QUOTE(janson_kaniaz @ Jan 21 2017, 09:06 AM)

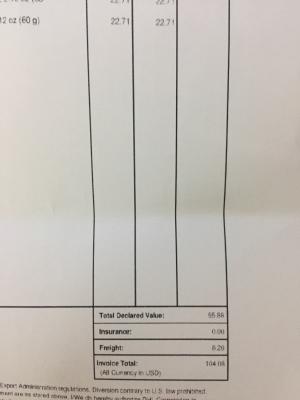

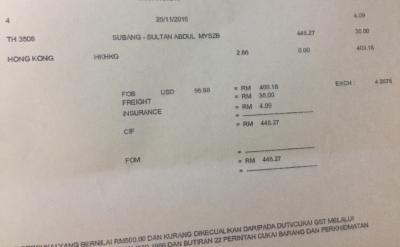

Just got the K1 form from DHL. To my horror the custom has charged me $100 additional for shipping. My merchant gave me free shipping for spending above $100. I'm not sure who to complain now and what options do I have? I don't think I will have a case with custom, DHL will claim they are just the middle person and merchant will claim it's my custom's problem.

did your shipper put the shipping charges in the invoice for this shipment? If not custom will charge according to the standard rates they have. I think basically DHL person who is doing the K1 form and not the custom. Unless custom dispute the shipping rates.

Once you paid getting back your money from the custom department is going to be very hard.

They have the rights to charge you according to the rates like what Kherell77 said but most of the time if they included the shipping rates charges in the invoice you are basically safe on that side. Which what happen on your previous shipment. Company who shipped frequently have a better shipping rates.

Jan 20 2017, 11:18 PM

Jan 20 2017, 11:18 PM

Quote

Quote

0.0240sec

0.0240sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled