Hello everyone...

Don't see much sharing about these 'agents', so just to share on my experience.

Was approached by them for DMP, explaining on standard things like consolidating all the personal loans and credit cards into a 10 year repayment with step-up monthly repayment. For example,

1. Year 1 - Year 2 >> RM1000

2. Year 3 - Year 4 >> RM1500

3. Year 5 - Year 6 >> RM2000

4. Year 7 - Year 10 >> RM2500

The 'agents' will be transparent saying you can personally apply without any charges, but it'll be troublesome to submit documents, meeting with the counsellor, attending counselling sessions and even the interest rates will be high. By using their services, for a sum of 8% - 10%, the process will be more straighforward and with high approval rate.

They do seem legit, with physical office and even can meet them there as to provide you with a sense of security (not just scam money, but not getting the DMP).

However, I was lucky to not went through with them. As the process of applying directly is pretty much hassle free. Approval takes about 7 working days, with the same kind of step-up monthly repayment.

For anyone looking to get DMP, please do not listen to these 'agents' as the process of applying directly is just the same as using their services. They don't 'scam' you, but just making a quick buck out of our financial predicament.

Do not hesitate if there's unmanageable debts. Start early, clear the debts and plan your finances accordingly. Good luck all!

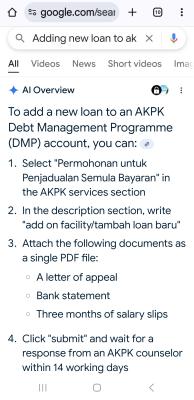

Currently i'm under DMP, 2 CC's and 1 personal loan. I'm planning to clear one of the CC. And continue the DMP. Is that possible ? Anyone has done this ?

If monthly im paying 1.6k for PL, i ask for 400 per month, will that be approve?

Dec 24 2024, 03:06 PM

Dec 24 2024, 03:06 PM

Quote

Quote

0.0210sec

0.0210sec

0.45

0.45

6 queries

6 queries

GZIP Disabled

GZIP Disabled