QUOTE(monsta2011 @ Aug 8 2011, 06:23 PM)

keep some in bank as emergency fund. don't put all the money in place. 20% in FD

50% stock

30% in UT.

or it depends how u plan with ur risk tolerance VS urs age factor.

Public Mutual v2, PB/Public series

|

|

Aug 8 2011, 07:06 PM Aug 8 2011, 07:06 PM

|

Senior Member

952 posts Joined: Feb 2011 |

QUOTE(monsta2011 @ Aug 8 2011, 06:23 PM) keep some in bank as emergency fund. don't put all the money in place. 20% in FD 50% stock 30% in UT. or it depends how u plan with ur risk tolerance VS urs age factor. |

|

|

|

|

|

Aug 8 2011, 07:09 PM Aug 8 2011, 07:09 PM

|

Junior Member

432 posts Joined: Jul 2011 |

.

Added on August 8, 2011, 7:17 pm QUOTE(wongmunkeong @ Aug 8 2011, 06:41 PM) Yup but i wont go banzai and dump in one shot lump sum, UNLESS the market fell like a stone already and U see the heart beat nearly flat.... then ok. Even then, i'd suggest lump sum 50% only, hold the other lump sum until U see the trend is starting to go up. Just my thoughts - no hard & fast rules. I believe I have enough cash for emergency use, ya? and like you said, put 50% which is ard 35k into investment first and see the trend.. or I should start from low risk investment first like bond? by the way bond is not subject to 5.5% commission like the mutual fund right? I am prepared to lock my money for long term in fact i have that cash sitting in FD for 2 yrs already Before investments, U've covered all the other stuff like i've mentioned? if not, U better cover those first - imho, any $ ear-marked/dumped into investments should be thought of as $ gone into a timehole for 5 to 10years, ie. cant touch this (hammer time!). Reason: If U suddenly need the $, U may be forced to sell at a loss. Added on August 8, 2011, 7:20 pm QUOTE(kparam77 @ Aug 8 2011, 07:06 PM) keep some in bank as emergency fund. don't put all the money in place. my risk tolerance is moderate maybe 20% in FD 50% stock 30% in UT. or it depends how u plan with ur risk tolerance VS urs age factor. This post has been edited by monsta2011: Aug 8 2011, 07:20 PM |

|

|

Aug 8 2011, 07:21 PM Aug 8 2011, 07:21 PM

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

RM70k..depend on your age. Active or passive investor?

if early 20s and no time to do research on stocks, convert it into UT form then. Let the managers/analysts do the job. Depend on your monthly saving also. If I were you, i dont mind to put a little heavier on equity. 60% equity 40% bond. |

|

|

Aug 8 2011, 07:46 PM Aug 8 2011, 07:46 PM

|

Senior Member

952 posts Joined: Feb 2011 |

QUOTE(monsta2011 @ Aug 8 2011, 07:09 PM) . u r just in 20's. and u r a moderate risk tolerance person.Added on August 8, 2011, 7:17 pm I believe I have enough cash for emergency use, ya? and like you said, put 50% which is ard 35k into investment first and see the trend.. or I should start from low risk investment first like bond? by the way bond is not subject to 5.5% commission like the mutual fund right? I am prepared to lock my money for long term in fact i have that cash sitting in FD for 2 yrs already Added on August 8, 2011, 7:20 pm my risk tolerance is moderate maybe BOND = conservative = EPF. i believe u hv EPF. than u can put cash in BOND lesser than others. well my suggestion only. my EPF = MY bond at the moments. plan to transfer some equity funds to BOND when I reach 50 to 55 yrs old. now production time for growing my money in equity funds. 50%/50% = moderate/aggressive. |

|

|

Aug 8 2011, 07:49 PM Aug 8 2011, 07:49 PM

|

Junior Member

27 posts Joined: Nov 2009 |

quite bad performance today ...

