What's the difference between a 'return %' and a 'yield %'?

Lets say a fund that generated a return of 18% and a yield of 6%, what do the two percentages really mean?

Public Mutual v2, PB/Public series

Public Mutual v2, PB/Public series

|

|

Aug 2 2011, 02:09 AM Aug 2 2011, 02:09 AM

Return to original view | Post

#1

|

Junior Member

432 posts Joined: Jul 2011 |

What's the difference between a 'return %' and a 'yield %'?

Lets say a fund that generated a return of 18% and a yield of 6%, what do the two percentages really mean? |

|

|

|

|

|

Aug 2 2011, 01:47 PM Aug 2 2011, 01:47 PM

Return to original view | Post

#2

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 2 2011, 10:34 AM) Returns = usually capital growth + dividends calculated Thank you Yield = usually only dividends calculated Thus, returns of REIT A = 13% which consist of 7% from Dividend yield + 6% from Capital growth (ie. price of stock) In this context, REIT A's returns = 13% and its Dividend Yield = 7% Good? |

|

|

Aug 3 2011, 12:30 PM Aug 3 2011, 12:30 PM

Return to original view | Post

#3

|

Junior Member

432 posts Joined: Jul 2011 |

The fees are quite scary for equity and balanced funds

- Service Charge per unit 5.5% of NAV/unit - Transfer charge RM25 - Annual mgmt fee 1.5-1.8% p.a. of NAV amount (fees varies across funds) - Annual Trustee fee 0.06-0.08% or minimum RM 18,000-60,000. (fees varies across funds) The fees and charges are like >7%, so does that mean a fund have to have at least >7% return to cover all the bloody fees? On the other hand, Stock Exchange only charge commision and brokerage fee of less than 1%. This post has been edited by monsta2011: Aug 3 2011, 12:31 PM |

|

|

Aug 3 2011, 06:01 PM Aug 3 2011, 06:01 PM

Return to original view | Post

#4

|

Junior Member

432 posts Joined: Jul 2011 |

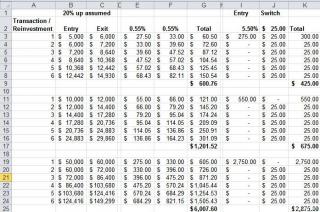

QUOTE(wongmunkeong @ Aug 3 2011, 01:52 PM) Each vehicle has its own pros & cons lor. Use a spreadsheet and do a head to head calc eg. Stocks - to & fro transaction cost is about 1%+ Mutual funds - buying is about 3.6%+ + switching $25 However, simulate it for a few times and increasing quantity of $ U may notice, depending on how much U transact for stocks, that mutual funds may be "cheaper" in the long run. Remember, the equity service charge is once-off. IF U switch it to bonds/MM to lock in profits, and back to equities when equities are low, it's only $25 or free (depending on mutual gold or etc.). Imagine moving $500K using $25 switching fee or $0. Heck, imagine moving $1M or more using $25. How many percent is that ar? Do that a few times and see the transactions' cost difference between stocks and mutual funds Next, mgt fees, trustee fees, etc. Say U have $5K to invest If U put into stocks, cost effectively U can only buy into 1 or max 2 stocks If U put into equity funds, it straight away diversifies yr $ into 10 or more stocks. Mind U, i aint saying that mutual funds are silver bullets but it has it's uses, especially for the extreme lower investments (cost effective - try buying stocks directly with $100, see how much the commission, etc. is as a % of the value of the stocks U bought) and extreme higher amount of investments (switching at $0 or $25). Note - i use both vehicles myself AND to lower my own cost (thus increasing probability of profits), i'm my own agent Since i had time to kill inbetween meetings, see the attached. 6 transactions/reinvestments using stocks (0.55% per buy/sell assumed) and equity mutual funds (5.5% and $25), at 3 amount of investable $ - $5K, $10K and $50K, assuming 20% net profits each round. [attachmentid=2366152] |

|

|

Aug 3 2011, 07:00 PM Aug 3 2011, 07:00 PM

Return to original view | Post

#5

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(gark @ Aug 3 2011, 06:28 PM) Umm.. if you read in the annual report of the mutual funds you will see that, the trading/administrative costs are already charged to you. So in mutual funds, those with heavy turnover (ie. >1), you can expect to add another 2% as brokerage fees. Mind if I ask if turnover = management fee? Sorry I'm a beginner That is why I often select funds which have turnover not more than 2. otherwise the manager is trading and not investing for you. Trading costs are not transparent, but it is better to ensure that the fund have policy of not accepting soft commissions. otherwise the trading costs will be relatively higher. |

