QUOTE(mois @ Aug 8 2011, 09:14 PM)

This the the hard part to understand bro

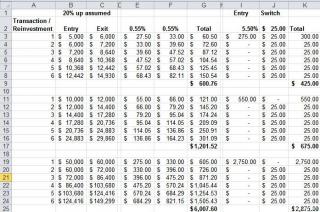

Twinvest. I think few of us know how it works exactly. From general, i only know it involves 25% DCA and 75% VCA.

Brudder - if U are around Klang Valley, i can show & tell U easily. Other than that, go buy that book lar - i bluff U for what, no commission or royalty from that book

Added on August 8, 2011, 10:02 pmQUOTE(lowyat2011 @ Aug 8 2011, 09:23 PM)

Wow! this is what I am looking for... 'A ENTRY PLAN', the hardest part to understand is the 'TwinVest'... like a secret weapon used by sifu in the last moment of a kungfu show

Btw, during the every 3 months investment, do you recommend 'switch' to different funds or just apply DCA or VCA in bull/bear run? PIX (Public Index Fund), PSSF (Public Sector Select Fund) & PAGF (Public Aggressive Growth Fund)... all these funds are equity/aggressive funds (high equity ration/highr risk/high return)?

Thanks.

Heheh - It's definitely no secret and no... (firstly i'm always a student, not seafood) i dont use it at the last moment. The trick is to CONSISTENTLY use it or work the plan

Last moment use it and win = pure dumb luck OR an illegal / dirty move

Hm.. i'm a bit unclear about yr Q. Perhaps i clarify the 3mths yar

1. IF my ammo is in cash, then i use PM Online to inject the cash, amount = as advised by the formulas of VCA/TwinVest/DCA.

2. IF i stored my ammo in Bond Funds, i'd then need an extra step to calculate the units = amount i need to inject. Again, amount = as advised by the formulas of VCA/TwinVest/DCA.

3. Whether BULL or BEAR or side-ways market, the thing is to work the plan, track & manage (ie. tweak the plan IF necessary). Look, in BULL market as it gets higher and higher, VCA & TwinVest puts in lower and lower amounts of $, thus saving me from a correction / return to mean. Notice SHTF usually when market have hit highs?

Side Q: Why 3 months period or 6 months period?

Simple - funds hardly move enough every month, thus why bother? Not much difference and if U do it too often/fast, U lose the effect of Value averaging.

eg. Think of it this way - would U do Asset Re-balancing EVERY month? Or Every Year?

hhehe - things can get more complicate for Asset Re-balancing if i added - every month check only and if more than XX% unbalanced, then only rebalance

- okok that's for another day yar.

And you're welcome - thanks for absorbing and clarifying

Added on August 8, 2011, 10:10 pmQUOTE(monsta2011 @ Aug 8 2011, 09:49 PM)

Thank you thank you.

So is it recommended to pump in money periodically? can I just put in i.e. 10k from the start and let it grow for years or is that a stupid move?

Different strokes for different folks. BTW, what's your exit plans? Sitting on it until....? Always have exit plans else U will get into a bind.

eg. Some ppl invest blindly overseas (FX, Stocks, etc.) making good $. Yeah great

How to bring back ar? Or moving there?

What if something happens to U, how will your inheritors get to your assets/$? Wei - fly to UK/US, stay there for a few days/weeks to clear things up using THEIR legal, etc. Cheap hor?

My approach, IMHO is to control risk & yet optimize profits.

However, if U do as the ideas i've presented, U may come & kill me IF the market went shooting sky high. Thus IF U put in lump sum $10K, you'd do much MUCH better vs TwinVest / VCA / DCA periodically.

a. I'd do lump sum 33% only if the market has ALREADY crashed at least 20%+.

b. Thus, i got 2/3 capital unused left to average down (this isn't trading yar, averaging down is ok for diversified stuff like funds, and good funds only) IF it continues south to 40%+ down like end 2008, i'd put another 33%

c. and IF it goes south like 1997/1998 i've got another 33% left to grab it all and sit on them till 3 to 5 years, then.. FAT TATT man!

BTW, i'm not preaching both methods - it's in my entry plans for investments (mutual funds + stocks + REITs + Properties).

50% cold hard logic, no fear, no greed (TwinVest with mutual funds)

50% value oriented (stocks, REITs, Properties)

Nope - not doing FOREX or Futures or Options yet. Haven't even mastered one type of stocks trading, better not hehe. Own self know own limitations and "stretchability".

This post has been edited by wongmunkeong: Aug 8 2011, 10:15 PM

Aug 8 2011, 06:54 PM

Aug 8 2011, 06:54 PM

Quote

Quote

0.0321sec

0.0321sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled