed in 2.2% in VISA's calculator, it was only RM 160.19/20

But after I added the 2nd decimal point (2.22%), it tallied with the final amount (RM160.23)

When I checked on XE, it was around RM154/155 yesterday, so...

Is EVOL's 5% CB for online transactions enough to cover?

|

|

|

|

|

Jun 2 2025, 07:58 PM

Jun 2 2025, 07:58 PM

Quote

Quote

0.0177sec

0.0177sec

1.06

1.06

6 queries

6 queries

GZIP Disabled

GZIP Disabled