|

|

Aug 8 2011, 12:51 AM Aug 8 2011, 12:51 AM

Return to original view | Post

#6

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 6 2011, 01:11 AM) You're welcome. Last idea to bounce off U - if U are investing $10K or more per year via EPF (or $7K-ish cash), then it may be worth your while to be your own agent. Reason: EPF to Equity Funds' 3% service charges - 2% goes to the agent Cash to Equity Funds' 5.5% service charges - 2.75% goes to the agent Cost of being an agent: Initial year $250 subsequent years $100ish $90 for them software which U can access donkey loads of historical prices and statistics like the one i posted Does that mean you pocket your own agent fees? |

|

|

|

|

|

Aug 8 2011, 02:37 PM Aug 8 2011, 02:37 PM

Return to original view | Post

#7

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 8 2011, 11:53 AM) IMHO, it depends on what was / is your entry rule. i'm ass-u-me-ing U dont have clearly defined exit rules, thus U are asking this Q Bro, what are the formulas for the last two columns? The rates are very impressive! If you're doing lump sum / trend riding, YES! Get out! If you're doing TwinVest / VCA - heheh, your risk of market falling ALREADY taken into account for your entry - ie. the fomula stopped U from putting much $ in coz market was high-ish AND as it goes down, U use your unused capital to get more If you're doing DCA - I'd split some to bonds. BTW, just for statistics, attached is a monthly transaction list of investment into PBOND - checkout the last 2 columns, see the PER ANNUM RETURNS growing? Reminds me of post 1997/1998 where PBOND went up to about 10%+pa. Hope this use-less stats help your decision making [attachmentid=2374732] Added on August 8, 2011, 11:55 am Wah bro - loaded Q leh Either answer also die. The smartest answer would be... it depends... Also, what fees were inccurred each time you pump in the money? |

|

|

Aug 8 2011, 03:11 PM Aug 8 2011, 03:11 PM

Return to original view | Post

#8

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 8 2011, 02:54 PM) Huh? I got it I got it The 2nd last column = simple returns Current Value of Transaction / Cost of Transaction The last column = pa returns ( Current Value of Transaction / Total Cost of Transaction ) ^( 1 / ( (Current Date -Purchase Date)/364.25) ) -1 Cost for PBOND = 0.25% Impressive? bwhahaah this is bond fund wor - U should see the Equity Funds' i'm doing. Anyhow, i'm just sharing something - PBond's returns seem to be going up, like in 1998 to 2003/2004. Those days it was hitting about 10%+ to 11%+ pa!! With the cost is it just 0.25% nothing else? That is so good I only have a small capital currently parking at FD |

|

|

Aug 8 2011, 06:23 PM Aug 8 2011, 06:23 PM

Return to original view | Post

#9

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 8 2011, 03:19 PM) Dont rush. When rushing, mistakes / lapse of judgement happens. By the way do you think RM70K is sufficient to go for investment? That is all that I have in bank Build a strong base first - debt free (other than property loans maybe), good buffer / emergency funds, enough insurance, then only start getting into Equities. If U are totally new, i'd suggest a simple 50% bonds + 50% equities asset allocation OR 33% bonds + 33% Equities exREITs/Properties + 33% REITs/Properties. The 1% U figure out where to put This post has been edited by monsta2011: Aug 8 2011, 06:24 PM |

|

|

Aug 8 2011, 07:09 PM Aug 8 2011, 07:09 PM

Return to original view | Post

#10

|

Junior Member

432 posts Joined: Jul 2011 |

.

Added on August 8, 2011, 7:17 pm QUOTE(wongmunkeong @ Aug 8 2011, 06:41 PM) Yup but i wont go banzai and dump in one shot lump sum, UNLESS the market fell like a stone already and U see the heart beat nearly flat.... then ok. Even then, i'd suggest lump sum 50% only, hold the other lump sum until U see the trend is starting to go up. Just my thoughts - no hard & fast rules. I believe I have enough cash for emergency use, ya? and like you said, put 50% which is ard 35k into investment first and see the trend.. or I should start from low risk investment first like bond? by the way bond is not subject to 5.5% commission like the mutual fund right? I am prepared to lock my money for long term in fact i have that cash sitting in FD for 2 yrs already Before investments, U've covered all the other stuff like i've mentioned? if not, U better cover those first - imho, any $ ear-marked/dumped into investments should be thought of as $ gone into a timehole for 5 to 10years, ie. cant touch this (hammer time!). Reason: If U suddenly need the $, U may be forced to sell at a loss. Added on August 8, 2011, 7:20 pm QUOTE(kparam77 @ Aug 8 2011, 07:06 PM) keep some in bank as emergency fund. don't put all the money in place. my risk tolerance is moderate maybe 20% in FD 50% stock 30% in UT. or it depends how u plan with ur risk tolerance VS urs age factor. This post has been edited by monsta2011: Aug 8 2011, 07:20 PM |

|

|

Aug 8 2011, 08:38 PM Aug 8 2011, 08:38 PM

Return to original view | Post

#11

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(mois @ Aug 8 2011, 07:21 PM) RM70k..depend on your age. Active or passive investor? if early 20s and no time to do research on stocks, convert it into UT form then. Let the managers/analysts do the job. Depend on your monthly saving also. If I were you, i dont mind to put a little heavier on equity. 60% equity 40% bond. QUOTE(kparam77 @ Aug 8 2011, 07:46 PM) u r just in 20's. and u r a moderate risk tolerance person. Thanks. I've been doing a lot of reading/research these past two months and would love to follow the footsteps of some of the sifus here. I was told in my late teen that i need to save some money before i can start investing. Now that I have save some (probably not enough) I plan to invest but am hesitating a lot. BOND = conservative = EPF. i believe u hv EPF. than u can put cash in BOND lesser than others. well my suggestion only. my EPF = MY bond at the moments. plan to transfer some equity funds to BOND when I reach 50 to 55 yrs old. now production time for growing my money in equity funds. 50%/50% = moderate/aggressive. Anyway no pain no gain.... This post has been edited by monsta2011: Aug 8 2011, 08:40 PM |

|

|

Aug 8 2011, 09:49 PM Aug 8 2011, 09:49 PM

Return to original view | Post

#12

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 8 2011, 09:00 PM) » Click to show Spoiler - click again to hide... « Personally, if i've saved up a lump sum like that and assuming all else is covered (buffer fund, insurance, etc.), i would: a. Filter mutual equity funds to go into b. Select 2 to 3 very different funds, with good returns for 10yrs (if possible), 5yrs & 3yrs eg. PFES, PRSEC & PFEPRF if U want to use cash for foreign mixed which i do. EPF is used for local mix like PIX, PSSF & PAGF c. Take 50% of the sum, say $30K (i'm just example-ing here k, not exactly 50% of your $70k. Momma's boy can count This $30K, i'd apportion to these 3 funds, eg. $10K each Then, each fund, i'd stick to doing it for at least 3 years, thus that's $3,333.33 each year I'd do the investment every 3 months (qtr), thus, that's $1,111.11 each period Then comes the hard part - to do this using DCA or VCA or combination (TwinVest)? heheh - knowing me, i'd do TwinVest See how it works out? That's JUST THE ENTRY PLAN example. U can leave yr $ allocated for these in cash OR put into Bond fund and then switch the value as needed every quarter. » Click to show Spoiler - click again to hide... « So is it recommended to pump in money periodically? can I just put in i.e. 10k from the start and let it grow for years or is that a stupid move? |

|

|

Aug 9 2011, 01:32 AM Aug 9 2011, 01:32 AM

Return to original view | Post

#13

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 8 2011, 09:51 PM) Different strokes for different folks. BTW, what's your exit plans? Sitting on it until....? Always have exit plans else U will get into a bind. my exit plan... um... QUOTE(wongmunkeong @ Aug 8 2011, 09:51 PM) eg. Some ppl invest blindly overseas (FX, Stocks, etc.) making good $. Yeah great The costs are peanuts when compared to the multi million dollar assets How to bring back ar? Or moving there? What if something happens to U, how will your inheritors get to your assets/$? Wei - fly to UK/US, stay there for a few days/weeks to clear things up using THEIR legal, etc. Cheap hor? QUOTE(wongmunkeong @ Aug 8 2011, 09:51 PM) My approach, IMHO is to control risk & yet optimize profits. I see However, if U do as the ideas i've presented, U may come & kill me IF the market went shooting sky high. Thus IF U put in lump sum $10K, you'd do much MUCH better vs TwinVest / VCA / DCA periodically. a. I'd do lump sum 33% only if the market has ALREADY crashed at least 20%+. b. Thus, i got 2/3 capital unused left to average down (this isn't trading yar, averaging down is ok for diversified stuff like funds, and good funds only) IF it continues south to 40%+ down like end 2008, i'd put another 33% c. and IF it goes south like 1997/1998 i've got another 33% left to grab it all and sit on them till 3 to 5 years, then.. FAT TATT man!BTW, i'm not preaching both methods - it's in my entry plans for investments (mutual funds + stocks + REITs + Properties). 50% cold hard logic, no fear, no greed (TwinVest with mutual funds) 50% value oriented (stocks, REITs, Properties) Nope - not doing FOREX or Futures or Options yet. Haven't even mastered one type of stocks trading, better not hehe. Own self know own limitations and "stretchability". QUOTE(wongmunkeong @ Aug 3 2011, 01:52 PM) 6 transactions/reinvestments using stocks (0.55% per buy/sell assumed) and equity mutual funds (5.5% and $25), at 3 amount of investable $ - $5K, $10K and $50K, assuming 20% net profits each round. by the way i would like to point back to your excel last week, it shows that the 5.5% service charge for equity mutual fund is a one-off payment.. um.. the excel also shows a one-off contribution right? so any subsequent contributions will still incur the 5.5% fee? I hope I read the excel the right way

This post has been edited by monsta2011: Aug 9 2011, 01:37 AM |

|

|

|

|

|

Aug 9 2011, 11:47 AM Aug 9 2011, 11:47 AM

Return to original view | Post

#14

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 9 2011, 09:18 AM) Well, if one's a multi-million or billionaire, no issue mar. How many flers U know personally does investing overseas VS flers that U personaly know AND investing overseas AND are multi-millionaires? Very very small % are multi-millionaires right? if not, hey dude - whatcha doing here? U should be teaching & guiding us how to network with them mega-rich folks and also how to manage $ like a millionaire On the Excel example, please notice that a. I just used the STARTING amount (row 1 of each set of data), b. added 20% profits (assuming a few months or years passed after (a.) ) c. sold / switch it out of equity d. Bought back in / switched in back into equity (assuming a few months or years passed after (c.) ) Rinse and repeat Thus, seed capital is the starting amount and the only "out of pocket" original outlay, no additional $ was put in. This is to easily see the costs in % over the years / multiples of transactions. If i put in real-world additions, i think it'll muddle it up until 99% of forumers will be cursing me All subsequent contributions for mutual funds DOESNT INCUR THE 5.5% FEE IF USING SWITCHING. That's the concept of "how expensive/cheap in % vs transaction value OVER TIME Stocks Vs Mutual Funds" i'm trying to convey. So, like for example, i put rm 100 (first contribution) in i'll ended up with $94.5 in the fund and the following contribution, say, rm 10,000,000 is free of charge |

|

|

Aug 9 2011, 12:22 PM Aug 9 2011, 12:22 PM

Return to original view | Post

#15

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 9 2011, 12:04 PM) No... your initial units which U received for $94.5, when U switch to bond, then back to equity, etc. - $25 only or free (if Mut Gold and switched less than X times a year). Dude - look at the snapshot example. It's a lump sum (transaction 1) which goes up 20%, switched to bonds... then later switched back to equity and rises 20% again, then switched back to bonds (rinse and repeat). The same loaded Units growing and switched. If I put in $1K only now and later dump in $500K and no service charges, U think PM doing charity meh QUOTE(kparam77 @ Aug 9 2011, 12:14 PM) Ok I got it Added on August 9, 2011, 12:42 pmBy the way, if a fund has a historical 3 yr return of 35%, to get the p.a. return is it calculated this way (∛1.35 - 1) x100% = 10.52% p.a.? This post has been edited by monsta2011: Aug 9 2011, 12:45 PM |

|

|

Aug 9 2011, 01:41 PM Aug 9 2011, 01:41 PM

Return to original view | Post

#16

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 9 2011, 01:34 PM) (∛1.35 - 1) x100% Oh haha, if work it backward it's like [(1.1052^3)-1] x100% = 35% hehe i hope that's righter.. hehe - gimme a few minutes to digest maths equation (told U i'm a simpleton If Excel i can digest easily lar.. square root of 3 coz it's the years.. ok.. right 1.35 = coz 100% +35% returns? er.. no idea - i usually fill in the $ to get the R as in S = P *(1+R%)^n Let me Excel-ize it and test - stay tuned bwhahaah (that's what U get for testing me when i'm not on caffeine) Added on August 9, 2011, 1:43 pm QUOTE(kucingfight @ Aug 9 2011, 01:37 PM) Eg.[(135/100)^(1/3)] - 1 = 0.1052 This post has been edited by monsta2011: Aug 9 2011, 01:47 PM |

|

|

Aug 9 2011, 01:57 PM Aug 9 2011, 01:57 PM

Return to original view | Post

#17

|

Junior Member

432 posts Joined: Jul 2011 |

QUOTE(wongmunkeong @ Aug 9 2011, 01:49 PM) Dagnabit maths boy, stop with those funny looking stuff ∛. I only know "square root" Added on August 9, 2011, 1:51 pm |

|

|

Aug 9 2011, 02:18 PM Aug 9 2011, 02:18 PM

Return to original view | Post

#18

|

Junior Member

432 posts Joined: Jul 2011 |

|

|

|

Aug 9 2011, 02:24 PM Aug 9 2011, 02:24 PM

Return to original view | Post

#19

|

Junior Member

432 posts Joined: Jul 2011 |

|

|

|

Aug 9 2011, 03:05 PM Aug 9 2011, 03:05 PM

Return to original view | Post

#20

|

Junior Member

432 posts Joined: Jul 2011 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0487sec 0.0487sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 01:53 PM |