all red colour ... except bond fund ... US debt crisis really affect our stock market .... |

|

|

Aug 8 2011, 08:24 PM Aug 8 2011, 08:24 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

|

|

|

Aug 8 2011, 08:38 PM Aug 8 2011, 08:38 PM

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(mois @ Aug 8 2011, 07:21 PM) RM70k..depend on your age. Active or passive investor? if early 20s and no time to do research on stocks, convert it into UT form then. Let the managers/analysts do the job. Depend on your monthly saving also. If I were you, i dont mind to put a little heavier on equity. 60% equity 40% bond. QUOTE(kparam77 @ Aug 8 2011, 07:46 PM) u r just in 20's. and u r a moderate risk tolerance person. Thanks. I've been doing a lot of reading/research these past two months and would love to follow the footsteps of some of the sifus here. I was told in my late teen that i need to save some money before i can start investing. Now that I have save some (probably not enough) I plan to invest but am hesitating a lot. BOND = conservative = EPF. i believe u hv EPF. than u can put cash in BOND lesser than others. well my suggestion only. my EPF = MY bond at the moments. plan to transfer some equity funds to BOND when I reach 50 to 55 yrs old. now production time for growing my money in equity funds. 50%/50% = moderate/aggressive. Anyway no pain no gain.... This post has been edited by monsta2011: Aug 8 2011, 08:40 PM |

|

|

Aug 8 2011, 08:43 PM Aug 8 2011, 08:43 PM

|

Senior Member

3,294 posts Joined: Dec 2005 |

Is it a good time to buy any REIT stock now?

|

|

|

Aug 8 2011, 08:56 PM Aug 8 2011, 08:56 PM

|

Senior Member

2,050 posts Joined: Dec 2009 From: DC |

may i know what is PM REIT ? or you guys talking about something else

|

|

|

Aug 8 2011, 09:00 PM Aug 8 2011, 09:00 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(monsta2011 @ Aug 8 2011, 08:38 PM) Thanks. I've been doing a lot of reading/research these past two months and would love to follow the footsteps of some of the sifus here. I was told in my late teen that i need to save some money before i can start investing. Now that I have save some (probably not enough) I plan to invest but am hesitating a lot. If i may suggest:Anyway no pain no gain.... Draw up a simple and cohesive plan first. Then do & track. Then revisit your plans VS yr tracking results. Tweak yr plans and do, & track Rinse & repeat. BTW, $70K is nothing to sneeze at. Congrats! Personally, if i've saved up a lump sum like that and assuming all else is covered (buffer fund, insurance, etc.), i would: a. Filter mutual equity funds to go into b. Select 2 to 3 very different funds, with good returns for 10yrs (if possible), 5yrs & 3yrs eg. PFES, PRSEC & PFEPRF if U want to use cash for foreign mixed which i do. EPF is used for local mix like PIX, PSSF & PAGF c. Take 50% of the sum, say $30K (i'm just example-ing here k, not exactly 50% of your $70k. Momma's boy can count This $30K, i'd apportion to these 3 funds, eg. $10K each Then, each fund, i'd stick to doing it for at least 3 years, thus that's $3,333.33 each year I'd do the investment every 3 months (qtr), thus, that's $1,111.11 each period Then comes the hard part - to do this using DCA or VCA or combination (TwinVest)? heheh - knowing me, i'd do TwinVest See how it works out? That's JUST THE ENTRY PLAN example. U can leave yr $ allocated for these in cash OR put into Bond fund and then switch the value as needed every quarter. BTW, the remainder i'll leave in Bond fund until i figure out what to do with it - most probably learn about REITs and then go after that EXIT PLAN example: When will i take profit or cut loss for mutual funds? 1. Take /lock in profits I'd do this when there's super abnormal profits - eg. when i know statistically that returns on average for equity funds are about 7%pa to 10%pa, if any of my transaction hits like 20%pa to 25%pa OR like 50% to 60% in less than 1 year, i'd take some $ off the table 2. How much to take / lock-in profits? All? 50%? 66.66%? Me - i'd take the cost + expected profits off the table (switch back to Bond fund and await to be reused) eg. cost +10%pa, and leave the abnormal profits to keep running if it keeps going up at least i've gotten my expectations already AND those $ is still earning me % in Bond Funds 3. Cut loss er.. i wont do this if i'm using Value Averaging or TwinVest. The risk is already mitigated (not entirely though) by putting in less $ when prices are high, thus unused capital is available to buy more when prices go down. Whew.. sorry ar, long winded stuff. Just wanted to share. MOIS - i think i've answered your Q here too Added on August 8, 2011, 9:08 pm QUOTE(koinibler @ Aug 8 2011, 08:56 PM) Most probably REITs as in stock market's REITs. Real Estate Investment Trusts like BSDREIT, TWRREIT, AXIS, SUNREIT, etc.PM's closest fund i think to a REITs fund is PFEPRF - Pub Far East Properties & Resorts Fund. Pls correct me if i'm mistaken / lalaland This post has been edited by wongmunkeong: Aug 8 2011, 09:11 PM |

|

|

Aug 8 2011, 09:14 PM Aug 8 2011, 09:14 PM

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

QUOTE(wongmunkeong @ Aug 8 2011, 09:00 PM) Then comes the hard part - to do this using DCA or VCA or combination (TwinVest)? heheh - knowing me, i'd do TwinVest |

|

|

Aug 8 2011, 09:23 PM Aug 8 2011, 09:23 PM

|

Junior Member

48 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 8 2011, 09:00 PM) If i may suggest: Wow! this is what I am looking for... 'A ENTRY PLAN', the hardest part to understand is the 'TwinVest'... like a secret weapon used by sifu in the last moment of a kungfu show Draw up a simple and cohesive plan first. Then do & track. Then revisit your plans VS yr tracking results. Tweak yr plans and do, & track Rinse & repeat. BTW, $70K is nothing to sneeze at. Congrats! Personally, if i've saved up a lump sum like that and assuming all else is covered (buffer fund, insurance, etc.), i would: a. Filter mutual equity funds to go into b. Select 2 to 3 very different funds, with good returns for 10yrs (if possible), 5yrs & 3yrs eg. PFES, PRSEC & PFEPRF if U want to use cash for foreign mixed which i do. EPF is used for local mix like PIX, PSSF & PAGF c. Take 50% of the sum, say $30K (i'm just example-ing here k, not exactly 50% of your $70k. Momma's boy can count This $30K, i'd apportion to these 3 funds, eg. $10K each Then, each fund, i'd stick to doing it for at least 3 years, thus that's $3,333.33 each year I'd do the investment every 3 months (qtr), thus, that's $1,111.11 each period Then comes the hard part - to do this using DCA or VCA or combination (TwinVest)? heheh - knowing me, i'd do TwinVest See how it works out? That's JUST THE ENTRY PLAN example. U can leave yr $ allocated for these in cash OR put into Bond fund and then switch the value as needed every quarter. BTW, the remainder i'll leave in Bond fund until i figure out what to do with it - most probably learn about REITs and then go after that EXIT PLAN example: When will i take profit or cut loss for mutual funds? 1. Take /lock in profits I'd do this when there's super abnormal profits - eg. when i know statistically that returns on average for equity funds are about 7%pa to 10%pa, if any of my transaction hits like 20%pa to 25%pa OR like 50% to 60% in less than 1 year, i'd take some $ off the table 2. How much to take / lock-in profits? All? 50%? 66.66%? Me - i'd take the cost + expected profits off the table (switch back to Bond fund and await to be reused) eg. cost +10%pa, and leave the abnormal profits to keep running if it keeps going up at least i've gotten my expectations already AND those $ is still earning me % in Bond Funds 3. Cut loss er.. i wont do this if i'm using Value Averaging or TwinVest. The risk is already mitigated (not entirely though) by putting in less $ when prices are high, thus unused capital is available to buy more when prices go down. Whew.. sorry ar, long winded stuff. Just wanted to share. MOIS - i think i've answered your Q here too Added on August 8, 2011, 9:08 pm Most probably REITs as in stock market's REITs. Real Estate Investment Trusts like BSDREIT, TWRREIT, AXIS, SUNREIT, etc. PM's closest fund i think to a REITs fund is PFEPRF - Pub Far East Properties & Resorts Fund. Pls correct me if i'm mistaken / lalaland Btw, during the every 3 months investment, do you recommend 'switch' to different funds or just apply DCA or VCA in bull/bear run? PIX (Public Index Fund), PSSF (Public Sector Select Fund) & PAGF (Public Aggressive Growth Fund)... all these funds are equity/aggressive funds (high equity ration/highr risk/high return)? Thanks. This post has been edited by lowyat2011: Aug 8 2011, 09:25 PM |

|

|

Aug 8 2011, 09:49 PM Aug 8 2011, 09:49 PM

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 8 2011, 09:00 PM) » Click to show Spoiler - click again to hide... « Personally, if i've saved up a lump sum like that and assuming all else is covered (buffer fund, insurance, etc.), i would: a. Filter mutual equity funds to go into b. Select 2 to 3 very different funds, with good returns for 10yrs (if possible), 5yrs & 3yrs eg. PFES, PRSEC & PFEPRF if U want to use cash for foreign mixed which i do. EPF is used for local mix like PIX, PSSF & PAGF c. Take 50% of the sum, say $30K (i'm just example-ing here k, not exactly 50% of your $70k. Momma's boy can count This $30K, i'd apportion to these 3 funds, eg. $10K each Then, each fund, i'd stick to doing it for at least 3 years, thus that's $3,333.33 each year I'd do the investment every 3 months (qtr), thus, that's $1,111.11 each period Then comes the hard part - to do this using DCA or VCA or combination (TwinVest)? heheh - knowing me, i'd do TwinVest See how it works out? That's JUST THE ENTRY PLAN example. U can leave yr $ allocated for these in cash OR put into Bond fund and then switch the value as needed every quarter. » Click to show Spoiler - click again to hide... « So is it recommended to pump in money periodically? can I just put in i.e. 10k from the start and let it grow for years or is that a stupid move? |

|

|

|

|

|

Aug 8 2011, 09:51 PM Aug 8 2011, 09:51 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(mois @ Aug 8 2011, 09:14 PM) This the the hard part to understand bro Brudder - if U are around Klang Valley, i can show & tell U easily. Other than that, go buy that book lar - i bluff U for what, no commission or royalty from that book Added on August 8, 2011, 10:02 pm QUOTE(lowyat2011 @ Aug 8 2011, 09:23 PM) Wow! this is what I am looking for... 'A ENTRY PLAN', the hardest part to understand is the 'TwinVest'... like a secret weapon used by sifu in the last moment of a kungfu show Heheh - It's definitely no secret and no... (firstly i'm always a student, not seafood) i dont use it at the last moment. The trick is to CONSISTENTLY use it or work the plan Btw, during the every 3 months investment, do you recommend 'switch' to different funds or just apply DCA or VCA in bull/bear run? PIX (Public Index Fund), PSSF (Public Sector Select Fund) & PAGF (Public Aggressive Growth Fund)... all these funds are equity/aggressive funds (high equity ration/highr risk/high return)? Thanks. Hm.. i'm a bit unclear about yr Q. Perhaps i clarify the 3mths yar 1. IF my ammo is in cash, then i use PM Online to inject the cash, amount = as advised by the formulas of VCA/TwinVest/DCA. 2. IF i stored my ammo in Bond Funds, i'd then need an extra step to calculate the units = amount i need to inject. Again, amount = as advised by the formulas of VCA/TwinVest/DCA. 3. Whether BULL or BEAR or side-ways market, the thing is to work the plan, track & manage (ie. tweak the plan IF necessary). Look, in BULL market as it gets higher and higher, VCA & TwinVest puts in lower and lower amounts of $, thus saving me from a correction / return to mean. Notice SHTF usually when market have hit highs? Side Q: Why 3 months period or 6 months period? Simple - funds hardly move enough every month, thus why bother? Not much difference and if U do it too often/fast, U lose the effect of Value averaging. eg. Think of it this way - would U do Asset Re-balancing EVERY month? Or Every Year? hhehe - things can get more complicate for Asset Re-balancing if i added - every month check only and if more than XX% unbalanced, then only rebalance And you're welcome - thanks for absorbing and clarifying Added on August 8, 2011, 10:10 pm QUOTE(monsta2011 @ Aug 8 2011, 09:49 PM) So is it recommended to pump in money periodically? can I just put in i.e. 10k from the start and let it grow for years or is that a stupid move? eg. Some ppl invest blindly overseas (FX, Stocks, etc.) making good $. Yeah great How to bring back ar? Or moving there? What if something happens to U, how will your inheritors get to your assets/$? Wei - fly to UK/US, stay there for a few days/weeks to clear things up using THEIR legal, etc. Cheap hor? My approach, IMHO is to control risk & yet optimize profits. However, if U do as the ideas i've presented, U may come & kill me IF the market went shooting sky high. Thus IF U put in lump sum $10K, you'd do much MUCH better vs TwinVest / VCA / DCA periodically. a. I'd do lump sum 33% only if the market has ALREADY crashed at least 20%+. b. Thus, i got 2/3 capital unused left to average down (this isn't trading yar, averaging down is ok for diversified stuff like funds, and good funds only) IF it continues south to 40%+ down like end 2008, i'd put another 33% c. and IF it goes south like 1997/1998 i've got another 33% left to grab it all and sit on them till 3 to 5 years, then.. FAT TATT man! BTW, i'm not preaching both methods - it's in my entry plans for investments (mutual funds + stocks + REITs + Properties). 50% cold hard logic, no fear, no greed (TwinVest with mutual funds) 50% value oriented (stocks, REITs, Properties) Nope - not doing FOREX or Futures or Options yet. Haven't even mastered one type of stocks trading, better not hehe. Own self know own limitations and "stretchability". This post has been edited by wongmunkeong: Aug 8 2011, 10:15 PM |

|

|

Aug 8 2011, 10:18 PM Aug 8 2011, 10:18 PM

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

QUOTE(monsta2011 @ Aug 8 2011, 09:49 PM) So is it recommended to pump in money periodically? can I just put in i.e. 10k from the start and let it grow for years or is that a stupid move? |

|

|

Aug 8 2011, 10:27 PM Aug 8 2011, 10:27 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(mois @ Aug 8 2011, 10:18 PM) Depend bro. But to grow 10k into 20k which is 100% gain need some brains and times. All you need to know is how things work. Just dont spend too much times on it. At the end of the day, you might realise the times you used to learn advance investing skills can be used for other purposes. Think how to increase income first, then proceed slowly into investing. Hm.. IMHO, beware of what U wish for IF U dont have any exit plans.eg. U chase a career and find that U've "gotten there". However, other than $ and perks, U also have lots of stress, too little time for yrself or yr loved ones. Hey, i'm still assuming your health is still good even with all that stress. Now, the question is - how to exit? ie. U make a lot of $ but U dont have the time to spend it + your loved ones are beginning to look like strangers... U may go like - holy crap, this isn't what i bargained for for the next 15+/- years! I'm assuming U hit your peak at 40ish lar, thus have 10s of years to suffer Ever thought about this? Sorry mods - wrong topic. Done to emphasize importance of EXIT PLANS. |

|

|

Aug 9 2011, 01:32 AM Aug 9 2011, 01:32 AM

|

Junior Member

432 posts Joined: Jul 2011 |

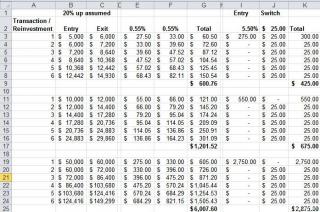

QUOTE(wongmunkeong @ Aug 8 2011, 09:51 PM) Different strokes for different folks. BTW, what's your exit plans? Sitting on it until....? Always have exit plans else U will get into a bind. my exit plan... um... QUOTE(wongmunkeong @ Aug 8 2011, 09:51 PM) eg. Some ppl invest blindly overseas (FX, Stocks, etc.) making good $. Yeah great The costs are peanuts when compared to the multi million dollar assets How to bring back ar? Or moving there? What if something happens to U, how will your inheritors get to your assets/$? Wei - fly to UK/US, stay there for a few days/weeks to clear things up using THEIR legal, etc. Cheap hor? QUOTE(wongmunkeong @ Aug 8 2011, 09:51 PM) My approach, IMHO is to control risk & yet optimize profits. I see However, if U do as the ideas i've presented, U may come & kill me IF the market went shooting sky high. Thus IF U put in lump sum $10K, you'd do much MUCH better vs TwinVest / VCA / DCA periodically. a. I'd do lump sum 33% only if the market has ALREADY crashed at least 20%+. b. Thus, i got 2/3 capital unused left to average down (this isn't trading yar, averaging down is ok for diversified stuff like funds, and good funds only) IF it continues south to 40%+ down like end 2008, i'd put another 33% c. and IF it goes south like 1997/1998 i've got another 33% left to grab it all and sit on them till 3 to 5 years, then.. FAT TATT man!BTW, i'm not preaching both methods - it's in my entry plans for investments (mutual funds + stocks + REITs + Properties). 50% cold hard logic, no fear, no greed (TwinVest with mutual funds) 50% value oriented (stocks, REITs, Properties) Nope - not doing FOREX or Futures or Options yet. Haven't even mastered one type of stocks trading, better not hehe. Own self know own limitations and "stretchability". QUOTE(wongmunkeong @ Aug 3 2011, 01:52 PM) 6 transactions/reinvestments using stocks (0.55% per buy/sell assumed) and equity mutual funds (5.5% and $25), at 3 amount of investable $ - $5K, $10K and $50K, assuming 20% net profits each round. by the way i would like to point back to your excel last week, it shows that the 5.5% service charge for equity mutual fund is a one-off payment.. um.. the excel also shows a one-off contribution right? so any subsequent contributions will still incur the 5.5% fee? I hope I read the excel the right way

This post has been edited by monsta2011: Aug 9 2011, 01:37 AM |

|

|

Aug 9 2011, 09:18 AM Aug 9 2011, 09:18 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(monsta2011 @ Aug 9 2011, 01:32 AM) my exit plan... um... Well, if one's a multi-million or billionaire, no issue mar. by the way i would like to point back to your excel last week, it shows that the 5.5% service charge for equity mutual fund is a one-off payment.. um.. the excel also shows a one-off contribution right? so any subsequent contributions will still incur the 5.5% fee? I hope I read the excel the right way How many flers U know personally does investing overseas VS flers that U personaly know AND investing overseas AND are multi-millionaires? Very very small % are multi-millionaires right? if not, hey dude - whatcha doing here? U should be teaching & guiding us how to network with them mega-rich folks and also how to manage $ like a millionaire On the Excel example, please notice that a. I just used the STARTING amount (row 1 of each set of data), b. added 20% profits (assuming a few months or years passed after (a.) ) c. sold / switch it out of equity d. Bought back in / switched in back into equity (assuming a few months or years passed after (c.) ) Rinse and repeat Thus, seed capital is the starting amount and the only "out of pocket" original outlay, no additional $ was put in. This is to easily see the costs in % over the years / multiples of transactions. If i put in real-world additions, i think it'll muddle it up until 99% of forumers will be cursing me All subsequent contributions for mutual funds DOESNT INCUR THE 5.5% FEE IF USING SWITCHING. That's the concept of "how expensive/cheap in % vs transaction value OVER TIME Stocks Vs Mutual Funds" i'm trying to convey. This post has been edited by wongmunkeong: Aug 9 2011, 09:19 AM |

|

|

Aug 9 2011, 10:20 AM Aug 9 2011, 10:20 AM

|

Junior Member

311 posts Joined: Mar 2005 From: Kuala Lumpur |

QUOTE(wongmunkeong @ Aug 9 2011, 09:18 AM) » Click to show Spoiler - click again to hide... « All subsequent contributions for mutual funds DOESNT INCUR THE 5.5% FEE IF USING SWITCHING. That's the concept of "how expensive/cheap in % vs transaction value OVER TIME Stocks Vs Mutual Funds" i'm trying to convey. |

|

|

Aug 9 2011, 11:00 AM Aug 9 2011, 11:00 AM

|

Senior Member

952 posts Joined: Feb 2011 |

QUOTE(8181 @ Aug 9 2011, 10:20 AM) I'm still in the blur when you say all subsequent contributions for mutual funds doesn't incur the 5.5% fee. Do you mean if I switch my current PM saving funds to another fund this will not incur any 5.5% fees? to make it simple.1. if u pay more then 0.25% as service charge on any funds, u not need to pay SC when u switching. 2. if u only pay SC 0.25%, so , u need to pay SC for switching for equity/balance funds. its clearly stated in prospectus on switching. low-loaded units =bond/money market= 0.25% SC loaded units = equity/balanced = more than 0.25% SC |

|

Topic ClosedOptions

|

| Change to: |  0.0228sec 0.0228sec

2.28 2.28

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 07:44 PM |